August 20th, 2024 | 07:15 CEST

The world keeps turning! Caution with VW, Mercedes, Altech Advanced Materials, Plug Power, and Nel ASA!

E-mobility and the upstream battery market are making headlines. Following the abolition of tax incentives, the topic of "electric mobility" has to face up to the harsh market conditions. Hydrogen is also competing, but it is currently still far too expensive to be economically successful. This leaves us with battery technologies, which are used both in energy storage systems and in vehicles. The near bankruptcy of Varta shows how tough the market has become here. There is plenty of room for innovative ideas! Altech Advanced Materials is making waves in German engineering with solid concepts. The market eagerly awaits the first mid-sized products, while many other market players must first justify their billion-dollar valuations. We take a closer look.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

VOLKSWAGEN AG VZO O.N. | DE0007664039 , MERCEDES-BENZ GROUP AG | DE0007100000 , ALTECH ADV.MAT. NA O.N. | DE000A31C3Y4 , PLUG POWER INC. DL-_01 | US72919P2020 , NEL ASA NK-_20 | NO0010081235

Table of contents:

"[...] The collaboration with CVMR offers two primary advantages for Power Nickel: We can cover a larger portion of the value chain in the future, and despite the extensive cooperation with all its positive outcomes, we have remained significantly independent. [...]" Terry Lynch, CEO, Power Nickel

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Volkswagen and Mercedes - Struggles in China

The uncertainty in the German automotive market is self-inflicted. For months, there have been ongoing discussions about bans and the removal of subsidies instead of allowing the market to decide from the outset and propagating technological openness. Unfortunately, it is difficult for Berlin to accept that the economy does not operate according to politics but that politics must submit to the laws of economics. The European consumer is not susceptible to ideologically driven controls, which primarily distinguishes us from regimes such as China. Nevertheless, China's business practices show remarkable resilience in a fragmented market. In the land of the rising sun, the course has clearly been set, and the economy and the consumer are expected to adapt accordingly.

This pace is causing considerable problems for our premium manufacturers. Consequently, the profits of major German vehicle brands such as VW and Mercedes-Benz have plummeted in China - the reason is the dramatic decline in sales of combustion vehicles. While 94% of all new vehicles in China were still powered by petrol or diesel in 2020, this proportion shrank to just 59% in the first half of 2024. At the same time, sales of electric and hybrid vehicles increased by 38% compared to 2020. For Western car manufacturers, this development is a considerable burden on their core business. VW, in particular, the former market leader in Asia, has lost a lot of ground in recent years. Since 2020, the sales volume of the core VW brand has fallen by almost 450,000 units, and its market share in China has dropped from 19% to 14%. Operating profit, including all local joint ventures, collapsed by 79% to just EUR 1 billion in the first half of the year. The Stuttgart-based car manufacturer Mercedes was similarly affected, with around 350,000 new registrations in the first half of the year, which is 15% down on 2023.

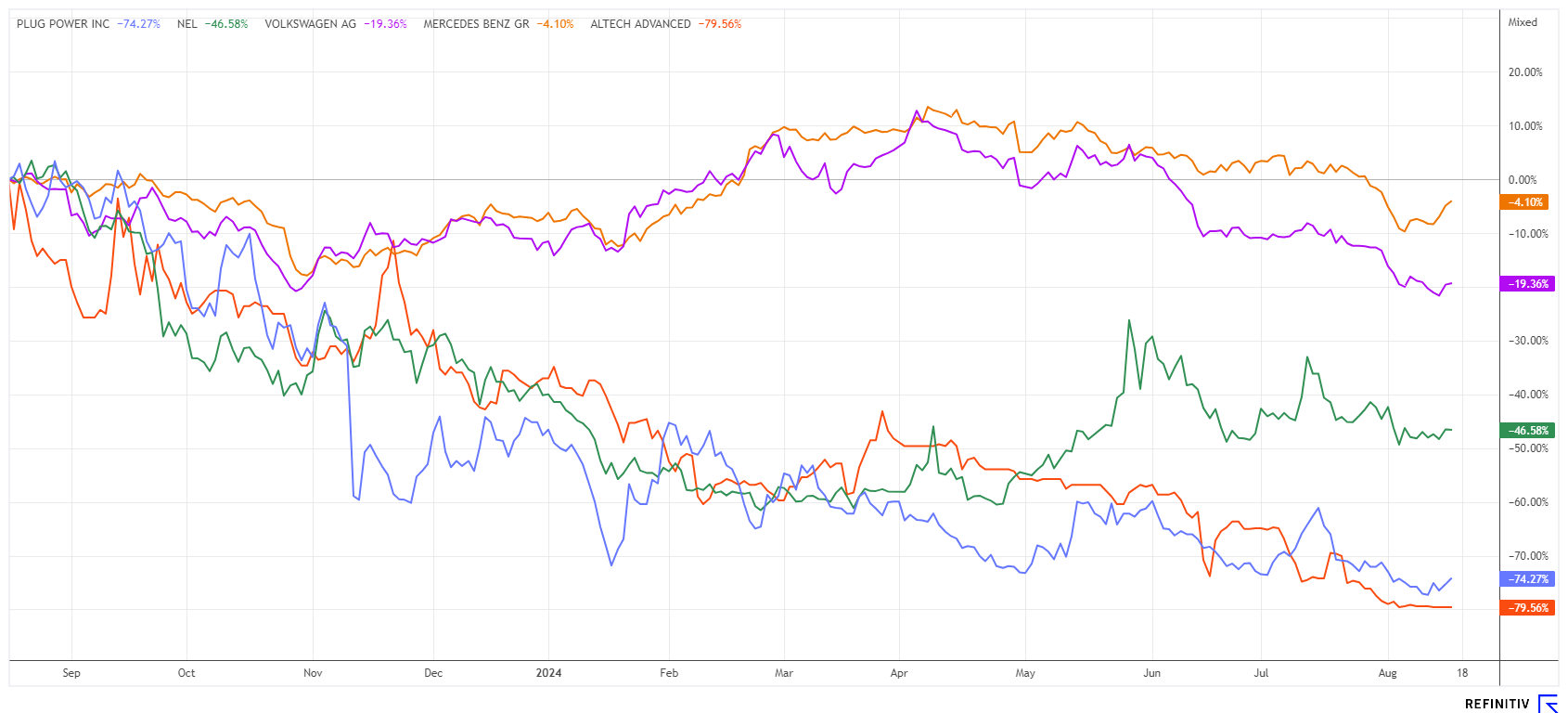

The main problem is the technological lead in the digitalization of vehicle technology, battery control, and futuristic interiors. The market share of Chinese manufacturers has been on the rise since 2020, rising from 33% to 52%, with the Chinese state providing substantial subsidies. Due to price advantages of over 30%, import duties are squeezing margins, but the cheeky Chinese cars are still being bought. Those who want to score in the electric vehicle market do so with a touch of foreign flair. Tough times for VW and Mercedes shareholders. The charts speak for themselves.

Altech Advanced Materials - Consistently moving forward

Altech Advanced Materials AG from Frankfurt recently presented figures that were in line with expectations. The balance sheet is characterized by a strong investment cycle; only when production starts, according to the feasibility study, should the first sales be booked. Until then, personnel costs will remain high as the Company wants to retain its technical expertise. Now, it is a matter of obtaining permits and funding from Germany and the EU. After all, some investment still needs to be made before the first units leave the conveyor belt at the Schwarze Pumpe site.

In the financial report, CEO Uwe Ahrens remains cautiously optimistic: "We assumed a loss of around EUR 1.6 million to EUR 2.1 million in the forecast report of the last annual financial statements for 2024. We are sticking to this forecast. Accordingly, the development of the first half of the 2024 financial year is in line with expectations as far as can be planned, as no revenue has yet been generated from the CERENERGY® and Silumina Anodes™ projects to date. This will only happen when the corresponding planned plants start production."

Altech has promising and highly competitive solutions that can bring about disruptive changes when they enter the market and generate high-demand dynamics. It is very positive to highlight that Altech is staying on course and tackling milestone after milestone. Even if the shares are currently suffering somewhat from a lack of new information, levels have now been reached that could offer high returns if the investment progresses positively. And at EUR 2.85, a large market player could acquire everything for just around EUR 20 million. A small amount in an industry worth billions.

Plug Power and Nel ASA - A tragedy of the first order

In the hydrogen sector, the clocks are being set back to zero. Poor operating figures, declining order intake, and still billion-dollar valuations? Seasoned investors have recently realized that political announcements cannot create markets if they are not supported by substantial public investment. Therefore, the charts of the protagonists Plug Power and Nel ASA are moving from low to low, constantly searching for technical support.

While the US market leader is struggling with the USD 2 mark and is valued at a low USD 1.75 billion, Nel ASA is struggling at the NOK 5 mark and still weighs in at EUR 800 million. When using the price/sales ratio as a benchmark, Nel is three times more expensive than Plug Power, which suggests that investing in the American company might be more attractive. However, CEO Andy Marsh seems to have been dreaming too often instead of delivering. Despite two capital increases, the Company is stumbling and is publicly hoping for a Democratic victory in the upcoming US elections. However, Donald Trump is no friend of hydrogen, so a lot could still go wrong here.

The major Nasdaq correction put renewed pressure on the hydrogen sector. German premium car manufacturers are facing headwinds from China and will likely need to develop new sales strategies. Altech has already presented a great deal conceptually; now, it is time for the implementation phase. Sensible diversification stabilizes the portfolio return.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.