December 18th, 2025 | 07:00 CET

Dividend comeback: Why Mercedes-Benz and VW look outdated compared to RE Royalties' model

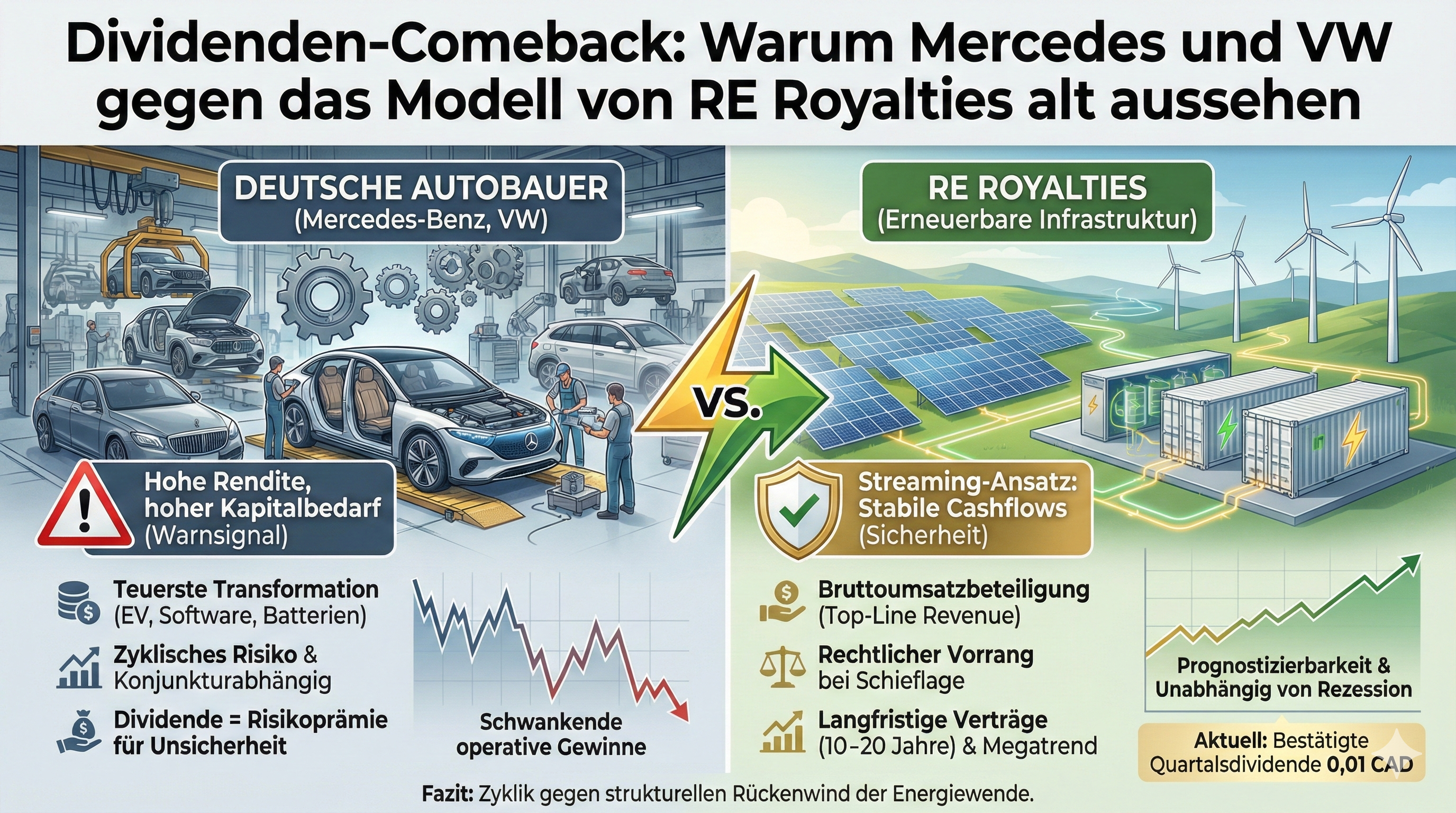

In a market phase in which interest rates have peaked, and tech stocks are ambitiously valued, investors are once again turning their attention to the oldest source of income in stock market history: dividends. But the hunt for the highest returns often turns out to be a dangerous undertaking, because a high percentage payout is usually not a sign of strength, but a warning signal for falling prices or structural problems. While German automotive giants Mercedes-Benz and Volkswagen attract investors with seemingly favorable valuations and generous returns, their business model is facing the most expensive transformation in history. In this environment, RE Royalties, a Canadian niche stock, is coming into focus. Its business model is specifically designed to generate stable cash flows from the megatrend of the energy transition without bearing the operational risks of an industrial group.

time to read: 3 minutes

|

Author:

Nico Popp

ISIN:

MERCEDES-BENZ GROUP AG | DE0007100000 , VOLKSWAGEN AG VZO O.N. | DE0007664039 , RE ROYALTIES LTD | CA75527Q1081

Table of contents:

"[...] Nickel, therefore, benefits twice: firstly from its growing importance within batteries and secondly from the generally growing demand for such storage. [...]" Terry Lynch, CEO, Power Nickel

Author

Nico Popp

At home in Southern Germany, the passionate stock exchange expert has been accompanying the capital markets for about twenty years. With a soft spot for smaller companies, he is constantly on the lookout for exciting investment stories.

Tag cloud

Shares cloud

The automakers' dilemma: High returns, high capital requirements

At first glance, German premium manufacturers seem tailor-made for dividend investors. Under the leadership of Ola Källenius, Mercedes-Benz has consistently focused on the luxury segment and has recently been able to present operating margins that have enabled dividend yields of over 7% in some cases. The Company distributes billions in profits, which still come primarily from the sale of highly profitable combustion engine models. The situation is similar at Volkswagen. The Wolfsburg-based company's preferred shares are trading on the stock exchange at a price-to-earnings ratio of less than 4 in some cases, which can lead to double-digit dividend yields in mathematical terms. But these figures are deceptive, as they reflect the skepticism of the market.

Both companies are facing a huge financial balancing act. On the one hand, they have to keep shareholders happy with high dividends, but on the other hand, they need every available euro to finance the gigantic investments in electric mobility, software, and battery factories. Every euro that goes to shareholders as dividends is one less euro available for developing the next generation of vehicles. If the global economy slows down or sales in China continue to weaken, dividend cuts at cyclical stocks such as Mercedes or VW are not unlikely. Here, the dividend is a kind of premium for the entrepreneurial risk that investors bear in a volatile phase of transformation.

RE Royalties: The streaming approach to green energy

The Canadian company RE Royalties works in a completely different way. Its business model is not based on selling products to consumers, but on financing infrastructure. RE Royalties provides capital to project developers in the renewable energy sector – from solar parks and wind turbines to battery storage facilities. In return, the Company does not receive a share of the often fluctuating operating profits, but a gross revenue share (royalty) or fixed-interest loans. This approach largely decouples revenues from classic business risks such as rising personnel costs or inflation, as revenues are often directly linked to electricity production and government-guaranteed feed-in tariffs.

This model is attractive to dividend hunters for one key reason: security through legal priority. RE Royalties typically structures its financing in such a way that it is given priority in the event of financial difficulties on the part of the project operator. While a common shareholder is only paid once all costs, interest, and taxes have been paid, RE Royalties often captures cash flows on the revenue side. This is called "top-line revenue." The Company has thus carved out a niche that banks often find too complex and private equity funds too fragmented. This gap enables RE Royalties to achieve returns that are well above the market average and to pass these on to shareholders in the form of stable distributions. The portfolio is broadly diversified across various technologies and jurisdictions in North America and Europe, which minimizes cluster risk.

Robustness in comparison: Cyclical versus megatrend

The key difference between the business models lies in their predictability. Volkswagen and Mercedes-Benz's profits are heavily dependent on consumer sentiment, interest rates on car loans, and geopolitical tensions. A single weak quarter in China can ruin the calculations for the entire year. At RE Royalties, on the other hand, cash flow is based on long-term power purchase agreements that often run for 10 or 20 years. The sun shines, and the wind blows regardless of whether the economy slips into recession or not.

Investors are therefore faced with a fundamental decision. Those who bet on Mercedes-Benz or Volkswagen are betting that the transformation of the automotive industry will succeed and that profits from the combustion engine era will continue to flow long enough to finance the change. This is a high-stakes bet with a high degree of volatility. Those who choose RE Royalties are investing in the infrastructure of the future via a financing model that was originally perfected in the gold and oil sector to spare investors precisely this volatility. Since the global hunger for renewable energy is politically desirable and irreversible, RE Royalties offers a structural tailwind that the cyclical automotive industry is currently sorely lacking. For portfolios that depend on predictable income, the Canadian company's licensing model thus appears to be the significantly more robust alternative for the coming years. RE Royalties recently confirmed its quarterly dividend of CAD 0.01, which has revitalized the stock and offers investors solid key figures.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.