July 9th, 2025 | 07:25 CEST

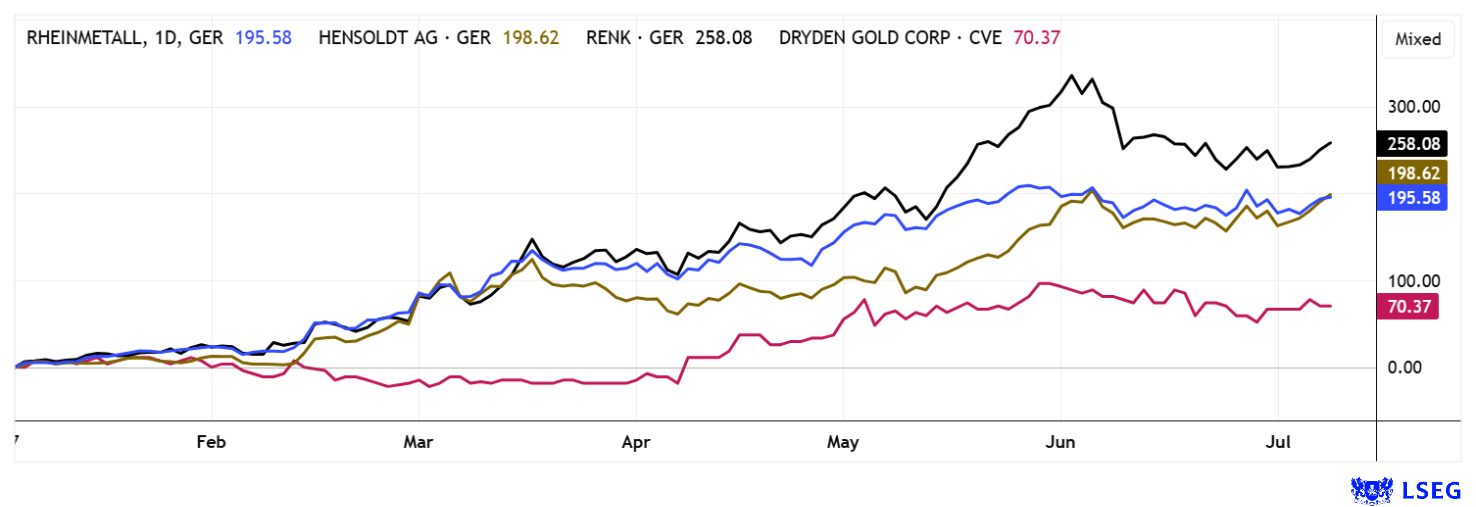

1,000 tanks for NATO - another 150% with armaments and gold? Rheinmetall, Dryden Gold, Hensoldt, and RENK in focus

The news hit like a bombshell. NATO plans to deploy up to 1,000 modern main battle tanks along its eastern flank. Amid growing tensions with Russia and against the backdrop of the ongoing war in Ukraine, the defense alliance is sending a clear signal of deterrence. The plan is part of a comprehensive rearmament program to strengthen what is called "Forward Defense." Germany, Poland, and other Eastern European member states, in particular, are set to serve as logistical and operational hubs. It is not just about tanks; ammunition, spare parts, and maintenance infrastructure are also to be built up on a large scale. In addition, the defense sector will see investments of over EUR 1 trillion over the next decade. Reason enough for the next price explosion at Rheinmetall and Co. Security is also likely to be the reason for the impressive gold rally since the beginning of the year. Where will it end?

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

RHEINMETALL AG | DE0007030009 , DRYDEN GOLD CORP | CA26245V1013 , HENSOLDT AG INH O.N. | DE000HAG0005 , RENK AG O.N. | DE000RENK730

Table of contents:

"[...] Internally we expect the resource to significantly grow the deeper we mine. [...]" Dennis Karp, Executive Chairman, Manuka Resources

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Rheinmetall – One order after another

Rheinmetall is the clear winner in the European defense sector. Since the start of the war in Ukraine, the share price has increased almost twentyfold and is already up more than 250% again in the current year. In the first quarter, revenue rose by 46% to EUR 2.3 billion, while EBIT increased by 49% to EUR 199 million, driven by the booming defense business. The order backlog reached a record high of EUR 63 billion, approximately six times the expected revenue for 2024. Strategically, Rheinmetall is now focusing entirely on defense, converting two plants and acquiring Hagedorn-NC to secure its powder supply. The Düsseldorf-based company is also a supplier for the F-35 stealth bomber. The new cooperation with Anduril will also bring modern drone technology to Europe. A new missile competence center is being established in collaboration with Lockheed Martin. Revenue growth of up to 30% and an EBIT margin of 15.5% are expected for 2025. Analysts view Rheinmetall as a key beneficiary of rising NATO spending; however, the share price has already reached the weighted target range of EUR 1,940 set by LSEG experts in recent days. With funds and private investors all seemingly moving in the same direction, there are few arguments to the contrary. However, a 2028 P/E ratio of 23 suggests that much of the positive outlook is already reflected in the share price. What the stock needs now is a stock split. Then the final rally should take off!

Hensoldt and RENK – Caution at the edge of the platform

In the second tier of German defense stocks, familiar patterns are emerging. While Rheinmetall will be able to expand its defense share to around 90% by 2026, companies such as RENK and Hensoldt will remain in the 70 - 75% range with their defense activities. Nevertheless, the stocks performed similarly to the number one. It cannot be ruled out that this phenomenon may continue for a few more weeks, as no easing of the international geopolitical situation is anticipated. From an analytical perspective, it is worth examining the facts for Hensoldt and RENK, despite numerous reports suggesting further upward revisions. In the case of Hensoldt, the expected revenues for 2027 are currently valued at 3.5 times, while the multiplier for RENK is around 4.5. Comparing the 2027 P/E ratios, the figures are 37 and 30, respectively. In the general herd mentality, investors will likely realize too late that the euphoric movement is lifting the profit and loss ratios of recent years off their pegs. Of course, it may also be that rearmament will fuel the upswing in European industry for years to come. After all, during the last world war, the printing presses ran around the clock to finance the war effort. Government leaders seem to be ignoring the fact that the accumulated debts will have to be paid by future generations or that currency devaluation could reach a pace similar to that seen in the run-up to the global economic crisis of 1929.

Dryden Gold – A top position in the gold boom

Precious metals have historically proven themselves as a portfolio hedge and protection against incalculable risks. The average return on gold over the last 30 years is approximately 8.7% per annum. In the second quarter of 2025, the price of gold reached over USD 3,450, an increase of over 40% in the last 12 months and a new all-time high. Those who do not want to invest in physical gold can also do so through active mining or future mining companies. The further the possible production date is in the future, the greater the leverage in this speculation.

In the Canadian province of Ontario, Dryden Gold's properties are coming into focus. The conditions there are crucial in the international race for favored locations: cheap energy, good infrastructure, a mining-friendly jurisdiction, and strong connections with the indigenous landowners. With its extensive property in the Gold Rock Camp, Dryden Gold has positioned itself as one of the most promising explorers in North America. With approximately 70,000 hectares of land and strategically important acquisitions, including Cross River, Sheridon, and Hyndman, the Company has a remarkable project pipeline. Dryden Gold employs a systematic, multi-phase exploration approach that incorporates comprehensive geophysics, LiDAR, soil, and till sampling. The comparatively high number of high-grade intersections is already reminding some analysts of the early stages of Red Lake. Supported by well-known partners such as Centerra Gold and Alamos Gold, the Company is well-financed, with approximately CAD 5.8 million already earmarked for the planned 2025 drilling program, which is expected to comprise 12,000 to 15,000 meters. The focus of the Company's activities is in one of Ontario's most productive gold regions. For example, the nearby Musselwhite mine has already produced around 1.5 million ounces of gold, and the new Greenstone mine is targeting 400,000 ounces per year. The Madsen Mine near Red Lake, with over 1.7 million ounces of resources, is also scheduled to restart production in 2025.

Management views 2025 as a pivotal year for identifying several new high-grade targets and laying the groundwork for its first resource estimate. The ultimate goal is a significant gold discovery in the established mining district. The Company has already scored its next hit in the well-known Gold Rock Camp. Two recent drill holes encountered visible gold in a newly identified parallel slope wall structure, a promising find in close proximity to the historic discovery from drill hole KW-25-003, which returned a sensational 301.67 g/t gold over 3.90 meters. The results of the new drill holes, DGR-25-011 and DGR-25-012, are still pending; however, the visible gold alone is already a strong signal.

CEO Trey Wasser emphasizes: "We are not just discovering individual veins here; a broad, multi-layered gold corridor is emerging." The structural diversity at Gold Rock is increasingly reminiscent of the famous Red Lake camp. Several superimposed gold-bearing zones indicate a deep-seated system that was barely visible at surface, a potential game changer. Dryden shares have already gained 70% in the last six months, and with a bit of luck and continued high precious metal prices, the journey should continue significantly further.

**The stock market continues to be on the sunny side. In high-tech and defense stocks, general hysteria and megatrends such as AI are fueling ever-new fantasies. However, it is questionable whether money can still be made with defense stocks. We consider further appreciation of precious metals to be more likely as a hedge against the inherent risk and threat situation. Global debt also speaks in favor of tangible assets and gold. The explorer Dryden Gold sits on a super property in the heart of Ontario's gold center. Exciting!

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.