January 20th, 2026 | 07:35 CET

Will new Trump tariffs slow down the stock market boom? Keep an eye on Plug Power, dynaCERT, and Nordex

The stock market currently has to cope with all kinds of weather conditions. First, there is a very dry and cold winter, which is causing problems for Ukraine in particular due to the war. To make matters worse, the energetic US President Donald Trump is suddenly laying claim to Greenland. Most likely, he is only interested in securing the entire NATO, hence the pressure over the new tariffs. The EU will also have to make a huge security contribution for Greenland. It feels as if the war machine is running at 300% capacity. How the states intend to finance all this is more than questionable, because taxes will no longer cover the costs if they do not want to stifle their economies. In this environment, capital market interest rates should actually be skyrocketing, but Trump is vehemently demanding interest rate cuts. We are looking for attractive opportunities in a challenging environment.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

PLUG POWER INC. DL-_01 | US72919P2020 , DYNACERT INC. | CA26780A1084 , NORDEX SE O.N. | DE000A0D6554

Table of contents:

"[...] The VERRA certification adds credibility to dynaCERT's emission reduction technologies by demonstrating compliance with internationally recognized standards for carbon emissions reductions and sustainable development. [...]" Jim Payne, CEO, dynaCERT Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Nordex – Is growth really that high?

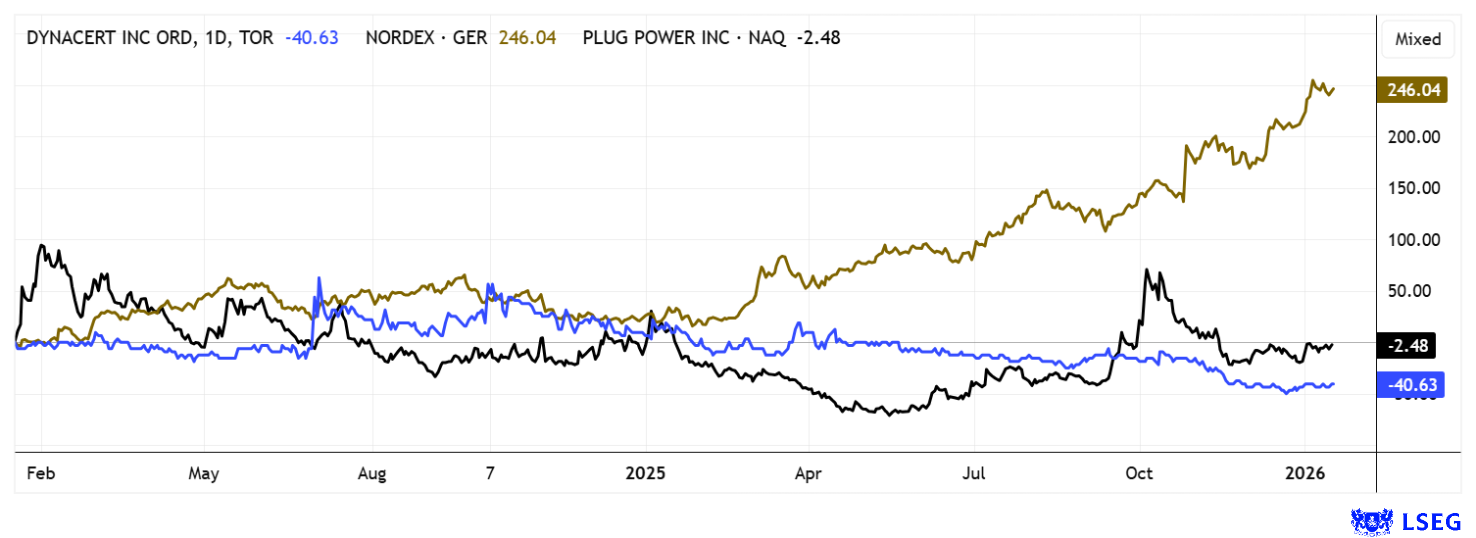

In the German Greentech industry, Nordex has been on a noticeable upward trend over the last two years. Not only is its operating business flourishing, but its share price has also risen from below EUR 10 in 2024 to EUR 33 today. But is a P/E ratio of over 20 still justified after a 300% rise in the share price? Analysts on the LSEG platform have their doubts, with only Metzler and mwb research predicting prices above the high of EUR 35 and EUR 36, respectively, over the next 12 months. Nordex management has emphasized that results are expected to continue rising slightly after 2025, and that the 8% EBITDA margin will already be achieved or slightly exceeded with the 2025 figures. For 2026, the decisive factor will be order intake, which already stood at around 2.2 GW in Q3, accompanied by a record order book of over EUR 9 billion. By way of comparison, revenues have increased from EUR 6.5 billion in 2023 to just under EUR 8 billion, while EBIT has risen somewhat disproportionately to around EUR 417 million. Analyst consensus sees EBIT doubling again to around EUR 874 million by 2029. The distant 2029 P/E ratio then falls to a favorable 12.8 – why the stock market is already pricing in the growth of the next four years remains unclear in our view. Based on the current price of EUR 32.30, Nordex shares are therefore a clear sell candidate. The 2025 annual figures are scheduled to be published on February 26.

dynaCERT – Cleantech stock with leverage on regulation and emissions markets

The equity story of dynaCERT has not yet been fully understood, even though the Company is on the verge of an international breakthrough after years of costly development. This is because dynaCERT is positioning itself as a pragmatic beneficiary of the global transition to lower-emission transport and industrial processes. While many competitors are focusing on future hydrogen infrastructure, the Company's HydraGEN™ technology addresses the huge stock of diesel engines that will remain in use for decades to come. The system generates hydrogen on demand, improving combustion and leading to measurable savings in fuel consumption and a reduction in CO₂ emissions. The key to its economic appeal is not only the sale of hardware, but also the possibility of converting the emission savings into tradable CO₂ certificates via the recognized VERRA standards. This is transforming dynaCERT from a pure technology provider to a model with potentially recurring revenue streams.

Financially, dynaCERT has recently secured its ability to act by successfully placing financing of CAD 2 million. The funds will be used specifically for the distribution of HydraGEN systems in industries such as transportation, mining, and oil and gas, while also strengthening working capital. With its own production capacity of up to 36,000 units per year, the Company is operationally prepared for growth. The cloud-based data platform HydraLytica also creates the basis for the transparent recording and monetization of emission savings. For investors, the stock offers access to a technological pioneer with tangible revenue leverage in the transportation, raw materials extraction, and infrastructure development segments. Based on a market capitalization of only CAD 48 million, dynaCERT is currently trading below the level of investments made over the past ten years. The stock has high liquidity on both the German and Canadian stock exchanges. With a price target of CAD 0.75, research firm GBC signals a possible upside that, based on the current price of CAD 0.09, implies a potential increase of around eightfold. Speculatively very interesting!

Plug Power – Between bottoming out and political headwinds

The American electrolyser market leader, Plug Power, is a prime example of the extreme cycles in the Greentech sector and, after a spectacular rise through 2021, has undergone an equally drastic correction of over 90%. The massive revaluation of the stock resulted from repeatedly lowered forecasts, high capital requirements, and an increasingly difficult political environment in the US. However, several capital measures at low share prices have recently provided financial stabilization and noticeably reduced selling pressure. After all, the Company is generating smaller but strategically relevant orders in the US, for example, from government research institutions, which provide basic capacity utilization and references. These projects show that Plug Power continues to be taken seriously as a supplier despite political uncertainties.

From a technical perspective, the first signs of a bottoming out process are emerging in the range between USD 0.75 and USD 1.50, even though volatility remains high. Fundamentally, there is at least a slight improvement, as the revenue base continues to grow and significantly higher revenues are expected again in the medium term. Nevertheless, the road to profitability remains long and rocky, as positive results only appear realistic towards the end of the decade. Analysts are correspondingly cautious, although a small group of six experts has recently retaken a positive stance. Although the price targets of USD 2.65 are only a stone's throw above the current level, there have been hardly any advocates for buying PLUG shares in the last two years. However, there are also voices such as BMO Capital, which rate Plug Power as "Underperform" and announce a price target of USD 1.30. Only suitable for risk-aware investors!

After an extensive correction in the Greentech sector, there is now room again for high-growth technology and sustainability stocks. Nordex has demonstrated how a functioning business model can affect the share price. After many years of adjustment, Plug Power and dynaCERT are on the verge of an operational turnaround. If there are quick success stories, there will likely be no stopping the share prices. Due to the high volatility of the sector, investors should at least take a risk-conscious approach.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.