April 1st, 2025 | 07:20 CEST

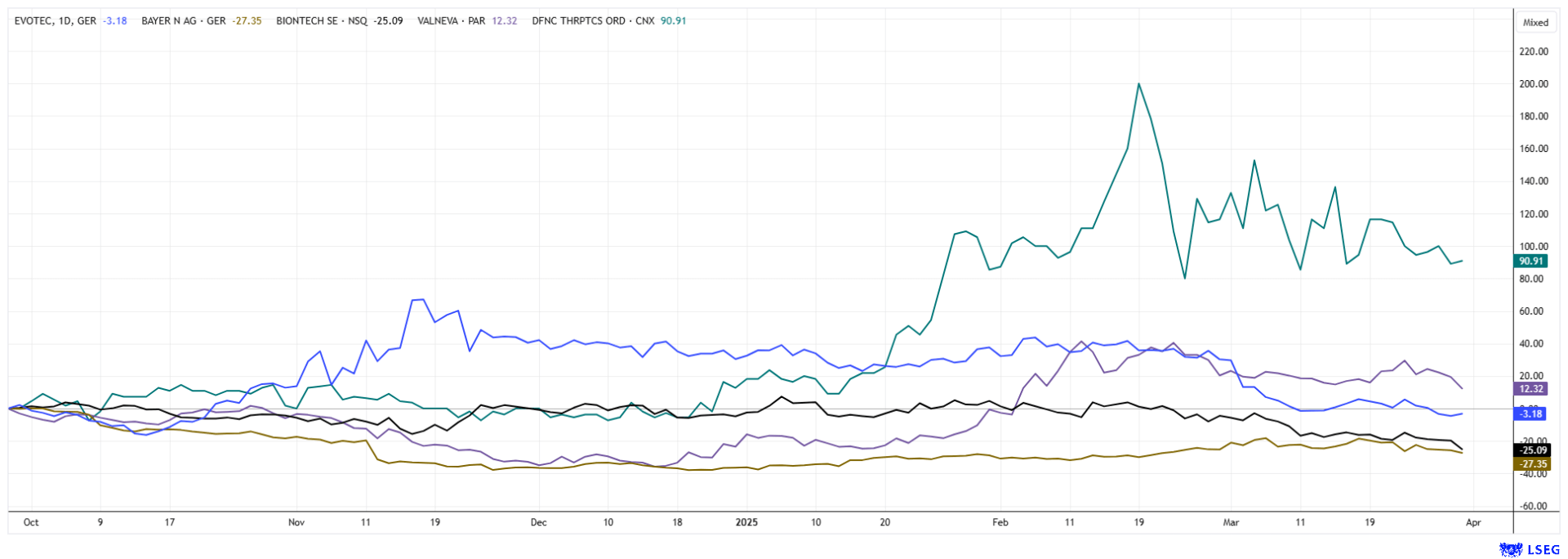

Was that the Trump crash? Nevertheless, steeply upwards with Evotec, Bayer, BioNTech, Defence Therapeutics, or Valneva?

Since November 2024, Donald Trump has driven the markets sharply upward - his controversial new presidency was largely celebrated by investors. Now, his leadership feels somewhat unsettling, with fires seemingly being set again at every corner. The new president is acting more imperiously than ever, with Panama, Canada, and Greenland verbally on the agenda as the next US states. Meanwhile, the US administration is facing a considerable deficit, which is to be addressed by drastically reducing the size of the public sector and introducing tariffs. Unsurprisingly, interest rates are now rising sharply, which is a reason for weaker prices in the biotech sector. However, the sector has done its homework and is emerging from a three-year downturn. Are we now at buying levels?

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

EVOTEC SE INH O.N. | DE0005664809 , BAYER AG NA O.N. | DE000BAY0017 , BIONTECH SE SPON. ADRS 1 | US09075V1026 , DEFENCE THERAPEUTICS INC | CA24463V1013 , VALNEVA SE EO -_15 | FR0004056851

Table of contents:

"[...] As a company dedicated to developing treatments for rare heart diseases, we see this as an opportune moment to contribute to the fight against heart disease and make meaningful strides in improving heart health worldwide. [...]" David Elsley, CEO, Cardiol Therapeutics Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Investors are looking to BioNTech and Bayer

For a long time, it had looked like there would be a trend reversal at BioNTech since the fall. However, the optimism quickly evaporated with the publication of the figures for the full fiscal year 2024. The reason: Q4 ended with a decline in profits for BioNTech. The share price fell from EUR 1.90 in the previous year to just EUR 1.08. Revenue amounted to EUR 1.19 billion after 1.48 billion. For the full year, earnings deteriorated from EUR 3.83 to minus 2.77 per share, as BioNTech slipped significantly into the red on the way to developing cancer drugs and must now cut jobs.

The focus is now on the development of mRNA-based cancer therapies. The Company had previously earned billions from vaccines, but now it faces the threat of high investments, especially in costly clinical trials, which are eating up its cash reserves. The bottom line was a net loss of around EUR 700 million in 2024, compared to a profit of around EUR 9.4 billion in the COVID-19 year 2022. BioNTech aims to obtain the first marketing authorization for its projects in 2026. It has now announced the reduction of 1,350 of its 7,200 jobs worldwide. At the end of the fiscal year, BioNTech had liquid funds and securities totaling EUR 17.4 billion, and its market capitalization is still as high as EUR 21 billion. Wait for the restructuring!

Bayer saw a technical flare-up, as the value has risen by as much as 30% to EUR 24.50 since December. The problems are well known. In addition to an ongoing restructuring, the glyphosate lawsuits from the US, which are still pending, continue to weigh on the Company. However, investors have now digested the negative points, and the community is vigilantly standing by to support the stock at around EUR 22 and is ready to drive the stock up again with every good report. We had already recommended the stock at EUR 19.45 – so keep collecting! The experts on the LSEG platform expect average prices of around EUR 26.80 in 12 months.

Defence Therapeutics tripled from zero in January

The Canadian biotech specialist Defence Therapeutics develops vaccines against cancer. The first series of trials delivered astounding results. At the heart of the Company's proprietary platform is Accum® technology, which enables the precise delivery of vaccine antigens or ADCs in their intact form to the target cells. The approval of AccuTOX® in 2024 as one of the Company's first-in-class therapies marks a significant advance for Defence in the field of immuno-oncology. After initial successful use in mice, Defence is testing the vaccine ARM-002 in difficult-to-treat pancreatic, colon, and ovarian cancers. These results will determine the target indication for the Phase I trials and show how versatile and adaptable the cancer vaccine is.

As of April, Dr. Elias Theodorou (PhD) is joining the management team as COO. He is a molecular biologist with over 25 years of experience in cancer research, stem cell differentiation, and gene transfer, and he co-founded Protos Biologics Inc., where he developed innovative DNA delivery systems. Dr. Theodorou was previously a research director at WBC Biosciences LLC, where he co-invented a method for modifying innate immune cells for enhanced anti-cancer properties. Dr. Theodorou received his doctorate from Yale University, where he focused on identifying novel drivers of neuronal differentiation. He has authored numerous publications and holds patents related to gene therapy and protein engineering.

"The appointment of Dr. Theodorou as COO marks a significant milestone for Defence Therapeutics," said CEO and President Sebastien Plouffe. "His leadership skills, scientific acumen, and extensive experience in innovative biotech start-ups will be instrumental in accelerating our development programs and strengthening our position in the US market." Upon taking office, 350,000 Defence options with a strike price of CAD 1.07 and a term of 10 years will be granted. This incentive package could also benefit Defence shareholders, as the stock previously traded at CAD 8 in 2021, and plans for a NASDAQ listing are likely to resurface with the Company's new US management addition. **The Company is currently valued at only CAD 54.7 million. Take advantage of the current correction to buy more!

What about Evotec and Valneva?

A brief technical look at Evotec and Valneva. We have reported on these stocks frequently. While Evotec is undergoing a strenuous realignment following the departure of long-standing CEO Lanthaler and is being driven up and down in a volatile manner, Valneva was recently able to gain some momentum again. Last week, Evotec approached its 10-year low of EUR 5.08 at a dangerously low level of EUR 5.86. The abrupt change of CFO continues to cause great uncertainty, and even milestone payments such as the one recently received from Bristol Myers Squibb are currently of little help. A technical buy signal will only emerge above EUR 7.25. Monitor and jump in when momentum increases.

At Valneva, the chikungunya outbreak on the French island of La Réunion is providing a boost. An additional 40,000 vaccine doses will be delivered in April. The French government is paying for the vaccine because, similar to the 2005-2006 chikungunya outbreak, there is a risk of transmission to mainland France and other French overseas territories. **A good technical boost for the bombed-out value to a quick EUR 3.70 – however, the share is currently consolidating again at its 200-day line in the range of around EUR 3.00. One should definitely keep this stock on the watchlist.

The stock market has finally reacted to the negative effects of the Trump administration. This led to discounts on the tech stocks that had previously risen to remarkable heights. How the stock markets will continue to develop depends largely on geopolitical developments and interest rates. Everyone needs money – unfortunately, the cost of capital is rising almost daily. One standout performer since January has been Defence Therapeutics. After the current consolidation, the rally here is likely to resume quickly.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.