November 17th, 2025 | 06:55 CET

The new cold war over strategic metals! The buying frenzy continues at Almonty, Rheinmetall, TKMS, and RENK

Investors today need a long-term perspective if they want to step outside the trading herd. For the past five years, machines have largely been calling the shots. They detect patterns across investor behavior and can anticipate mass movements even while you are still busy entering your order. This is because data aggregation takes place in nanoseconds. If, for example, a few more sell orders than usual enter the market, the machine immediately sends the Xetra price down, and vice versa. Those who invest over months and years do not need to worry about these practices, but anyone focused on short-term movements requires solid technical equipment and nerves of steel. Our peer group stocks Almonty Industries, Rheinmetall, TKMS, and RENK are currently seeing plenty of action. We provide a few extras so you can make the right move!

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

ALMONTY INDUSTRIES INC. | CA0203987072 , RHEINMETALL AG | DE0007030009 , TKMS AG & CO KGAA | DE000TKMS001 , RENK AG O.N. | DE000RENK730

Table of contents:

"[...] China's dominance is one of the reasons why we are so heavily involved in the tungsten market. Here, around 85% of production is in Chinese hands. [...]" Dr. Thomas Gutschlag, CEO, Deutsche Rohstoff AG

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Almonty Industries – All eyes are on 2026

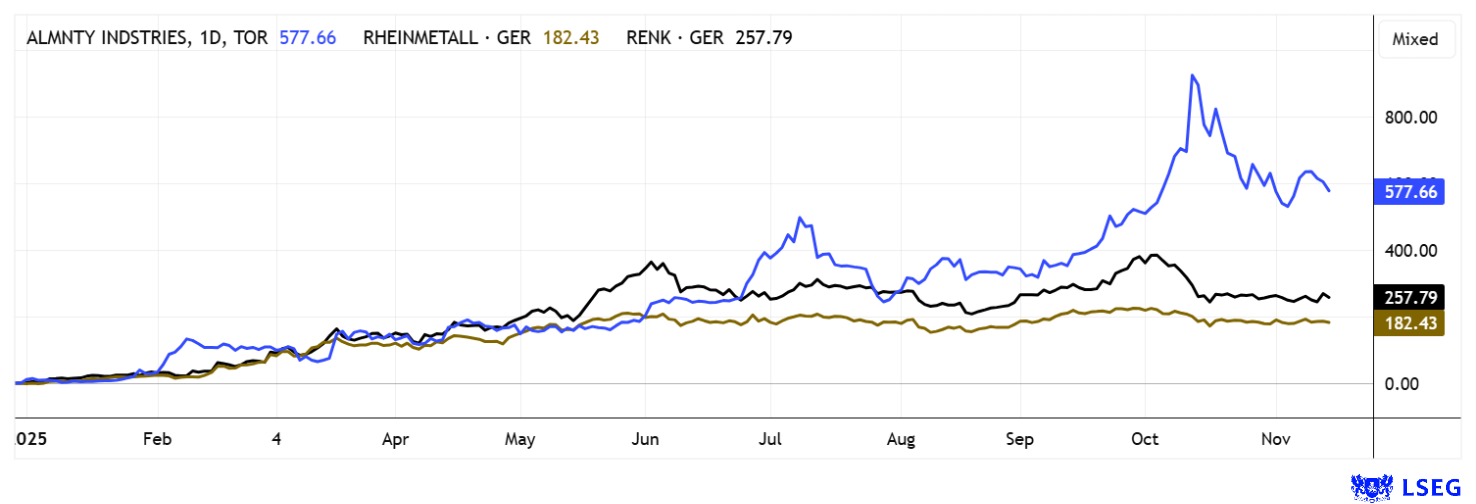

The stock market is not a one-way street! This is also reflected in the price of Almonty Industries. Although there are several reasons for further appreciation, the stock markets are tending toward a slight correction in the current autumn phase, following the recent strong rally in favor of rare or strategic metals. Almonty is in good company in this correction, as the shares of Critical Metals, Energy Fuels, and MP Materials have also trended sharply downward. Long-term investors should not worry after such adjustments, because in purely statistical terms, the following is now happening: Early entrants who are sitting on high profits are realizing their gains in a setback. Buyers are now more likely to be cautious investors with a long-term view. As professionals say, ownership is shifting from weak to strong hands. Investors should therefore view the current correction of around 30% from the top as a shift from short-term to medium-term, with a significant improvement in the average price.

Those who have not already been buying steadily in the uptrend should therefore take courage and increase their holdings now.

Brokerage firms such as Oppenheimer and D.A. Davidson feel quite comfortable with a 12-month target of CAD 12. And from today's perspective, there is still plenty of room for growth of 33%. As a reminder, the South Korean Sangdong mine will begin production by 2026, and drilling continues in Portugal to increase production capacity. The recently acquired US project in Beaverhead County is also likely to boost the production curve significantly from 2030 onwards. For the US and international producers, this is a strong statement in favor of Western raw material independence. CEO Lewis Black said of the Montana acquisition: "The Gentung Browns Lake project is one of the few advanced tungsten projects in the US that can move quickly into production. This acquisition allows us to import Almonty's proprietary tungsten processing and mining technologies and expand our global presence and resource base into the US market!" Long-term investors are not wasting any time and are betting on the 5-year outlook, which continues to point to a multiplication of the share price.

The new cold war over resources is also the subject of Lyndsay Malchuk's interview with Christopher Ecclestone. Click here for the video.

Rheinmetall versus TKMS – Those who charge high prices must also be able to deliver

One buyer of tungsten products is Rheinmetall; as a result, the needs of the defense industry are directly linked to the delivery capabilities of producers such as Almonty Industries. In addition to supply chain relationships, the Düsseldorf-based defense technology manufacturer also attaches great importance to its own ability to handle orders with a high degree of sensitivity and to process them on time and in a professional manner. A recent example of a frigate order from Berlin shows that this is not always a smooth process. Last week, a stock trader considered a report in the "Bild" newspaper to be damaging for Rheinmetall, according to which Defense Minister Boris Pistorius is said to have questioned a billion-euro deal because there are reportedly significant problems with the order for six new frigates. According to the report, the project, with current costs of nearly EUR 10 billion, is significantly over budget and also behind schedule.

According to the newspaper, the federal government is now reportedly considering measures. A more precise recalculation of costs is expected, as ships produced by TKMS, priced at just under EUR 1 billion each, offer potential savings. TKMS has been restructured and, as a committed industry player, naturally has a strong interest in securing orders. Competition stimulates business, and this pressure contributed to a 5% drop in Rheinmetall's share price on Friday. TKMS, which was spun off from thyssenkrupp, managed to recover slightly, climbing from EUR 69.20 to EUR 70.80. For investors, the key factor remains where Berlin invests; for taxpayers, more consistency in the awarding of contracts would be desirable. Analysts on the LSEG platform expect 12-month targets of EUR 2,163 for Rheinmetall, though the stock has traded between EUR 1,520 and EUR 2,005 over the past six months – the big rally appears to be over!

RENK – Good figures, but little euphoria

It is not uncommon to see price swings in direct connection with analyst conferences. However, there has been little movement in the shares of Augsburg-based special gear manufacturer RENK following the 9-month figures. With a 19.2% increase in sales to EUR 928 million, the Bavarian company is heading for record figures, but some analysts had expected more momentum after the change in management in the spring. The biggest driver for RENK was, of course, the defense business, which grew by 25.2% to EUR 690 million, now accounting for 70% of consolidated sales. Adjusted earnings rose by more than a quarter to EUR 141 million, and new orders worth EUR 1.25 billion (+45%) caused the order backlog to explode to a record EUR 6.4 billion. According to Adam Riese, that is almost five times the annual sales.

Management is consistently raising its forecasts and now expects annual revenue of EUR 1.3 billion and earnings in excess of EUR 210 million. CFO Anja Mänz-Siebje comments: "Our order backlog is at an all-time high and now secures five times our current annual sales. This gives us an extremely solid foundation for the coming years and high visibility of our business development." Expectations prior to the figures were likely higher, as the share price fell by around 33% in the last four weeks. We had often pointed out the overvaluation of RENK, and now the chart has finally reacted. The 2027 P/E ratio has fallen from 5 to 3.5 in parallel – a first step toward normality.

The stock market is currently consolidating, a development that can only be described as healthy. Investors who recognize this are now crossing paths with those bold enough to re-enter the market. The bottom line is that entry prices are rising, unlocking new upside potential for the protagonists of the current bull market.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.