June 27th, 2025 | 07:00 CEST

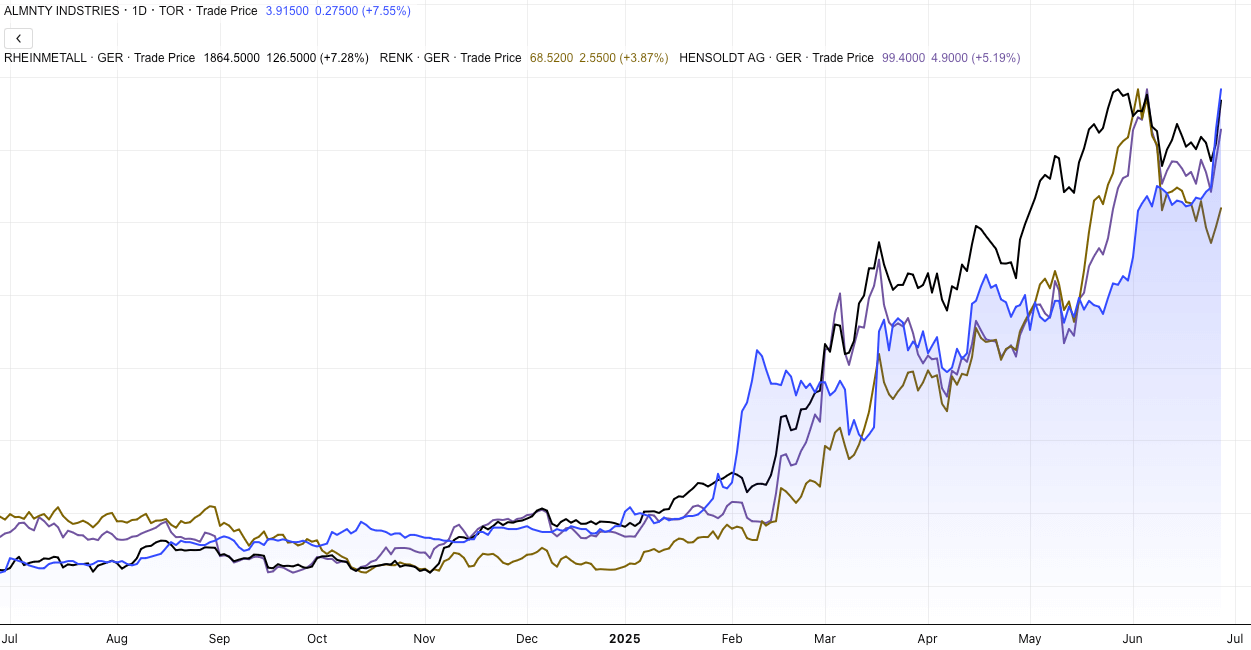

Almonty Industries shares EXPLODE! Rheinmetall, Renk, and Hensoldt left in the shadows!

Almonty Industries' share price has gained over 20% in recent days. On its current home exchange in Toronto, the market capitalization has now surpassed the important CAD 1 billion mark. The upcoming IPO on the NASDAQ is a contributing factor to the price surge, but there are many other reasons! The shares of what will soon be the largest tungsten producer outside China are in a perfect storm of positive momentum. The 5% defense spending target agreed upon by NATO countries is also pushing the stock higher. The shares still appear to be an attractive buy. Analyst price targets have not yet been reached and are likely to be raised soon. Almonty currently overshadows Rheinmetall, Renk, and Hensoldt – and rightly so.

time to read: 3 minutes

|

Author:

Fabian Lorenz

ISIN:

ALMONTY INDUSTRIES INC. | CA0203981034 , RHEINMETALL AG | DE0007030009 , RENK AG O.N. | DE000RENK730 , HENSOLDT AG INH O.N. | DE000HAG0005

Table of contents:

"[...] While tungsten has always played an important role in the chip industry, it is now being added to batteries for e-cars. [...]" Lewis Black, CEO, Almonty Industries

Author

Fabian Lorenz

For more than twenty years, the Cologne native has been intensively involved with the stock market, both professionally and privately. He is particularly passionate about national and international small and micro caps.

Tag cloud

Shares cloud

NATO's 5% defense spending target boosts defense stocks

Sentiment toward defense stocks is positive again. Once again, the weak phase for RENK, Rheinmetall, and Hensoldt was short-lived. The shares have risen again in recent days but have been overshadowed by Almonty. Following the latest NATO meeting, there is a gold rush in the industry. NATO member countries have reaffirmed their commitment to higher defense spending. In future, 5% of economic output is to be spent on the military and defense. In its summit declaration, NATO committed to investing billions in armaments and infrastructure by 2035.

US President Donald Trump had repeatedly pushed for higher spending in the past and was accordingly satisfied with the latest commitments. He even went so far as to reaffirm the transatlantic military alliance's commitment to mutual defense (Article 5).

A large portion of the billions in investments is also likely to benefit US defense companies. And regardless of whether production takes place in Europe or the US, the entire industry needs tungsten and, therefore, Almonty.

No tungsten production in the US since 2015

The situation is particularly precarious in the US. The country has not produced any commercial tungsten since 2015, making it entirely dependent on imports. Yet tungsten is indispensable in aerospace, electronics, defense, and mechanical engineering. With a melting point of 3,422 °C, tungsten has the highest melting point of any metal and is extremely hard. This makes it ideal for use in rocket nozzles, armor-piercing ammunition, protective coatings, and armor plating. The problem is that China produces over 80% of the world's tungsten and is increasingly using it as a weapon in the trade war.

The US is currently fighting back with all its might – and Almonty is benefiting. The company has received an official letter from the US House Select Committee on the Strategic Competition between the United States and the Chinese Communist Party and is now part of the Critical Materials Forum.

Almonty is the tungsten hope for the West

Almonty is seen as the great tungsten hope for the US, Europe, and all Western countries. The Company already operates a mine in Portugal, with plans for expansion, and owns two projects in Spain. But the key driver of its share price is in South Korea. There, after years of preparation and with support from Germany's KfW, Almonty is about to start production at the Sangdong mine. This mine has a lot to offer: Not only is it high-grade, but it also has a lifespan of over 90 years, making it the largest tungsten mine outside China. By 2027, Almonty aims to supply 43% of global demand outside China, with a particular focus on the defense sector, as CEO Lewis Black recently emphasized in an interview with CNBC. A US defense contractor has already secured at least 40 tons of tungsten oxide per month. The fact that there is a price floor but no price ceiling highlights the strength of Almonty's position.

https://youtu.be/g6pys3NNk44?si=zxQUtZgLcwciC29e

Plenty of fuel for the share price rocket

Anyone speculating that the NASDAQ listing and the start of operations at the Sangdong mine will trigger a setback is likely to be disappointed. For one thing, there is currently IPO fever in the US, with shares doubling on their first day of trading. In addition, Almonty has another strategically important raw material on offer: molybdenum. The heavy metal deposit is located on the Sangdong property. A long-term purchase agreement has already been signed for this as well. And then there are the expansion plans in Portugal and the two mines in Spain. Furthermore, the value chain can be extended. The fuel for Almonty's share price rocket is unlikely to run out anytime soon.

Analysts likely to raise price targets soon

Analysts are likely to raise their price targets once operations commence, as this will significantly increase the visibility of future revenues and profits. Sphene Capital's price target is currently CAD 5.40. Analysts at GBC Research currently estimate the fair value of Almonty shares to be CAD 5.50. Yesterday, the stock traded just under CAD 4. Almonty plans to ramp up Sangdong by 2027. GBC analysts expect revenues of CAD 314 million and net income of CAD 212 million by 2027, with the upward trend expected to continue.

Conclusion: The price rocket still has plenty of fuel

Investors are likely to continue benefiting from investing in Almonty shares. There are simply too many reasons pointing toward further gains. Those who waited for a significant price correction in recent months have missed the rally. Analyst price targets appear realistic and suggest more than 30% additional upside – unless the NASDAQ listing pushes the price even higher.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.