January 20th, 2025 | 07:15 CET

150% stocks in focus! D-Wave, Saturn Oil + Gas, Plug Power, Nel and Rivian

Higher – faster – further! Today at 6:00 p.m., Donald Trump will be sworn in for his second term. The stock markets have been booming for months since Trump's re-election, seemingly pricing in a major shift in American politics that is expected to primarily benefit companies and wealthy individuals. Growth stocks on the NASDAQ are soaring from high to high, although the inflation figures do not suggest lower interest rates in the short term. The Shiller P/E ratio has climbed to around 37, a level not seen since the tech bubble of 2000. Selection is becoming increasingly challenging. Here are a few 150% ideas for risk-conscious investors.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

D-WAVE QUANTUM INC | US26740W1099 , Saturn Oil + Gas Inc. | CA80412L8832 , PLUG POWER INC. DL-_01 | US72919P2020 , NEL ASA NK-_20 | NO0010081235 , Rivian Automotive | US76954A1034

Table of contents:

"[...] China's dominance is one of the reasons why we are so heavily involved in the tungsten market. Here, around 85% of production is in Chinese hands. [...]" Dr. Thomas Gutschlag, CEO, Deutsche Rohstoff AG

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

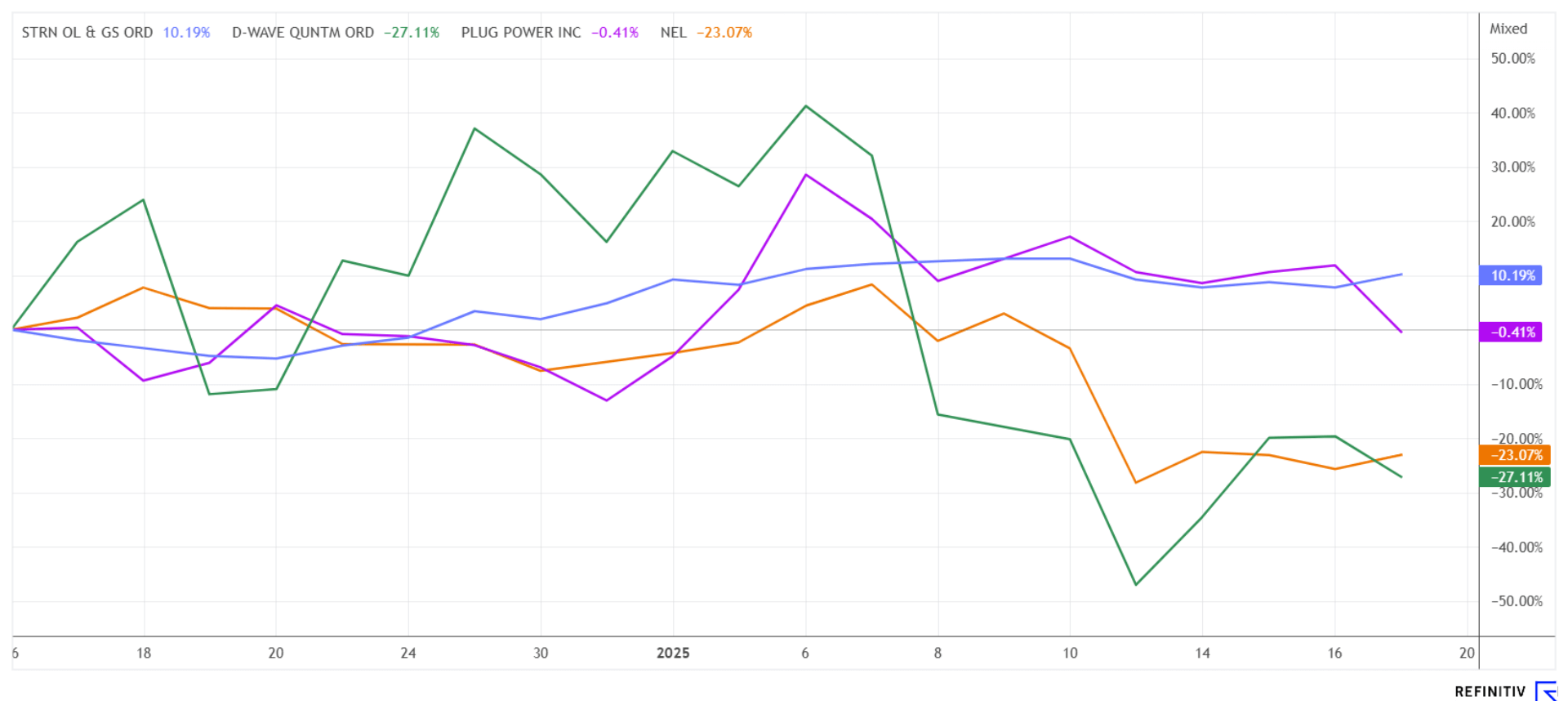

D-Wave Quantum – 150% in one month

The highly volatile D-Wave Quantum share is the right choice for those who want to achieve good returns with strong nerves. It has gained a whopping 150% since December. There were actually no fundamental reasons for this, as the high-tech company from Palo Alto (California) only generated sales of just under USD 9 million at the end of its 2024 financial year. Nevertheless, its market value has exploded to USD 2.5 billion since mid-December because, according to the AI gurus, certain applications of artificial intelligence can only be mastered with quantum computers.

D-Wave is a leader in the development and delivery of futuristic computer systems, software and services, and is the world's first commercial provider of quantum computers and the only company that can offer both the annealing and gate model. D-Wave's technologies are used by some of the best-known companies, including Google, NASA, Mastercard, Deloitte, Siemens Healthineers, Unisys, NEC and Lockheed Martin. According to current expert estimates, sales are expected to quadruple by the end of 2026. However, NVIDIA CEO Jensen Huang recently expressed doubts about the potential of quantum computing in the coming years. As a result, the D-Wave price plunged from a high of over USD 10 to below USD 5 within three days. On the Refinitiv Eikon platform, there are currently 5 broker studies on D-Wave, which show 12-month price targets between USD 2.25 and USD 9.00. A tech boom like in 2000 for minute traders who can take on algo machines!

Saturn Oil & Gas – Analyst firms expect a 150% price increase

Canadian oil and gas specialist Saturn Oil & Gas (SOIL) has now taken its daily production to a new level of 38,000 to 40,000 BOE. The January presentation shows that debt at the end of the third quarter has now reached CAD 779 million. With a share price of CAD 2.25, the Company's total value (EV) is currently CAD 1.23 billion. In the outlook, the above-mentioned production rate is also confirmed for 2025; in the last four quarters (up to the end of Q3), an adjusted EBITDA of CAD 430 million was achieved. The liquid surpluses were used to advance new drilling and, since August 2024, to buy back 2.2 million treasury shares. At the current WTI price of just under USD 80, the operating surplus remains at a good CAD 43, with production and transport costs having been reduced by 26% since 2021. For the current year, adjusted EBITDA is expected to increase to between CAD 525 million and CAD 575 million, lifting adjusted funds flow (AFF) per share to between CAD 2.25 and CAD 2.50 and putting the share in a good light.

Since October 2024, the price of Saturn stock has fluctuated between CAD 1.90 and CAD 2.52, with a total of 440,000 shares purchased by registered insiders since November. Based on the strong fundamentals, five out of six analysts on the Refinitiv platform have issued a "Buy" recommendation. The expected target price over 12 months varies from CAD 3.75 to CAD 7.50. On average, this yields CAD 5.40 – a full 150% potential. The Company has grown so strongly that institutional investors have now discovered the stock. This increases stability, and with oil prices trending higher, a solid performance can be expected for 2025 and beyond. Risk-conscious investors are using the current low prices to build up their positions in the medium term.

Plug Power and Nel ASA – A false start to the new year

After share price losses of more than 90% since the 2021 highs, many investors are wondering what the future holds for hydrogen protagonists Nel ASA and Plug Power. While the Company has been struggling with a lack of major orders in Norway for some time, it is now also facing pressure to cut costs. Last week's announcement stated that Nel would cut one-fifth of the full-time positions at its leading production site by the end of September 2024. However, there is positive news from the investment area. The petrol station subsidiary Cavendish Hydrogen, which was spun off last year, has once again quietly collected 4.85% of the capital on the stock exchange, 75% lower than at the time of the spin-off. Nel CFO Kjell Christian Bjørnsen recalls the shared history of the two companies and the continued good cooperation. Nel currently seems to be doing better in asset management than in the hydrogen business. Despite the news, Nel's shares plunged to a new all-time low of NOK 2.10 or around EUR 0.18. On Friday, there were slight attempts at recovery, peaking at EUR 0.195. Volatility is likely to continue.

The US counterpart Plug Power is experiencing a noticeable rollercoaster ride. Since the turn of the year, the New York-based company's share price has conjured up a performance of plus 57%, with prices up to EUR 3.30 before profit-taking recently pushed the price down again considerably. Shortly before the change of power in Washington, the US government is approving billions in loans for green projects. As reported by Bloomberg, Plug Power is receiving USD 1.7 billion to build hydrogen plants, while Rivian is being awarded up to USD 6.6 billion to construct a new production facility in Georgia. Both measures have been approved by the US Department of Energy and are expected to take effect before the change of administration. With the funds pledged by Joe Biden, Plug Power can breathe a sigh of relief again in the short term, but a further capital increase could be necessary due to the equity regulations for the large loan. While Rivian barely reacted to the news, Plug Power rose to USD 2.85. In the end, however, skepticism prevailed again and the price plummeted back down to USD 2.42. The stock market is clearly waiting for Trump to give the green light for Greentech investments. Until then - pure casino!

The AI, high-tech and defense stocks rally is entering the next round. However, valuation concerns are emerging. The Shiller P/E ratio based on the S&P 500 is climbing to highs of 37 and urging caution. We see a good chance of a revaluation for Saturn Oil & Gas. There is a clear undervaluation here. Today, Donald Trump will be sworn in as president. It will be interesting to see which of his announced "America First" programs will be implemented in the short term.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.