September 27th, 2024 | 07:00 CEST

150% turnaround likely! TUI, Saturn Oil + Gas, Plug Power, Novo Nordisk, and Evotec in focus

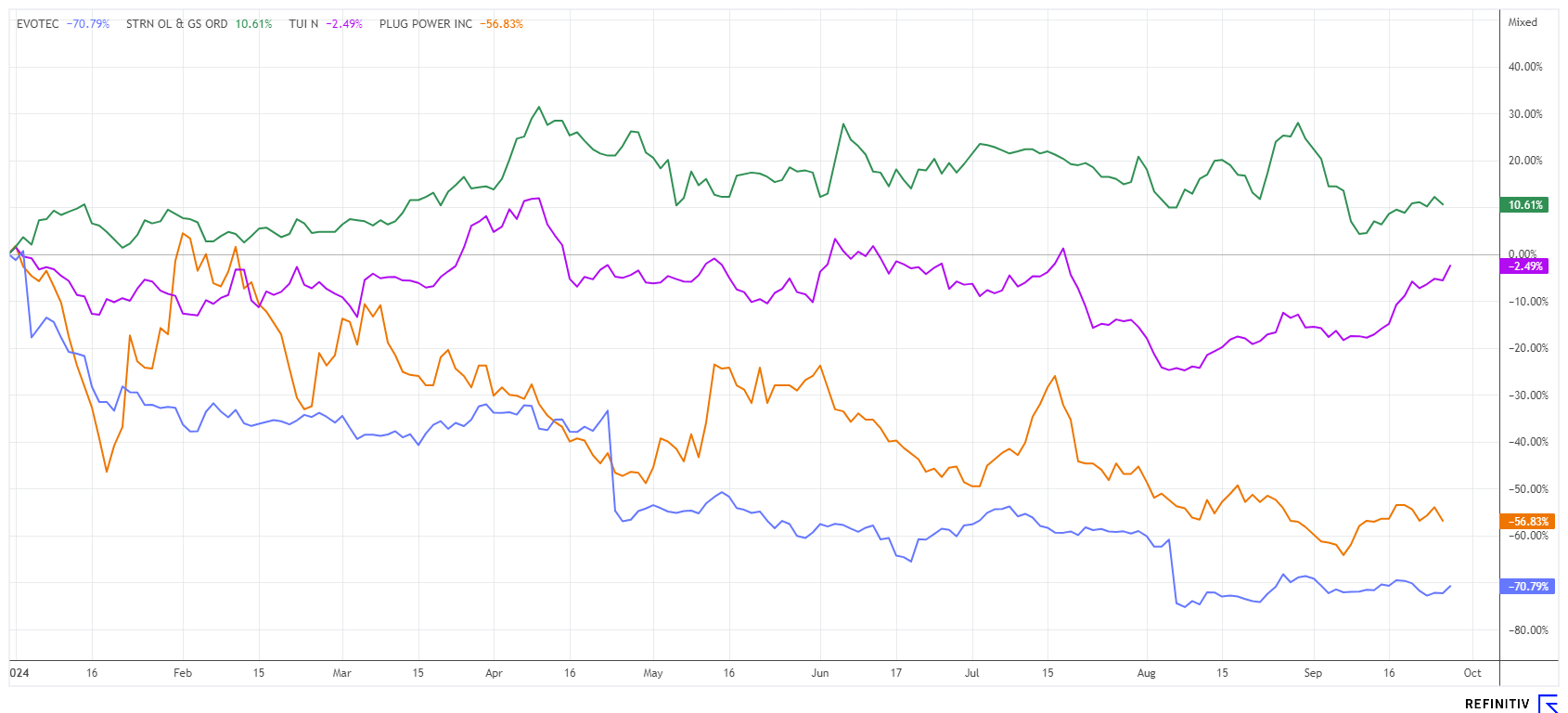

With the FED's latest interest rate cut, the way is paved for higher prices. In addition to the main performers, investors are increasingly turning their attention to equities that have so far seen little appreciation. The key question here is when the fundamentals will ultimately improve. This could then ensure that the analysts' bias finally turns and positive assessments are possible again. TUI, Evotec, and Plug Power are currently at very interesting points, while Saturn Oil & Gas is delivering results consistently and is now being recognized by institutional investors. Where are the opportunities for investors?

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

Saturn Oil + Gas Inc. | CA80412L8832 , TUI AG NA O.N. | DE000TUAG505 , PLUG POWER INC. DL-_01 | US72919P2020 , NOVO NORDISK A/S | DK0062498333 , EVOTEC SE INH O.N. | DE0005664809

Table of contents:

"[...] The Oxbow Asset now delivers a substantial free cash flow stream to internally fund our impactful drilling and workover programs. [...]" John Jeffrey, CEO, Saturn Oil + Gas Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

TUI – The technical breakout is approaching

The European tourism market leader TUI is currently benefiting from its technical breakout and its inclusion in the MDAX and STOXX 600 because fund managers have to increase their weightings accordingly. Consequently, there were a number of upgrades from analysts last week. While Bernstein Research left its "Market Perform" rating with a target price of EUR 6.80 unchanged, the Deutsche Bank team dared to take a bigger step forward. Here, the vote is "Buy" with a target price of EUR 10.50. At a price of EUR 6.90, there is still a good 50% potential from today's perspective. We already had TUI in our sights at EUR 5.95 and are now raising the stop-loss from EUR 5.70 to EUR 6.40. At a P/E ratio of just 7.5, the valuation is not excessive for the current year, 2024, either. According to consensus estimates, sales should rise by a good 8% to EUR 22.85 billion this year. Long-term buy signals are given after overcoming the EUR 7.80 mark. The stock should remain on the buy list.

Evotec – Now with Novo Nordisk on board

We have pointed out the attractive chart situation at Evotec a few times in recent weeks. Now, fundamental news has reached us that makes us sit up and take notice. Novo Nordisk is providing the financial resources for technology development to support the clinical and commercial manufacture of stem cell-based therapies. Both Evotec and Novo Nordisk have extensive expertise and a strategic focus in this therapeutic approach. In the coming months, the companies will collaborate on the development of advanced technologies to enable next-generation "off-the-shelf" cell therapy products for clinical development and potential future commercialization. As part of the agreement, Novo Nordisk will provide funding for technology development activities at Evotec's R&D site in Göttingen, Germany, and at the certified cell therapy manufacturing facility in Modena, Italy. Novo Nordisk will also have the option to acquire exclusive rights to use the results of the partnership for a predefined therapeutic application area. Evotec stands to benefit from R&D funding, potential milestones, and license payments. Yesterday, Evotec's shares rose by 10% to up to EUR 6.50 before the first profit-taking set in. The chart picture of the Hamburg-based biotech company is currently strengthening noticeably above the EUR 6 mark. Blockbuster title Novo Nordisk has now also corrected 25% from its peak at EUR 148 and is again highly interesting due to its remaining growth momentum.**

Saturn Oil & Gas – Big growth at a low price

In May this year, the Canadian oil and gas specialist Saturn Oil & Gas completed a transformational deal. This involved the acquisition of larger shale properties in southern Saskatchewan. This time, the transaction volume was CAD 525 million, bringing the daily production capacity by a further 10,000 barrels per day (BOE) to a new level of 38,000 to 40,000 BOE. As we learned at a roadshow, daily production is currently even higher than 39,000 BOE. The key advantage is that the new drilling fields are directly adjacent to the Company's existing facilities, enabling significant operational savings and leveraging synergies in the logistics area.

With this acquisition, Saturn is taking the next step towards becoming a mid-sized producer and catapulting itself into a CAD 1.5 billion oil and gas company. Together with Goldman Sachs, it has been possible to convert previously very high-yield loans into a new long-term bond financing of USD 650 million. The new loan will be used to refinance old debt and reduce the average interest rate from 15% to just 9.625%. Management's earnings guidance at the mid-year point was for adjusted earnings before interest, taxes, depreciation and amortization (adjusted EBITDA) of approximately CAD 586 million in 2024. Now that the spot price for US light oil fell below USD 70 a few weeks ago, this expectation will likely need a slight revision soon. According to our calculations, the total debt of CAD 856 million is now approximately 1.55 times the expected operating income, which is not a problem for the Company, which has strong cash flows. 5 out of 6 analysts on the Refinitiv Eikon platform recommend Saturn as a "Buy". The average price expectation is CAD 5.50, but with normalized oil prices above USD 80, CAD 8.00 is more plausible in a peer group comparison.

Plug Power – Everything will be better with Kamala Harris

Anyone concerned about the energy transition should also have the US elections on their radar for the last quarter of 2024. This is because the Biden administration's "Inflation Reduction Act" (IRA) will likely come back into focus quickly if Democrat Kamala Harris is elected as hoped. For months, things were fairly quiet for hydrogen stock Plug Power, then at the end of last week, a new major order from Spain was announced. British oil giant BP and Spanish energy company Iberdrola have ordered electrolysers with a total output of 25 megawatts. The large-scale plants are intended for the oil refinery jointly operated by BP and Iberdrola in Castellon, Spain. They are to produce green hydrogen to replace the grey hydrogen from natural gas previously used in refining. According to Plug Power, this will save 23,000 tons of CO2 annually. The PLUG share, which has fallen by up to 85%, is in need of a revival. For several weeks now, the value has been trading very volatile at the USD 2 mark. The last two major capital increases also took place here. The share remains very speculative but highly exciting in view of the US elections. From a chart perspective, it will be interesting to see what happens after the USD 2.30 to USD 2.50 zone is overcome. Stay tuned!**

The stock market gives and it takes. After an extensive rally in AI, high-tech and defense stocks, a slow consolidation is setting in there. Beaten-down stocks such as Evotec, TUI, and Plug Power could surprise on the upside in the coming months due to shifts in investment flows. Saturn Oil & Gas is still undervalued. However, there has recently been institutional interest in the stock, which suggests that a further increase can be expected.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.