March 4th, 2024 | 07:00 CET

1200% with artificial intelligence, 100% with Bitcoin, and now comes Gold! Barrick, Desert Gold, Aixtron and Super Micro

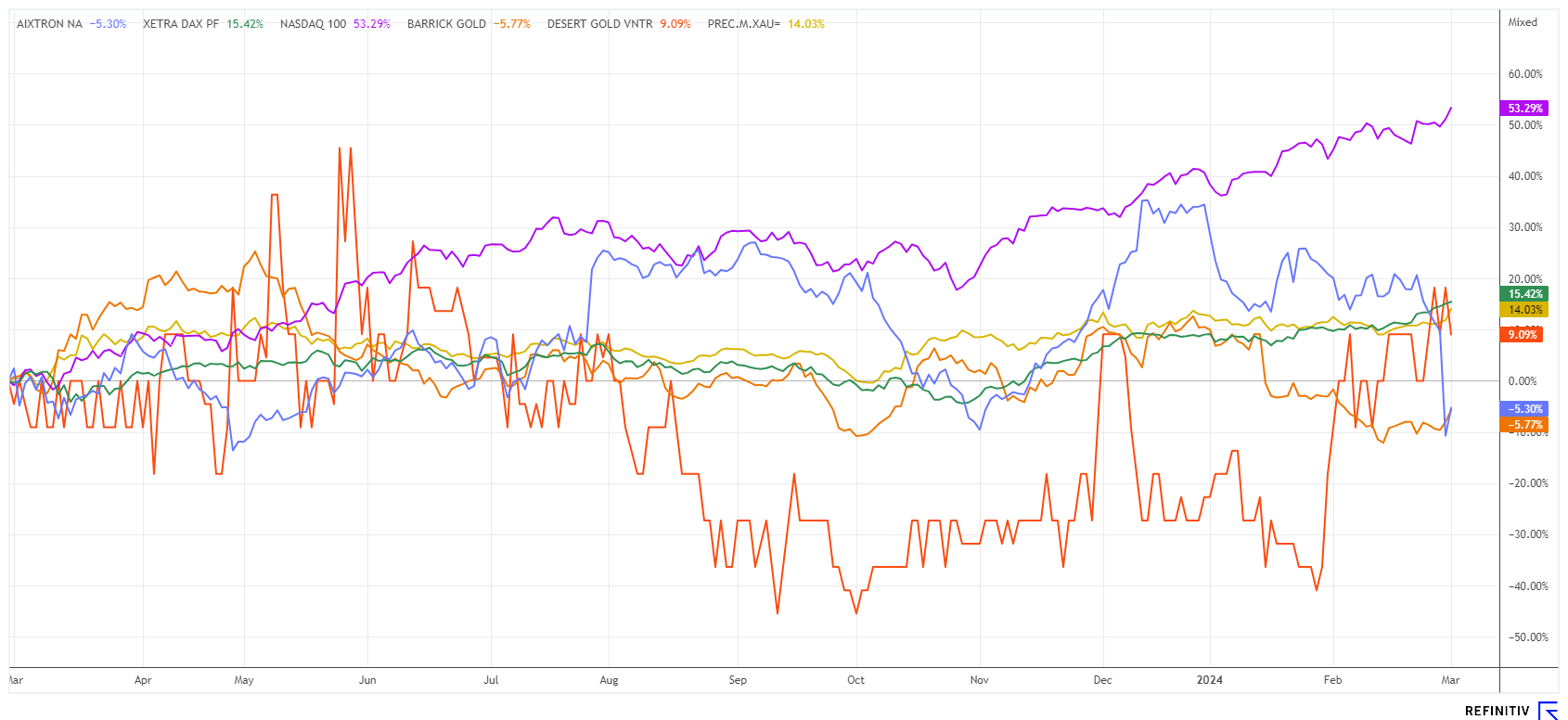

The stock market keeps rising - this is indicated by the ever-new highs of prominent indices such as the NASDAQ 100 or the DAX 40 index. However, a closer look reveals some inconsistencies. For example, only 7% of all traded stocks are currently reaching new highs, while over 60% of all listed stocks are falling. In short, global liquidity is aggregated in just a few blockbuster stocks worldwide, while the rest are being left behind. Such bubbles occurred in 1999, 2007, and 2015, followed by a 25% to 50% correction. No one knows when it will happen again, but the party will likely last a little longer. Gold and Silver have been trending sideways at a high level for the past 3 years, but the yellow metal showed the first signs of life last week. What should investors look out for now?

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

BARRICK GOLD CORP. | CA0679011084 , DESERT GOLD VENTURES | CA25039N4084 , AIXTRON SE NA O.N. | DE000A0WMPJ6 , SUPER MICRO COMPUT.DL-_01 | US86800U1043

Table of contents:

"[...] Our projects are at the initial, high reward exploration stage. [...]" Humphrey Hale, CEO, Managing Geologist, Carnavale Resources Ltd.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Gold versus Bitcoin - Two sides of the same coin

The year 2024 is starting as 2023 ended, with stocks from the high-tech, artificial intelligence and, most recently, cryptocurrency sectors in demand after Bitcoin broke through the USD 60,000 mark again. Precious metals were sidelined for a long time but were able to send out significant signs of life last week. Gold rallied from USD 2,018 to USD 2,087 within 24 hours, reaching the peak from May and December 2023. Silver is also preparing to leave the all-important USD 23 mark behind. While cryptocurrencies are becoming increasingly popular with younger investors, older investors, in particular, see precious metals as a haven of security. After all, gold has enjoyed a return of 8% per annum since the 1990s.

The rapid doubling of Bitcoin from USD 30,000 to over USD 60,000 is likely due to the upcoming halving in April. Like precious metals, cryptocurrencies also have to be "mined", which requires very high computing power, a lot of energy and a mining community that actively runs the business. Successful mining leads to a reward, namely a new unit in Bitcoin. With each technical halving, this reward is halved, meaning fewer and fewer Bitcoins come into circulation over time. This, in turn, drives the price higher and higher, with no end in sight. Convinced precious metal investors also have good arguments at the moment: Increased labor, energy and material costs mean that the average ounce production price is rising steadily and mine output is falling in parallel. This should also lead to rising gold, silver and platinum prices in the medium term.

Barrick and Desert Gold - Neighbors in Mali

Gold is currently attracting renewed interest, as geopolitical conflicts and bankruptcies in the real estate sector are permanently increasing the need for security. Another driver of gold prices is inflation, the steady reduction in purchasing power. It destroys the consumption possibilities of entire population segments and has a strongly depressive effect on economic growth. The indebtedness of industrialized countries is also fostering mistrust in FIAT currencies. Therefore, there is currently a lot of fuel for precious metal investors.

Africa has been a continent of precious metals and raw materials for several hundred years. It has enormous potential in essential metals and minerals. Traditionally, the connection to Western investors has been a guarantee for investments on the continent. The Canadian explorer Desert Gold Ventures has been focusing on the Senegal Mali Shear Zone (SMSZ) for several years. Here, 1 million ounces of gold have already been identified close to surface. The Company is currently seeking influential investors to finance the next big step. CEO Jared Scharf and his management team are confident of bringing potential strategic partners on board to conduct the pre-feasibility study and fund the Heap Leach plant. The study will determine the viability of mining the oxide and transitional mineral resources at the Barani East and Gourbassi West gold deposits.

If all goes according to plan, production could commence in the second half of 2025. The Company is also considering exploring near-surface gold commercially in a joint venture, which should significantly increase cash flow for future drilling programs and resource expansion. Desert has already identified 24 gold zones in its land sections, and the drilling program now underway is expected to reveal some undiscovered mineralization. The exploration activities of the major mining companies in the region could also be a catalyst for Desert Gold's success. They are constantly looking to expand their mines and can finance further drilling from their cash flow. The majors are currently focusing on possible mineralization to the south. It is here where Allied Gold's Diba exploration zone is located. It borders directly on Desert Gold's properties, and the initial soil samples showed grades ranging from 1.2 to 5.6 grams of gold per ton. Allied Gold CEO Peter Marrone sees significant consolidation potential among smaller gold companies in Africa. This bodes well for Desert Gold.

Aixtron and Super Micro - What the analysts have to say

While Aixtron disappointed with an outlook that was too weak, Super Micro Computer was able to exceed the already high expectations. The result: Aixtron lost almost 30%, while Super Micro added a good shot to its 300% rally in 2024.

Analysts have a mixed view of the Aixtron results; UBS downgrades to "Sell" with a price target of EUR 26.90, while Jefferies confirms its "Buy" rating with a price target of EUR 55. The opinion is that the restrained sales forecast of EUR 630 to 720 million for the special machine manufacturer could well be raised this year. On the Refinitiv Eikon platform, an average price of EUR 36.3 is expected for the next 12 months, which puts the P/E ratio for 2024 at around 21. The price/sales ratio of 4 seems a little high. Super Micro, on the other hand, is growing at over 30% per annum in terms of sales. While a P/E ratio of 47 may seem expensive, 10 out of 13 analysts call for an entry. The catch: The average price targets, reaching USD 685, have long since been exceeded by 50%. An additional inclusion in the S&P 500 has been announced, meaning index funds will continue buying the overheated share.

The stock market is currently taking no prisoners. Those who disappoint face significant declines, while those who surprise can often experience extreme gains. This is modern algo-trading, where news is processed in milliseconds. AI and high-tech, therefore, remain a constant theme, currently joined by crypto, gold and silver. A healthy diversification across several sectors helps protect against significant portfolio fluctuations.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.