June 22nd, 2023 | 07:00 CEST

A lot of movement can be expected here: Covestro, Globex Mining, and Nikola - The focus is on 100% returns!

Greentech is politically promoted and booming. Many stocks are traded on the stock market with this fantasy. But what is really technologically feasible? Those seeking to switch from fossil energy to electric forms often overlook the sometimes poor efficiency in converting fossil primary energy sources to electricity from the socket. Truly green solutions are defined per se by applications that improve the overall energy balance of the goods moved or even achieve a net-zero impact. Access to cheap raw materials, especially high-tech metals, is a prerequisite for all endeavours. We look forward to interesting price movements in the sector.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

COVESTRO AG O.N. | DE0006062144 , GLOBEX MINING ENTPRS INC. | CA3799005093 , NIKOLA CORP. | US6541101050

Table of contents:

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

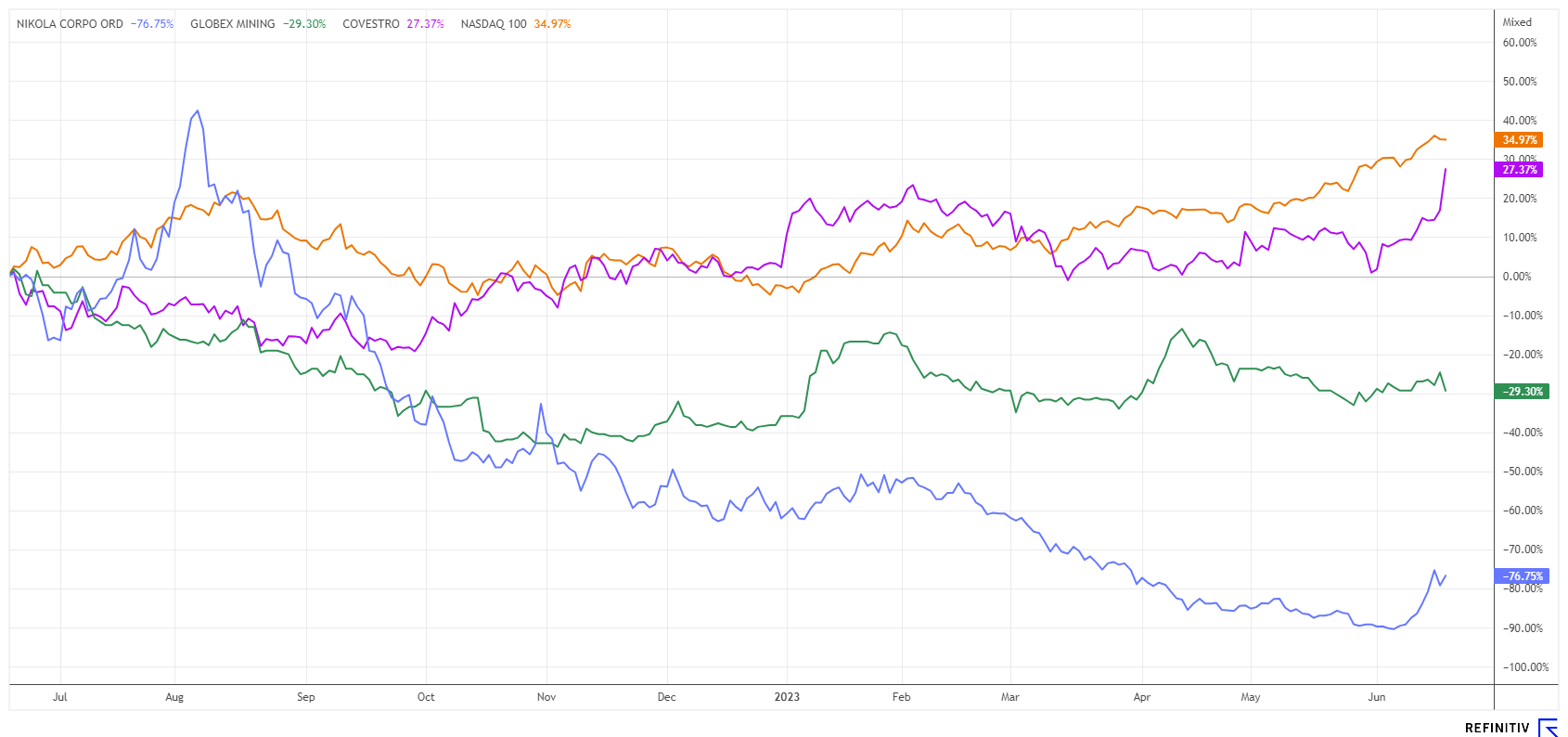

Covestro - Takeover bid worth 15% in one day

The market value of Covestro increased by just over EUR 1 billion the day before yesterday. The oil group Abu Dhabi National Oil Company (ADNOC) seems to have its sights set on the plastics group. If one is to believe informed circles, there have already been initial talks with Covestro representatives in Leverkusen. The possible takeover price is reportedly around EUR 50 to 55, about 30% above the average price of the last 3 months. With around 193 million bearer shares, this price would result in a market valuation of almost EUR 10 billion. It is difficult to imagine that the shareholder community would approve of this offer, especially considering the stock reached EUR 63 in 2021.

Bidder ADNOC produces almost all the oil for OPEC member in the United Arab Emirates. The group recently announced plans to invest EUR 150 billion to expand its natural gas, chemicals and green energy activities worldwide. Last year, ADNOC already bought shares in Austria's OMV AG worth around EUR 3.9 billion.

Covestro belongs to the group of technical specialty chemicals companies. Fundamentally, the leading producer of high-tech polymer materials as well as coatings and binders is trading at a 2025 P/E estimate of 11 and a price/sales valuation of a low 0.6 after an expected earnings slump in 2023. Analysts applauded the rumours and raised their estimates. Goldman Sachs rates the stock a "buy" and expects a target price of EUR 64 in 12 months. Conversely, the consensus target price on the Refinitiv Eikon platform still stands at EUR 46.10. The difference to the takeover price is still more than 10%, so the chances of price gains are not bad.

Globex Mining - Broadly diversified and affordable

The Greentech wave and the related fuss about strategic metals is playing into the hands of Canadian resource company Globex Mining (GMX). CEO Jack Stoch has been running the well-diversified explorer for over 30 years. The Company is a potential supplier of valuable metals in the energy renewal process. The current portfolio comprises over 200 properties, which are optioned to partner companies as exploration properties. This places the exploration risk outside of Globex. If a resource is discovered, the optionor receives permanent royalties from the start of production or can be bought out via a larger one-off payment. The holding company's properties, therefore, yield regular portfolio returns, steadily and reliably increasing shareholder income.

In early June, Globex reported on its latest deal with Burin Gold Corporation. This is for the acquisition of a 100% interest in the Dalhousie project, which consists of 31 claims and is located 53 km east of Matagami on Lac au Goéland in Québec. The property comprises an ortho-magmatic nickel-copper-cobalt deposit located within the mafic-ultramafic package of the Bell River Complex. Existing historical drilling until the late 1980s focused on poorly delineated geophysical anomalies, although mineralisation was successfully encountered. Historic chip channel samples assayed up to 3.79% Cu, 0.90% Ni and 0.28% Co.

Field work will commence this summer. Under the terms of the agreement, Burin will pay CAD 1.5 million upfront and issue 4 million shares which will be transferred to Globex. Exploration work of CAD 5 million is to be carried out over a 4-year period. Globex will receive 3% royalties on top after the potential sale in 2026. The good news sent GMX shares up from CAD 0.72 to CAD 0.81. With a market cap of CAD 44 million, Globex Mining is still undervalued.

Nikola - Like a phoenix from the ashes

The scandal-ridden company Nikola was in the news a lot, especially in 2022, when founder Trevor Milton was convicted of securities fraud. Even today, he owns 50 million Nikola shares and is always conspicuous for negative comments on social media. At the launch of its hydrogen-powered trucks, Nikola faced accusations that a promotional video showed false facts. The stock subsequently fell like a stone by 98% from a former USD 75 to below USD 1.50. However, a denotation from the Nasdaq was successfully prevented in 2023.

Now, with a market value of USD 820 million, the Company is making headlines again, as the first H2-powered truck is scheduled to be delivered in the autumn. Nikola recently reiterated that its third-quarter launch of the Tre FCEV Class 8 fuel cell electric truck remains on schedule. The Company says it has 178 orders from 14 different end customers. To get a grip on costs, Nikola is laying off 270 employees, 150 of them in Europe. It is hoped that this will result in annual savings of USD 50 million.

The Nikola share price seems to have turned around at the beginning of June. It gained 100% in 10 trading days and was quoted at USD 1.48 yesterday. On the Refinitiv Eikon platform, there are at least 9 analysts with an opinion on Nikola, which are cautiously between Neutral and Buy. The weighted average of the price expectations is calculated at USD 3.14, which is still a good 100% premium to the current price. Highly speculative and also quite volatile!

Since the big turnaround in interest rates, stock markets have become particularly vulnerable. Bad news leads to sharp individual markdowns in equities. Nevertheless, interesting opportunities are always lurking in the artificial intelligence and Greentech sectors. The long-neglected commodities market should also soon regain traction.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.