December 8th, 2025 | 07:05 CET

The high flyers of 2026: who will lead the next rally? Almonty, Rheinmetall, BYD, and Mercedes-Benz in focus

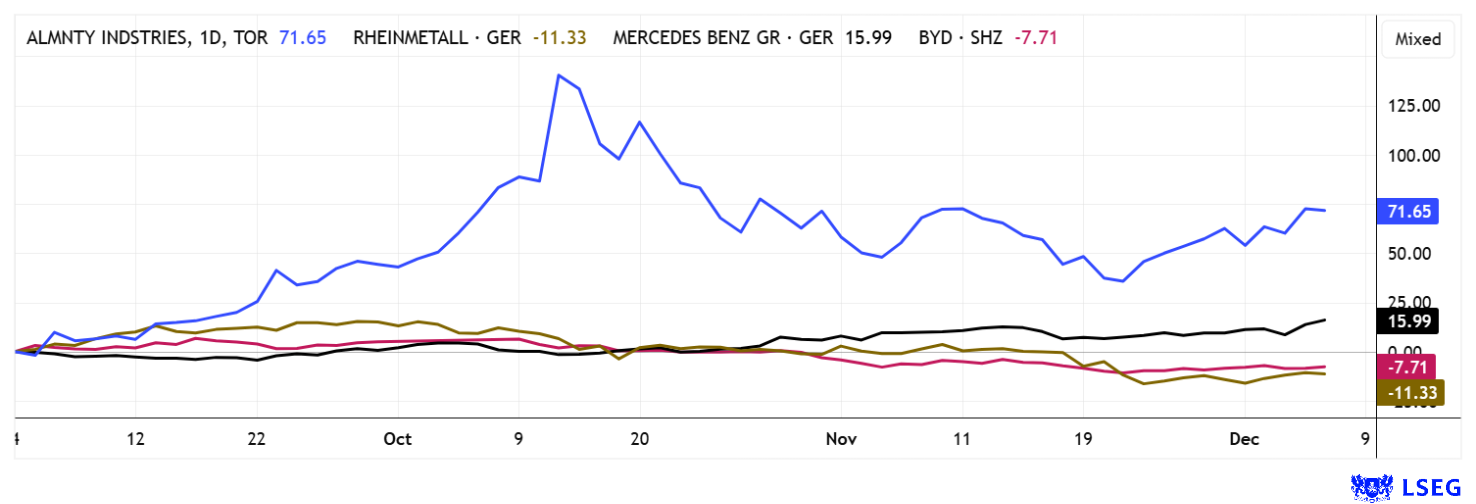

As the year draws to a close, investors are already thinking about the next investment year. This is understandable, as hardly any other period in history has brought as much return as the past year. AI, defense, and high-tech stocks led the way, with some even reaching 1,000% in individual cases. However, the price trends also show that stocks that have performed well will eventually enter a consolidation phase. In the case of Almonty, the share price rose tenfold, and even after the correction, it was still up almost 700% at the beginning of December. In addition to fundamental data, timing also plays a decisive role in success. We are thinking about the coming year. Will the old favorites also be the new winners?

time to read: 6 minutes

|

Author:

André Will-Laudien

ISIN:

ALMONTY INDUSTRIES INC. | CA0203987072 , RHEINMETALL AG | DE0007030009 , BYD CO. LTD H YC 1 | CNE100000296 , MERCEDES-BENZ GROUP AG | DE0007100000

Table of contents:

"[...] While tungsten has always played an important role in the chip industry, it is now being added to batteries for e-cars. [...]" Lewis Black, CEO, Almonty Industries

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Almonty Industries – US expansion unleashes new momentum

The chart situation is obvious. After a rise of more than 1,000%, Almonty Industries' stock needed to take a breather. It fell by almost 50% from its peak of around CAD 15 to CAD 7.60. However, the situation now appears to have stabilized again. Last Friday, the stock easily climbed back above the CAD 10 mark, a 25% gain in just two weeks.

Amid global tensions, Almonty Industries has become a key player in the market for security-related raw materials and is once again coming to the attention of Western industries thanks to the strategic importance of tungsten. What makes CEO Lewis Black happy is the fact that investors are paying less attention to headlines and more to long-term integration into stable supply chains. From a purely strategic perspective, pressure is growing on Western governments to become less dependent on Chinese tungsten imports. Almonty's project pipeline has been clearly aligned with this need over the past two years. In Portugal, an intensive drilling program is expanding the resource base of the Panasqueira mine and laying the foundation for higher production capacities. At the same time, the completion of the high-grade Sangdong mine in South Korea is progressing, which is expected to account for a significant share of non-Chinese global production in the future. With the acquisition of the Gentung Browns Lake project in Montana, Almonty is now also establishing a permanent foothold in the American raw materials sector. The US project brings proven resources, existing infrastructure, and clear production prospects from 2026 onwards. To increase its operational traction, Almonty is expanding its management team and strengthening global coordination by appointing experienced retired Brigadier General Steven L. Allen as COO. His expertise in logistics and multinational organizations will optimize delivery capabilities from mines worldwide. The transcontinental tungsten triangle of Asia, Europe, and North America is taking shape!

The fundamentals for the next valuation jump are obvious. Analysts expect revenues and earnings to rise sharply starting in 2026. Furthermore, the stock continues to show a valuation premium that reflects the strategic rarity value of Almonty's assets. Particularly noteworthy is the planned relocation of the Company's headquarters to the US, which further strengthens its proximity to American security interests. Investors see this geographical and political orientation as a clear advantage in the battle for stable raw material flows. The recent jump in the share price indicates that the market is pricing in Almonty's new role in defense, high-tech industries, and Western supply chains alike. The current price targets are USD 12 at Oppenheim Research and CAD 13.50 at Sphene Capital. The next booster stage could therefore ignite even before the turn of the year!

CEO Lewis Black explained his assessment of the coming year for Almonty at the 17th International Investment Forum (www.ii-forum.com) on December 3. Click here for the video.

Rheinmetall – Can Rheinmetall really take off again?

The crowd favorite and defense stock Rheinmetall graced all the newspapers from 2022 to 2025. The former mechanical engineering company's valuation rose from around EUR 90 in February 2022 to EUR 2,005 in October 2025. Fundamentally, the valuation of the Düsseldorf-based arms manufacturer increased 22-fold. Looking soberly at revenue, it rose during the same period from EUR 6.4 billion to an estimated EUR 12.3 billion - in other words, it merely doubled. If we take the price-to-sales ratio (P/S) and price-to-earnings ratio (P/E) as a basis for a temporary comparison, the P/S jumped from 0.7 to 5 and the P/E from 7 to the current 53. Analysts often discuss this unusual premium, but are not bold enough to derive a sell recommendation from it. We have repeatedly warned about Rheinmetall's overvaluation and still see little reason why the current correction cycle down toward EUR 1,500 should already be over. Looking strictly at the timeline, there has been no positive price movement since May. Even more unsettling is the fact that the stock has already tried four times to break through the EUR 1,900 to 2,000 zone - without success!

All in all, the current consolidation could continue into the first quarter of 2026, as Rheinmetall should first prove with its 2025 annual figures that the high order momentum will also lead to the already priced-in sales explosion and bring shareholders a corresponding dividend. 18 of 22 analysts on the LSEG platform are unanimously singing the same tune: "Buy" with an average 12-month price target of EUR 2,204. Only the Italian bank Intesa San Paolo, with a "Neutral" rating and a target of EUR 1,900, seems to share our skeptical stance. Investors should therefore not be surprised if a short-term sell-off causes the price to drop to EUR 1,200. In the long term, over a three-year period, Rheinmetall could grow operationally to match its current valuation.

The comparison: Mercedes-Benz versus BYD – class instead of mass?

A closer look at the international automotive sector reveals a highly successful BYD Group that is rapidly gaining a foothold on the European continent. Production will also start in Hungary in mid-2026, eliminating 17.4% import duties on goods manufactured there. BYD has already exceeded the 1% market share threshold in Europe this year, and the number of sales outlets will double again next year. Management expects annual sales growth of more than 20% on the old continent. BYD shares have currently undergone a 40% consolidation. With a current price of EUR 10.95, the 2026 P/E ratio is 11.2. As a vertically integrated group, BYD is growing at around 12% per annum and currently serves the mass markets in the mid-price segment. Promising!

The German premium manufacturer Mercedes-Benz is positioned quite differently. Due to a fatal slump in revenue from combustion engine models in Asia and America, revenue fell by 8% to EUR 98.5 billion after nine months, while adjusted EBIT slumped by 35% to EUR 6.63 billion. After provisions for ongoing restructuring, net profit was down by as much as 50% to just EUR 3.9 billion. The burden resulted from an unfavorable model mix, especially in the core business of passenger vehicles and vans. With only 125,100 vehicles sold in nine months, the broad China business slumped by 27%, while the luxury class posted double-digit growth. CEO Källenius regularly emphasizes that Mercedes-Benz sees the future of the Company in "building the most desirable cars – electric, digital, and beautiful – to lead the luxury segment." With a 2026 P/E ratio of 5.3 and a dividend of 7.9%, the long-established company could indeed become one of the winners on the stock market if the turnaround is successful. BYD is also one of our favorites for the coming year, with analysts on the LSEG platform seeing a good 40% potential. At Mercedes Benz, however, skepticism continues to prevail.

It may still be a bit premature to declare 2026 a banner year for the stock market. After all, the past year has been full of surprises: no meaningful economic growth, high prices, strained household budgets, and a sense that conflict is everywhere. The belief that AI could save the planet and provide 8.5 billion people with all the necessities of life is an illusion. Yet because the stock market thrives on debt, defense spending, and job cuts, the hype could continue unabated despite major grievances. One sector, however, is clearly in a supercycle: commodities! Triple-digit returns remain a realistic expectation here.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.