November 30th, 2022 | 10:57 CET

Alibaba, Kleos Space, Plug Power - Turnaround candidates with potential

In the wake of the recent stock market rally, some stocks have fallen behind. While the market has been optimistic about the future of some stocks, others have not had the same success. For investors looking for a potential turnaround stock, we have picked three companies worth considering. Each company has its own challenges and opportunities, and investors should do their due diligence before investing. With the right timing and strategy, these companies could be well poised for a comeback in the not-too-distant future.

time to read: 4 minutes

|

Author:

Armin Schulz

ISIN:

ALIBABA GR.HLDG SP.ADR 8 | US01609W1027 , KLEOS SPACE CDI/1/1 | AU0000015588 , PLUG POWER INC. DL-_01 | US72919P2020

Table of contents:

"[...] When we acquire something, we want to make sure that the acquisition fits with our strategy and has the potential to be successful for our shareholders. [...]" John Jeffrey, CEO, Saturn Oil & Gas Inc.

Author

Armin Schulz

Born in Mönchengladbach, he studied business administration in the Netherlands. In the course of his studies he came into contact with the stock exchange for the first time. He has more than 25 years of experience in stock market business.

Tag cloud

Shares cloud

Alibaba - Decent quarterly numbers

Alibaba is a Chinese technology company that specializes in online retail. It is one of the largest online retailers in the world. The Company's three main pillars are retail, cloud computing and digital media. After the founder Jack Ma criticized the Chinese government, the Company was the focus of the authorities. The ANT IPO had to be canceled, there was a hefty fine, and most recently, the Zero-COVID policy of the Chinese caused uncertainty. All these are reasons why the stock is trading far from its highs.

About 2 weeks ago, the Company presented its quarterly figures. Sales climbed 3.2% to CNY 200,690 million. Adjusted EBITDA, meanwhile, grew by over 24% to CNY 43,311 million. The main driver was the e-commerce business, followed by the cloud segment. Only the digital media segment was loss-making. The Company pointed out that 4 factors are making business difficult. There are geopolitical tensions, inflation, currency devaluation and the government's Corona measures. At least the latter is to be eased, said the Chinese health department after a conference.

There is growth in the e-commerce sector, mainly through international expansion. The cloud division should grow significantly in the coming years. Alibaba has recently expanded its share buyback program, which makes sense given the sharp drop in share price. Currently, one pays USD 79.72 for a share certificate. Compared to Amazon, the stock is significantly undervalued. The easing of the Corona measures could significantly stimulate consumption. Then the stock should start the turnaround.

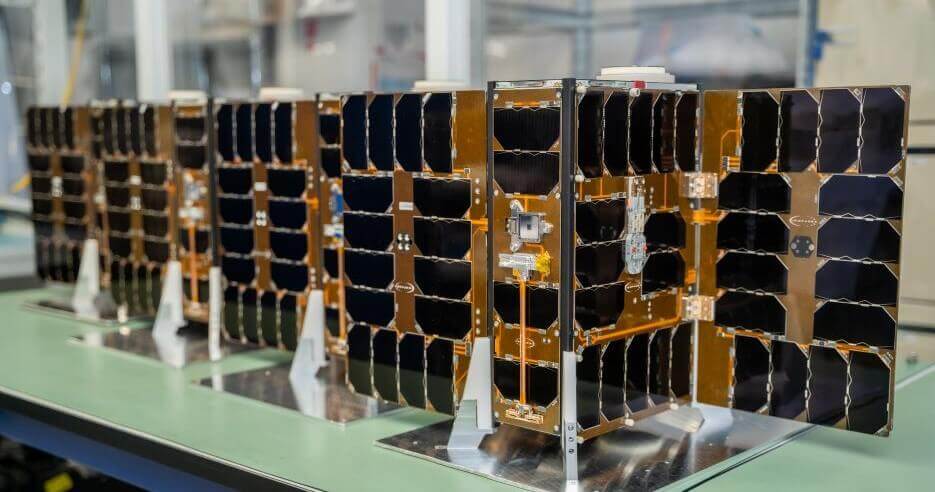

Kleos Space - Launch of the 4th cluster this year

Space is opening up new opportunities, such as the Internet via Starlink satellite from mastermind Elon Musk. Australian company Kleos Space uses satellite clusters of 4 satellites each to collect data from radio frequency (RF) signals around the globe. These signals are processed using artificial intelligence and can thus be used to geolocate RF transmitters both on land and in water. Customers include both commercial companies and government agencies, as use cases range from anti-piracy to border security. The Company now has 3 clusters, or 12 satellites, in orbit. With each new cluster, even more data can be collected. The fourth cluster, Observer Mission, is scheduled to launch from Cape Canaveral later this year.

However, it will take a few more months before it becomes operational, as it first has to be commissioned. The third cluster launched in April and recently completed commissioning. This cluster will start operations in the first quarter of 2023 and cover about 253 million sq km. The Observer Mission cluster is also expected to be operational in the first half of the year. That will allow another 119 million sq km to be covered. Due to the delays in launching the third cluster, this year's revenue expectations can no longer be met. Originally, EUR 2.2 million had been expected, but now it is likely to be around EUR 1.2 million. As soon as the third cluster is fully operational, more data can be made available to customers and in the course of this, revenues will also increase.

Current CFO Alan Khalili will become the Company's new CEO at the end of the year. Current CEO Andy Bowyer will remain a director. With this move, Kleos Space will then be led by a US citizen. This will help the Company close deals with the US government. Since September, the Company has been evaluating Kleos data with the US Navy's Naval Surface Warfare Center. Orders from the US Army would be an accolade for Kleos. The stock has recently been under the weather, trading at AUD 0.18. With the start of the fourth cluster, the rebound should begin. Most recently, First Berlin Equity Research published its company analysis. The analysts issued a buy recommendation with a price target of AUD 1.60.

-

Plug Power - Must deliver now

Investors looking for a high-growth opportunity in renewable energy should look at Plug Power. The Company covers the entire hydrogen value chain. Plug Power customers are reducing their carbon footprint and increasing their sustainability. It is safe to assume that the hydrogen industry will grow rapidly in the coming years. In addition, there is hope for subsidies from the USD 370 billion climate package. The goals the Company set for itself recently proved to be too high when looking at the figures for the 3rd quarter.

In mid-October, Plug Power revised its full-year forecast downward after announcing its third-quarter results on November 8. Revenue of USD 188 million was 31% higher than last year but well below the USD 246 million estimated. In addition, earnings per share were -USD 0.30, far below the expected -USD 0.07. Despite the disappointing results, the fourth quarter is expected to be better, while at the same time, the Company will achieve its revised guidance. The only positive news was the significant increase in order backlog compared to the second quarter.

Management expects to reduce fuel costs in the coming year significantly. Already, fuel cells and material handling are profitable. Next year, the same should be true for electrolyzers. Sales in 2023 are expected to be USD 1.4 billion and break even on operating margins. The stock was sold off after the forecast was cut and is currently trading at around USD 15. If the Company succeeds in the turnaround in Q4 as promised, the stock will rebound because hydrogen is the future.

All three companies are among the strongest in their respective fields. But each also has its challenges. If the Chinese government makes good on its promises and noticeably eases the Corona measures, that would help Alibaba. For Kleos Space, it is all about launching the rockets on time to further ramp up its satellites. Then they can collect more data and have better signals that ensure higher sales. At Plug Power, the initial spark is still missing. However, the Company is well-positioned in all areas.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.