July 21st, 2025 | 07:20 CEST

150% with Gold, Caution in Defense stocks! BYD, AJN Resources - Are RENK and Steyr headed for a crash?

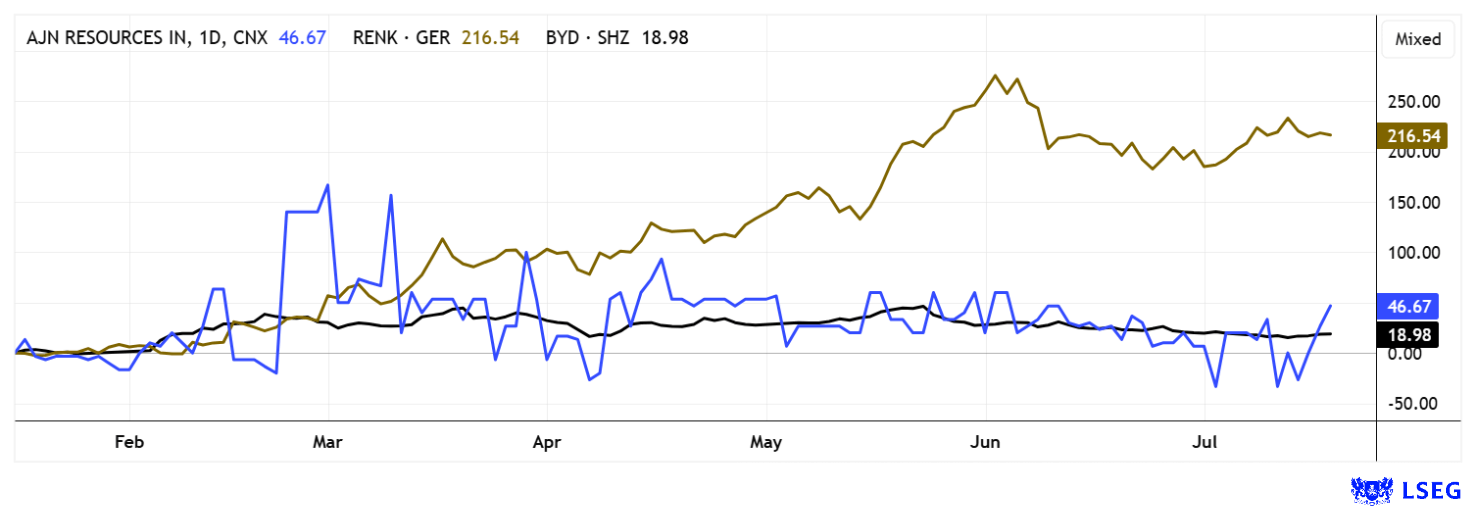

The stock market is currently experiencing fluctuations. While defense stocks are leading the performance list, precious metals have also been back in focus for several months. The reason: Currency devaluation is accelerating as inflation rates remain high. Now, there are rumors that Donald Trump may want to replace his hawkish monetary watchdog, Jerome Powell. Wall Street is betting that a more dovish figure will soon steer US interest rate policy. That would be the next rocket boost for stocks. However, risk-averse investors are increasingly turning to gold. In 2025, the price per ounce has already risen as high as USD 3,490. Due to low production costs, projects in Africa remain firmly in focus. One example is AJN Resources, which has recently refinanced and is repositioning itself in Ethiopia. Where do the real opportunities lie for dynamic investors?

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

BYD CO. LTD H YC 1 | CNE100000296 , RENK AG O.N. | DE000RENK730 , STEYR MOTORS AG | AT0000A3FW25 , AJN RESOURCES INC. O.N. | CA00149L1058

Table of contents:

"[...] Both the geology and the infrastructure around the project make for a very attractive cost structure. We expect to be able to produce at 50% of the current gold price. [...]" Bill Guy, Chairman, Theta Gold Mines Limited

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

AJN Resources – Gold in East Africa in focus

Precious metals are shining particularly brightly this year, with gold reaching a high of USD 3,490 and silver climbing to USD 38.4 in July. This surge is being driven by ongoing geopolitical concerns, high inflation, rising long-term interest rates, and growing doubts about global financial stability. New conflicts, such as the recent one between Israel and Syria, are also keeping investors on edge. Gold is therefore not just experiencing a temporary rally; it is becoming a strategic reserve.

AJN Resources, a Canadian explorer focusing on East Africa, is positioned right in the middle of this market trend. Under the leadership of renowned geologist Klaus Eckhof, the Company is shifting its focus from lithium to gold, particularly in Ethiopia. AJN recently acquired a 70% stake in the promising Okote gold project, located just 100 km from Ethiopia's largest deposit, Lega Dembi. Historical drilling data from the project indicate gold grades ranging from 1.6 to 8.7 grams per tonne, which is a promising start. The region itself is gaining economic momentum. East Africa, particularly Ethiopia and Kenya, is investing heavily in infrastructure, and mining licenses are being liberalized, with international investors showing increasing interest. The political climate is stabilizing and new trade agreements are increasing the attractiveness for foreign capital.

AJN raised CAD 500,000 in fresh capital in May, and the current market valuation of only CAD 6 million appears very low given the wealth of opportunities. At the same time, 13.42 million warrants were extended until 2028, with the exercise price falling from CAD 0.30 to CAD 0.15, which is favorable for investors. Further capital inflows are therefore within reach for the Company, and progress on the projects should be just as dynamic. The originally planned Dabel gold project was rejected after critical review, a sign of the team's selective and professional approach. With prices around CAD 0.11, the stock is highly interesting!

BYD – Under pressure with high inventories

Chinese electric vehicle manufacturer BYD is facing increasing pressure, despite the general stock market rally. More than 340,000 unsold vehicles are piling up in warehouses, many of them in Europe. This is the result of an aggressive expansion strategy that led to massive overproduction. To drive sales, BYD has launched a fierce price war that is also forcing competitors to offer discounts and plunging the entire industry into a vicious circle. The consequences are not only closed branches and production cuts, but also growing concerns on the part of the government and questionable sales practices, such as offering high discounts on so-called "zero-kilometer" cars with registered previous owners.

Analysts are now warning of parallels with real estate giant Evergrande. Officially, BYD is not reporting any losses; however, hidden debts, particularly to suppliers, are putting the Company in a difficult financial position. The fundamental problem affects the entire Chinese market, where manufacturers often operate at less than 50% capacity; a comprehensive market shakeout, therefore, seems inevitable. The looming crisis offers new opportunities for European carmakers in particular: with their focus on quality, safety, and sustainability, they could benefit from the weakness of their Chinese competitors. The BYD case highlights the dangerous bubble in the Chinese electric vehicle sector. While Western media talk of the Chinese threat, the supposed game changers themselves are burning billions in an irrational competition for new electric customers. The real disruption could therefore come in the future from a confident reorientation of European mobility concepts. Following the recent 25% correction in BYD's share price, the market capitalization has once again fallen far short of the EUR 100 billion mark. If the management's outlook nevertheless materializes, the stock is currently trading at a 2026 P/E ratio of 11 – a growth stock has rarely been this inexpensive. Or is a major e-disaster looming?

Steyr and RENK – Riding the wave of euphoria

Shares in defense companies have experienced an unprecedented rally in recent months. In light of geopolitical crises, growing defense budgets, especially in NATO countries, and the now monotonous "turning point" rhetoric, investors are investing virtually blindly in stocks such as Steyr Motors and RENK in Augsburg. As suppliers of key components, both companies are indirectly benefiting from the increased demand for military technology; however, their current valuations raise serious questions.

Steyr Motors, an Austrian niche supplier of high-performance diesel engines, is now trading on future expectations that go far beyond its current business. For example, revenue estimates for 2025 are around EUR 70 million. However, the current market capitalization is EUR 318 million. With prices above EUR 60, the 2025 P/E ratio has risen to over 30, even though growth of 10 to 15% at best can be expected, given still limited capacities. A short squeeze drove the share price above EUR 300 in March, before it fell back to below EUR 40. Crazy! The picture is similar at RENK, one of the leading manufacturers of tank transmissions and military drive technology: The Company is solidly positioned, but with a 2025 P/E ratio of over 45, the valuation already appears very ambitious, especially since revenue is already valued at a factor of 5. This is particularly true for a business that is heavily dependent on political decisions and is hardly scalable.

Both stocks have already received a lot of advance praise, but there are cheaper alternatives with comparable growth figures. The defense sector remains highly sensitive, as it depends on the continued expansion of public debt. However, broadly desired peace agreements could quickly shift market sentiment and put pressure on these stocks. Investors should keep in mind that even positive outlooks have their limits, especially when prices rise much faster than the underlying fundamentals can justify. A major correction? Not unlikely in this environment, but difficult to predict.

The recent euphoria surrounding Steyr and RENK goes hand in hand with the extreme rise in the valuation of arms and defense stocks. If this rally ends abruptly, investors could soon see a shift into alternative sectors. Gold and silver stocks currently appear particularly interesting, as they are benefiting from geopolitical uncertainty and inflation fears. Junior company AJN Resources is well-positioned in East Africa. Good diversification reduces portfolio risk.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.