March 21st, 2025 | 06:30 CET

250% Stock Rockets: Attention, it is taking off now with Nel ASA, naoo AG, Steyr, Mutares, and Hensoldt

The German economic stimulus package has been launched. The only thing missing is the approval of the Bundesrat, which is expected today. Public opinion is divided because the total of up to EUR 1 trillion in "special funds" is the largest debt incurred by the now 75-year-old federal government. The doubters see it as an enormous burden for future generations, while supporters emphasize that Germany has hardly invested in its future for many years and that the renewal backlog is now finally being addressed. This measure will increase the debt-to-GDP ratio by around 25%, while at the same time, the targeted measures in armaments, infrastructure, and climate protection will improve growth by around 0.2 to 0.3% annually with an increased state quota. The stock market celebrates, while the working population has to contribute around EUR 500 in interest annually as an additional tax burden. The election winners had promised significant tax relief. Where do the opportunities for investors lie?

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

NEL ASA NK-_20 | NO0010081235 , NAOO AG | CH1323306329 , STEYR MOTORS AG | AT0000A3FW25 , MUTARES KGAA NA O.N. | DE000A2NB650 , HENSOLDT AG INH O.N. | DE000HAG0005

Table of contents:

"[...] The mere fact that we have to write off around EUR 5 million shows that mistakes were made. We have to admit this quite openly to ourselves. [...]" André Kolbinger, CEO, Smartbroker Holding AG

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Nel ASA – Like a phoenix from the ashes

Like a phoenix from the ashes, the shares of Nel ASA have recently shot up. On the one hand, hopes are being pinned on the new Green Deal within the German debt package to revive the European hydrogen strategy. On the other hand, the Norwegian pioneers have also been able to win a new major shareholder. Nel ASA has signed an EPC (engineering, procurement and construction) cooperation agreement with the South Korean construction and project management company Samsung E&A. The deal enables the Koreans to offer their customers complete hydrogen plants using Nel's electrolysers. In addition, Samsung E&A is acquiring a 10% stake through a direct placement. After the transaction, the South Korean group will own around 9.1% of Nel shares. This is a major cash injection for the crisis-ridden Nel ASA, as public sector orders have fallen sharply in recent months. It has also been a game-changer for the Nel share price, which has now risen by around 60% in a single week. In the three-year chart, the hydrogen stock is still down 83%. The cooperation with Samsung is important in our opinion, but what Nel needs to recover are billion-dollar orders. Chart-wise, however, the turnaround could now be in place!

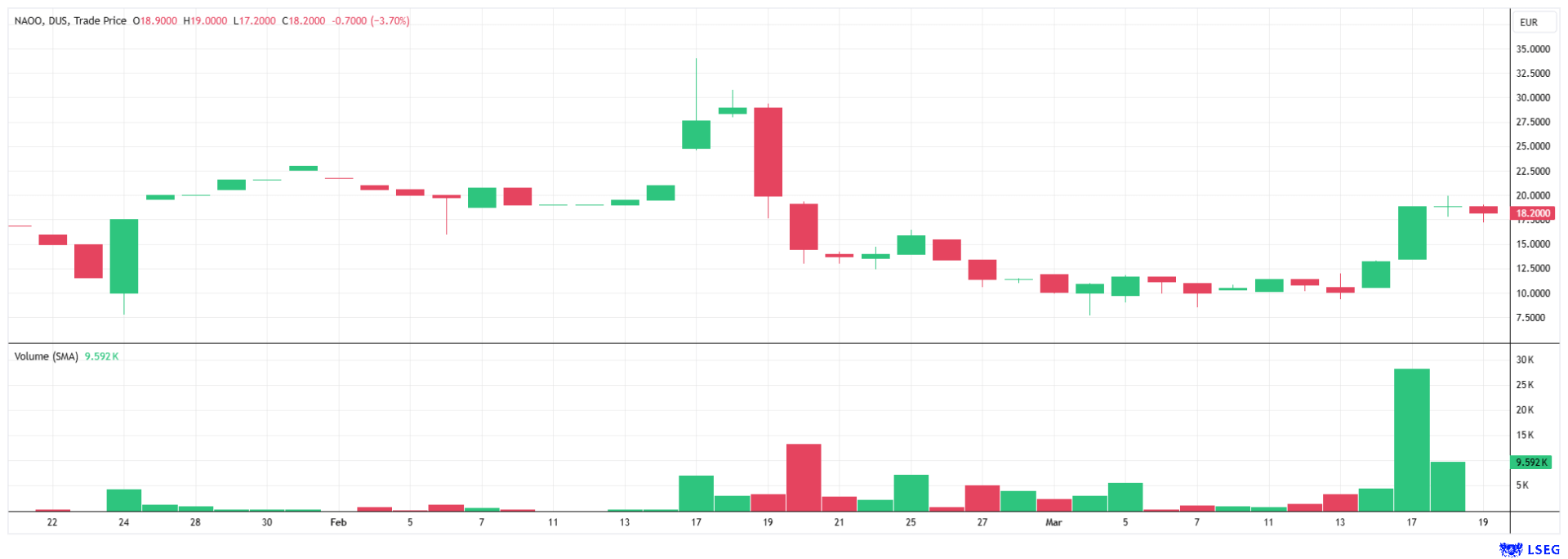

naoo AG – A beautiful M&A deal boosts the stock

A 100% price jump was also achieved by the Swiss company naoo AG, and all this without any connection to the Federal Republic's debt. The innovative tech company operates a new social media platform and is thus competing with tech giants such as Meta Platforms, Microsoft, Tencent, and ByteDance. By exploiting the known weaknesses of large platforms, programmers have launched a new type of social media platform that rewards user activity. The key features include valuable content and a new, detailed, and personalized kind of profile. naoo incentivizes its users with a unique point system that rewards users for high-quality content and interactions, regardless of their reach. The "rewards" earned through activity can be exchanged for goods, services or cash, subject to availability.

Last week, there was an acquisition to report. The Company acquired an 87% stake in Kingfluencers AG, the largest influencer agency in Switzerland, based in Zurich. The transaction is being paid for with 81,092 new naoo shares, a loan of CHF 0.3 million and a further commitment of CHF 0.9 million. The acquisition directly impacts the income statement, as Kingfluencers AG generated revenues of around CHF 7 million in 2024. The exact purchase price was not disclosed, but naoo CFO Karl Fleetwood described the acquisition as a milestone for naoo. Synergies can now be leveraged, with the larger product offering and increased reach strengthening their market position. The management board makes it clear that M&A will continue to be an important strategic pillar in the future.

The naoo share was trading at around EUR 10 before the transaction and doubled in value to EUR 20. There is currently a small consolidation, which can be used to build up positions. With this deal, management is demonstrating its strong commitment to growth. Shareholders of the Company, valued at around EUR 75 million, can still expect a lot.

Steyr and Hensoldt – Defense in vogue, but for how much longer?

As if stung by a tarantula, defense stocks have surged in recent days. New highs were reached at Rheinmetall, Hensoldt, and Renk. However, the standout was the recent market debut of Steyr Motors AG, brought to the stock exchange by Mutares. The defense stocks on the exchange will be able to benefit to varying degrees from the German government's "special liabilities." While Rheinmetall is in first place due to its international standing, Renk and Hensoldt can expect revenue increases of around 10 to 20% in the next few years due to their share of defense in the revenue structure. For Rheinmetall, this could rise to 25% if they can structurally manage the high order intake. The price gains are therefore understandable, but it is highly doubtful whether the 100% premiums will hold in the coming weeks. After all, the securities are trading at valuations that fully price in NATO's spending dynamics over the next five years. Peace negotiations with positive results could quickly turn the sentiment here to the negative and create selling pressure.

An absolute "rocket example" is provided by Steyr Motors AG, which has only been relisted since October. The parent company, Mutares, floated its subsidiary on the stock market at a placement price of EUR 14 per share. On March 18, it reached a daily high of EUR 384 in XETRA trading before crashing back below EUR 100 on Thursday. Congratulations to Mutares, who even managed to have the lock-up lifted early. The reason cited was the market tightness of Steyr shares. This is good for future shareholders but a blow to traders who executed at over EUR 380. The free float will now increase significantly as Mutares can freely cash out - a dream investment for the Munich-based investment company. At the time of the IPO, Mutares held a 71% stake in Steyr Motors, and the Company plans to remain on board in the long term with a significant stake. With a market capitalization of more than EUR 1 billion in the short term, Steyr is a hot stock among defense stocks. Unfortunately, there were no instruments for short positioning!

Crazy times on the stock market. The high volatility and the sometimes significant price jumps are reminiscent of the year 2000. With his obscure decisions, Donald Trump is creating a strong differentiation among economic sectors, jeopardizing long-standing relationships. Investors need to be focused because the days of "long-only" are definitely over. We believe that naoo AG will continue to grow dynamically and attract thousands more new users to its innovative platform.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.