November 25th, 2025 | 07:35 CET

Trump makes peace – Maybe? Strong profit prospects for BYD, Pasinex Resources, and DroneShield

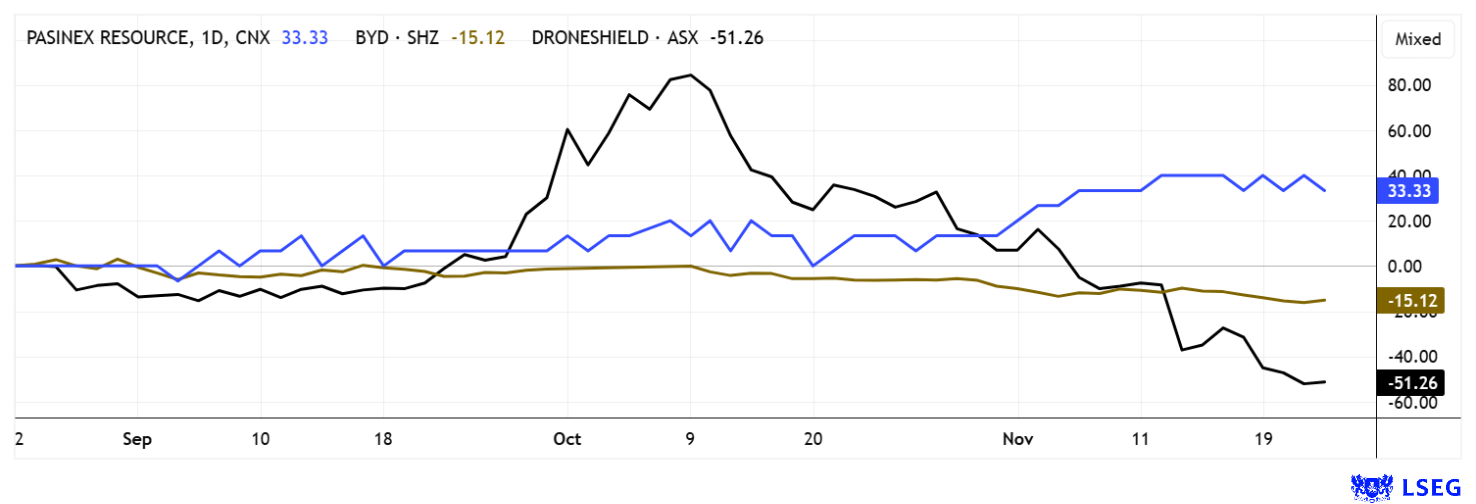

In the daily battle for returns, selecting the right assets is becoming increasingly complex. Markets have risen sharply despite the generally sluggish sentiment in global economies. First, there was the celebration of Donald Trump, then the bull market due to lower-than-expected tariffs, and most recently, a super rally in AI and high-tech stocks. Defense and armaments stocks have also been consistently on the shopping list for two years now. After 25 years of disarmament and a 180-degree political shift among left-green parties, defense has suddenly become the cure-all for Western societies. For years, frowned upon and subject to lawsuits in Germany's Constitutional Court, arms exports now appear to represent the highest ethical stage a company can reach. But now a taboo word is making the rounds: "peace." And with that, defense stocks are once again treated like clearance items, and prices are falling. A politically fueled boom and bust cycle at its finest. Rheinmetall is now even included in ESG-oriented funds - what a farce. Very few can still see clearly through this nine-lane highway of contradictions, but we are here to help.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

PASINEX RESOURCES LTD. | CA70260R1082 , BYD CO. LTD H YC 1 | CNE100000296 , DRONESHIELD LTD | AU000000DRO2

Table of contents:

"[...] We know exactly what we are doing and are implementing what we consider to be a proven technology in an industrially applicable and scalable way. [...]" Uwe Ahrens, Director, Altech Advanced Materials AG

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

DroneShield – That went badly wrong

When Ursula von der Leyen registered drone flights over Lithuania, Latvia, and Poland, there was a massive outcry in Brussels. "We must be able to defend ourselves against this invasion of unknown flying objects!" Even before anyone could think about ordering suitable drone defense systems, the share price of Australian drone defense specialist DroneShield exploded. In just four weeks of trading, the share price quadrupled from EUR 0.60 to EUR 2.40, then consolidated slightly and continued to rise to a high of EUR 3.78 in October. There were already concrete declarations of intent from the EU to combat drones effectively. Several airports even had to divert or cancel hundreds of flights due to suspected drones above runways - resulting in millions in damages, but at the same time highlighting a billion-dollar market opportunity for DroneShield.

In mid-October, however, a strange announcement reached the public. Through clever option agreements linked to certain revenue hurdles, company employees were able to purchase a full 5% of the outstanding capital as shares and sell them immediately. The revenue threshold was the AUD 200 million mark. And because there appear to be no limits to self-service here, the next revenue thresholds for further options have already been agreed at AUD 300, 400, and 500 million. At the beginning of November, it became known that even the entire management team had thrown all their incentive shares overboard. As expected, the market reacted with a dramatic collapse in the share price from EUR 3.78 to EUR 0.82. The crux of the matter: we had reported in several reports on the exorbitant valuation of DroneShield with a P/E ratio of 40, and now, even 80% lower, the share is still valued at a P/E ratio of 8. **In addition, the Company will only start making a profit in 2030, provided that its ambitious plans come to fruition. A return of the share price to its February levels, around EUR 0.50, appears likely, representing another 50% downside from yesterday's closing price. We will reassess our valuation once the dust has settled.

Pasinex Resources – High-grade zinc for a fully electric future

A variety of critical metals are necessary for high-tech and defense applications. Zinc is one of them due to its metal refining properties, and it is also irreplaceable in battery production. Explorer Pasinex Resources is increasingly establishing itself as a strategically important player in the global zinc market. This sector is becoming significantly more important in light of the energy transition driven by e-mobility and sustainable battery technologies. Zinc is used as corrosion protection in infrastructure and is indispensable for modern zinc-ion batteries, which are considered safe alternatives to lithium-based energy storage devices. While high-grade zinc deposits are dwindling worldwide, Pasinex's projects in Turkey deliver exceptionally high ore grades of up to 50%, well above the market average of 10%. The Company is continuously expanding its position in Turkey. With the acquisition of the Sarıkaya project and full control of Horzum A.Ş., which includes the high-grade Pinargözü zinc mine, Pasinex brings together two first-class properties under one roof.

The quarterly figures as of September 30, 2025, reflect the investment and growth offensive. While a moderate net profit of USD 42,989 was reported for the third quarter (previous year: USD -245,877), the nine-month result showed a net loss of USD 1.13 million, impacted by one-time and administrative costs. Production and sales also diverged significantly. In the most recent quarter, 71 tons of zinc product were produced, but 700 tons were sold, indicating inventory levels and sales from stockpiles. The average zinc content of the products sold was a strong 43.4%. Total production for the first nine months was 1,044 tons, a strong sign of increasing production volumes.

Current strategic guidelines include planned expansion, in particular direct control over all assets, and a strengthened management structure, for example, through the nomination of Dr. Mehmet Kömürcü to the supervisory board. The complete takeover of Horzum A.Ş. and the Sarıkaya project secures exclusive access to high-quality zinc resources and opens up considerable exploration opportunities in the short to medium term. Through its expansion in Turkey and its 51% stake in the Gunman project in Nevada, Pasinex is further expanding its pipeline of potential high-grade deposits. The latest capital measures strengthen equity, with the number of shares increasing to 204.8 million. The market capitalization currently remains low at EUR 12.5 million, keeping Pasinex in an early valuation stage with far-reaching growth potential. Collect!

Listen to Pasinex Chairman Dr. Larry Seeley in conversation with IIF correspondent Lyndsay Malchuk in the following video.

https://www.youtube.com/watch?v=dV9QQmn0kug&t=4s

BYD – No end in sight for the sell-off?

Things are really heating up at Chinese e-mobility growth star BYD. The stock has already reached prices of over EUR 17 this year, but last week the price briefly fell back to EUR 10, ending the year in negative territory. Several problems have now come to light: Q3 quarterly profits have slumped by around 30%, which is attributed to intense price competition in the Chinese EV market. Regulatory intervention is also weighing on the Company, particularly as the Chinese government criticizes aggressive discounts and delayed supplier payments. BYD has also slowed down its production plans and postponed its planned capacity expansion in China, raising doubts about its future growth momentum. The plant in Hungary will not start production until mid-2026, while management has significantly revised its annual delivery target downward, from 5.5 million to 4.6 million vehicles. Analysts also view the product portfolio as no longer quite as fresh, as new models are not expected to hit the market in large numbers until 2026. The sharp drop in valuation is certainly positive: a P/E ratio of only 11.1 is expected for 2026, and experts on the LSEG platform calculate an upside potential of 45% over the next 12 months. The stock is likely to have ended its cyclical downward trend soon!

The stock markets are prone to slight corrections. Whether this will lead to a complete sell-off is questionable. After all, the major stock markets have gained a good 25% since April 2025. Is everything hunky-dory? Certainly not. As always, selection is key. Pasinex Resources could multiply in value from a standing start, while DroneShield continues to correct. BYD appears to be worth buying in the long term.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.