April 22nd, 2025 | 07:20 CEST

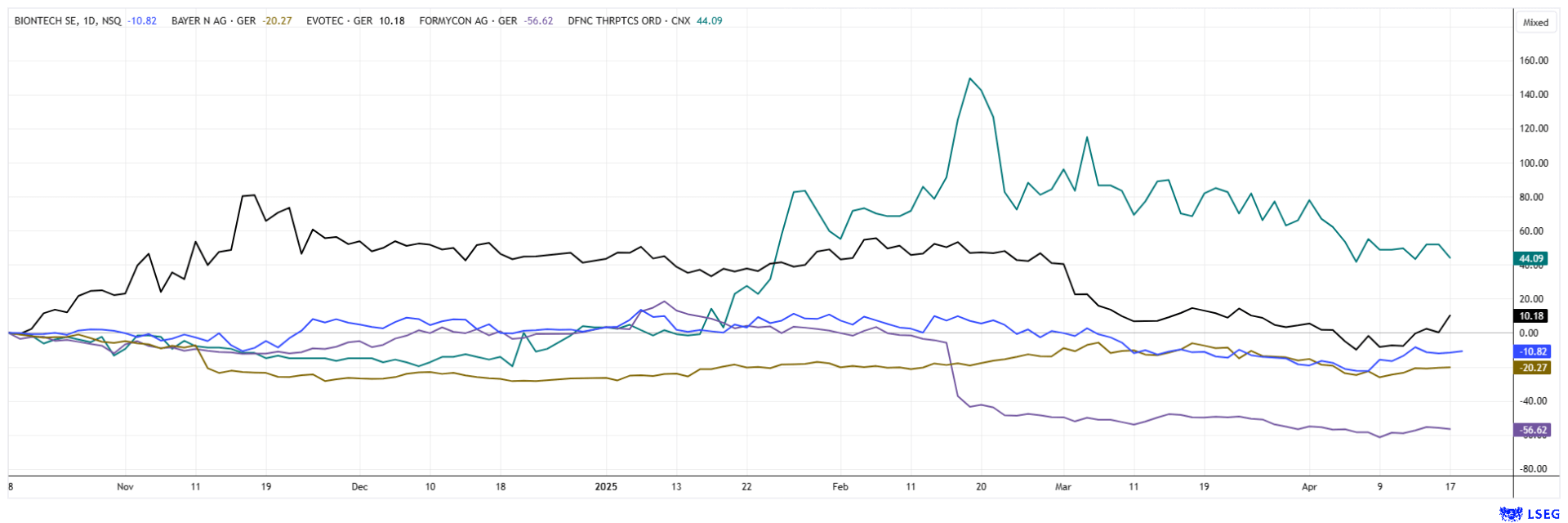

This is the post-Easter opportunity! Evotec, Bayer, BioNTech, and Defence Therapeutics in focus

Donald Trump snubs his international partners, insults prominent Americans, and withdraws long-standing funding commitments to Harvard. Who would have thought? The new US administration is turning out to be an unpredictable fragmentation bomb that could hit anyone. Economic policy resembles a game of hot and cold when stability is needed. On the stock market, investors are trying to price in old tariffs, no tariffs, and new tariffs - every day brings a fresh bouquet of announced measures. There has hardly been a similarly volatile period in recent years, but Donald Trump is not interested in stock market prices. For the overvalued high-tech sector, this is a welcome opportunity to take profits. The biotech sector could finally take off were it not for the sharp rise in interest rates. The only thing that can help now is a case-by-case assessment of investment opportunities.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

EVOTEC SE INH O.N. | DE0005664809 , BAYER AG NA O.N. | DE000BAY0017 , DEFENCE THERAPEUTICS INC | CA24463V1013

Table of contents:

"[...] Defence will continue to develop its Antibody Drug Conjugates "ADC" and its radiopharmaceuticals programs, which are currently two of the hottest products in demand in the pharma industries where significant consolidations and take-overs occurred. [...]" Sébastien Plouffe, CEO, Founder and Director, Defence Therapeutics Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Bayer and BioNTech – There is more to come

Investors in Bayer shares are now looking back on a 10-year losing streak. At the end of 2014, the Leverkusen-based company's shares were trading at just under EUR 140. At that time, the Company was the heavyweight in the DAX 30 index with a value of EUR 135 billion. Today, the German life sciences and agrochemicals company is worth only EUR 20 billion and ranks 27th in the DAX 40 index. Following the Monsanto takeover, investors are watching as billions of euros are being poured into court cases and settlements while margins in the pharmaceuticals business are also crumbling. However, after cutting more than 3,000 middle management jobs, the cost situation is improving, and earnings per share are rising again by around 5–7% per year, according to analysts on the LSEG platform. A 2025 P/E ratio of 4.5 is no longer too expensive, and the dividend is expected to reach just under 4% again from 2026. Optimists should take advantage of the current volatility and add to their holdings in the EUR 19 to 21 range. We believe a 50% return by the end of 2027 is possible once the wave of lawsuits has subsided.

Investors are betting on new mRNA achievements at BioNTech. With over EUR 15 billion in the bank, the Mainz-based company can continue its research for several years before it runs out of steam. Cancer research is also focusing on dangerous pancreatic cancer. This type of cancer is one of the deadliest forms of the disease, as the tumor is usually detected late and existing drugs have only limited effectiveness. "In medicine, we will see significant advances in the treatment of pancreatic cancer in the next five to ten years," Ugur Sahin, co-founder and CEO of Mainz-based pharmaceutical company BioNTech, said in an interview with the Handelsblatt newspaper. The Mainz-based company is already in Phase 2 clinical trials with its drug "Autogene cevumeran" in collaboration with Roche subsidiary Genentech. Although there is still a long way to go before market approval, the outlook is promising. Meanwhile, partner DualityBio has gone public in Hong Kong, with a market capitalization currently standing at a high HKD 17 billion. Risk-aware investors are taking advantage of the Mainz-based company's renewed weakness below USD 100, as experts on the LSEG platform expect average prices of around USD 138 in 12 months. Promising!

Defence Therapeutics – 50% gain since the start of the year

Cancer remains the focus for many emerging biotech companies. Canadian company Defence Therapeutics has been developing new cancer vaccines for several years. The first trials have already delivered astonishing results. At the heart of the Company's proprietary platform is its Accum® technology, which enables the precise delivery of vaccine antigens or ADCs in their intact form to target cells. The approval of AccuTOX® in 2024 as one of the Company's initial first-in-class therapies is a huge step forward for Defence in the field of immuno-oncology. After successful initial trials in mice, Defence is testing the ARM-002 vaccine in difficult-to-treat pancreatic, colorectal, and ovarian cancers. These results will determine the target indication for Phase I trials and demonstrate the cancer vaccine's versatility and adaptability.

Defence Therapeutics Inc. has entered into a collaboration agreement with Canadian Nuclear Laboratories (CNL). CNL, Canada's leading nuclear science facility, will conduct preclinical studies combining alpha particle radiation therapy with actinium-225 (Ac-225) and Defence's Accum transport technology. Targeted radiation therapies with Ac-225 have proven very promising in cancer treatment. Ac-225 emits powerful alpha particles that irreparably damage the DNA of cancer cells, leading to cell death. Ac-225 is usually bound to antibodies that target cancer. However, many of these Ac-225 antibody complexes remain trapped in cellular compartments called endosomes, preventing them from reaching the cell nucleus where they can be most effective. Defence's Accum technology aims to improve the escape of these complexes from the endosomes and increase their accumulation in the cell nucleus. This approach could reduce the required dosage of Ac-225, which could minimize side effects and maintain therapeutic efficacy.

The research aims to determine how effectively the Accum-modified antibodies deliver Ac-225 to cancer cells and how they affect tumor growth. This collaboration is an important step in Defence's mission to revolutionize cancer treatment through improved targeted therapies. CEO and founder Sebastien Plouffe comments: "The synergy between Accum's expertise and CNL's will advance precision oncology and lead to more effective and safer treatments." With the global radiopharmaceutical market expected to reach USD 16.9 billion by 2033, Defence is well positioned to contribute to this rapidly growing field of precision oncology. The stock is currently trading at between CAD 0.87 and CAD 0.95 on high volumes. Highly exciting.

Evotec and Formycon – Not far from the bottom

It is also worth taking a quick look at the shares of Evotec and Formycon. Both stocks have lost over 50% of their value over the past 12 months. While Evotec is still working on its operational turnaround following the departure of CEO Lanthaler, Formycon suffered bitter disappointments with its first drug, FYB201, the Company's Lucentis biosimilar. It is expected to be temporarily withdrawn from the US market. According to reports, Formycon wants to protect the value of the biosimilar, as it has recently been selling rather sluggishly and only with high discounts. The Munich-based company must also scale back its ambitions for the Stelara biosimilar. CEO Stefan Glombitza speaks of value adjustments in the low three-digit million range. Analysts have lowered their price targets but remain steadfast in their "Buy" recommendations. Berenberg expects EUR 32, Warburg still sees EUR 40 as possible after revenue adjustments in 2026 and 2027, and Hauck Aufhäuser even sees potential for a doubling to EUR 46 within the next 12 months with purchase prices in the current range of EUR 21 to 23. Things will get very interesting after a double bottom around EUR 5.20 for Evotec, as the Q1 figures are due May 6. The share price already gained almost 25% in the week before Easter. Both stocks are currently attractively priced!

The stock market is on a rollercoaster ride again. This means opportunities to invest in the highly volatile biotech sector are constantly emerging. Bayer and BioNTech are performing fairly steadily, while Evotec and Formycon are already showing signs of a bottoming out. Defence Therapeutics could take off in the future with its radiation therapy products. DTC shares are currently attractively priced.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.