September 25th, 2024 | 07:00 CEST

The biotech rally of the century is on the horizon! 150% returns with BioNTech, Pfizer, Nyxoah, Bayer, or Evotec?

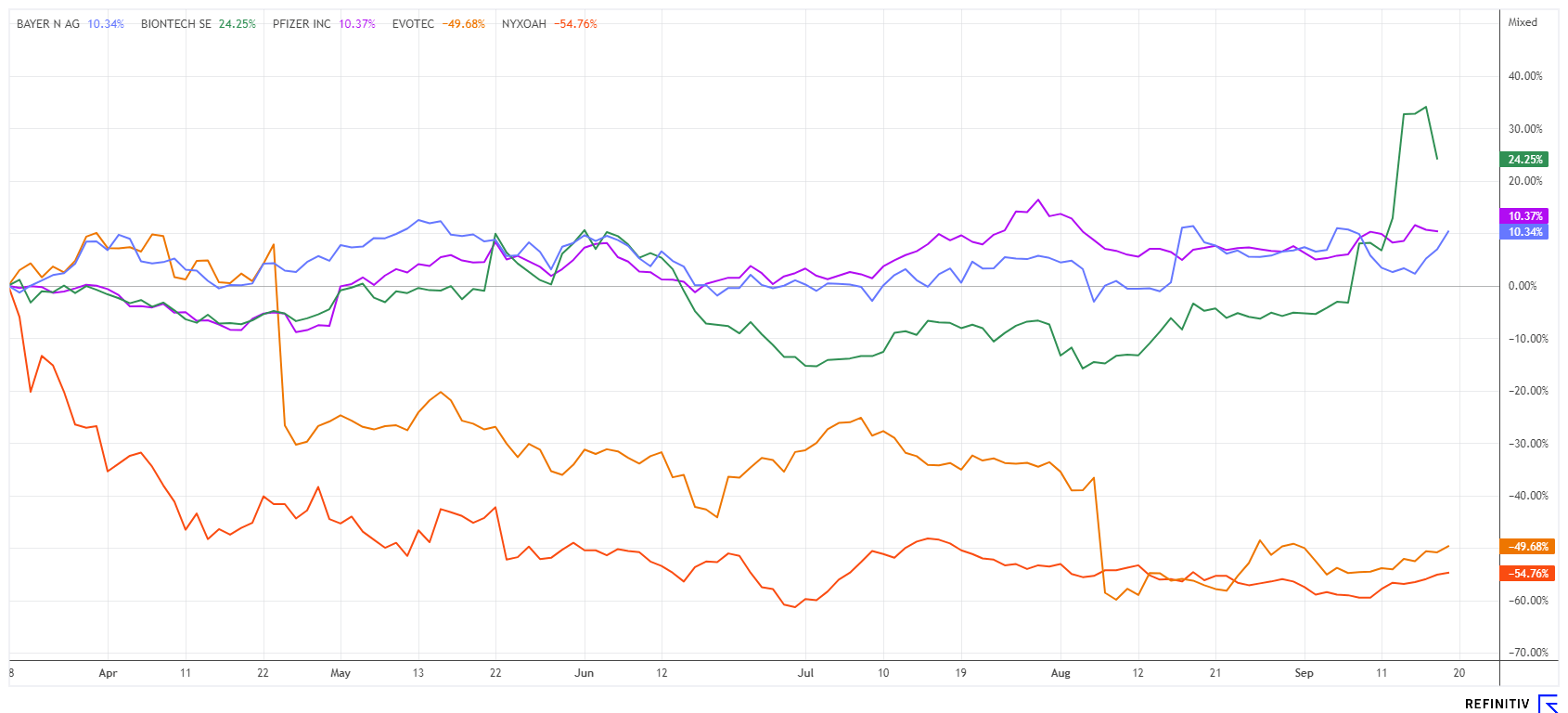

The stock market keeps climbing, and now it is moving even faster with a double-whammy interest rate cut from the Fed! In a surprising move, the US Federal Reserve pulls a 0.5% rate cut from its magic hat, boosting market sentiment. Now, it is certain that life will continue in the biotech sector. However, selecting the right stocks remains challenging. With a medium-term focus, paying attention to management quality is important because the recent price declines were too high in some cases. However, some research approaches promise a better future. BioNTech, Pfizer, and Bayer have already bottomed out. Nyxoah and Evotec are now showing the first signs of breaking out after a period of consolidation. What is the short-term outlook?

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

BIONTECH SE SPON. ADRS 1 | US09075V1026 , PFIZER INC. DL-_05 | US7170811035 , NYXOAH SA | BE0974358906 , BAYER AG NA O.N. | DE000BAY0017 , EVOTEC SE INH O.N. | DE0005664809

Table of contents:

"[...] As a company dedicated to developing treatments for rare heart diseases, we see this as an opportune moment to contribute to the fight against heart disease and make meaningful strides in improving heart health worldwide. [...]" David Elsley, CEO, Cardiol Therapeutics Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

BioNTech and Pfizer – The world after Corona

BioNTech and Pfizer have had to endure a long dry spell since their dream profits in 2021 and 2022. For BioNTech, with the blockbuster Comirnaty, it went down a full 75%. With its extensive portfolio of pharmaceuticals, Pfizer was able to hold its own relatively better, with a 40% drop. Of course, the Mainz-based company had previously quintupled, while the Americans "only" doubled in the pandemic. Fortunately, the stock market has now drawn a line under COVID-19. What happens next for the key players?

In the case of BioNTech, things were very quiet until the end of August. Then, there was a surprising jump of a full 40% in just 2 trading weeks. The catalyst was a report that the Mainz-based company would present promising study results on cancer therapies at the ESMO congress. "At this year's ESMO, we will present data from three clinical trials with BNT327/PM8002, one of the key building blocks for our combination treatment strategy," said Prof. Özlem Türeci, Co-founder and Chief Medical Officer. JPMorgan reacted quickly, revised its assessment from "Underweight" to "Neutral", and raised its 12-month target price from USD 91 to USD 125. BNTX shares ended up there last week but quickly consolidated again to USD 112. We are now adding a stop loss of EUR 98 to our shares, which we collected in the area of around EUR 85. The stock should now attract attention again and, with EUR 17 billion in cash, has a decent reach into the future.

After a long consolidation, Pfizer has defended the EUR 24 to 26 zone. The Company has achieved success in the clinical Phase 2 study in the development of a drug candidate against life-threatening cachexia, a form of pathological severe emaciation that often occurs in connection with tumors. With a 2025 P/E ratio of 10.4 and a dividend yield of 5.8%, the share is a top pick among large and mid-caps in the life sciences sector. Experts on the Refinitiv Eikon platform expect an average price target of just under EUR 30.

NYXOAH SA – Profits in sleep with Genio

With capital raises of EUR 86 million, the Belgian medical technology manufacturer Nyxoah SA is well financed. Founded in 2009, the Company has been listed on Euronext since 2020 and on the US technology exchange Nasdaq since 2021. The focus is on the patient-centered treatment of obstructive sleep apnea (OSA), which causes repeated interruptions in breathing during sleep. The constant apneas reduce the oxygen level in the blood and are associated with sometimes serious comorbidities such as heart attacks, strokes and depression. Since OSA significantly impairs sleep quality, sufferers often also experience severe daytime sleepiness and reduced performance.

The first choice for treating sleep apnea is continuous positive airway pressure (CPAP), which requires the patient to sleep with a large mask to supply air. However, CPAP treatment is often perceived as uncomfortable, hence many patients are looking for an alternative. That is why Nyxoah developed Genio. Genio treats OSA with neurostimulation. The effectiveness of which has already been scientifically proven in patients with moderate to severe OSA. In the largest market, Germany, the product is already being used successfully in many ENT clinics. In the US, Nyxoah is now expecting approval at the end of the year, and a sales organization is currently being set up.

In a recent interview, CEO Olivier Taelman described the Company's vision for the future: "Our declared goal is to become a global leader in the treatment of obstructive sleep apnoea and related indications. One of our visions for 2030 is to make the product even more convenient and easier to use and thus to remain the clear innovation leader in neurostimulation technology for OSA." In September, Nyxoah's shares were already able to gain 10% and are once again heading towards their old highs of over EUR 16. The medical technology stock currently has a market capitalization of around EUR 260 million, with around 44% held by core investors and a good 20% invested by international fund managers. Nyxoah is an interesting niche player with potential!

Evotec and Bayer – Fundamentally still in the burden of proof

Despite strong sales and historically high short interest, the price of the Hamburg-based life sciences company Evotec is not really picking up. Currently, opinions also differ on fundamental expectations. For 2024, analysts estimate a range of EUR 829 million in revenue, which is well below the corridor recently published by management. With a market capitalization of EUR 1.15 billion and a price of EUR 6.12, the Company is currently inexpensive, especially considering that at the end of June, there was still around EUR 222 million in cash on the balance sheet. The upcoming dates seem crucial: Today, the Royal Bank of Canada is hosting the RBCCM Pharmaceutical CDMO and Bioprocessing Conference. However, investors are eagerly awaiting tomorrow's Berenberg and Goldman Sachs conference in Munich. Perhaps the new CEO, Dr. Christian Wojczewski, can come up with a surprise at the Oktoberfest. We have raised our stop-loss to EUR 5.85.

At the German pharmaceutical flagship Bayer, the rebound to over EUR 29 last week felt very good. There are currently increasing signs that the reduction of up to 5,000 jobs will lower costs accordingly. The Leverkusen-based company's problems are not only the glyphosate class actions from the US but also the expiring patents on blockbuster drugs, which will lead to a decline in margins in the medium term. High debts of EUR 33 billion, very little sales growth, and falling margins are weighing on the Company. CEO Bill Anderson may have announced a lot in his first year in office, but the share price is still only 15% above its 5-year low at EUR 28.80. For long-term thinkers, Bayer, with a 2025 P/E ratio of 5.4 and a historically low market capitalization of EUR 27.5 billion, is a stock to consider for the portfolio, with a plan to close their eyes for two years.

The shift in interest rates has finally arrived! This should bring a sigh of relief for stocks in the life sciences sector, as refinancing can now be obtained under better terms. BioNTech and Pfizer have billions in the bank, and Nyxoah is also in a strong financial position. Although Evotec has sufficient funds, its short-term operating prospects are more of a burden, as is the case with Bayer. A healthy mix in the portfolio helps to reduce risk.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.