April 6th, 2023 | 09:51 CEST

AI trend only at the beginning - Palantir, Star Navigation Systems, C3.AI

The topic of artificial intelligence finally reached the masses with the meteoric rise of the chatbot ChatGPT and is unlikely to be stopped despite short-term bans, as happened in Italy. The topic is also already on everyone's lips on the capital market. The companies in the sector are exposed to a high degree of fluctuation, which is nothing unusual at the beginning of a long-term trend.

time to read: 4 minutes

|

Author:

Stefan Feulner

ISIN:

PALANTIR TECHNOLOGIES INC | US69608A1088 , STAR NAVIGATION SYS GRP | CA8551571034 , C3.AI INC | US12468P1049

Table of contents:

"[...] In Canada, there is $1.75 of debt for every dollar of disposable income - and that was true even before the pandemic. [...]" Karim Nanji, CEO, Marble Financial

Author

Stefan Feulner

The native Franconian has more than 20 years of stock exchange experience and a broadly diversified network.

He is passionate about analyzing a wide variety of business models and investigating new trends.

Tag cloud

Shares cloud

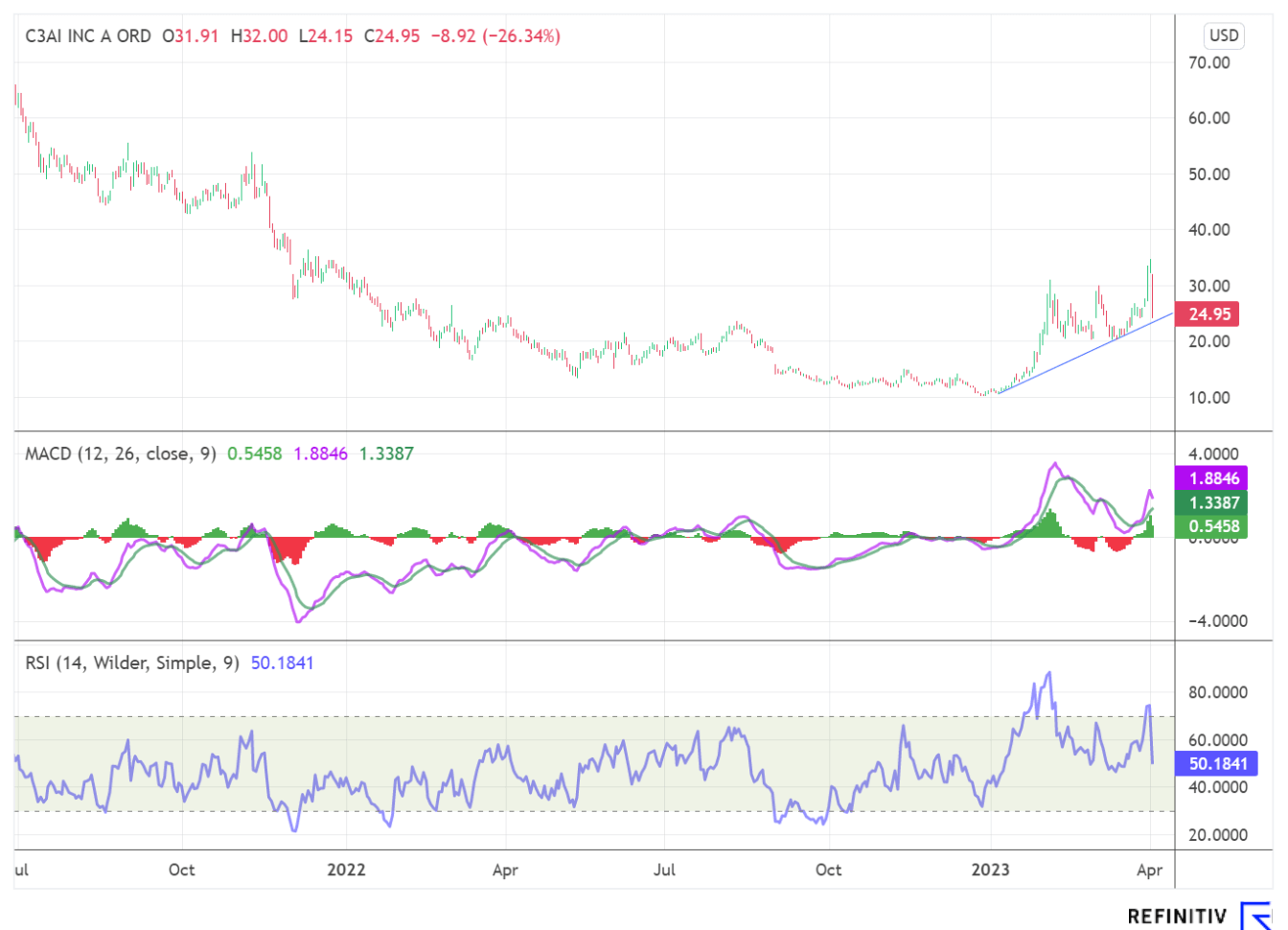

C3.AI - Shortseller brings share to its knees

After a share price explosion of 70% in the past four weeks and reaching a new high for the year, the signs are pointing to a correction for the leading company for enterprise software based on artificial intelligence. The Company, founded by industry veteran Tom Siebel, plunged more than 25% to USD 25.50 after short seller Kerrisdale Capital cited "serious accounting and disclosure issues" at the enterprise software developer.

The Company was using "very aggressive accounting to inflate its income statement to meet sell-side analyst estimates for revenue and certain profit metrics and to hide a significant deterioration in underlying operations," Sahm Adrangi, Kerrisdale's chief investment officer, wrote in a letter to Deloitte & Touche LLP, C3.AI's auditor. The Company, based in Redwood City, California, and the auditor have yet to comment.

In addition, Kerrisdale criticised in a letter published on its homepage that C3.AI records the costs for the production of customised software as research and development costs and not as cost of sales in order to increase profit margins. This is part of the accounting practices C3.AI uses to present itself as a high-margin company in the Software-as-a-Service business rather than one based on lower-margin consulting.

Should a denial come from C3.AI, this is unlikely to be the end of this allegation, so investors would prefer to remain on the sidelines due to the uncertainties. Due to the high volatility of the share, an investment currently resembles a gamble.

Star Navigation Systems - Right on trend

Star Navigation Systems, headquartered in Ontario, Canada, has been on the market for about 20 years, but only now has it been listed on the Frankfurt Stock Exchange. The timing could not be better, as the Company, which has a market capitalisation of CAD 53.05 million, focuses on in-flight analysis, satellite communication and data analysis for the aviation industry and provides both hardware and software. Star Navigation Systems' advantage over the competition is to perform in-flight calculations using edge computing to analyse them using artificial intelligence and algorithms. The processed data of key parameters such as engine, airframe or position data are then relayed in real time via satellite to the operators on the ground. This allows incidents to be accurately detected and warnings to be transmitted. According to the management, it is thus possible at any time to locate aircraft with the Company's own Inflight Safety Monitoring System, ISMS, even if they have left their planned position.

The Canadians' plans for the future go far beyond the aviation industry. Last October, the foundation stone was laid with the signing of a memorandum of understanding with the Lapsset Corridor Development Authority for tracking trucks, trains and ships in East Africa's largest infrastructure project. In the process, the mammoth project will connect the countries of Kenya, Ethiopia and South Sudan. The letter of intent includes the purchase of Star Navigation's tracking and monitoring technology to track ships, trains, trucks and boats for the Lapsset Corridor Programme. Through this, Kenya aims to combat illegal and controlled fishing, strengthen border surveillance, and improve logistics sector inefficiencies.

For the Company, access to the Lapsset project, which costs around USD 30 billion, means recurring revenue through its Subscription-as-a-Service model and a significant increase in hardware sales. The Lapsset project alone could result in revenues of several USD 100 million for the hardware sold and the recurring monthly revenues.

Palantir - Expensive future stock

Big Data, the experts are certain, is the gold of the 21st century. Leading this gigantic market is the innovative as well as controversial analytics company Palantir. However, with a market capitalisation of USD 17.55 billion, the Company is considered by various analysts to be grossly overvalued. A look at the annual figures confirms this view. For example, annual sales rose by 24% to USD 1.91 billion compared to the previous year, with sales in the US increasing by 32% to USD 1.16 billion compared to the previous year. Adjusted operating profit was USD 421 million, a margin of 22%.

According to US analyst firm William Blair, there is currently an acute risk that Palantir's 8.5x revenue multiple premium will shrink as competition puts pressure on revenue growth and profitability. Thus, in a worst-case scenario, the EV-to-revenue multiple could decline and approach the average multiple of established enterprise IT consultancies, which is around three times. "A multiple between 3 and 5 times revenue implies a share price between USD 4 and USD 5," the Company said.

At the latest, since ChatGPT, everyone knows the term artificial intelligence. Yet Star Navigation Systems has a unique selling point thanks to its real-time technology. C3.AI was ticked off by short sellers. Palantir is still too highly valued, according to analysts.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.