August 25th, 2025 | 07:00 CEST

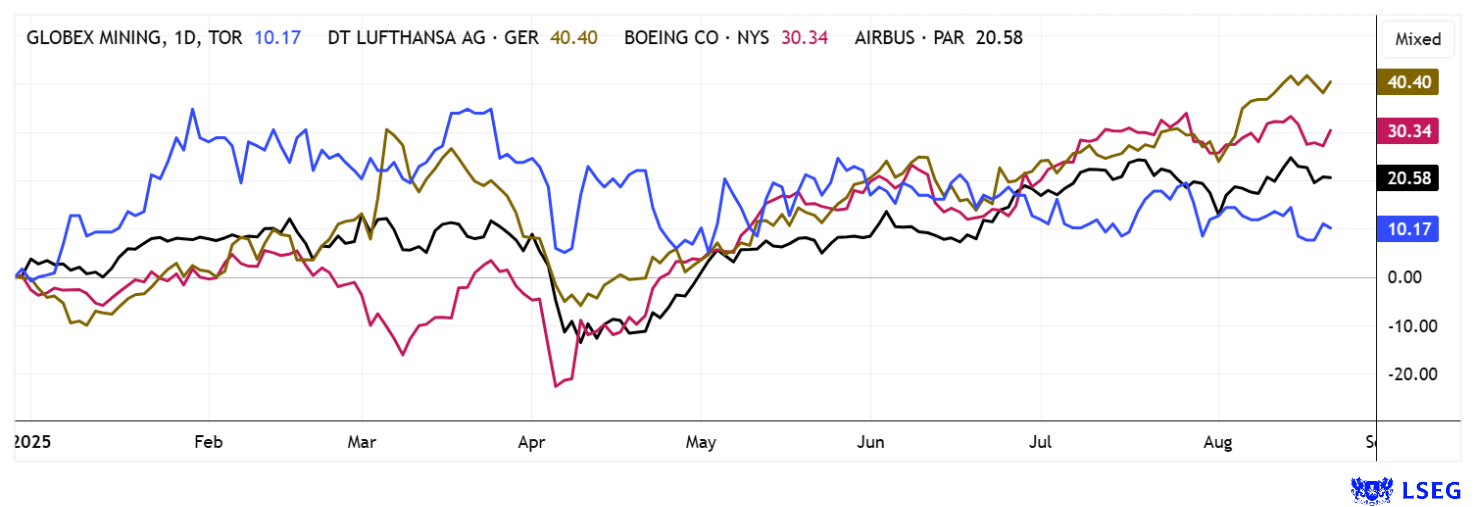

100% with NATO contracts from the air! Airbus, Globex Mining, Boeing, and Lufthansa

The craziness continues! NATO member states have agreed on new planning targets for armaments and capabilities and, according to Secretary General Mark Rutte, have increased the requirements for air and missile defense by about 30%. Rutte stated: "We need more resources, troops, and capabilities to be prepared for any threat." German Chancellor Friedrich Merz emphasised that Germany would provide all the necessary resources to expand the Bundeswehr into the strongest conventional army in Europe. According to experts, large-scale defense projects, particularly in the aerospace sector, will require enormous investments and far-reaching acquisitions. Across Europe, around EUR 300 billion is expected to be invested in air forces by 2030. Investors should now set the course to benefit from the flood of orders in the aerospace sector.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

GLOBEX MINING ENTPRS INC. | CA3799005093 , BOEING CO. DL 5 | US0970231058 , LUFTHANSA AG VNA O.N. | DE0008232125 , AIRBUS | NL0000235190

Table of contents:

"[...] The transaction offers benefits to all parties: Shareholders now have three promising projects in their portfolio. [...]" Bradley Rourke, President, CEO and Director, Scottie Resources Corp.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Airbus and Boeing – NATO's wishes meet full order books

Airbus can expect a significant increase in NATO orders in the coming years, particularly in the context of the modernization and expansion of European armed forces. NATO is investing around EUR 1 billion in the current modernization of the NATO AWACS fleet alone, with Boeing acting as the main contractor. In addition, Boeing has received massive orders for F-35 fighter jets in recent months, including 35 units for Germany in a ten-billion-euro package and major orders from Finland and Poland. Airbus is also benefiting, primarily from the 2025 Paris Air Show, where more than 250 aircraft were ordered and preliminary agreements were signed, including by European countries, Saudi Arabia, and Vietnam. According to experts, large-scale defense projects, particularly in the aviation sector, require enormous investments and far-reaching acquisitions. The industry will therefore also experience significant consolidation through acquisitions due to the high cash inflows. The US government under President Trump is calling on European NATO partners to allocate up to 5% of GDP to defense spending in the medium term, which will further boost the order situation for international manufacturers.

Overall, Airbus and Boeing expect orders in the mid to high double-digit billion range if the new NATO targets are implemented. Technological innovations and the integration of new systems will continue to gain in importance. With an estimated revenue of EUR 75 billion and a current P/E ratio of 28 for 2025, Airbus is operating at full capacity with a full order book. The share price is currently hovering around the old technical threshold of around EUR 180. Further follow-up purchases are likely to follow if the old high of EUR 187.20 is exceeded. Analysts on the LSEG platform expect an average price of EUR 198.50. With estimated revenue of USD 86 billion in 2025, Boeing will not achieve a turnaround until 2026. The Company has been undergoing a tough restructuring program for years. However, in the wake of the defense spending boom, the long-established Seattle-based company quickly rose from USD 130 to USD 230. Analysts' 12-month price targets average USD 254, representing less than 10% upside potential. European investors are likely to favor Airbus, as annual profit jumps of 15% are expected here until 2030.

Globex Mining – Management team reinforcement provides boost

In this environment, Quebec-based Globex Mining is emerging as one of the most exciting commodity stocks on the market. In times of scarce metals and geopolitical uncertainty, the Company's impressive track record since the 1980s is increasingly coming to the fore. All of its properties are located in North America, mainly in Quebec. This allows Globex to benefit from stable conditions such as a reliable energy supply, modern infrastructure, mining-friendly legislation, and good relations with the region's indigenous communities. Under the leadership of CEO Jack Stoch, Globex has built up a portfolio of over 250 projects, many with historical or current resource estimates in accordance with NI 43-101, as well as more than 100 royalty agreements. In addition, the Company has a solid financial base of approximately CAD 25 to 30 million in cash and stock holdings and is completely debt-free.

To drive further growth, the management team has been strengthened. Jack Stoch will assume the role of Executive Chairman and CEO, while David Christie will join the Company as President and COO, focusing on operational management. Christie brings nearly four decades of experience in the commodities sector, including senior positions at Orford Mining, Eagle Hill Exploration, and Osisko Mining. He has been instrumental in capital financings, acquisitions, and mergers, and also has extensive experience as a precious metals analyst. His combination of geological expertise, financial acumen, and strategic vision is considered a major asset to Globex. With this leadership duo, Globex is well-positioned to continue to deliver value to shareholders and pursue new opportunities in the international commodities market. With a market capitalization of approximately EUR 46.5 million, the Company appears significantly undervalued relative to its projects and financial reserves. In light of ongoing geopolitical tensions, which continue to support high gold prices, Globex's extensive property base is excellently positioned to benefit from macroeconomic tailwinds. For long-term investors, the current environment may offer a compelling entry point.

Globex'sttps://cdn.jwplayer.com/previews/CgRsPOId-ur02VgM2 text: Listen to CEO Jack Stoch talk about Globex Mining's current projects. target: _blank) (The Market Online).

Lufthansa – Back on the rise after years of crisis

The Lufthansa Group is consistently pushing ahead with its fleet modernization and has ordered a total of 75 state-of-the-art Airbus A350s, which will be delivered gradually from 2028. In addition, there are further orders and options with Boeing and Airbus, including 34 Boeing 787-9s, 20 Boeing 777Xs, many narrow-body aircraft, and freighters for the cargo division. This modernization will ensure sustainable CO₂ savings for Lufthansa and a premium travel experience for customers. The Executive Board emphasizes that this marks the start of the largest fleet investment in the Group's history and will keep Lufthansa at the forefront of the European aviation industry.

The latest quarterly figures underscore the proclaimed strategy: In Q2 2025, Lufthansa increased its revenue by 3% to EUR 10.3 billion, while the operating result rose by 27% to EUR 871 million. The technical and cargo divisions performed particularly well, while the passenger business recovered by a further 4%. Despite global uncertainties and increased costs due to wages and climate protection measures, the outlook for 2025 remains positive, as CEO Carsten Spohr confirms. Investors can now expect more again. Efficient and modern jets, a robust business model, continuous improvements in earnings, and innovative premium offerings make Lufthansa a profitable addition to any portfolio once again. With a premium of over 40% at the beginning of the year, the share price has clearly surpassed the EUR 8 mark. Analysts on the LSEG platform are not quite as confident, with a weighted 12-month price target of only EUR 7.69. Nevertheless, with a 2025 P/E ratio of 5.3 and a price-to-book ratio of 0.8, little can go wrong in the medium term.

Airbus and Boeing are poised to see a significant increase in NATO orders in the coming years, particularly in the context of the modernization and expansion of European armed forces. Lufthansa is also consistently expanding its capacity, as air travel has returned to pre-pandemic levels. A major challenge for Western industry remains securing critical raw materials—an area where Globex Mining plays a key role, managing over 250 projects across North America.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.