June 2nd, 2023 | 07:30 CEST

Altech Advanced Materials, Volkswagen AG, BYD - Electric drive solutions fuel the share rally

Heidelberg-based Altech Advanced Materials AG is revolutionizing the market for lithium-ion batteries and is now expanding into the renewable energy sector. With a focus on the development of solid-state batteries for stationary applications under the CERENERGY® brand, the Company has already produced prototypes with promising results. Europe is becoming the world's second-largest market for electric vehicles and offers a promising opportunity, especially for Chinese battery manufacturers. Volkswagen is moving to Southeast Asia to build battery factories. However, they are not alone in this endeavour because one of their strongest competitors, BYD, is already one step ahead...

time to read: 5 minutes

|

Author:

Juliane Zielonka

ISIN:

Altech Advanced Materials AG | DE000A31C3Y4 , VOLKSWAGEN AG VZO O.N. | DE0007664039 , BYD CO. LTD H YC 1 | CNE100000296

Table of contents:

"[...] Boron is one of the most versatile elements in the whole world! Everyone reading this text regularly uses hundreds of products that depend on boron. [...]" Tim Daniels, CEO, Erin Ventures

Author

Juliane Zielonka

Born in Bielefeld, she studied German, English and psychology. The emergence of the Internet in the early '90s led her from university to training in graphic design and marketing communications. After years of agency work in corporate branding, she switched to publishing and learned her editorial craft at Hubert Burda Media.

Tag cloud

Shares cloud

Altech Advanced Materials: Full speed ahead thanks to stationary battery innovation

Altech Advanced Materials AG, headquartered in Heidelberg, Germany, wants to revolutionize the market for lithium-ion batteries in electric mobility and is going one step further by now targeting the wind and solar energy market.

To this end, the Company is further emphasizing the development of solid-state batteries for stationary battery applications under the CERENERGY® brand. The Company has started production of two prototypes of the CERENERGY® 60 KWh (ABS60) battery pack for rapid market entry. The prototypes of this novel sodium-alumina solid-state battery are produced in collaboration with joint venture partner Fraunhofer IKTS. Smaller prototypes with 5 and 10 kWh capacity already produced successful results over a longer period of time.

The powerful 60 kWh battery packs have a nominal operating voltage of 600 volts at 100 amperes (A). They are primarily designed for use in energy storage of renewable energies from wind and solar power plants and as grid storage.

The CERENERGY® Sodium Chloride Solid State (SCSS) represents a revolutionary alternative to lithium-ion batteries in the field of stationary grid storage. Industrial production of this product will take place at the Schwarze Pumpe site in Saxony.

The CERENERGY® batteries are designed to have a service life of more than 15 years. They are fire and explosion-proof and can be operated under extreme climatic conditions worldwide without loss of power. This battery technology uses common salt and is free of lithium, cobalt, graphite and copper, thus eliminating dependence on critical third countries, significant price fluctuations in raw materials and potential problems in the supply chain. All raw materials required can be sourced from Europe, and agreements to this effect have already been concluded.

The site has already been acquired, and the production concept is currently being worked out in a feasibility study. The feasibility study is expected to be completed in 2023, after which the building application can be submitted promptly. In the first stage of expansion, the plant will have one production line and an annual capacity of 100 MWh.

Volkswagen builds battery factory in Indonesia, and China invests in Europe

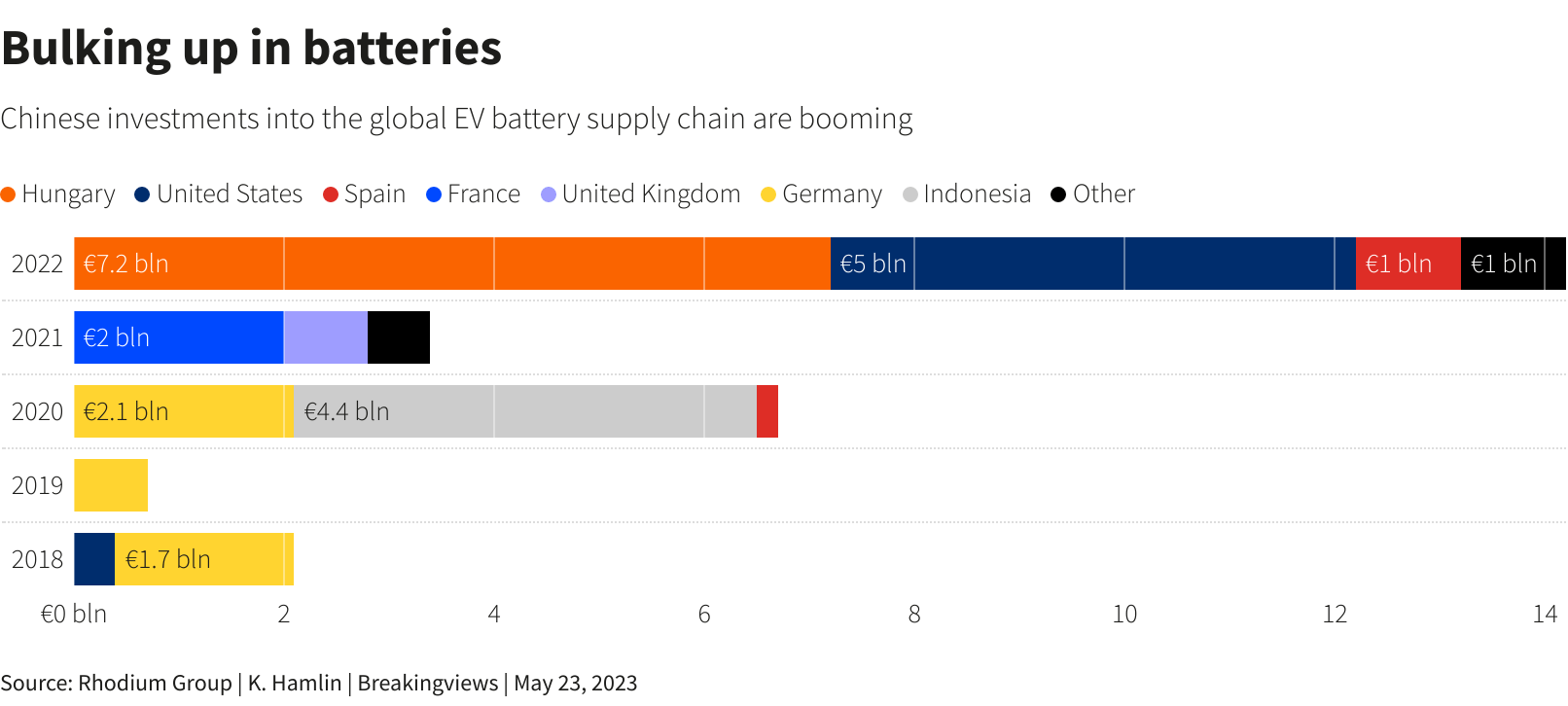

More than every 5th car sold in Europe last year was electric. That makes the region the second-largest market for e-vehicles in the world after China. This opens up a promising new opportunity for battery manufacturers from the People's Republic, as they already supply European brands such as Volkswagen, BMW and Stellantis, as well as global companies such as Geely, the owner of Volvo. However, over-reliance on Chinese market leaders such as CATL and its competitors could pose a risk. According to a Mercator Institute for China Studies report, China's global investment in the electric car battery supply chain rose from EUR 3.4 billion in the previous year to EUR 14.2 billion in 2022. Of the total investment, Hungary and Spain accounted for EUR 8.2 billion (see chart).

According to media reports, the Volkswagen Group plans to build a battery factory for electric cars in Indonesia. According to Ikmal Lukma, secretary of the Indonesian Ministry of Investment, Volkswagen intends to invest around EUR 4.7 billion in the factory.

Construction is scheduled to start this year, although the exact location has yet to be announced. The investment is to be made by Volkswagen's battery subsidiary PowerCo, and there is also talk that the carmaker will produce electric cars on site. Details such as production capacity or the planned start of operations were not given. However, it is noteworthy that there is only talk of a "battery factory", which could include cell production and pure battery assembly. However, if the mentioned investment sum of about EUR 4.7 billion is confirmed, this points to battery cell production, as this is significantly more expensive than pure assembly.

According to Reuters, PowerCo plans to work with partners to build a battery ecosystem for electric vehicles in Indonesia, as reported by Indonesian Investment Minister Bahlil Lahadalia back in mid-April 2023. Among the partners are said to be Ford, mining company Vale and battery materials manufacturer Huayou Cobalt. In addition, French mining company Eramet and several Indonesian firms are said to be involved in the project, the investment minister said.

BYD captures market in Southeast Asia, displaces Japanese internal combustion vehicles

BYD, the largest electric vehicle maker in China, has begun to enter the Southeast Asian market, challenging the dominant position of Japanese carmakers in the region.

In Thailand, where the average monthly income is only 15,000 baht (about EUR 403), fuel efficiency is a decisive factor for consumers when choosing a vehicle. For example, a Japanese Honda with an internal combustion engine consumes up to 8,000 baht (EUR 215) per month in fuel. In comparison, drivers pay around 1,000 baht (EUR 27) in electricity costs for BYD. BYD entered the Thai market in 2022 and is rapidly building distribution networks in other Southeast Asian countries in cooperation with local companies.

In March, BYD began construction of its first overseas manufacturing plant in Rayong province, Thailand, with the goal of producing and delivering 150,000 vehicles by 2024. Given the future market potential, governments including Indonesia, Vietnam and the Philippines are competing to locate factories in their countries.

However, the Company is still in the process of establishing a customer service network for inspections and repairs. In Thailand, there is currently no market for the sale of used electric cars to meet the demand for replacement vehicles. A company representative stressed that the used car market is not necessary due to BYD's sales policy of offering new vehicles with an eight-year repair warranty. Nevertheless, this poses a challenge to the Company's long-term growth strategy.

Altech Advanced Materials is establishing itself as an innovative company with a focus on high-performance and durable battery solutions for electromobility, wind power and solar energy. Volkswagen makes an economical decision in favour of Indonesia as a location for building a battery factory. For good reason: According to the mine and project database of GlobalData, more than 186 nickel mines are in operation worldwide, 127 of them are in Indonesia. BYD saw an impressive rise in sales of its electric cars to 910,000 units last year, almost triple that of the previous year, catching up with Tesla Inc, the US company, which saw a 40% rise to 1.31 million units sold. The move to be cheaper in running costs for Thai drivers will also be BYD's next move to overtake its still combustion-heavy competitors.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.