May 24th, 2023 | 07:30 CEST

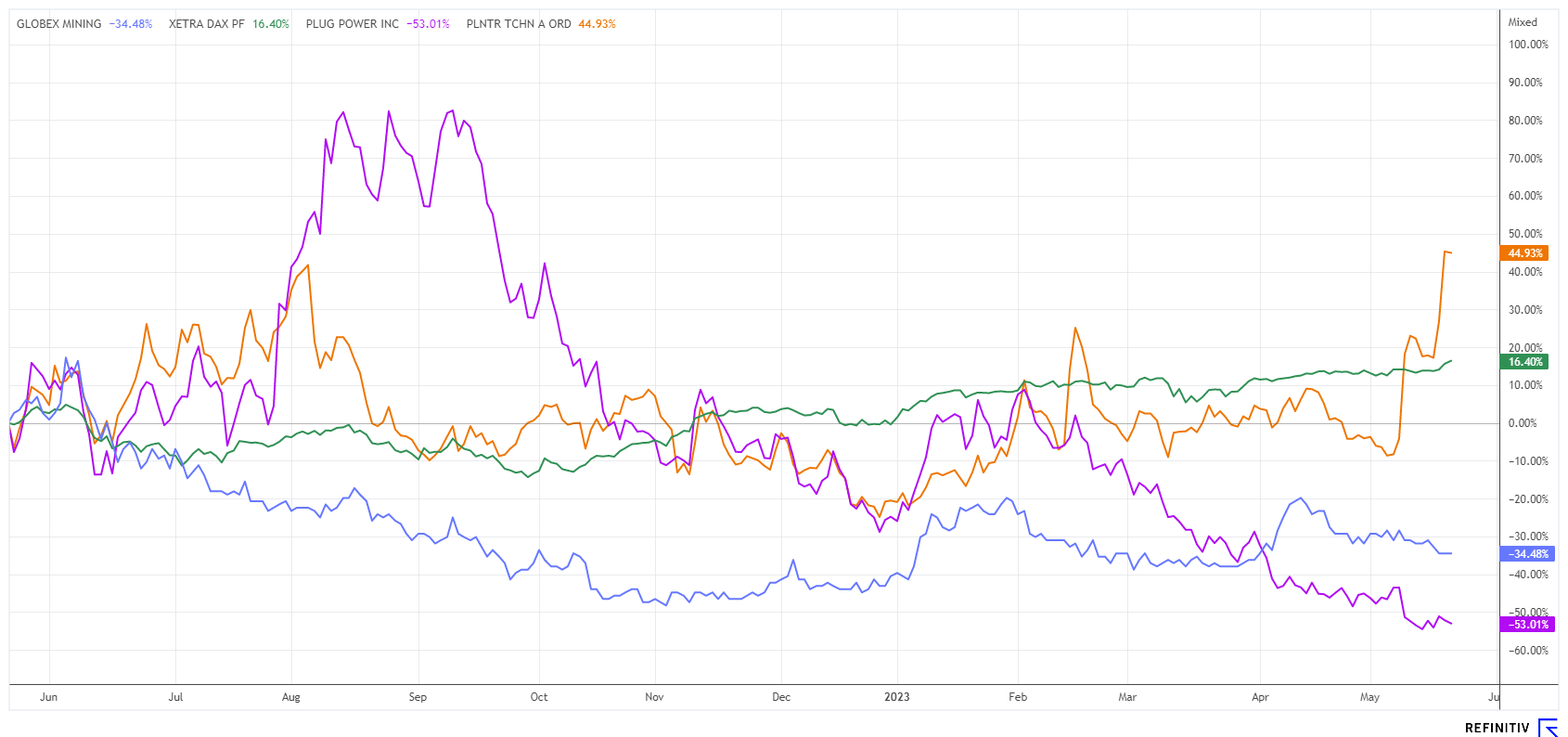

100% and more with these turnaround stocks! Plug Power, Globex Mining, Palantir. Take a close look now!

When investing in stocks, the goal is always to find low entry prices to optimize long-term performance. Unfortunately, buying downward-trending stocks promises less success than investing in stocks that constantly reach new highs. This principle embodies the wisdom of "The Trend is Your Friend." In applying this advice, one should let profits run and limit losses. A sensible risk diversification also requires a portfolio approach that spans countries, industries, and currencies. We look at three stocks from different sectors with promising return potential.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

PLUG POWER INC. DL-_01 | US72919P2020 , GLOBEX MINING ENTPRS INC. | CA3799005093 , PALANTIR TECHNOLOGIES INC | US69608A1088

Table of contents:

"[...] China's dominance is one of the reasons why we are so heavily involved in the tungsten market. Here, around 85% of production is in Chinese hands. [...]" Dr. Thomas Gutschlag, CEO, Deutsche Rohstoff AG

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Plug Power - Like a Phoenix rising from the ashes?

Plug Power, as a fallen angel and a climate change-related stock, is closely watched on many investment lists. Striking option movements have been visible for several weeks. Amazingly, both calls and puts are heavily traded, and the number of open contracts is increasing daily. Due to the downward trend of the last months, put options still clearly predominate with 63% compared to call options with 37% market share. Speculators have "locked in" their positions in the range of USD 7.50 to USD 12.50 - the price development could therefore suggest a vehement breakout to one side or the other in the coming weeks.

Fundamentally, the US hydrogen experts have disappointed once again. Although sales climbed significantly by 50% YOY to USD 210 million, the loss also increased from USD 156 million to USD 207 million. Plug is demonstrably unable to convert the rising turnover into reduced losses, let alone profits. Although cash and cash equivalents only shrank from around USD 1.74 billion to USD 1.37 billion, the first analysts are already reacting and lowering their price targets significantly.

JPMorgan has reduced its 12-month expectation from USD 20 to USD 14. Analyst William Peterson nevertheless maintains his "Overweight" rating. Much more cautious tones can be heard from the BMO Capital Markets experts, who now only rate the investor favourite as "Market Perform" with a price target of USD 7.50. Plug Power's outlook for 2024 is USD 1.2 to 1.4 billion, but analysts were expecting a good USD 2 billion. Like a Phoenix from the ashes, the share price jumped 14% at the beginning of the week. Is there more to come? Strong technical buy signals can only be seen above USD 11.50, but that would require a further 30% rally from the current level of around USD 8.90.

Globex Mining - A portfolio of over 200 properties

Portfolio diversification is an important criterion when investing in commodity stocks. However, if one does not have the necessary expertise, this endeavour is sometimes very strenuous and much depends on lucky choices and timing. In the current cycle view, commodities have been in a robust upward movement since 2020, induced by many fundamental framework conditions such as the energy transition and climate protection. From the perspective of global inflation, gold and silver stocks have also regained a high relevance in investor portfolios, as precious metals serve to preserve value and safeguard purchasing power.

Rare commodities such as copper, nickel and lithium are part of a desired climate change, but they must first be mined. It is no coincidence that the well-diversified commodity explorer Globex Mining is based in Canada. North America, in particular, plays an important role in securing strategic metals in the fight for essential resources in the face of global geopolitical imbalances. The current portfolio comprises over 200 projects and holdings, many of which are optioned as exploration properties or deliver permanent royalties once production begins. Globex Mining owns many concessions and grants them mainly to third-party companies to gain a steady cash flow from the land rights.

Earlier in May, optionee Orford Mining intersected several gold zones on the Joutel Eagle property in northern Quebec and found powerful gold zones such as 1.4 g/t AU over 9.9 metres and 5.0 g/t AU over 2.3 metres. Orford president and CEO David Christie said, "The continued strong results from the 2023 drill campaign on the Joutel Eagle property continue to indicate the tremendous potential value of the South Gold Zone." In the medium term, Globex can leverage considerable revenue potential on this property, which applies equally to the other 200 properties. Globex shares are currently trading between CAD 0.72 and CAD 0.84. The current market capitalization of EUR 29.2 million represents a high cash balance and a well-defined resource holding. A gold jewel with doubling potential!

Palantir Technologies - Comeback with AI fantasy

The US technology company Palantir is involved in tracking systems, big data and artificial intelligence. The share started with much furore on the NASDAQ in September 2020. German billionaire Peter Thiel is one of the co-founders and visionaries of the controversial company. Palantir has repeatedly appeared in the press because of its sloppy handling of users' personal data. After the listing, the share price rose quickly to over USD 30 but fell back by over 80% to around USD 6.

Since the beginning of May, however, there has been a surprising 60% revival in the share price from around USD 7.50 to USD 11.80. The US investor platform WallStreetBets lists Palantir at the top of its list, as it suspects great potential due to existing AI fantasy. Artificial intelligence is currently traded as a new megatrend, and associated shares such as C3.ai, PayPal and Upstart are performing accordingly. In addition, Q1 results exceeded expectations, and the ARK Fund, managed by Cathie Woods, increased its Palantir position by USD 3.4 million.

The Company is expected to break even in 2023 with an estimated turnover of USD 2.2 billion. This still means that 10 times sales are being paid on the stock market, and the 2023 P/E ratio of 56 is hardly tempting to buy. However, the enormous trading volumes and high momentum are factors to consider. Nevertheless, from a technical standpoint, the downtrend will only be neutralized once the USD 15 mark is overcome. This is a highly speculative investment.

The stocks considered here have charm. Plug Power is the most internationally respected hydrogen stock. Globex Mining convinces with a balanced risk approach in the commodities sector. And Palantir Technologies has already made good gains due to its fantasy in the field of "artificial intelligence". Three stocks that fit into a speculative portfolio at any time.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.