November 6th, 2024 | 08:00 CET

US election and the biotech sector – A hot November is on the cards! BioNTech, Pfizer, Nyxoah, Bayer or Evotec?

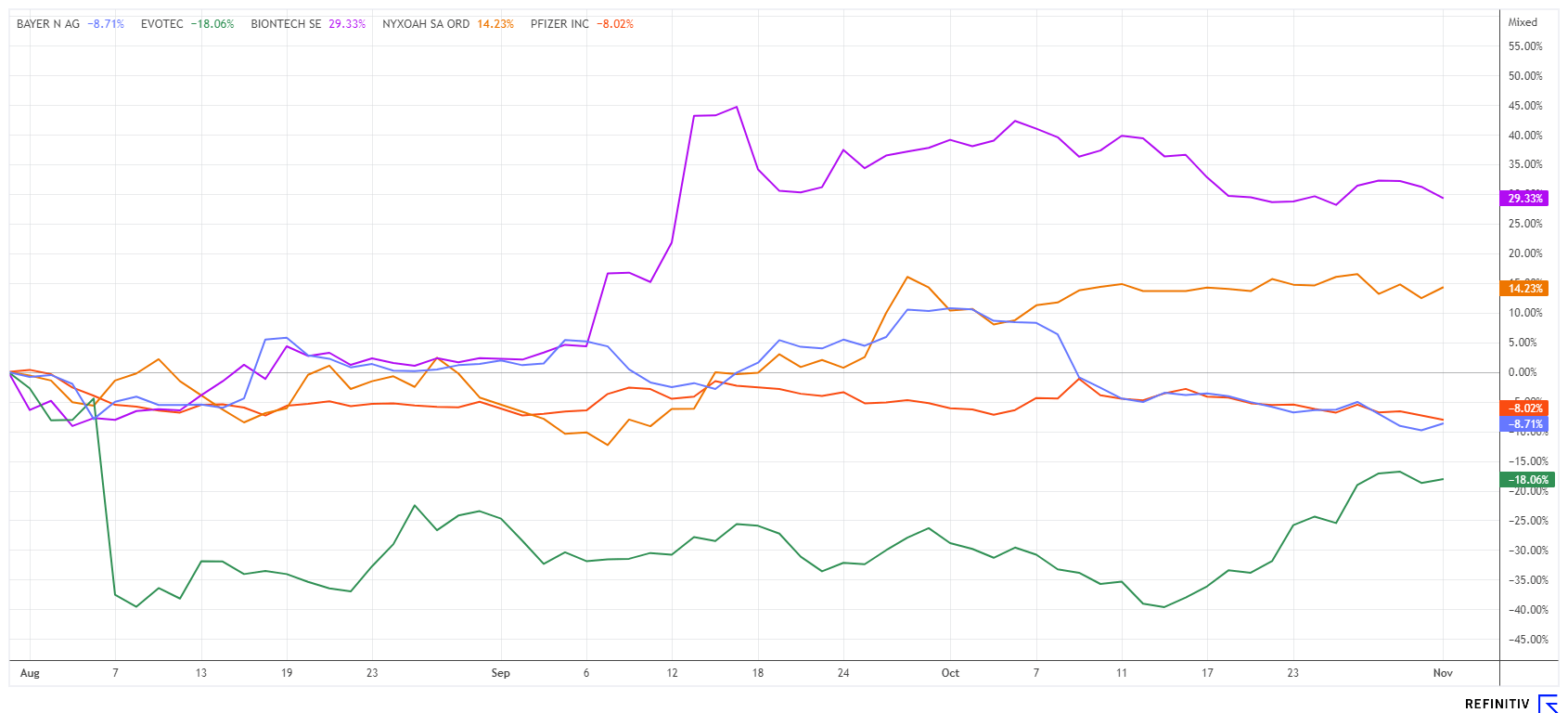

With anticipation building for both the Q3 earnings season and the US election results, the markets are in a wait-and-see mode. Democrat frontrunner Kamala Harris is said to be committed to continuing the successful policies of her predecessor Joe Biden. Of course, science, research and climate protection are in the spotlight. Her rival, Donald Trump, is said to be more concerned with strengthening the traditional economy, where automotive engineering, the defense industry and security companies come to the fore. Additionally, markets are looking to central banks for cues, as lower interest rates would be a boon for the biotech sector. Here are some investment ideas for dynamic investors in this promising climate.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

BIONTECH SE SPON. ADRS 1 | US09075V1026 , PFIZER INC. DL-_05 | US7170811035 , NYXOAH SA | BE0974358906 , BAYER AG NA O.N. | DE000BAY0017 , EVOTEC SE INH O.N. | DE0005664809

Table of contents:

"[...] Defence will continue to develop its Antibody Drug Conjugates "ADC" and its radiopharmaceuticals programs, which are currently two of the hottest products in demand in the pharma industries where significant consolidations and take-overs occurred. [...]" Sébastien Plouffe, CEO, Founder and Director, Defence Therapeutics Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Evotec and Bayer – Breakouts and Setbacks

The two German biotech and life sciences companies, Evotec and Bayer, are under constant fire. The Hamburg-based company has considerable restructuring ahead after the departure of long-standing CEO Dr. Lanthaler, and investor confidence in 2024 remains fragile. Nevertheless, the stock has so far been able to defend itself well against multiple short attacks. In October, the stock even managed to break through the EUR 7 mark again with some good news. Currently, about 3% of Evotec's stock is sold short, which could lead to significant gains if momentum increases over the coming weeks. Evotec will release its Q3 earnings on November 6, and while the financial results are critical, even more crucial are projections for Q4 and especially for next year. Technically, the Hamburg-based company has to overcome the EUR 7.80 line, and then larger price increases beckon.

Bayer is currently facing another wave of lawsuits from the US, after which the Company had hoped that the glyphosate lawsuits might come to an end. The Leverkusen-based company is also struggling in the pharmaceuticals division, as important patent protection will soon expire, and the pipeline does not currently have enough to finance the energy-sapping reorganization of the group. However, the job cuts are progressing, with up to 4,000 middle management positions to be eliminated by 2026. This could save the Company around EUR 500 million per year. Bayer is already reporting tomorrow, with analyst consensus at EUR 0.357 earnings per share. Last week, the Leverkusen-based company reached a new 20-year low of around EUR 24.7. Wait and see!

Nyxoah SA – Excitement ahead of the quarterly figures

The medical technology manufacturer Nyxoah SA from Belgium is making rapid progress. The Company recently raised a further USD 27 million in gross proceeds in an "at-the-market" placement on the US NASDAQ exchange. At the beginning of the year, the Company was already able to raise over EUR 80 million. This creates the basis for the upcoming US market launch of the main product Genio®, a patient-centered treatment for obstructive sleep apnea (OSA). The disease causes repeated interruptions in breathing during sleep and thus leads to significant stress on the cardiovascular system.

People with untreated sleep apnea have a higher risk of heart attacks, strokes and cardiac arrhythmias. The constant breathing interruptions reduce the oxygen content in the blood, which puts a strain on the heart and increases the likelihood of heart disease. The Company has spent years developing the Nyxoah Genio® application, which is based on neurostimulation. The product is already being used successfully in the largest market, Germany, in many ear, nose and throat clinics. In the US, Nyxoah is now expecting approval by the end of the current year, and the sales forecast gives reason to hope for great things.

After the capital increase, there are now around 34.36 million shares, with a market capitalization of almost EUR 300 million. This valuation makes the share popular with institutional investors. On November 6, investors will already be able to take a closer look at the Company's figures. Individual participation is possible via a webcast. So far, the Belgians are showing a good set-up for further price increases. A positive outlook for the coming quarters could spark short-term momentum.

BioNTech and Pfizer – The technology has improved

BioNTech and Pfizer have been on our watchlist for a long time. From 2020 to 2022, the Comirnaty vaccine manufacturers celebrated an exceptional economic boom. Notably, despite the ongoing debates surrounding vaccination, newly adapted vaccines for the KP.2 subvariant of COVID-19 will be available on the market next week. Expectations for revenue figures are relatively low, as surveys show a vaccination rate of under 10% in Europe. Nevertheless, it is interesting to note that the devaluation of BioNTech and Pfizer in late summer appears to have come to an end, suggesting that investors might be anticipating improved performance during the upcoming flu season.

In addition to further developments in cancer drugs, BioNTech is also, of course, reporting on new achievements in AI. With its London-based subsidiary InstaDeep as an in-house AI specialist, the Mainz-based company aims to advance the use of artificial intelligence in the development of personalized vaccines and targeted therapies. Therefore, the "Innovation Series Day" on November 14 could also be interesting. Here, BioNTech will provide insights into the current research pipeline. Deutsche Bank recently confirmed its price target of USD 150 with a "Buy" rating. Today's quarterly figures from BioNTech could also point the way forward.

BioNTech's partner Pfizer increased sales to USD 17.7 billion in Q3, significantly exceeding analysts' expectations of USD 14.9 billion. The COVID-19 vaccine and the antiviral pill Paxlovid contributed to the growth in particular. In view of the good results, Pfizer raised its full-year forecast and now expects adjusted earnings per share of between USD 2.75 and 2.95. This lowers the 2024 P/E ratio to around 9, on top of which there is a current yield of around 6%. Both stocks deserve a higher weight within a life sciences allocation.

The biotech sector has so far been one of the losers at the 2024 stock market party. High-tech and defense stocks were in demand, but especially artificial intelligence. However, with falling central bank interest rates and progress in the development pipeline, the previously neglected life science stocks could soon take off again. Nyxoah will provide a current outlook today. Exciting!

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.