May 22nd, 2024 | 07:15 CEST

The party is over - Sell defense stocks now! Rheinmetall, First Hydrogen, Renk and Hensoldt

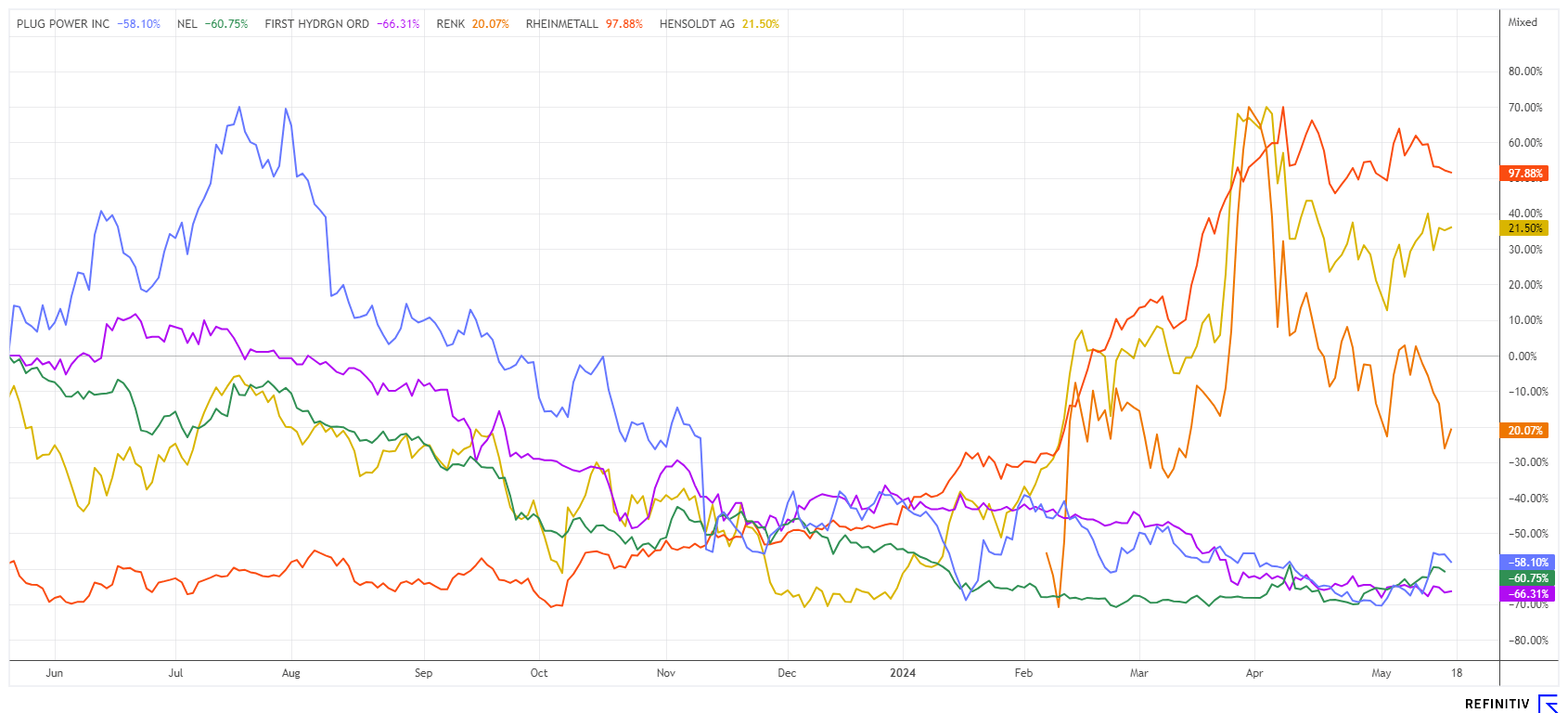

While the DAX and NASDAQ are reaching new highs, sectors like armaments and high-tech are taking a break. After an extended rally, it is also good to see other stocks coming back into focus. A surprising rebound in Plug Power sent the bombed-out stock soaring by 80%, but unfortunately, 60% of this gain was quickly lost. Easy come, easy go! A significant sell-off occurred at Renk, raising the question of when Rheinmetall and Hensoldt might follow suit. We analyze the current trends in more detail.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

RHEINMETALL AG | DE0007030009 , First Hydrogen Corp. | CA32057N1042 , RENK AG O.N. | DE000RENK730 , HENSOLDT AG INH O.N. | DE000HAG0005

Table of contents:

"[...] dynaCERT's HydraGEN™ device offers a retrofit solution for diesel engines designed to protect the environment while providing economic benefits. [...]" Bernd Krueper, President & Director, dynaCERT Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Rheinmetall - The Bundeswehr special fund at a glance

The share price of Düsseldorf-based armaments manufacturer Rheinmetall has had a clean 48-month run, rising from around EUR 90 to EUR 570 in April 2024. Since then, the upward momentum seems to have stalled. The fundamental view shows a market capitalization of EUR 22.5 billion with expected revenues of EUR 9.86 billion in 2024. Earnings per share are expected to rise from EUR 12.3 in the previous year to EUR 21.4, almost a doubling. The expected P/E ratio is 24, whereas it was only 7 before the war in Ukraine. With anticipated growth of around 17 to 20% by 2026, the share is already valued with the 2026 figures in mind. The reason: Rheinmetall's management expects that around 30-40% of the special Bundeswehr EUR 100 billion fund - which, unlike the government, we do not consider an asset - will end up on its books. The catch: Major contracts must be submitted to international tender.

However, the figures for the first quarter are good. The high demand for ammunition has boosted sales in this division by 70% year-on-year to EUR 362 million. Thanks to substantial orders for Ukraine, the order backlog in this area amounted to EUR 1.14 billion, almost twice as high as a year earlier. With ammunition for tanks, artillery, and anti-aircraft guns, Rheinmetall produces goods that are urgently needed for use on the Russian front.

With the acquisition of the Spanish ammunition manufacturer Expal, Rheinmetall strengthened its position in this business unit, and existing production areas were also expanded. Total sales in Q1 rose 16% year-on-year to EUR 1.58 billion, while the operating result improved disproportionately by 60% to EUR 134 million. Despite the high pace of growth, the share price momentum currently seems to be out. Therefore, increase your profit protection stop to EUR 485, as a desirable ceasefire in Ukraine alone would likely cause the share price to collapse.

Renk and Hensoldt - Major investors are exiting now

What can happen with overvalued stocks is evident to the discerning investor in the case of the specialized gearbox manufacturer Renk. The stock went public in February at EUR 17.50 with great expectations and more than doubled in value due to the general euphoria about armaments. However, once it reached lofty heights, the major investor, Triton, began to sell off its stake. According to reports, 10 million Renk shares were placed with institutional investors at a unit price of EUR 25 each, 5% below the closing price on Thursday. Together with the general selling pressure, the share price fell by 35% to just over EUR 26 between the end of March and May alone. We had pointed out the overvaluation of Renk at an early stage.

The picture is similar for Hensoldt. The share price has more than tripled since February 2022. Estimated revenues for 2024 are EUR 2.3 billion, valued with a price-to-sales ratio of 2. On a P/E basis, this translates to 24.7, with expected growth of approximately 10 to 15% per year, marking the share at least 30% too expensive. The share price has already corrected upwards by 13% in the last few days, but this may just be the beginning. It is advisable to set a stop at EUR 38.00 here as well.

First Hydrogen - Soon to be globally relevant?

In North America, investments in the future are often linked to special budgets that the US government proclaims for start-up financing. One such measure is US President Joe Biden's so-called "Inflation Reduction Act" (IRA). Within this framework, last week, the world's largest electrolyser manufacturer, Plug Power, received a USD 1.66 billion guarantee from the Department of Energy for the construction of 6 hydrogen megawatt factories in the US. The share price exploded by almost 100% in just 4 hours of trading and then quickly lost 70% of that gain.

With the "Hydrogen-as-a-Service" model, First Hydrogen wants to supply customers in the Montreal-Québec City region with clean, green hydrogen fuel for the first time. In addition, a feasibility study is underway for the construction of an assembly plant for the Company's innovative FCEV delivery vehicles. This could create the first zero-emission transportation ecosystem in the future. In recent weeks, it has been announced that one of the largest multi-national delivery companies is conducting a major test of the vehicles. Large corporations with billions in turnover, in particular, have the means to boost the climate transition.

Most recently, First Hydrogen has also entered into discussions with a nationwide industrial fleet operator in Mexico. The potential customer is looking to convert its fleets to hydrogen-powered fuel cells, add additional FCEVs to its fleet and build a broad hydrogen refueling station (HRS) infrastructure. The Mexican hydrogen association, Asociacion Mexicana de Hidrogeno (AMH), states that there are at least 15 projects under development across the country with a total investment volume of USD 20 billion. Hydrogen Insight estimates that the USD 20 billion will enable almost seven gigawatts of green hydrogen facility.

First Hydrogen's shares are currently trading actively in Germany in the EUR 0.65 to EUR 0.75 range. The surge in Plug Power had been a strong driver of sales in the sector. The FHYD stock is a top pick in the sector due to its high innovation potential and promising pipeline.

The buying panic in Plug Power last week showed how dry the H2 sector has become on the stock market. After strong rallies in defense, high-tech and AI, investors should soon expect a sector rotation in favor of other innovative sectors. These include, first and foremost, hydrogen and energy technology.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.