November 11th, 2024 | 07:00 CET

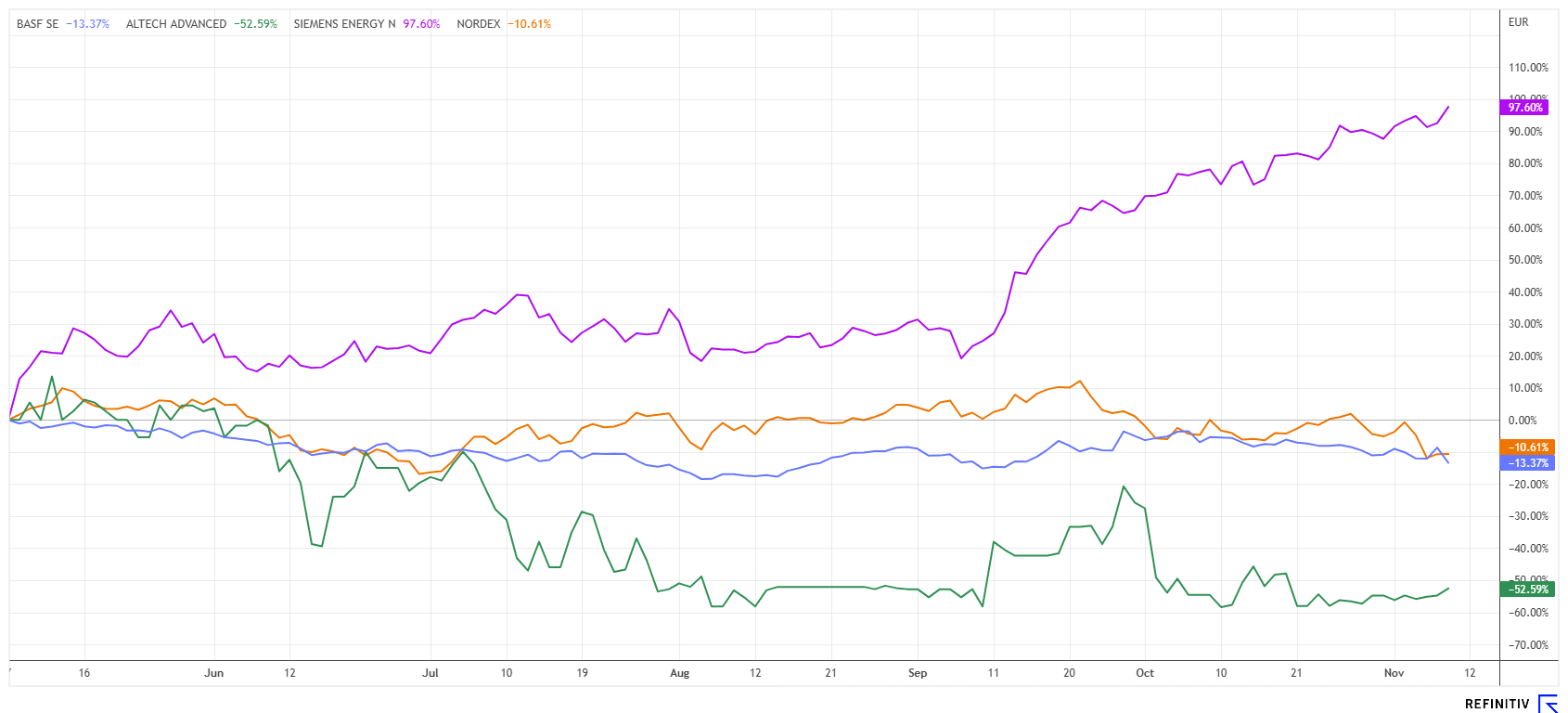

Traffic light madness! The turnaround at BASF, Altech Advanced Materials, Nordex and Siemens Energy

The traffic light coalition departs – and the economy breathes a sigh of relief. Key future topics such as the energy transition, e-mobility and the energy storage market now have good prospects. With a redefinition of industrial policy in Germany, confidence is returning to small and medium-sized companies. With a constant stream of new regulations, high energy costs and excessive bureaucracy, the failed coalition had many things in mind – but not the economic well-being of Germany. A murmur is going through the fragile industrial complexes with the announced new election. We expect a surge of innovative ideas, especially in the areas of energy security and mobility. Check your portfolio!

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

BASF SE NA O.N. | DE000BASF111 , ALTECH ADV.MAT. NA O.N. | DE000A31C3Y4 , NORDEX SE O.N. | DE000A0D6554 , SIEMENS ENERGY AG NA O.N. | DE000ENER6Y0

Table of contents:

"[...] Silumina Anodes® is a ceramic-coated graphite/silicon anode composite material that we plan to produce in Schwarze Pumpe, Saxony. Here, we aim to supply manufacturers of batteries for e-cars with an application-ready drop-in technology that is low-cost, high-performance and safe. [...]" Uwe Ahrens, Direktor, Altech Advanced Materials AG

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

BASF – Results still below expectations

And yet another dividend cut! The market's suspicions were once again confirmed. Slight signs of recovery emerged after BASF presented its figures for the third quarter of 2024. The decline in revenue has now been stopped, with group sales remaining at the previous year's quarterly level of EUR 15.7 billion. EBITDA fell by 6.3% to EUR 1.28 billion due to restructuring, but excluding the numerous special items, there would have been an increase of 5%. That is not too bad for the current environment. Nevertheless, the share price fell by almost 6% to EUR 42.40 after the announcements.

CEO Dr. Markus Kamieth did not change the earnings forecast for the full year. However, the Company in Ludwigshafen now expects to reach only the lower end of the EBITDA corridor of EUR 8 to 8.6 billion. This caveat was not mentioned at the mid-year point. Expectations for the automotive industry proved to be a burden. A decline of up to 2.5% in global vehicle and truck production is now expected. Deutsche Bank analysts promptly cut their EBITDA earnings estimates through 2026 by 5% but raised their estimates for earnings per share by a stronger 15%. BASF is drastically cutting its dividend to EUR 2.25, down from EUR 3.40 last year. Nevertheless, 15 of 32 analysts on the Refinitiv Eikon platform have issued a "Buy" vote with an average 12-month price target of EUR 51.80. This is encouraging, given that the current price is only around 10% above the 5-year low. We do not expect a quick turnaround, nor do we expect the share price to fall below EUR 40.

Altech Advanced Materials – Further expansion of site with fresh capital

Altech Advanced Materials AG reports a successful capital increase of around EUR 809 thousand as of October 31, though the offered shares were not fully subscribed. In a capital market announcement on October 2, 2024, the Company estimated a total equity requirement of around EUR 1.9 million for its upcoming projects in Schwarze Pumpe. This pertains to the two flagship projects, CERENGERY® and Silumina Anodes. At this point, we expect short-term support from the German Balaton Group, which, as a major investor, is likely interested in continuing the funding negotiations. After all, Altech's projects are among the most important battery innovations of recent years, "Made in Germany". If the dilution increases somewhat in this context, it would not be the end of the world either. From today's perspective, we continue to expect the financial closing of the CERENERGY® project by the end of the first quarter of 2025.

Altech has promising and highly competitive solutions that can cause disruptive changes when they enter the market and generate high demand momentum. The Altech management is combative, sticking to its course and tackling milestone after milestone. At a price of around EUR 2.90, the market capitalization is around EUR 24 million. Although it has been significantly higher before, it is now a real bargain for the big players in this industry after the correction. Therefore, watch out for significant increases in sales and insider reports on stock increases, as extraordinary opportunities could arise here.

Siemens Energy and Nordex – Where are the opportunities for transformation?

With the US elections, the focus on global energy supply has once again shifted strongly towards fossil and nuclear energy. In the US, oil and gas production is set to reach new heights in the coming years. Siemens Energy is a specialist in power plant planning, power grids and, above all, gas turbines. In contrast to fossil and renewable energies, the Munich-based company is no longer active in the construction of new nuclear power plants. Instead, it focuses on services and technologies for existing plants. These primarily include control and safety systems offered in partnership with nuclear power plant operators.

Overall, Siemens Energy recorded strong order growth in 2024, mainly due to the expansion of the gas and grid business, while renewable energies at its subsidiary Gamesa are facing structural challenges. Due to its strong market position, Siemens Energy is one of the best-performing stocks in Germany. Over the last 12 months, the share price has increased by over 300%. The figures for the last quarter will be released on November 13. They should be in line with the trend so that the price can remain in the EUR 40 zone.

Nordex reported its figures last week. Revenues fell by 3% to EUR 1.67 billion, down from EUR 1.86 billion, though EBITDA improved to EUR 72 million. This allowed the widely watched margin to increase from 2.8% to 4.3%, though only EUR 4 million remained as net profit. On a positive note, free cash flow rose again to EUR 159 million, which boosted net liquidity to EUR 583 million. Deutsche Bank, Jefferies, and Goldman Sachs issued "Buy" ratings with 12-month price targets between EUR 18 and EUR 21.50. From a technical analysis perspective, the EUR 12 level must hold; otherwise, trouble may loom. Although both Siemens and Nordex currently appear unattractive as investments, they remain key players in Europe's energy transformation under the "Net Zero" strategy.

The election in the US and the upcoming re-election in Germany are bringing other goals into focus. The energy transformation remains a major topic. Investors should take advantage of the high volatility and add innovative companies with prospects to their portfolios. A sensible diversification will stabilize the portfolio return!

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.