May 15th, 2025 | 07:15 CEST

100% buying frenzy at Palantir, investors look to D-Wave, European Lithium, and SMCI

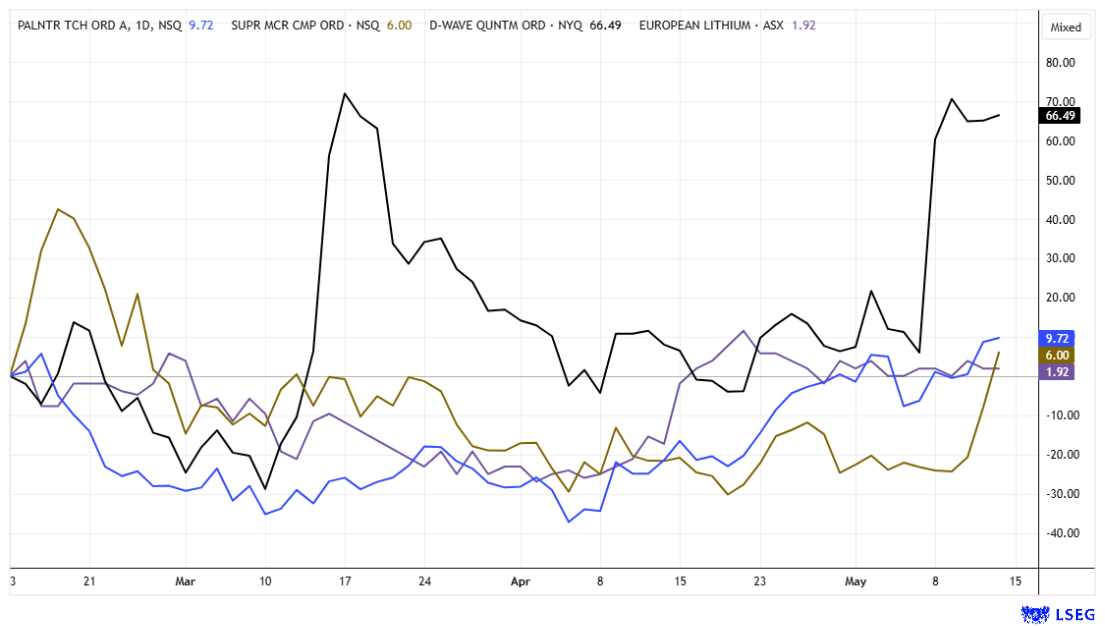

First the sell-off, then a new high for the year. Investors can speculate about which of the recent erratic movements was the "right" one. A 20% correction in response to unresolved tariff claims was followed by a 30% rally to new highs of over 23,900 points on the DAX 40 index. The NASDAQ saw an even sharper correction, with tech stock Palantir halving in value before doubling again within four weeks. In between, Q1 figures were released that, in truth, merely met expectations. SMCI and D-Wave Quantum are now back in the spotlight due to their high beta. For those focusing on Greenland and strategic metals, European Lithium is worth a closer look. We help with the analysis.

time to read: 6 minutes

|

Author:

André Will-Laudien

ISIN:

PALANTIR TECHNOLOGIES INC | US69608A1088 , D-WAVE QUANTUM INC | US26740W1099 , EUROPEAN LITHIUM LTD | AU000000EUR7 , SUPER MICRO COMPUT.DL-_01 | US86800U1043

Table of contents:

"[...] In 2020, the die is finally cast in the automotive industry towards electromobility. [...]" Dirk Harbecke, Executive Chairman, Rock Tech Lithium Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Palantir Technologies – 100% in just four weeks

The party continues at Palantir. Just over a week ago, the Denver-based big data analysts published their Q1 figures. After-hours trading saw a 10% decline. Just one week later, the share price is back at around USD 130, with market capitalization reaching an astonishing USD 300 billion. Donald Trump's arms deals in Saudi Arabia are apparently also fueling fantasies for Palantir, as the threat in the Middle East grows. The Colorado-based company offers espionage software combined with artificial intelligence and has already assisted Ukraine in its defensive war against Russia. In April's correction, the shares plummeted to around USD 65, meaning we have now seen them double in value within four weeks. Too much of a good thing? No, because irrationality has become a defining feature of the capital markets. Palantir combines defense characteristics with AI fantasy, which, in the eyes of stock market traders, also allows for 2025 P/E ratios of over 170. Casino Royale!

European Lithium – Strategic metals from Greenland

When considering high tech, one should not lose sight of the need for strategic metals. US President Donald Trump recently called for the securing of Western supply chains. Due to its stable supply chains, resource-rich Greenland is on the US's "annexation list" alongside Canada. This puts Australian resource explorer European Lithium in the crosshairs. The Company owns a flagship lithium property in Austria, three other lithium deposits in Ukraine and Ireland, and a rare earths project in Greenland. This provides European Lithium with an important key role in the global raw materials landscape. As political relations with China continue to deteriorate, metal deposits in Western jurisdictions are receiving particular attention. Another key factor is the 68% stake in Critical Metals Corp. (CRML), which is currently valued at USD 140 million. Based on a share price of around AUD 0.05, European Lithium is valued at AUD 76 million, which is even less than the value of its stake in the US company. European Lithium's current focus thus adds up to a unique portfolio for the future.

In 2023, the EU decided that by 2030, at least 10% of strategic raw material needs should be covered by domestic production, and 40% of raw materials should also be processed in the EU. The deposits in Greenland belong territorially to Denmark, which has been a member of the European Union since 1973. European Lithium stands to benefit particularly from peace in Ukraine. In the meantime, it is pressing ahead with its exploration work in Greenland. The evaluation of historical and new drill holes by Tanbreez Mining Greenland (42% owned by subsidiary Critical Metals Corp. with an option to increase to 92.5%) presents a compelling opportunity for the Company to increase the existing JORC mineral resource estimate (MRE) from 2012 of 45 million tonnes @ 0.38% rare earth elements (REE) over the Tanbreez Hill zone and the Fjord deposit. This would be achieved through infill and step-out drilling between all historical diamond and RC drill holes. The current diamond drill holes DX-02 and D306-13 were drilled to considerable depths to conduct stratigraphic and mineralogical studies. The most recent announcement reports exploration results confirming a deep, highly mineralized TREO deposit averaging 0.42% and 24% HREE for each drill hole, and 0.47% and 28% HREE for each drill hole at depths of 195 m and 328 m within the massive Kakortokite host rock.

CEO Tony Stage commented: "It is exciting to report further results from deep diamond drilling and excellent survey results from historic deep drilling that could confirm higher tonnage potential extending much deeper and wider than originally anticipated for the Tanbreez project." In our opinion, these results should lead to a rise in CRML's share price, which will also indirectly benefit its parent company, European Lithium. In Germany, the share price jumped back above EUR 0.03, and Critical Metals' share also appears to be ending its recent consolidation at around USD 1.40. Time to stock up!

Super Micro Computer – Back on the rise

Former stock market high-flyer Super Micro Computer (SMCI) has undergone a drastic decline in 2024. Uncertainties in its accounting had caused the share price to plummet from USD 120 to USD 20. Then the auditor changed, and the missing reports were submitted to the SEC. The threat of delisting was averted, and now the stock market is eagerly awaiting the 2024 annual general meeting, which will take place in early June. Since the sell-off in November, prices have recovered to USD 60, and in April's sell-off, the share price was back at USD 27.

At the start of the week, the California-based company made headlines as US President Donald Trump's trip to the Middle East coincided with the announcement of a $20 billion deal. The Saudi company DataVolt has announced a multi-year partnership with SMCI. As part of the collaboration, the US company will supply GPU platforms and liquid cooling systems for an AI campus in Saudi Arabia. This will also require the expansion of manufacturing capacities in the US. DataVolt is part of a new US-Saudi initiative that has pledged a total of USD 600 billion in investments in the aviation, defense, energy, and technology sectors. The Company serves AI data centers and energy infrastructure sectors in both countries. With its advanced technology, SMCi is one of the leading server manufacturers for AI-optimized infrastructure. Goldman Sachs has confirmed its "Sell" recommendation with a price target of USD 24, while SMCI closed at a high of USD 47 yesterday. With a market capitalization of around USD 27 billion and a 2025 P/E ratio of 25, the Californians do not yet appear too expensive, in our view.

D-Wave Quantum – 50% higher after the figures

D-Wave Quantum's Q1 figures hit like a bombshell, as the Canadian quantum computing pioneer far exceeded analysts' expectations. Losses fell while revenue exploded, and there was no stopping it. The stock reacted strongly, shooting up from USD 6.50 to over USD 10. The stock had already reached this level once before in March, but at that time, the current figures were not yet known. D-Wave reported an adjusted loss of 1.9 US cents per share – a huge improvement over the 10.7 cents loss in the previous year. Analysts had expected a loss of 4 cents, but D-Wave was able to reduce its loss faster than expected. Revenue increased fivefold from a low single-digit level to USD 15 million. In contrast, order intake declined more sharply than expected, falling 64% to just USD 1.6 million. The deal sealed in Germany in February is particularly noteworthy. The Jülich Supercomputing Centre (JSC), a European heavyweight in the computing world, has opted for a quantum system from D-Wave. This is a positive example of how strongly D-Wave technology is gaining a foothold in cutting-edge research. With a market capitalization of EUR 2.8 billion, however, the stock is still too expensive. In our opinion, it only makes sense to buy in during major correction phases, as D-Wave is one of the most expensive stocks on the NASDAQ with a price-to-sales ratio of 70.

Strategic metals remain in the focus of investors, especially in the current geopolitical environment. High-tech and defense manufacturers are dependent on access to these critical raw materials. With its stake in Critical Metals, European Lithium is ideally positioned to benefit from the future battle for distribution.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.