November 12th, 2024 | 08:00 CET

Traffic light disaster brings new opportunities for e-mobility: VW, BMW, ARI Motors, BYD and NIO

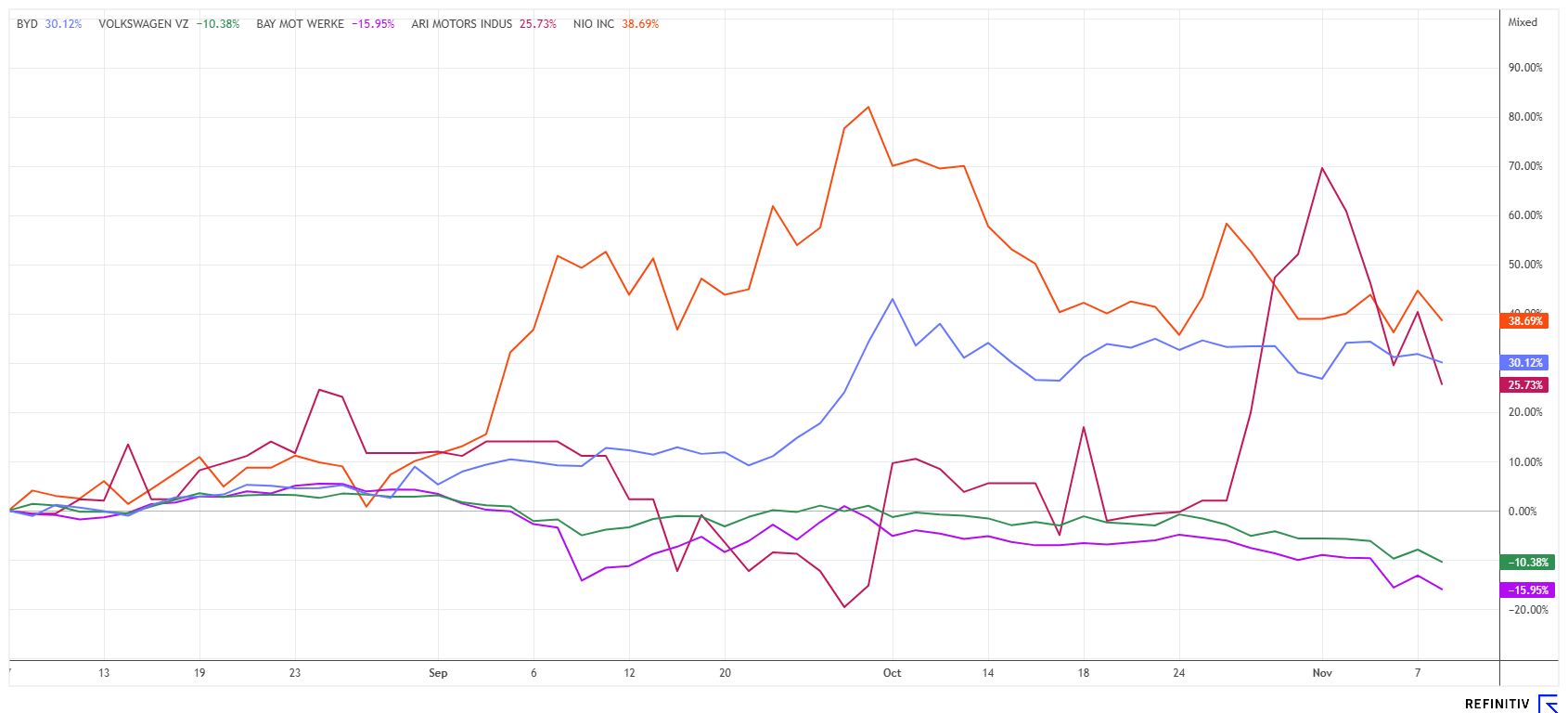

The traffic light coalition has broken down – so right before left applies! In addition to the Berlin disaster, a relentless struggle has long since broken out in the automotive market. Habeck, for example, wants to get the environmental subsidy back in 2025 due to a sharp drop in electric vehicle sales, while important market shares of German industry have long since been lost. Germany is making only hesitant progress in the area of energy transition, while nuclear energy is experiencing a renaissance worldwide. Fortunately, innovative concepts are repeatedly emerging from medium-sized companies, driving Germany forward as a business location. With a new, forward-looking industrial policy, Germany could regain its leading position. For dynamic investors, this is an explosive environment with extraordinary opportunities for high returns.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

VOLKSWAGEN AG VZO O.N. | DE0007664039 , BAY.MOTOREN WERKE AG ST | DE0005190003 , ARI MOTORS INDUSTRIES SE | DE000A3D6Q45 , BYD CO. LTD H YC 1 | CNE100000296 , NIO INC.A S.ADR DL-_00025 | US62914V1061

Table of contents:

"[...] Nickel, therefore, benefits twice: firstly from its growing importance within batteries and secondly from the generally growing demand for such storage. [...]" Terry Lynch, CEO, Power Nickel

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Volkswagen and BYD – E-mobility at the second attempt

The German automotive market is in a state of great uncertainty. While foreign manufacturers are entering the market with a great deal of innovative strength, domestic manufacturers are still clinging to the combustion engine. In the short term, this strategic approach is justified by the sales successes, but it means missing out on future technological advances. Because e-mobility will celebrate its triumph as we approach 2035. It is time to bring development efforts in this segment up to a high level.

In October, 35,491 new passenger vehicles with battery-electric drives were registered. According to the Federal Motor Transport Authority, this is 4.9% fewer than in the same month last year. Volkswagen and BMW are struggling in the face of these figures. For 2024, global deliveries by VW are expected to decline to around 9 million vehicles. Originally, VW had forecast growth of 3%, which has recently been revised sharply. VW shares have fallen by as much as 19% in the last 12 months, while the DAX has reached new highs.

The situation is similar for BMW, whose shares have lost as much as 27% over the same period. A dramatic slump in profits, triggered by difficulties with the braking systems of a supplier and a continued slowdown in business in China, is creating significant challenges. The bottom line is that the Munich-based carmaker earned only EUR 476 million in Q3, a year-on-year decline of 84%. The decline in the profit margin in the automotive business is particularly severe, falling from almost 10% in the previous year to just 2.3%. At EUR 84 and EUR 68, respectively, VW and BMW shares are now cheaper than they have been in three years, but technically, the stocks are more than battered, and there are still no signs of an entry.

BYD and NIO – Passing Tesla to conquer Europe

Asia, once the most important growth market for German premium vehicles, is increasingly causing concern for local carmakers. In particular, sales in China fell by around 30% in Q3, while at the same time, Chinese manufacturers significantly increased their exports to Europe. BYD's European market share in October is now around 8.7% of electric vehicles sold, but high import duties of up to 35.3% are now taking effect, which could slow down the expansion somewhat. To equalize the tariffs, BYD is launching its own production plant in Hungary in 2026.

Even though BYD has already overtaken Tesla in global sales, things are not yet going as well as the Chinese carmaker would like in Germany. That should change in the coming year. With government purchase incentives and subsidies in its pocket, BYD wants to present an EU record year in 2025. The Q3 figures already provided a taste. According to these, BYD increased its revenues by almost a quarter to the equivalent of EUR 26 billion, while profits rose by 18% to EUR 1.5 billion. With Elon Musk at the helm, Tesla only generated revenues of USD 23.3 billion during this period. Nevertheless, due to Trump's election victory, the share price was still able to rise by 25% to a new two-year high of USD 323.

NIO, which is still a relatively small manufacturer, continues to struggle to sell electric vehicles in larger numbers in European markets. However, the start-up could soon tap into a new source of revenue thanks to its battery exchange stations. There are already 56 such power swap stations throughout Europe, where NIO drivers can replace an empty battery with a nearly full one using a rented battery in just a few minutes. NIO also rents its battery capacity to local electricity providers, who stabilize their grid supply through bidirectional charging. During peak times, the batteries could, therefore, display charge levels. What the Chinese are offering here is very innovative.

BYD shares are trading at EUR 33.10, again just below their annual high of EUR 37.85, while NIO has lost a full 36% in the current year. BYD is worth over EUR 100 billion on the stock exchange, while NIO is still worth almost EUR 7 billion, although it is not expected to turn a profit until 2030.

ARI Motors Industries SE – Champion in daily operations

We reported on the small e-mobility provider ARI Motors from Thuringia in recent weeks. The stock has been attracting attention since the end of October. Following strong quarterly figures, the small title jumped by over 50% in the short term. ARI reported strong revenue growth for the first half of the year and announced that it had signed several promising framework agreements. SMC analyst Adam Jakubowski sees this as confirmation of his positive "Speculative Buy" rating and expects continued steep growth.

In figures, ARI increased its revenues by 60% to EUR 3.1 million in the first half of the year. Unfortunately, this has not yet led to a corresponding growth in earnings, as the cost of materials has increased almost twice as much. However, three promising deals are not yet included in the figures ARI reported at the end of September. These include a framework agreement with the internationally active building services provider Apleona and the acquisition of a procurement service provider for the medical and care sector. Overall, the new business has led to an order backlog of around EUR 4.3 million as of the end of September, which could push revenues into double digits over the course of the year.

The analysts at SMC Research, therefore, see their estimates confirmed with revenues of EUR 8.4 million and an EBIT of EUR 0.8 million. They have also left the growth assumptions for the next few years unchanged, although the recently reported framework agreements also suggest significantly stronger growth than the projected 50% for 2025. The 1710 model could prove to be a game-changer, as ARI is competing in the "Sprinter" segment. The highlight: the e-delivery van is 10% cheaper than its diesel-powered competitors. This positions ARI to enter the ESG-relevant league of transport service providers. With a current price of EUR 0.45 and an SMC price target of EUR 1.80, the outlook could see the stock surpass the EUR 3 mark within 12 months, as the relative undervaluation becomes fully apparent with the annual figures. It will be interesting to see what the management has to report at the Annual General Meeting on December 12. Collect!

Electromobility is showing a slight dip in 2024. Overall, the combustion engine-dominated automotive industry in Germany is finding it difficult to meet the challenges of the climate transition. China is pushing into the EU with technologically superior products, and cut-throat competition is in full swing. The comparatively small specialist provider ARI Motors from Thuringia is performing well. Diversification across several pillars makes sense and reduces portfolio risk.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.