November 8th, 2023 | 08:00 CET

Ukraine, Middle East, BRICS - Is climate policy over? Nel ASA, Klimat X, SFC Energy and Plug Power with 100% chances!

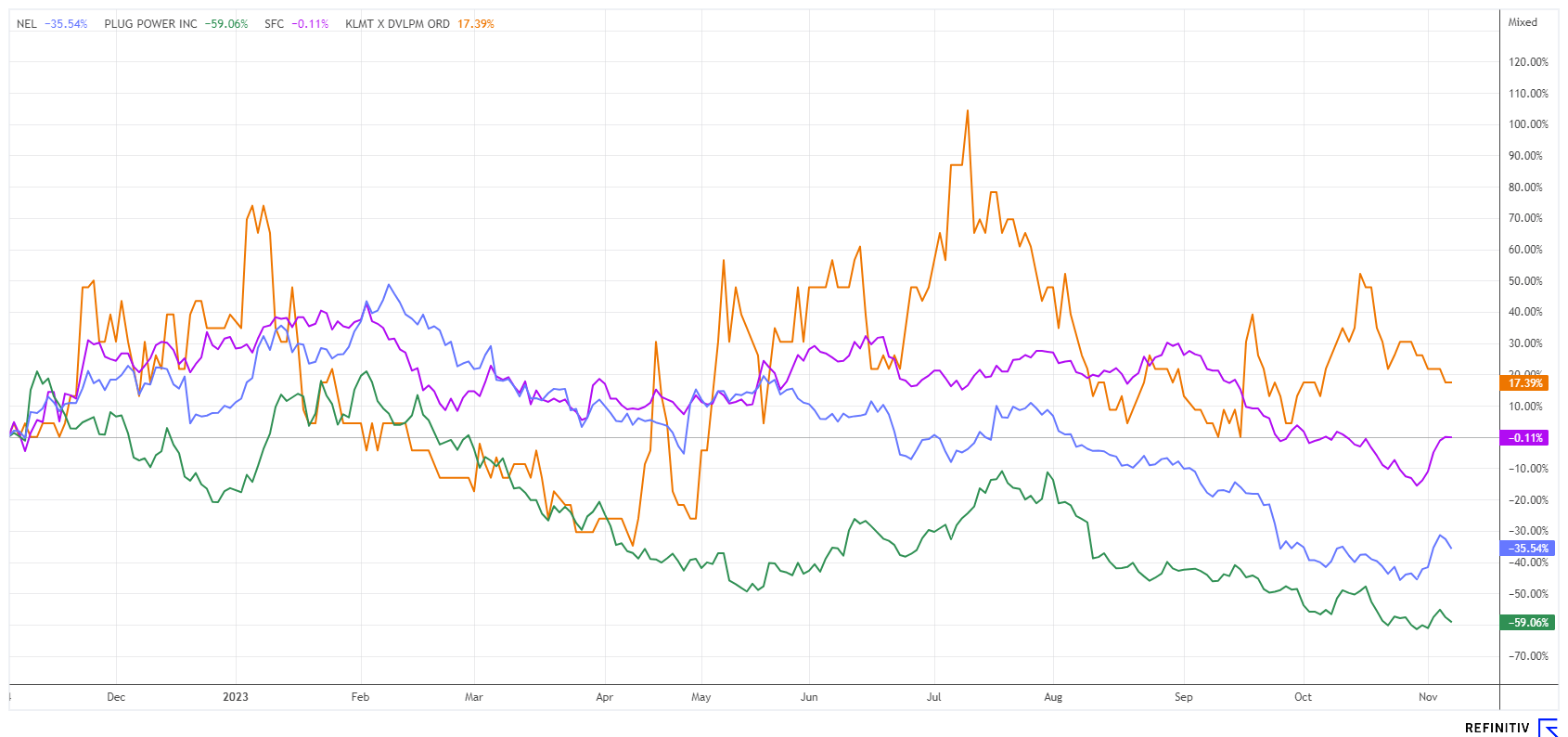

The turnaround was sudden and very sharp. A few days ago, the DAX, NASDAQ and hydrogen stocks were in free fall, but the tide turned at the beginning of November. The DAX 40 jumped 600 points because the central banks on both sides of the Atlantic finally ceased tightening, and the first interest rate cuts are now expected in 2024. The hydrogen protagonists suffered losses of up to 70% in just 6 months - but Nel & Co have already made up a third of those losses. What is next for Greentech stocks?

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

NEL ASA NK-_20 | NO0010081235 , KLIMAT X DEVELOPMENTS INC | CA49863L1067 , SFC ENERGY AG | DE0007568578 , PLUG POWER INC. DL-_01 | US72919P2020

Table of contents:

"[...] Recovery rates of more than 90% rare earths are another piece of the puzzle on the way to the economic viability of our project. [...]" Craig Taylor, CEO, Defense Metals

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Nel ASA and Plug Power - Is this the long-awaited turnaround?

Hydrogen stocks have recently come back into the limelight. This is because the Inflation Reduction Act (IRA) is now expected to be extended in the US from 2024. The national budget is currently burdened by high interest rates and rising defense and transfer spending to Europe. However, market observers expect a further expansion of government funding programs for future projects next year at the latest.

With this outlook, the losers of the investment year 2023, the hydrogen stocks, have recently been able to turn around impressively. After lows of EUR 0.57 for Nel ASA and EUR 5.28 for Plug Power, a rally quickly set in, resulting in a 30% premium in just 5 trading days. Yesterday, however, there was a renewed reversal, as fear of the Plug figures on Thursday is likely too great. Analysts on Refinitiv Eikon estimate a quarterly loss of USD 0.305 per share, i.e. around USD 183 million. That is quite a number! However, Plug Power aims to be profitable from 2025 onwards.

CEO Andy Marsh had recently prepared the markets for increasing order volumes and, accordingly, higher revenues. At his symposium in October, he even spoke of a turnover of USD 6 billion by 2027. From today's perspective, this would be a five-fold increase in just four years. By 2030, turnover is expected to rise to USD 30 billion. It can, therefore, be assumed that the share price will have to price in this scenario at some point. We are curious to see when this will finally happen. New investors from the H2 hype year 2021 have lost 90% of their investment for the time being.

Klimat X Developments - Focusing on improving CO2 balances

The energy and climate transition will only be possible through a combination of various measures. This includes compensation models that offset industrial pollution through as many green projects as possible. Although this is not possible on a one-to-one basis, there are organizations that are taking a very innovative approach to the issue of CO2 certificates. The Canadian company Klimat X Developments has delved into this approach and can already point to a successful pipeline of projects. It offers corresponding investment opportunities in environmental projects that focus primarily on the regeneration of forests and water.

Klimat X ensures the protection of forests and mangroves by cleverly offering incentives to industry and other interest groups. Anyone who cultivates on behalf of Klimat X receives credits in the form of CO2 certificates and can pass these on to interested parties at the best bid or add them to their own balance sheet. Klimat X focuses on restoring, protecting and creating new tree populations as well as green and agricultural areas. The main areas of activity are currently the West African countries of Sierra Leone and Ghana, as well as Suriname and Mexico.

In October, the next milestone was announced. The deal with a Fortune 500 company, which was already announced in June, has been initiated to such an extent that a further partial payment of USD 500,000 is now expected in accordance with the pre-sale agreement. CEO James Tansey comments: "This second milestone demonstrates that we have successfully completed our planting program in the summer of 2023. It shows our ability to meet the requirements expected by one of the world's largest buyers of carbon credits." The Company has completed approximately 1000 hectares in the current 2023 planting period and submitted the project planning document for final approval. Klimat X has also launched an initial large-scale reforestation project in Sierra Leone, which initially covers an area of 5,000 hectares and can be expanded by an additional 20,000 hectares.

By buying KLX shares, investors can participate directly in interesting ESG projects. The Company recently raised around CAD 1 million at CAD 0.15 and will seek further financing for its growth projects. The share is actively traded in Canada and Frankfurt. With a market capitalization of CAD 13 million, the entry point is currently still favorable. The great advantage of a Klimat X investment lies in the automatic participation in the global boom market for emission rights.

SFC Energy - hydrogen and methanol in reserve

Another protagonist in the field of alternative energy generation is Munich-based SFC Energy. As the fuel cell supplier announced yesterday, it has landed a follow-up order from a Canadian oil producer. The order for frequency converters is worth more than CAD 4 million. The order, worth the equivalent of EUR 2.7 million, will be fully recognized in sales and earnings in the current financial year. The Canadian customer uses SFC Energy's systems to operate electric submersible pumps for oil production on drilling platforms. The integration of the systems reduces installation and operating costs by a significant factor, as the operating times and delivery rates of the pumps are improved.

The SFC Energy share suffered severely in 2023, falling from a high of EUR 27 to a low of EUR 16 by the end of October. The Company, valued at EUR 326 million, aims to generate revenue of EUR 114 million in the current year and increase its sales by a further EUR 150 million by 2026. The Brunnthal-based company is focusing on small and medium-sized decentralized energy solutions. Most recently, a 50 KW hydrogen power station was launched. On the Refinitiv Eikon platform, there are 5 analyst firms with current buy recommendations and an average 12-month price target of EUR 33.5. *Interesting in the long term, but currently, the price/sales ratio of 3 is still somewhat high. Collect!

Investing in green is a new investment trend, especially among the younger population. Today's investors want to see sustainability and environmental protection reflected in their investments, leading to an increasing interest in ESG-compliant investments on the stock market. Nel ASA, Plug Power and SFC Energy are interesting Greentech companies with a high level of popularity. The small second-tier stock Klimat X has the potential to become a pearl in the portfolio due to its strong growth.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.