January 27th, 2026 | 07:00 CET

Trump 3.0 and gold at USD 5,000! Critical metals continue to skyrocket with Almonty, Rheinmetall, DroneShield, and CSG

US President Donald Trump appeared on the international stage in Davos and triggered mixed reactions. With his well-known "America First" slogan, the most powerful man in the world once again made clear which priorities dominate from a US perspective. For the international community, this reinforces concerns about transatlantic reliability and the growing realization that, in a crisis, countries may increasingly have to rely on their own capabilities when dealing with dictatorships and autocratic systems. This development exemplifies the geopolitical turning point already described by Klaus Schwab in Davos in 2020 as "The Great Reset." Geopolitical uncertainty is giving rise to constraints and unsettled investors. They are increasingly turning to true values, which are believed to lie in the commodities sector. Against this backdrop, critical metals, gold, and silver remain firmly in focus – a trend that has been gaining momentum for weeks. Here are a few tips for risk-conscious investors.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

ALMONTY INDUSTRIES INC. | CA0203987072 , RHEINMETALL AG | DE0007030009 , DRONESHIELD LTD | AU000000DRO2 , CSG NV | NL0015073TS8

Table of contents:

"[...] While tungsten has always played an important role in the chip industry, it is now being added to batteries for e-cars. [...]" Lewis Black, CEO, Almonty Industries

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

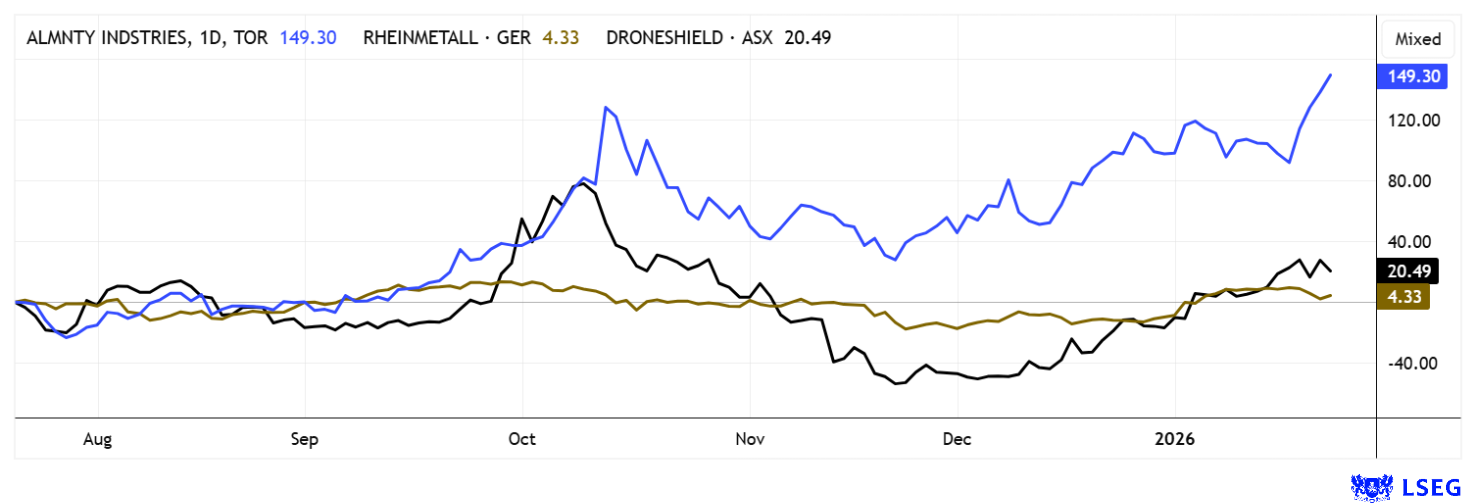

Almonty Industries – Another new high

Almonty shares continue to follow a clear pattern. Demand for the stock remains strong, with increasing participation from institutional investors. The background is the Company's almost unrivaled positioning in the tungsten and molybdenum markets. CEO Lewis Black has repeatedly highlighted the strategic importance of these materials, which can be summarized succinctly as: "No material - no production." Yesterday was another Almonty day with almost double-digit gains, and the newspapers will cite the new US Rare Metals Deal as the reason. But it could be said more succinctly: there are too few Almonty shares for this considerable demand! The rally is likely to continue unabated. While broker estimates remain cautious, scarcity considerations currently play a more important role than traditional valuation metrics. In this environment, balance sheet metrics temporarily take a back seat to long-term supply contracts and strategic positioning. It is therefore likely that analyst price targets will be revisited in the near term.

CEO Lewis Black spoke at the 17th International Investment Forum (www.ii-forum.com) on December 3 without a formal presentation. This made the impression all the more intense. Click here for the video.

IIF moderator Lindsay Malchuk also highlights the key aspects of the tungsten project in Montana in the video below.

Rheinmetall – Will the EUR 2,000 mark now be broken?

A comparable case and an equally astonishing 2,000% movement, as with Almonty Industries, occurred in the Rheinmetall share between 2022 and 2025. The difference is that Rheinmetall has to gradually grow into an already respectable valuation of approximately EUR 83 billion, given that the Company only had EUR 9.7 billion in revenue in 2024. At the recent Handelsblatt conference "Security and Defense 2026," CEO Papperger spoke of expected order intake of EUR 80 billion this year alone. Investors can therefore look forward to seeing what figures Rheinmetall can now present for 2025. Analysts estimate revenue of EUR 12.4 billion, which is expected to increase to around EUR 35 billion by 2029. Only when this level of revenue is achieved would we consider Rheinmetall to be fairly valued, as the stock is currently trading at a P/E ratio of 67 compared to a growth rate of 20 to 25%. It is, therefore, no surprise that the stock is constantly failing to break through the EUR 2,000 mark; it is simply a matter of mathematics. Wait for a decent consolidation to below EUR 1,500 and then jump on the defense bandwagon. Please note: Rheinmetall has not seen any revaluation for months. The 2025 figures will be released on March 11 at the latest, or earlier via ad hoc if there is good news to report. Caution at the platform edge!

DroneShield – Is trouble looming again?

After rising more than 170% since the correction to below EUR 0.90, DroneShield's stock appears to want to repeat its huge appreciation from 2025. Contrary to many industry services, we tend to advise against this stock, as the next revenue hurdle for the generous free shares to the workforce is looming, and there was a significant slump in momentum last week. These are technical signals that are very valuable for this volatile stock. From a fundamental perspective, investors are currently paying a market value of AUD 4.3 billion for an estimated AUD 310 million in revenue in 2026, a multiple of 14. Applied to Rheinmetall, this would imply a share price of around EUR 3,800. Caution is advised.

CSG – Czech defense company listed in Amsterdam

The CSG NV share completed the largest IPO of a defense company ever in Amsterdam on Friday. It is also the most powerful IPO since VW floated Porsche AG on the stock exchange. And it is highly successful! The Czech industrial group Czechoslovak Group (CSG) and its main shareholder, Michal Strnad, are bringing shares with a total value of EUR 3.8 billion to the market. Initial trading saw the stock jump 32% above the issue price of EUR 25. Yesterday, the price rose again to EUR 36.70, but late afternoon prices were already back at EUR 33.60. Czech billionaire Strnad cashed in a total of EUR 2.55 billion, and the listing is also expected to raise EUR 750 million in growth capital for the Company. It looks as if the shares could be sold without any problems, as demand in the defense sector is making historic deals possible. Here, too, we note that according to the prospectus, fully consolidated revenue in 2024 amounted to EUR 5.2 billion and is expected to rise to around EUR 7.6 billion by the end of 2026. With a market valuation of EUR 35 billion, a revenue multiple of 4.6 is already being applied here as well. It remains to be seen what higher valuations the new shareholders can expect in this case. The stock should quickly settle back around EUR 25 or below in the coming weeks. So, open your laptop and hit the right button!

The US president is sending the stock markets into a volatility trap with his announcements. First, tariffs are announced, then later withdrawn. Europe has long been a transatlantic ally, but today, in Donald Trump's eyes, the 770 million inhabitants of the old continent are likely just compliant bystanders with little influence on global affairs. Critical metals and defense stocks are fluctuating wildly in this environment. Blessed are those who can keep their nerve!

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.