July 23rd, 2025 | 07:25 CEST

After a 500% increase - is the next rocket stage about to launch? Rheinmetall, Almonty, Hensoldt, and Steyr in focus!

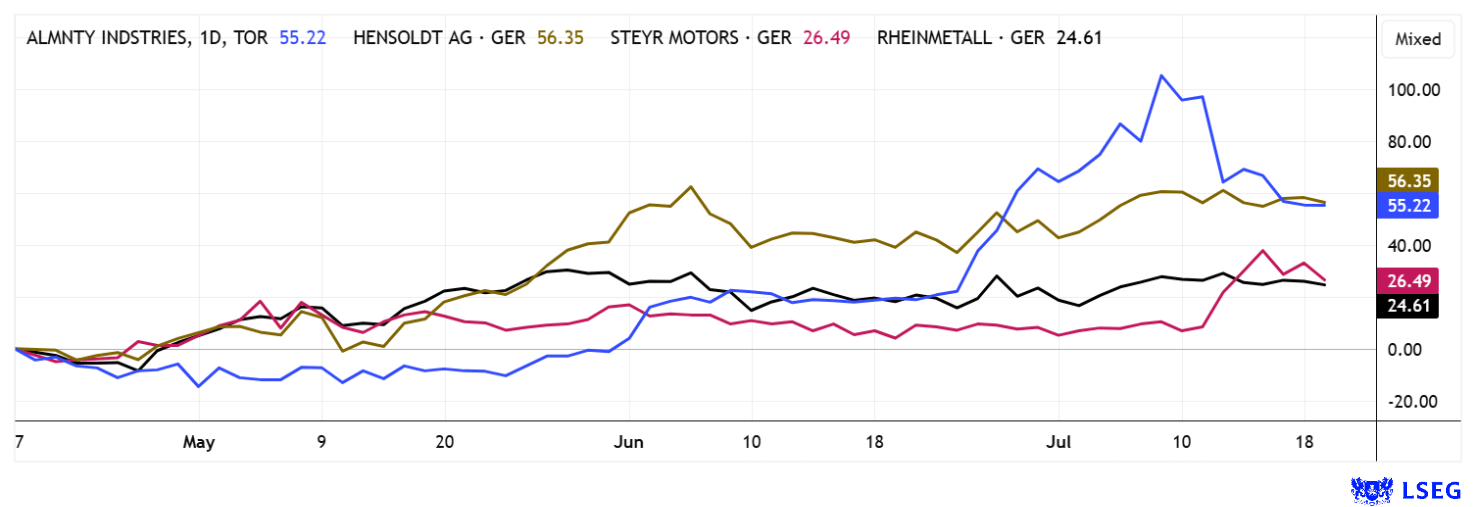

Some investors are reluctant to add stocks that have already performed strongly to their portfolios. In general, this is not good advice, as a sharp rise often has fundamental reasons. For example, the Düsseldorf-based defense company Rheinmetall is expected to increase its business volume roughly fivefold in the coming years. However, its share price has already skyrocketed by a factor of 20 since the start of 2022. The second-tier defense stocks have not been able to make the same leap, but some have managed gains of up to 500%. What happens next? Technical analysts often say: "The trend is your friend." This suggests that after a correction, the sun will soon shine again. In the strategic metals sector, Almonty Industries has recently made strong progress, and the rally could continue significantly regardless of defense investments. We have done the math for you.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

RHEINMETALL AG | DE0007030009 , ALMONTY INDUSTRIES INC. | CA0203987072 , HENSOLDT AG INH O.N. | DE000HAG0005 , STEYR MOTORS AG | AT0000A3FW25

Table of contents:

"[...] China's dominance is one of the reasons why we are so heavily involved in the tungsten market. Here, around 85% of production is in Chinese hands. [...]" Dr. Thomas Gutschlag, CEO, Deutsche Rohstoff AG

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Rheinmetall – Growth hopes are enormous

In February 2022, Rheinmetall received the initial impetus for a completely new orientation of the mechanical engineering group toward becoming a dynamic defense specialist with a European focus. Since then, its market valuation has increased twentyfold, reflecting not only the changed geopolitical landscape but also the extraordinary operational growth spurt the Company is currently experiencing. The main drivers are extensive arms deliveries to Ukraine and billion-dollar procurement programs by numerous NATO countries, which aim to significantly increase their defense budgets. Rheinmetall's involvement in ammunition production and air defense systems is also boosting growth. This establishes the group not only as a beneficiary, but also as a pillar in the reorganization of the European security architecture.

Nevertheless, the future performance of Rheinmetall shares remains difficult to predict, as analysts are also applying new leverage as the share price rises. For example, the P/E ratio for 2025 is high at 62.5, but according to estimates, it will fall to around 22.5 by 2028. With a projected annual growth rate of around 15 to 20%, the major business successes up to 2028 appear to be largely priced into the current share price. Investors who took profits at the high of EUR 1,940 in May may have made a sensible move from today's perspective, as the healthy consolidation continued yesterday with a 3% decline to EUR 1,758. Experts on the LSEG platform nevertheless set a 12-month price target of EUR 1,965. Now good advice is expensive!

Almonty Industries – The rocket is now taking off in the US

Whether it is modern defense technology, civil aviation, or high-performance electronics, many key industries of our time depend on the reliable availability of so-called strategic metals. A recent NATO report highlights twelve particularly critical elements that are indispensable for defense and security technology. At the top of the list is tungsten, an extremely durable, heat-resistant metal with exceptional material properties. It occurs only in limited quantities worldwide, with China currently controlling around 70% of global production.

Investors are now beginning to understand the bigger picture: those who want to be part of this game must look for undervalued commodity companies with strategic substance. While this shift has already brought MP Materials, a prominent representative of rare earths, to the fore in the US, Canadian company Almonty Industries has also recently entered the picture. The Nasdaq listing has now been successfully completed with a placement of USD 90 million, and the share price is now being revalued daily in Germany, Canada, and the US. While MP Materials is strongly supported by US programs and high-tech deals such as with Apple, CEO Lewis Black is already planning the next deals for Almonty. There are already material supply relationships with a US defense contractor, the headquarters are being relocated to the US, and important contacts have been brought on board.

Unlike rare earths, tungsten is truly rare, especially in reliably high-quality supply. Almonty is one of the few Western suppliers with a fully controlled processing chain, several operational mine sites, and the flagship Sangdong project in South Korea. The global market situation is also playing into Almonty's hands, as its main supplier, China, has recently cut its production quotas by around 7%. At the same time, prices are skyrocketing for both APT and ferro-tungsten. Demand from the high-tech and defense industries now significantly exceeds supply, which is inevitably leading to supply bottlenecks. This does not even take into account the EU's recent decision to put 1,000 new tanks into service in the next few years. This inevitably puts Almonty in the sights of larger industrial groups or government commodity security programs.

However, the valuation lags far behind strategic relevance: While MP Materials is valued at over USD 9 billion, Almonty currently weighs in at only around CAD 1.3 billion - only about one-tenth of that amount. This is despite analysts expecting EBITDA by 2028 that is in some cases twice as high as that of MP. If comparable valuation multiples were applied to Almonty, the fair enterprise value would be many times higher. Just yesterday, German research firm Sphene Capital raised its target price from CAD 5.40 to CAD 8.40 per share. The stock is still trading at consolidation levels, but this is likely not to last for much longer.

Hensoldt and Steyr – Very ambitious valuations

Defense company share prices have rallied like crazy in the last few months. This has been driven by geopolitical tensions, rising defense spending, and the ever-present talk of a new era. However, what at first glance appears to be a new growth story often turns out to be speculative exaggeration upon closer inspection. Stocks such as Hensoldt and Austrian engine manufacturer Steyr Motors are now valued based on future projections that far exceed their current performance.

Steyr Motors, for example, a specialist in high-performance diesel engines for military applications, has estimated revenues of around EUR 70 million for 2025; however, its market valuation currently stands at an impressive EUR 318 million. This is accompanied by an expected P/E ratio of over 30, with moderate growth and limited production capacity. The price volatility of recent months, from EUR 30 to over 300 and back again, shows how speculative the market has become. Hensoldt, one of the leading providers of sensor and radar technologies, also impresses operationally with a strong order backlog of EUR 6.93 billion. In the first quarter of 2025, revenue grew by 20% to EUR 395 million. In addition to hardware developments, the Company is also pushing ahead with a software-based defense strategy that enables AI-supported real-time solutions for defense. Nevertheless, the valuation remains ambitious here too: The expected P/E ratio for 2025 is over 56 and even by 2027 it only drops to 36.5. Impressive! In view of the overheated key figures, a healthy correction is more a question of when, not if.

After 1244 days of war in Europe, a new meeting between Ukrainian and Russian negotiators is taking place today in Turkey. The aim is to prepare for genuine peace negotiations, which are expected to begin in China in early September. This is currently bearish news for defense and arms stocks, which have been somewhat overheated. However, even if there is a short-term downturn here, Almonty Industries could still be a clear outperformer in the strategic metals sector over the next 12 to 24 months.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.