March 22nd, 2023 | 10:49 CET

A new banking crisis in 2023? Deutsche Bank, Blackrock Silver, Commerzbank - Gold and Silver are back!

Central bankers are currently in a huge dilemma. They should fight the price pressure with a tough interest rate policy and gradual withdrawal of liquidity. However, this increases the existing risk of recession and the danger of a new financial crisis worldwide. In fact, past interest rate restrictions have already left grinding marks in the US banking system because gigantic write-downs on price losses still lie dormant in the books of institutions that had believed in eternally low interest rates. After the collapse of Silicon Valley Bank and the forced takeover of Credit Suisse, uncertainty has again taken a stranglehold on the markets. Gold and silver reacted with a giant leap. We look at the current situation.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

DEUTSCHE BANK AG NA O.N. | DE0005140008 , Blackrock Silver | CA09261Q1072 , COMMERZBANK AG | DE000CBK1001

Table of contents:

"[...] We have already discovered 1.1 million ounces of gold on our 440 km2 flagship SMSZ Project and our stock market value is currently around USD 10.60 per troy ounce in the ground. [...]" Jared Scharf, CEO, Desert Gold Ventures Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Credit Suisse bailout - The default of subordinated bonds is a novelty

The worthlessness of CoCo bonds is a first in international bank bailouts. Although shareholders will lose only 88% of their value and will also receive UBS shares for their troubled paper, all issued CoCo subordinated bonds worth CHF 17 billion must be written down to zero, according to the SNB and the supervisory authority. This sends a problematic signal to the capital markets, as the takeover, completed with the backing of the Swiss government, is causing quite a stir in the market for subordinated bank bonds.

The bond class, which was only introduced with the great financial crisis after 2008, represents a mandatory conversion instrument that is only ranked behind shares in the order of liability. The write-off that has now taken place could, therefore, still result in legal action by the investors; after all, the changed pecking order was quite arbitrarily thrown over by the Swiss state. The shareholders, i.e. the primary equity, would have to bear the losses first. Only then should the subordinated bonds be called in.

Another bone of contention is looming: The compensation issue. Credit Suisse's top management has probably not yet paid any bonuses, as the Neue Züricher Zeitung reports. Because of a particularly heavy net annual loss of CHF 7.3 billion, there are too few arguments for a bonus after all. But even without bonuses, CHF 32.2 million in salary still flowed into the bank's management accounts, just CHF 6 million less than the year before. According to the Bloomberg news agency, Credit Suisse said in an internal letter that despite the takeover, all bonus and salary payments will be made as planned on March 24. The financial industry has apparently learned nothing since 2008 and continues blithely with unbridled self-enrichment. One can only hope that Swiss Finance Minister Karin Keller-Sutter, with the help of the Financial Supervisory Authority, will issue a ban on bonuses. What a farce!

Risk of contagion - Deutsche Bank and Commerzbank in recovery mode

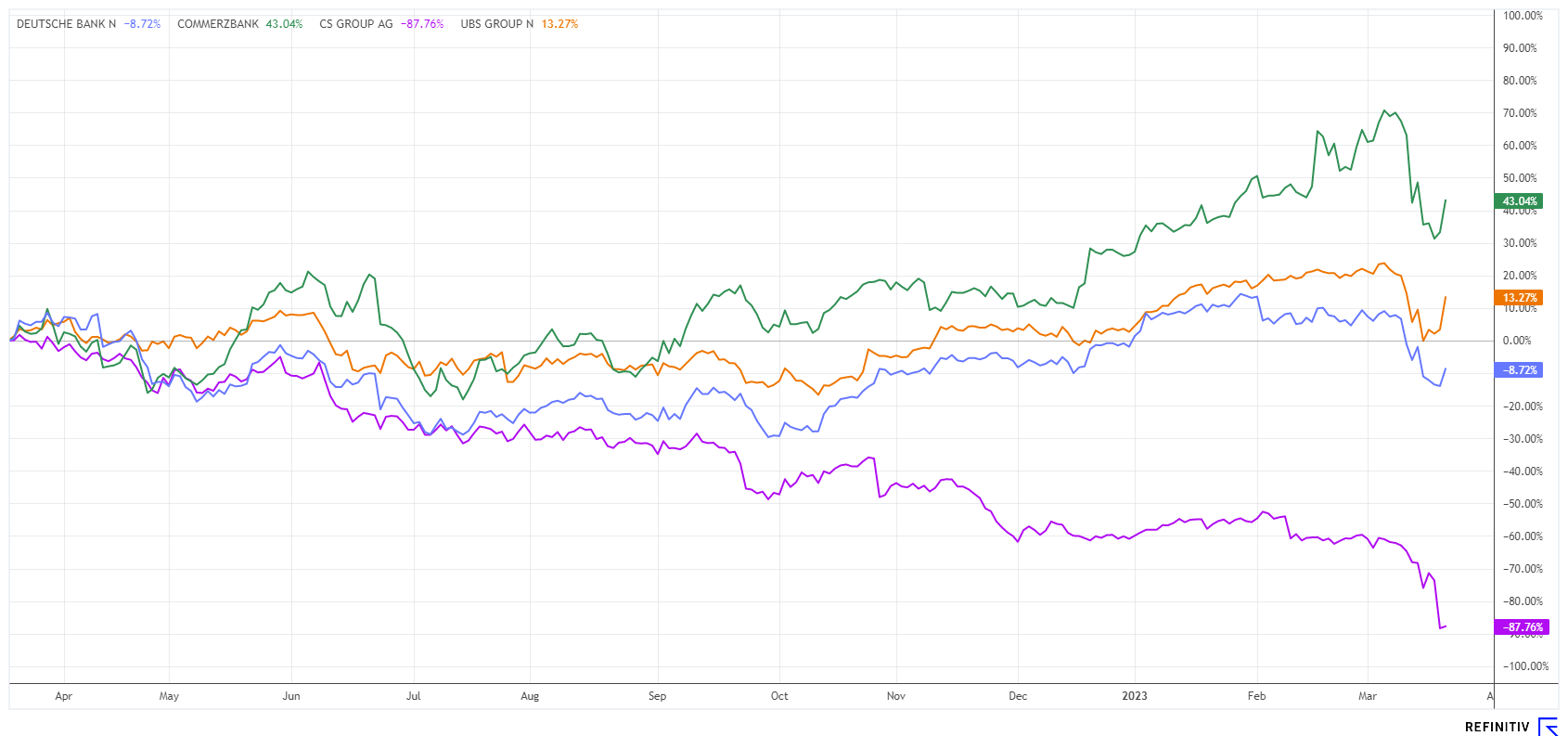

The shares of European banks fortunately continued their stabilization yesterday. The STOXX Europe 600 Banks were trading at a high of 13% higher than on the "shock Monday morning". The papers of Commerzbank rose the most with 20%, closely followed by Deutsche Bank with about 17%. But the disillusionment over the surprisingly necessary emergency rescue of Credit Suisse by UBS is not yet off the table. Experts consider the situation still too unmanageable, and one would prefer to wait to speak of a new bank crisis.

German banks hastened to explain that they are not or hardly affected by the losses with AT1 bonds of Credit Suisse. Deutsche Bank's exposure is close to zero, and Commerzbank, DZ Bank and Helaba, as well as the fund companies Union and Deka, do not hold any AT1 bonds of CS, according to their own statements. Nevertheless, there is a risk of contagion across the industry because insurance companies and capital collection agencies are also creditors of Credit Suisse and have invested in subordinated AT1 bonds. And no one knows what derivatives are slumbering in the background. One can only hope that UBS was able to get a sufficient overview of the risk book in the short time available. Nobody needs domino effects like in 2008 anymore, so we are waiting with bated breath to see how the US Federal Reserve will react to the turbulence in terms of monetary policy in the midst of its fight against inflation. Nobody wants to be sitting in the front row for the next meeting.

Blackrock Silver - A good positioning in Nevada

Banking and financial crises are fire accelerators for the gold and silver markets. Thus, the precious metals gained almost 4% each to USD 1989 and USD 22.9 on Friday, but at the beginning of the week, there was individual profit-taking. Market participants see an initial technical spark, which had already appeared in the charts of the last weeks. In the case of gold, now only the resistance at USD 2,050 must fall. In the case of silver, the buy mark is above USD 26.

The Canadian explorer Blackrock Silver (BRC) focuses on the exploration and development of projects in the silver state of Nevada. Historically significant discoveries included the Comstock Lode and Tonopah Silver District to the west within the so-called Walker Lane trend. The newly consolidated land package consists of 100 patented and 279 unpatented mining claims totaling 25.5 sq km. There is also already an initial drift-optimized mineral resource estimate of 2.975 million tonnes grading 446 grams for 42.65 million ounces of silver. That makes Tonopah West the highest-grade undeveloped silver project in the world, with significant potential for resource expansion.

The 2022 exploration program more than doubled the extent of mineralization beyond the initial resource boundary. It resulted in a lithium discovery at Tonopah North and a prospective option agreement with Tearlach Resources. A 3,000-meter drill program commenced at Tonopah North in February, with results pending. An application has been submitted to the authorities for a further 4,000-meter drill program, which will be processed in Q2 2023. Blackrock Silver shares recently consolidated to CAD 0.30 but could quickly move back up in the current environment. In January, BRC shares were already trading above CAD 0.60. If silver makes a sustained turnaround, Blackrock Silver will quickly become a golden investment.

In a fragile economic environment, bank failures can lead to minor earthquakes in the capital markets. The danger at Credit Suisse seems to have been averted, but risk-conscious investors should nevertheless remain on their guard and courageously add precious metal investments.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.