July 9th, 2025 | 07:10 CEST

Almonty Industries: The NASDAQ countdown is on! Everyone wants a piece of the Tungsten Gem!

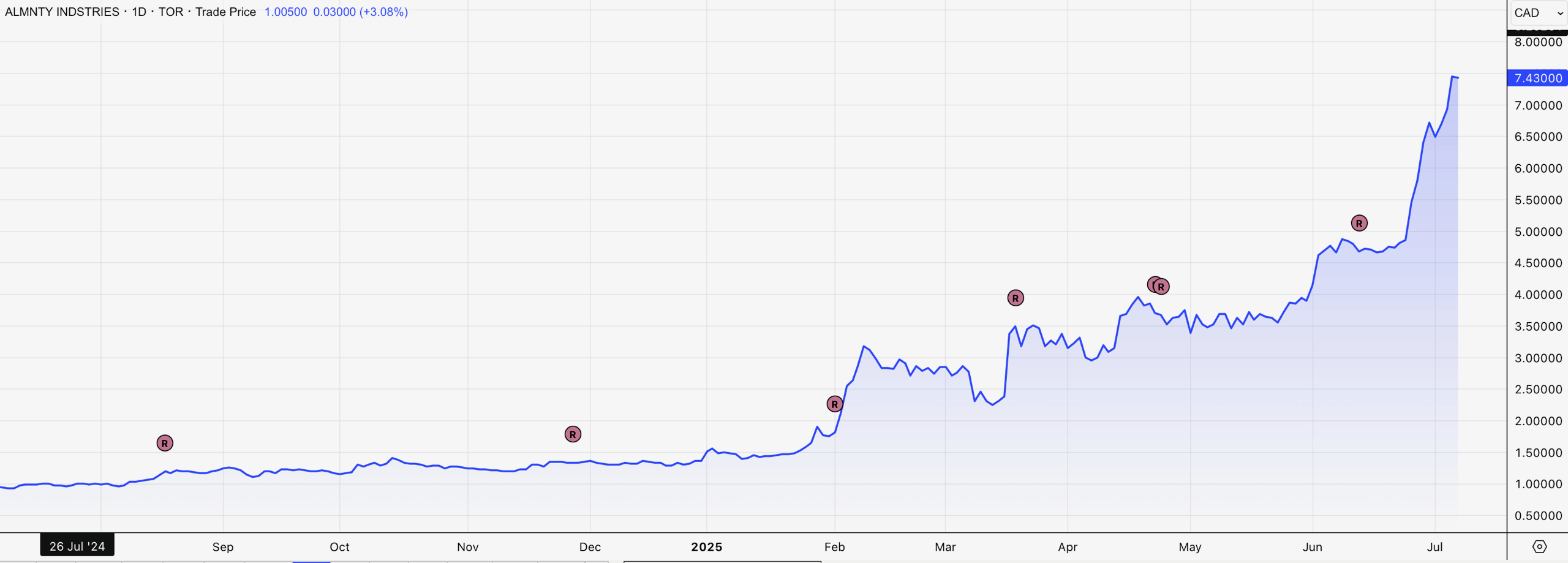

The countdown to Almonty's IPO on the NASDAQ is underway. The reverse split took place on Friday, and further details were released yesterday. A capital increase of around 10% is being supported by renowned banks. The fresh capital is intended to be used to extend the value chain. This move should enable Almonty to consolidate its position as the most important tungsten supplier in the West. The share price is responding with a spectacular rise. In addition, Europe appears to be slowly awakening to the issue of critical raw materials. Almonty stands to benefit from this as well. The outlook for this tungsten gem remains bright. The share price performance is more than just FOMO; it is based on geopolitical and operational fundamentals.

time to read: 3 minutes

|

Author:

Fabian Lorenz

ISIN:

ALMONTY INDUSTRIES INC. | CA0203987072

Table of contents:

"[...] China's dominance is one of the reasons why we are so heavily involved in the tungsten market. Here, around 85% of production is in Chinese hands. [...]" Dr. Thomas Gutschlag, CEO, Deutsche Rohstoff AG

Author

Fabian Lorenz

For more than twenty years, the Cologne native has been intensively involved with the stock market, both professionally and privately. He is particularly passionate about national and international small and micro caps.

Tag cloud

Shares cloud

NASDAQ IPO still in July?

The excitement continues to build. When will Almonty's NASDAQ IPO take place? It is likely to occur within the next 1 to 2 weeks. This is suggested not only by the recently completed reverse split, which raised the share price to ensure it meets NASDAQ's minimum listing requirements under all circumstances.

Almonty CEO Lewis Black commented: "We are pleased to announce our application for listing on the Nasdaq concurrently with a public offering in the US, which will enable us to secure our position as a leading supplier of tungsten to the US and its allies. Given the increasing geopolitical tensions worldwide, we anticipate that demand and price prospects for tungsten will remain robust for some time to come. I look forward to continuing to execute our strategy in the coming months as we strive to create sustainable, long-term value for our fellow shareholders."

On Monday, the tungsten company announced further details of the IPO. Almonty's share capital is to be increased by approximately 10% through the issuance of new shares. This is a relatively small volume considering that Almonty is entering a new stock market league, massively increasing its name recognition, and appealing to a huge investor universe, both private and institutional. The stock should react positively. The consortium is also exciting. Oppenheimer & Co. and Cantor are acting as joint lead underwriters. D.A. Davidson & Co. and Canada's Scotiabank are also involved.

Extending value creation

And what does Almonty plan to do with the fresh capital? The value chain is to be extended by building a tungsten oxide plant. This will make Almonty not only the largest tungsten producer outside China, thanks to its tungsten mines in South Korea, Portugal, and Spain, but also a major processor. This is because processing is also largely in Chinese hands and can therefore be used as a weapon in geopolitical tensions.

The West needs Almonty

But why are Almonty shares rising like a rocket this year? After years of development, supported by the German KfW, among others, the largest tungsten mine outside China is set to go into operation in South Korea soon. Almonty already operates a mine in Portugal, plans to expand it and could potentially reactivate two more mines in Spain. However, the Sangdong mine in South Korea is clearly driving the share price: not only is it high-grade, but it also has a lifespan of over 90 years. This makes it the largest tungsten mine outside China. By 2027, Almonty aims to supply 43% of global demand outside China, with a particular focus on the US defense sector.

Analysts at GBC Research expect Almonty to generate CAD 314 million in revenue by 2027. They believe the tungsten gem will post net income of CAD 212 million, with an upward trend. The estimates are based on lower tungsten prices.

https://youtu.be/XCpnqmg-sQA?si=u38-d3KzpvrIGVwh

Europe wakes up to critical raw materials

Europe appears to finally be waking up to the issue of critical raw materials. The EU Commission has presented a draft "Critical Raw Materials Act." The goal is for at least 10% of the EU's domestic consumption of various ores and minerals to be sourced within the EU by 2030, aiming to reduce dependence on third countries, such as China.

Among other things, approval procedures for strategic mines and processing capacities are to be accelerated. In addition, the conditions for access to subsidies are to be eased.

Almonty should also benefit from this. Tungsten is needed for semiconductors, batteries, and ammunition, among other things, and is therefore one of the critical raw materials. As already mentioned, Almonty aims to expand its mine in Portugal and could activate its mines in Spain. Easing approvals and subsidies can only be helpful in this regard.

Conclusion: NASDAQ IPO is only a stopover

Overall, the growth story for the Company and its shares is likely far from over. The current hype surrounding the NASDAQ IPO is well supported by both geopolitical dynamics and operational progress. Therefore, there should still be significant room for positive operational developments and price increases in the medium term.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.