June 29th, 2023 | 08:50 CEST

100% with Clean Energy! BYD, Regenx Technologies, BASF, Siemens Energy - Recycling is becoming a challenge!

As Western governments finally take climate protection seriously, the media has focused on the areas of energy, mobility, and health. It is clear to all participants that the changes in the world's climate will lead to undesirable developments. Glaciers are melting, the Earth's temperature is rising, and our oceans are already too warm for many species. Huge investments are being made in renewable power generation and modern mobility solutions. The high growth requires access to metals. Recycling also plays a major role because it conserves valuable resources and brings raw materials back into the cycle. Some companies are making a name for themselves, and shareholders can benefit from this.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

BYD CO. LTD H YC 1 | CNE100000296 , REGENX TECH CORP | CA75903N1096 , BASF SE NA O.N. | DE000BASF111 , SIEMENS ENERGY AG NA O.N. | DE000ENER6Y0

Table of contents:

"[...] Our projects are at the initial, high reward exploration stage. [...]" Humphrey Hale, CEO, Managing Geologist, Carnavale Resources Ltd.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

BASF and BYD - On the way to a climate-neutral circular economy

The global battery market is still far from a closed-loop economy. Most electric vehicles currently in operation still have the first battery on board. However, the problem of recycling raw materials is already within reach because, by 2025, the number of used units will reach a million. From 2030 onwards, experts estimate that between 3 and 5 million batteries could be due for recycling each year, and beyond 2030 this figure will be in double figures.

The recycling of batteries is a long-term requirement for the electric vehicle market in order to close the raw material cycle and reduce the sector's currently high CO2 footprint. BASF has already set itself the goal of closing the lithium cycle for the automotive industry worldwide in 2020. The Ludwigshafen-based company has in-depth experience in chemical and process engineering to ensure sustainable and cost-effective solutions for metal recovery. Highly efficient lithium extraction and the analysis and traceability of materials within the value chain are essential here. Current recycling technologies extract the most valuable metals (e.g. cobalt) but destroy much of the remaining battery, including lithium.

The South Korean market research company SNE Research has published important statistics on the development of the global battery market. According to this, the Chinese conglomerate BYD maintained its strong position with a 16% global market share behind the industry leader CATL with an astonishing 35%, but the Korean pursuer LG Energy Solutions is already close behind with 14%. According to SNE Research, BYD is gaining popularity, especially in the Chinese domestic market, thanks to its price competitiveness through its vertically integrated supply chain.

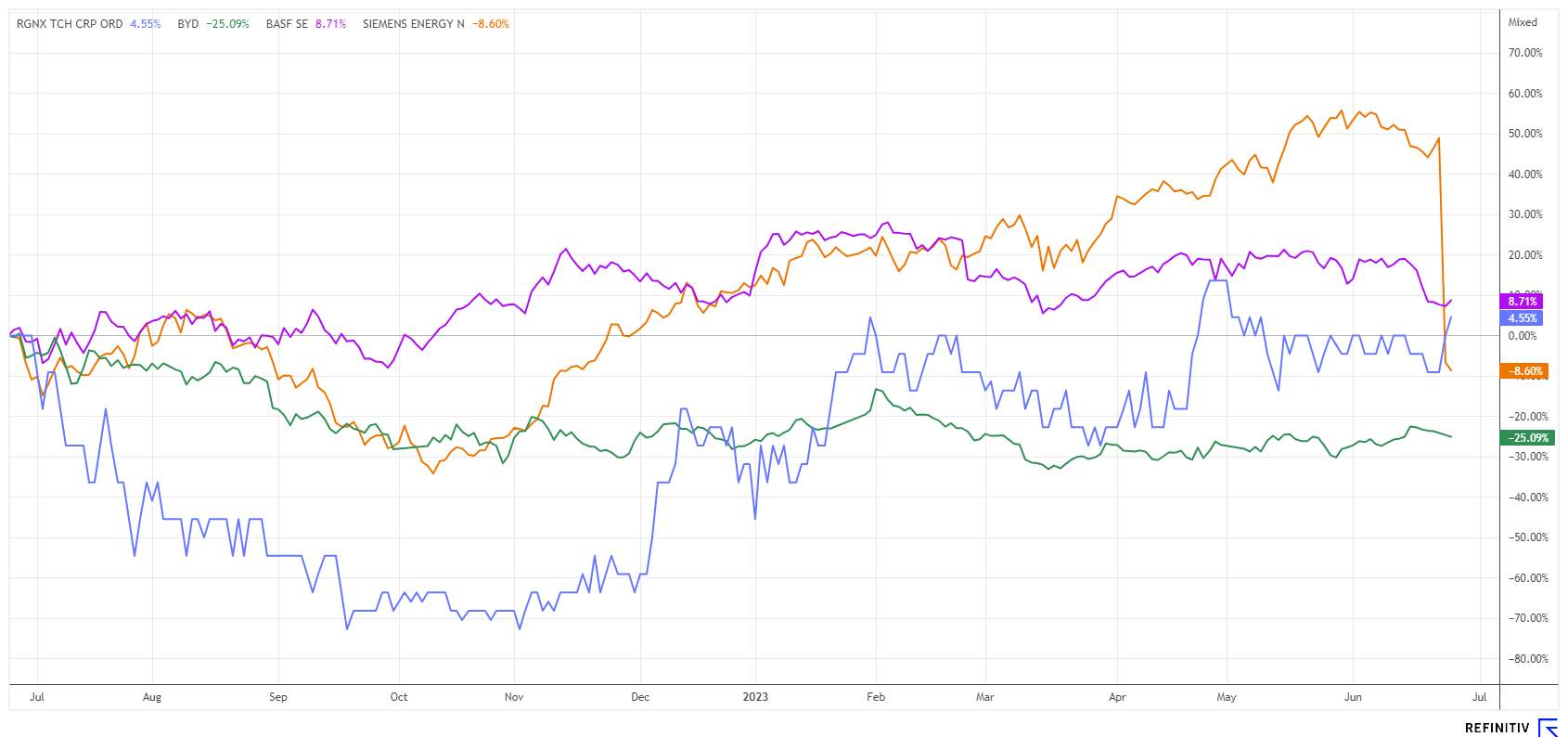

BYD shares are still in a recovery trend at EUR 29.70, but the stock is still down 24% on a 12-month basis. BASF is still slightly up for the year, but since the payment of a 7% dividend, the share has corrected sharply in the wake of the poor outlook for the chemical sector. Both shares remain attractive in the long term.

Regenx Tech - This is what a clean future could look like

Metals are indispensable, especially for Greentech solutions such as wind and solar plants. E-mobility also requires three times the amount of copper and additionally needs graphite, nickel, cobalt and, above all, lithium. The required quantities are still available for today's demand, but the high growth rates lead us to expect a further price increase. Today we know that it will only work with efficient recycling processes. The mindset should cover the entire value chain, as companies can do a lot to enhance their green image here.

Canadian Regenx Tech focuses on the recovery of precious metals from catalytic converters and is supporting a market worth billions with this technology. Contaminated soils, huge tailings piles and poisoned drinking water are not an issue for Regenx. Unfortunately, there are still too many negative examples worldwide. The Edmonton-based company has taken on the industry's problems and extracts the rare substances palladium and platinum from spent catalytic converters. Both metals are now indispensable in the automotive market; over 80% of the world's palladium production currently ends up in exhaust gas purification systems. Unfortunately, only about 30% of the palladium is recovered because there are not yet any 100% environmentally friendly plants.

The technologies developed by Regenx are modular in design and should be able to process up to 10 tonnes of catalyst material per day. The Company launched its first pilot plant in 2022, which will pay for itself after just one year. The US partner Davis Recycling has been docked as a supplier of dismantled catalytic converters, and the business has been growing neatly so far. Regenx Tech recently announced an uplisting from the TSX Venture Segment to the CSE. The approximately 347 million shares are trading liquid between CAD 0.11 and 0.13. As a result, the Greentech flagship company is valued at around CAD 37 million. It is a promising addition with a future.

Siemens Energy - Massive problems at Gamesa

That hit home hard! Siemens Energy, the Greentech star, made headlines with a huge profit warning. The recently fully integrated subsidiary Gamesa from Bilbao is one of the world's largest producers of wind turbines. Last week, the Spanish company reported massive quality problems. This is not in keeping with the image of the Munich-based energy company, one of the world's market leaders for energy plants. The error rates affect 15% to 30% of the total installations, and the resulting extent of the technical defects probably amounts to several billion euros.

Faulty rotor blades and bearings are said to be responsible for the turbine problems, and it is currently being investigated whether fundamental design problems also play a role. Not good news for investors, the share price collapsed by more than 40% at the beginning of the week, stabilising at just under EUR 14 after reaching EUR 24. The problems have already caused over EUR 1 billion in additional costs for 2023. Despite all the problems, the Siemens Energy share is only just in the red for the year, but after numerous downgrades, it will likely look for a bottom for the time being. The low at EUR 10.32 from October 2022 offers a chart orientation of where it can still go in the case of further bad news.

Greentech remains on everyone's lips. This is not only due to political guidance. Investors today are looking for sensible additions to their investments, so why not invest sustainably? BASF and BYD are very popular as standard stocks. Siemens Energy is currently suffering massive reputational damage. The Canadian Regenx Tech is very innovative and has high growth potential.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.