May 20th, 2025 | 12:30 CEST

Almonty Industries: Why is the share price set to multiply, and is the supply chain breaking down?

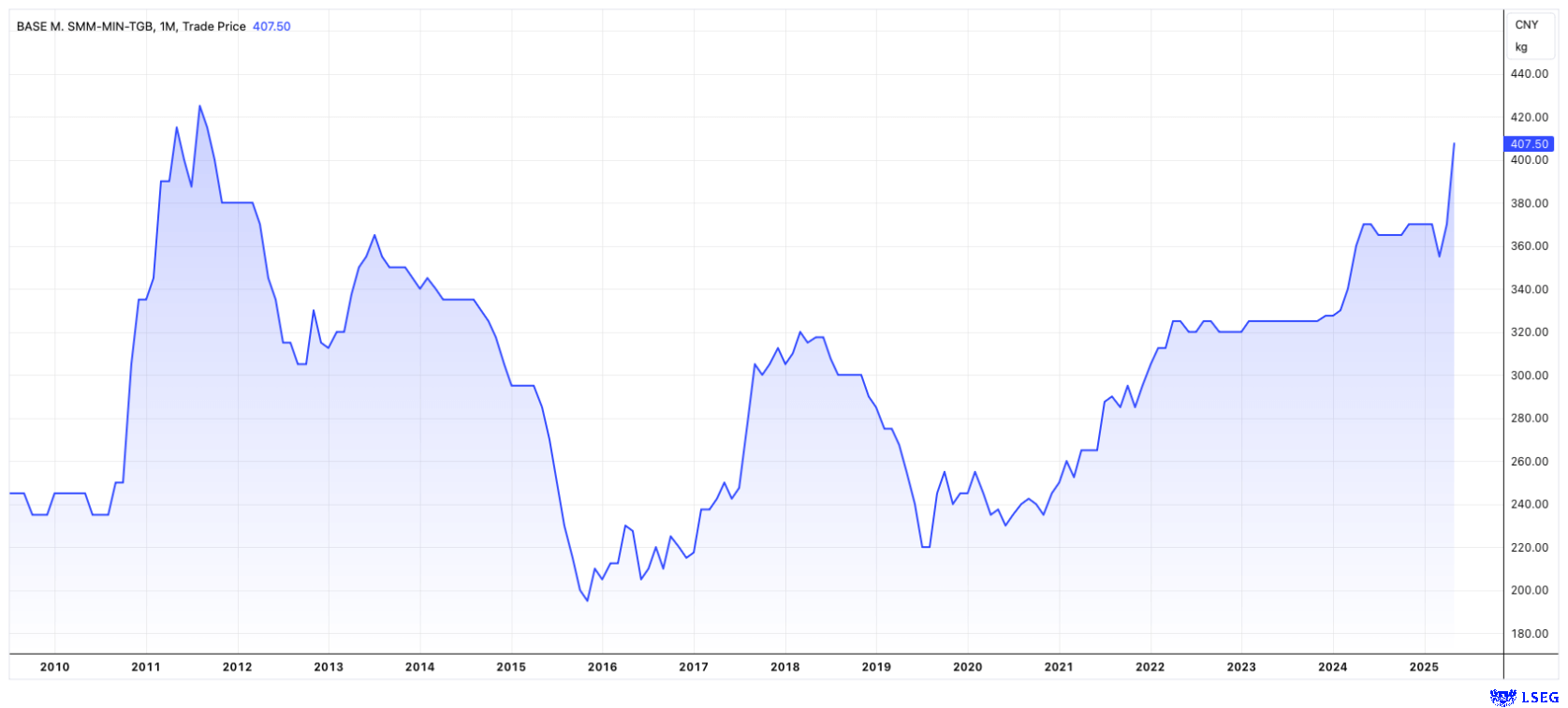

In corporate development, there are various triggers for growth spurts and rising profits. At Almonty Industries (TSX: AII), the reason is clear: the Company will begin operating one of the world's largest tungsten mines in South Korea this summer. While other mining projects often still have to contend with lengthy approval processes or environmental regulations, and often offer little realistic prospect of success, Almonty is on the verge of expanding its production to such an extent that it could meet the entire demand of the US in the future. Those looking to invest in tungsten should go for the "original" – Almonty shares. The situation on the tungsten market is now so tense that the price in Shanghai has risen to a 12-year high of over USD 56 per kg. Accordingly, the profitability of Almonty's mines in Portugal and South Korea is likely to increase further. Uncertain times lie ahead for defense companies such as Hensoldt, Renk, Rheinmetall, and their suppliers. When will the supply chain break down? – More on this in the report.

time to read: 3 minutes

|

Author:

Mario Hose

ISIN:

ALMONTY INDUSTRIES INC. | CA0203981034 , APPLE INC. | US0378331005 , RHEINMETALL AG | DE0007030009 , HENSOLDT AG INH O.N. | DE000HAG0005 , RENK AG O.N. | DE000RENK730

Table of contents:

"[...] While tungsten has always played an important role in the chip industry, it is now being added to batteries for e-cars. [...]" Lewis Black, CEO, Almonty Industries

Author

Mario Hose

Born and raised in Hannover, Lower Saxony follows social and economic developments around the globe. As a passionate entrepreneur and columnist he explains and compares the most diverse business models as well as markets for interested stock traders.

Tag cloud

Shares cloud

De facto unlimited taxpayer money for defense

Last week, German Foreign Minister Dr. Johann David Wadephul (CDU) announced at an international ministerial meeting that Germany will invest 5% of its gross domestic product (GDP) in defense in the future. This corresponds to around EUR 200 billion, which could potentially flow to companies such as Hensoldt, Renk, and Rheinmetall, as well as their numerous suppliers, not least to meet US President Donald Trump's demands for more responsibility on the part of European NATO countries.

China implements its plan - Companies follow suit

Almonty already successfully operates its own mine in Portugal and is soon set to become the largest tungsten producer outside China when it starts production in South Korea. The Middle Kingdom controls around 90% of the global tungsten trade – either through domestic mining or by processing imported raw materials. China is pursuing national interests and acting strategically. Almonty is therefore seen as a beacon of hope for Western industries, which are primarily concerned about the security of supply of this critical metal.

Almonty targeted as a takeover candidate

Without tungsten from reliable sources, it will become increasingly difficult to manufacture products such as ammunition or armored vehicles in the future. The high-tech industry also depends on secure sources of supply from allied countries. A prominent example is Apple's iPhone, whose vibration function is made possible by a tungsten component. The extremely hard metal is irreplaceable in many applications.

In plain terms: If Apple cannot obtain tungsten, iPhones will be delivered without a vibration function – or not at all. This is no longer just a question of rising prices, but primarily about access to the raw material. The global market comprises only around 100,000 tons per year and is dominated by a few players. If a major consumer loses access in the future, Almonty will become a realistic takeover target.

Entertainment or Defense – who wins?

What is the true potential of Almonty – and its stock? If Apple can no longer sell iPhones, this will have enormous economic consequences. In the first quarter of 2025 alone, Apple generated USD 46.8 billion in revenue from the iPhone; in the traditionally stronger fourth quarter of 2024, the figure was almost USD 70 billion. There are over 2.3 billion Apple devices in circulation worldwide. The question is: What would Apple be willing to pay to secure its supply chain in the long term? The tech giant is increasingly in direct competition with the defense industry.

NASDAQ listing brings fresh capital

Almonty recently announced its collaboration with the influential US lobby group American Defense International (ADI). Apart from Almonty, only one other raw materials company is represented there: MP Materials, which specializes in rare earths. The valuation comparison is particularly interesting: MP Materials has a market capitalization of around USD 3.5 billion, while Almonty stands at only USD 500 million. While MP Materials is already listed on the NASDAQ, Almonty has yet to take this step – a potential catalyst for the share price.

Get in now – and be patient

CEO Lewis Black has repeatedly emphasized that he is managing Almonty from a shareholder perspective. As founder and major shareholder, he has personally participated in financing rounds. It is therefore quite conceivable that Black would be open to a takeover at an attractive price.

Anyone who wants to be part of the upcoming launch of the Sangdong mine should get in early. Interest in Almonty will likely increase significantly once the first ton is mined. Sphene Capital analyst Peter Thilo Hasler recently raised his price target from CAD 5.20 to CAD 5.40 and reiterated his "Buy" recommendation. On Friday, Almonty's stock closed at CAD 2.40 ahead of the long holiday weekend (TSX: AII) – and as we all know, the profit is in the purchase.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.