August 1st, 2025 | 07:00 CEST

This could be explosive for e-mobility! Watch out for BYD, Pasinex Resources, VW, and Mercedes

The latest quarterly results from the automotive sector have led to further disillusionment. High costs, ever-changing technological requirements, and stricter regulations are leading to declining margins. For two years now, Chinese manufacturers like BYD have been making weekly deliveries by ship to the affluent EU market. Initially highly praised and selling several thousand units quickly, everything now appears to be stalling, as huge stockpiles are suddenly piling up. Investors should keep a close eye on developments. Anyone thinking about modern batteries, for example, cannot ignore the critical metal zinc. Here are a few ideas for your portfolio.

time to read: 6 minutes

|

Author:

André Will-Laudien

ISIN:

BYD CO. LTD H YC 1 | CNE100000296 , PASINEX RESOURCES LTD. | CA70260R1082 , VOLKSWAGEN AG VZO O.N. | DE0007664039 , MERCEDES-BENZ GROUP AG | DE0007100000

Table of contents:

"[...] Nickel, therefore, benefits twice: firstly from its growing importance within batteries and secondly from the generally growing demand for such storage. [...]" Terry Lynch, CEO, Power Nickel

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Pasinex Resources – Zinc in the focus of future technologies

E-mobility requires in-depth knowledge of battery technology. Auto giants are investing billions to be at the forefront. While many investors are looking at lithium and copper, an often underestimated raw material is increasingly becoming the focus of the energy transition: zinc. This base metal is not only crucial for corrosion protection in the construction and steel industries, but it also plays a key role in electromobility. In modern battery technologies, including zinc-air and zinc-ion batteries, the metal is being researched as a safe, cost-efficient, and sustainable alternative to lithium. In addition, the increased use of galvanized steel in lightweight car bodies for future-proof vehicles requires large quantities of zinc. This aspect is being taken into account increasingly in the automotive industry.

The International Energy Agency (IEA), therefore, now considers zinc to be one of the critical raw materials for a climate-friendly economy. At the same time, supply is becoming scarcer as many large zinc mines are depleted, and new high-grade deposits are rare. This is precisely where Canadian explorer Pasinex Resources comes in. The Company is developing extremely high-grade zinc deposits in Turkey. While the global average zinc content is around 10%, Pasinex's ore reaches peak values of between 25% and 50%. This results in a raw material value of over USD 1,000 per tonne, comparable to some gold projects. Thanks to near-surface deposits and favorable infrastructure, production costs are less than USD 300 per tonne in some cases, with a potential operating margin of 50%.

Pasinex is currently pushing ahead with two projects. At the Pinargozu mine, access to new mining areas is being prepared, while the nearby Serakaya project is expected to go into production in the near future. Further projects are located in Turkey and Nevada. The first revenues could flow soon. With high-grade resources, low capital requirements, and strong leverage to the zinc price, Pasinex is positioning itself as an exciting niche player in the commodities market of the future. In July, Pasinex announced a CAD 2 million capital increase. The stock is currently still trading in the cents range, but with cash flows starting and zinc demand growing, that is unlikely to remain the case for long. Collect!

Pasinex Chairman Dr. Larry Seeley presented at the 15th IIF Investor Conference. He spoke about high-grade deposits and significant margins in zinc mining. View here!

VW and Mercedes – Another loss-making quarter

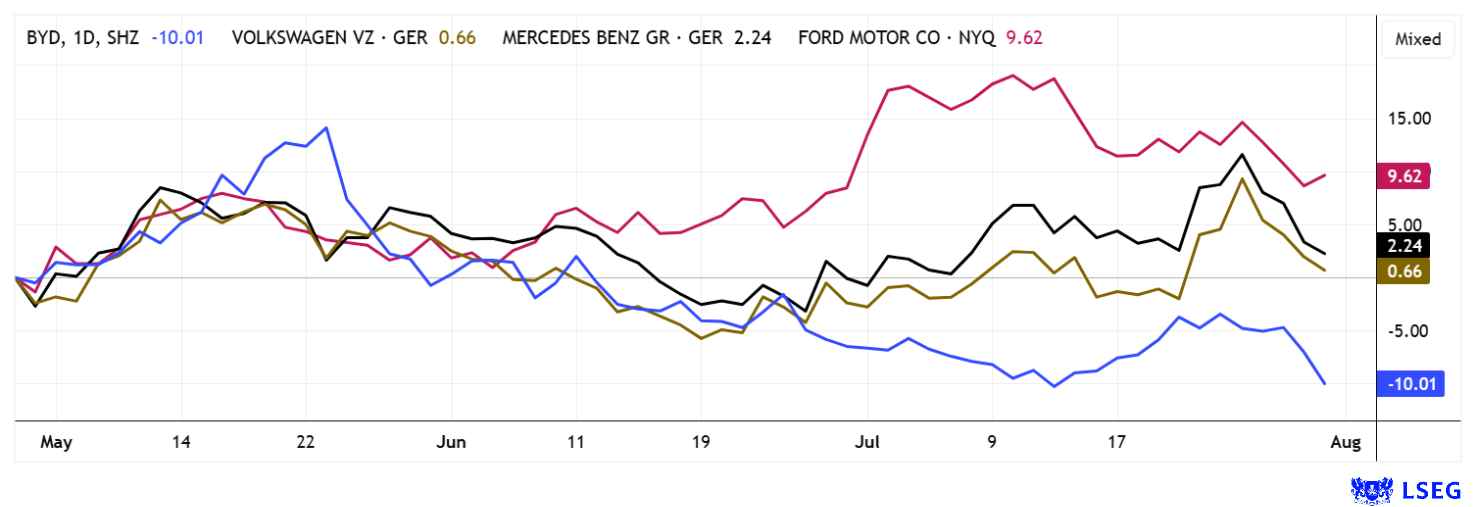

The most recent quarters for VW and the Mercedes-Benz Group were noticeably impacted by volatile sales markets, geopolitical tensions, and the multi-billion-dollar transformation to electric mobility. Volkswagen slightly increased its vehicle deliveries to around 4.36 million units in the first half of 2025, kept revenue stable at EUR 158.4 billion, but suffered a significant decline in operating profit of 33% to EUR 6.7 billion. High US import tariffs totaling EUR 1.3 billion and provisions weighed heavily on earnings. At just under 7%, the margin remained stable in Q2 only due to special effects, but VW lowered its target range for the full year to 4-5% and now expects revenue to be in line with the previous year. The Board of Management emphasizes the progress made in design, technology, and software, but cost discipline and securing cash flow remain at the top of the agenda. Mercedes-Benz had to digest significantly sharper declines in the same period. In Q2, EBIT and net profit plummeted by 68% and around 10% respectively due to weak sales in China, increased tariffs and price pressure, while revenue fell to EUR 33.2 billion. Margins in the core businesses were squeezed massively.

Strategically, both manufacturers are focusing on e-mobility, but the differences are striking: VW holds the market leadership in Europe with an electric share of around 28% and is aiming for 2 to 3 million BEV sales and 30 new electric models worldwide by 2025. Despite a growing electric portfolio, margins are suffering from the switch to electric vehicles, as higher production costs and weaker mix effects are weighing on operating earnings. However, VW points to "well-filled order books" and its strong position in Europe, yet its share price fell to just under EUR 92 yesterday. Mercedes-Benz is pursuing an even more ambitious course: the Company aims to become completely electric by 2030 and is investing around EUR 40 billion in new battery technologies to achieve this. Three pure electric architectures have been announced, and from 2025, the Company wants to offer a fully electric alternative for every model. According to this scenario, the medium-term margin targets are between 8 and 14%, but in reality, they are currently well below that. Mercedes is increasingly focusing on high-margin luxury and top-end models to stabilize profitability and cash flow, but with weak e-sales, this is no longer a sure-fire strategy. Mercedes is struggling massively with margin pressure in key markets, and the coming quarters are likely to decide who will better master the balancing act between sustainable returns and an electrified future. Mercedes shares have also been a loser in the last 12 months, falling 17%. Both stocks should be on the watch list for a possible turnaround.

BYD – 340,000 vehicles waiting for a buyer

Despite a strong market entry in Europe, Chinese electric vehicle manufacturer BYD is now struggling with considerable sales difficulties. Around 340,000 vehicles are unsold and in stock, mainly in Europe. Ambitious expansion and aggressive production have led to massive overcapacity, resulting in drastic price cuts and ruinous cut-throat competition. Dealers are attracting customers with record discounts on "zero-kilometer" vehicles, some new branches are being closed, and production is being scaled back. The latest sales figures confirm the problem: BYD's exports to Europe fell in the last quarter for the first time since the introduction of the new models. Analysts also report that orders in important markets such as Australia and South America are significantly lower than expected, as the price offensive by Chinese brands is already meeting resistance in many countries.

Experts are now warning that the situation could come to a head and that parallels with the Evergrande real estate crisis are becoming apparent. While BYD is not officially reporting any losses, hidden liabilities to suppliers are weighing on its balance sheet. Capacity utilization at many plants in China is now below 50%, which could contribute to a market collapse in the electric vehicle sector in the coming months. BYD shares have already lost 28% since their 2025 high, and market capitalization has slipped well below EUR 100 billion. Although the valuation level would be attractive if the turnaround is successful, the risks remain high. The coming quarters will decide whether BYD makes a comeback or becomes the next big example of a failed expansion in China. Yesterday, the stock fell below EUR 13, but a split is still pending.

The outlook for the automotive industry is clouded. The new tariff regime is creating entirely new margin ratios and calculations for the future. It is difficult for investors to make money here, with even the long-favored BYD trending south. Zinc explorer Pasinex Resources could see an upturn, as strategic metals are in constant demand.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.