October 10th, 2025 | 07:30 CEST

Achieve sustainable green returns of over 50%! How do Deutsche Bank, RE Royalties, and Nordex do it?

With the Green Deal, the European Union has committed itself to the most ambitious sustainability program in its history. Through multi-billion-euro funding instruments, from the EU taxonomy to the InvestEU Fund and the Innovation Fund, Brussels is directing capital specifically toward green technologies, renewable energy, and sustainable infrastructure. For investors, the triggers are clear: stricter climate regulations, rising CO₂ prices, and the increasing commitment of institutional investors to comply with ESG standards are creating structural demand for green projects. Those who invest early in low-emission business models benefit twice over - from political support and growing social acceptance. So what makes companies like Deutsche Bank, Nordex, and RE Royalties the winners?

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

DEUTSCHE BANK AG NA O.N. | DE0005140008 , RE ROYALTIES LTD | CA75527Q1081 , NORDEX SE O.N. | DE000A0D6554

Table of contents:

"[...] We have built one of the largest land packages of any non-producer in the belt at over 440 sq.km and have made more than 25 gold discoveries on the property to date with 5 of these discoveries totaling about 1.1 million ounces of gold resources. [...]" Jared Scharf, CEO, Desert Gold Ventures Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Deutsche Bank – Way ahead with green finance in 2025

Deutsche Bank comprehensively promotes green projects with a focus on sustainable financing, ranging from renewable energy to energy-efficient buildings. Since 2020, the bank has invested more than EUR 373 billion in sustainable finance and ESG investments, with the goal of reaching a total of EUR 500 billion by the end of 2025. In the second quarter of 2025, it achieved a sustainable financing volume of EUR 28 billion, the highest figure since 2021.

The projects supported include major investments in renewable energies, such as a 3.6 gigawatt power plant portfolio in Australia. Real estate financing with ESG components is also growing strongly. The bank is actively working with the European Investment Bank to promote climate-friendly housing with discounted loans. By the end of 2024, Deutsche Bank will have provided a cumulative financing volume of around EUR 373 billion for sustainable projects. Its announced strategy includes strict environmental frameworks and net-zero targets for 2030 and 2050. The bank has also revised its code of conduct with regard to greenwashing and is working to bring CO₂-intensive industries to net zero. However, critics highlight existing loans to environmentally harmful companies, which cloud the sustainability picture. After a prolonged restructuring trend, the share price turned upward at the end of 2023 and has since gained over 200%. Analysts on the LSEG platform still see potential for growth to around EUR 32, not much upside from the current level of EUR 30.40.

RE Royalties – A thoroughly innovative approach sets a precedent

RE Royalties is a Canadian company based in Vancouver that specializes in financing renewable energy projects. Unlike traditional banks or investors, RE Royalties uses a revenue royalty model, meaning it takes a share of the long-term revenues from energy projects. This concept enables project developers to access capital without giving up equity or taking on excessive debt.

Its core business consists of acquiring ongoing revenue shares from solar plants, wind farms, hydroelectric power plants, and energy storage facilities. RE Royalties focuses on non-dilutive financing solutions that give project operators flexibility and control. At the same time, the Company benefits from stable, recurring income secured by carefully selected projects. RE Royalties currently has more than 100 royalties across North America and Europe, spanning a wide range of renewable technologies, from solar and wind power to run-of-river hydropower and energy storage solutions. Geographic diversification reduces risk while providing access to various support programs and subsidy models in the respective regions. Growth is currently based on the steady acquisition of new royalties and the active management of existing projects.

The Company is not yet turning a profit, but that is not surprising given its innovative financing instruments. RE Royalties offers long-term investment opportunities in green projects, a great niche model with significant potential. Opportunities arise from the growing market for renewable energy, stable income from royalties, and strong political support. The appeal lies in its approach: the Company combines green projects with an innovative financing model, addressing a novel market niche for companies with high refinancing needs. Investors can still enter the model at a valuation of around CAD 12 million. The business concept aligns perfectly with the current political discussion!

Nordex – Driving the energy transition forward with strong order growth

A key player in sustainable technologies is the Hamburg-based wind turbine manufacturer Nordex. The Company again reported strong order growth in Q2 2025, with orders received totaling 2.17 GW, representing an increase of around 26% compared to the same period last year. In the first nine months, orders totaled 6.7 GW, with demand coming primarily from Europe, especially Germany, and North America, particularly Canada. The average selling price per MW of capacity remained largely stable at around EUR 0.93 million, which is attributable to regional mix effects and larger project volumes.

Record revenue of around EUR 2 billion is expected for the third quarter, which corresponds to annual growth of just under 20%. The often-criticized EBITDA margin is slowly moving toward the mid-term margin target of 8%, currently at 6.5%. This is encouraging analysts to continuously revise their price targets upward. On the LSEG platform, the average 12-month price target has now risen steadily to EUR 23.30. Twelve months ago, experts were still forecasting EUR 14.70. The stock has now reached EUR 24, marking a new 8-year high. The sustained growth in order intake and the largely stable price situation remain key factors for investors, positioning Nordex well in an increasingly competitive market. Geographical diversification and a focus on high-demand projects are also supporting growth. Secure your profits with a technical stop at around EUR 21.70, as this represents the next support level in the current upward breakout.

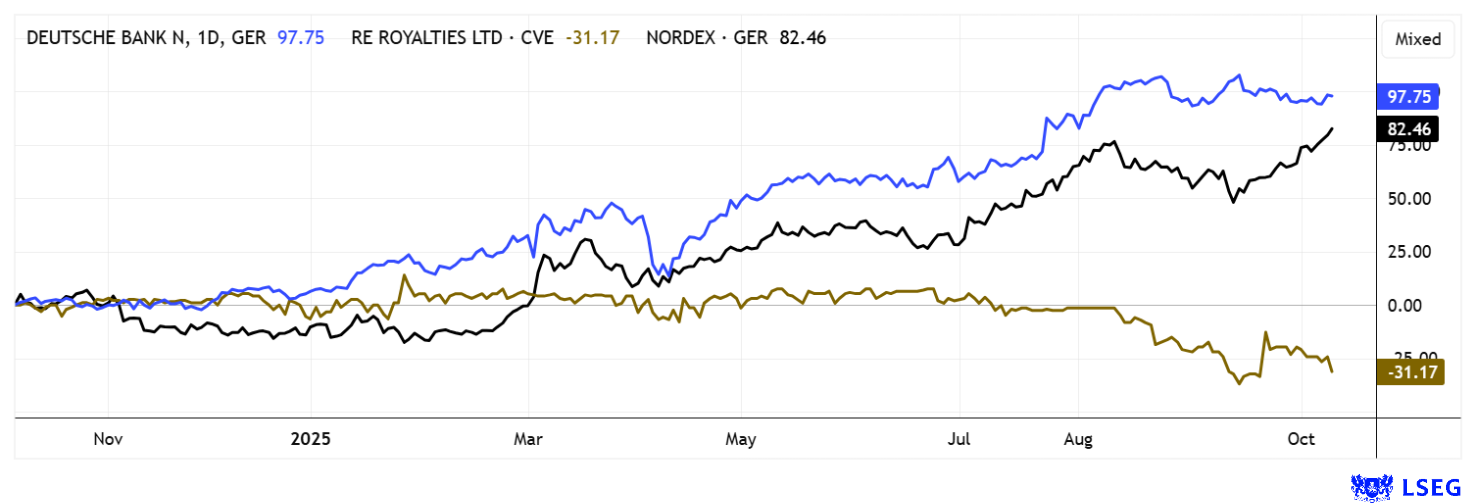

Volatility on the stock markets has remained extremely high for months. However, the markets have recovered impressively from Trump's tariff shock in April and are once again hitting new highs. Even sustainable investments such as Nordex have now gained over 70% in 12 months. The operational turnaround at Deutsche Bank has resulted in a 90% increase in value. Meanwhile, RE Royalities is currently consolidating at around CAD 0.35, but maintains promising prospects.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.