October 10th, 2025 | 07:10 CEST

The AI tech high-flyers! Up to 3,500% dream returns with D-Wave Quantum, Power Metallic, Nvidia and AMD

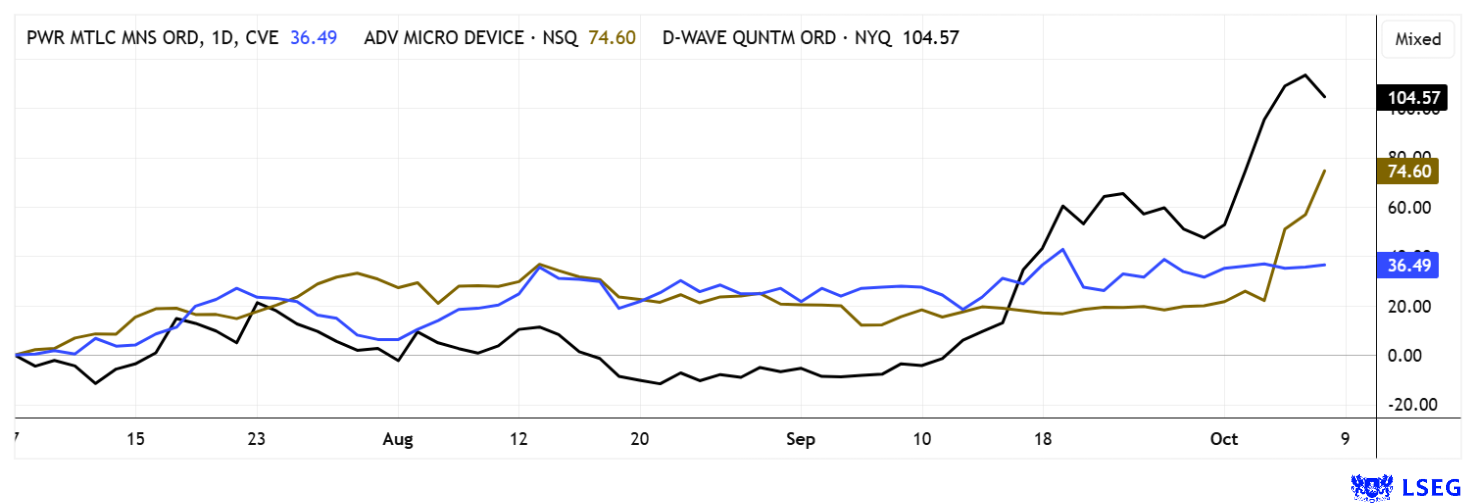

Hard to believe, but unfortunately true! Without a single setback, share prices in the AI, high-tech, and strategic metals sectors have been rising unabated for months now. This has led to dream returns, some of which are in the triple digits. The curtain call for this party seems a long way off, while underinvested investors are sitting on billions in idle cash. There is no conclusive advice for such a situation. Fundamental analysts have been sounding the alarm for months, noting that the well-known Shiller P/E ratio, at over 42, has long since broken through the band of irrational exaggeration. But who cares? Here is a selection of stocks that face daily demand, forcing constant appreciation. Of course, as with any party, it only ends when the last guest turns off the lights.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

D-WAVE QUANTUM INC | US26740W1099 , POWER METALLIC MINES INC. | CA73929R1055 , NVIDIA CORP. DL-_001 | US67066G1040 , ADVANCED MIC.DEV. DL-_01 | US0079031078

Table of contents:

"[...] We have a clear strategy for neutralizing sovereign risk in Papua New Guinea. [...]" Matthew Salthouse, CEO, Kainantu Resources

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

AMD – Nvidia CEO surprised by OpenAI deal

The stock market is blooming in the most beautiful colors: AMD is a case in point. The latest deal between AMD and OpenAI has caused a stir in the semiconductor industry and even surprised the experienced Nvidia CEO Jensen Huang. AMD recently announced that it would grant OpenAI warrants for up to 10% of its company shares as part of a multi-year partnership. This stake is linked to the purchase of AMD chips worth around six gigawatts of computing power, including the upcoming MI450 series, which is seen as a response to Nvidia's GPU dominance. In an interview with CNBC, Huang expressed surprise that AMD is willing to give up 10% of the Company before the new product is even ready for market. At the same time, he praised the move as "clever and unique" because it strategically places AMD at the heart of the OpenAI story.

The deal represents not only a technological leap forward, but also a symbolic alliance between OpenAI and AMD to reduce dependence on market leader Nvidia. OpenAI, which has worked closely with Nvidia systems to date, secures a second powerful chip supplier through the agreement, giving AMD a powerful sales lever. For investors, the transaction signals a realignment of the AI market, with AMD emerging as the new enabler of the OpenAI revolution. The share price increase of over 30% since the announcement underscores the market's confidence in the strategic importance of the deal. Huang remains impressed but vigilant! The alliance of his rival could become the first serious challenge to Nvidia's decades-long dominance. Investors have benefited from both AMD and Nvidia – adjust your stop-losses accordingly!

Power Metallic Mines – On the way to becoming a North American raw materials powerhouse

What applies to the high-tech industry also applies upstream in the supply chain: without metals, there can be no technological breakthroughs. Canada's Power Metallic Mines is currently considered one of the most exciting commodity stocks in the North American small-mid cap segment. The Company focuses on strategically important exploration projects with a focus on nickel, copper, lithium, and platinum group elements (PGEs). Following the recent discovery of high-purity lithium in northwestern Ontario and a 40% increase in the resource estimate, institutional investor interest is growing significantly.

Ongoing investigations of the Lion Zone by IOS Geosciences now confirm that copper is primarily bound in chalcopyrite and cubanite, minerals that are expected to have high metallurgical recovery rates. At the same time, valuable PGEs such as froodite and merenskyite occur in direct association with the copper minerals, suggesting economically efficient extraction. The geological structure is reminiscent of large polymetallic deposits such as Norilsk or Sudbury, further underscoring the long-term potential.

Analysts at Roth MKM rate the stock as a "Buy" and raise the price target to CAD 2.50, as they believe Power Metallic is well on its way to establishing itself as a strategic supplier of critical metals in North America. CEO Terry Lynch recently expressed confidence at investor events in Europe and the US, speaking of a "new phase of sustainable growth." This assessment is supported by a successful private placement of approximately CAD 50 million, which secures financing for the next exploration and drilling phases. The PNPN story continues to move toward its old high of CAD 1.95! Entries below CAD 1.60 are still possible. Stock up!

D-Wave Quantum – Higher, further, faster

D-Wave Quantum is considered one of the most exciting but also overvalued players in the young quantum computing market. The share price has risen by approximately 3,500% over the past 12 months, while fundamental metrics such as revenue, margins, and cash flow do not yet justify this valuation. Investors are clearly trading on the potential of the coming decades here. Despite notable technological advances, however, the business model remains fragile, with revenues driven mainly by one-off sales rather than recurring income, making long-term planning challenging. Analysts currently see the fair value of the stock at between USD 20 and USD 25, with the consensus on LSEG at USD 23.3.

In addition, D-Wave continues to post high losses and remains heavily dependent on ongoing R&D investment. While the Company has an innovative technology portfolio, it remains commercially vulnerable compared to heavyweights such as Google, IBM and Rigetti. If there are delays in the implementation of new gate models or technological setbacks, the valuation could quickly come under pressure. For investors, this means above all that caution is advised. It is important to follow future quarterly reports closely, pay attention to recurring revenues, and set clear stop-loss levels. The next management outlook is scheduled for November 6. A true casino stock!

Anyone looking at the stock performance of certain shares over the past 3 to 12 months might get teary-eyed. The big profit generators come from the megatrend sectors of AI, high-tech, defense, and, more recently, commodities. Those who, like Power Metallic, sit on a huge reserve of poly-metals, which are of ever-increasing strategic importance, can likely look forward to the coming months with optimism. Tech and defense stocks would normally be due for a consolidation, but perhaps the NASDAQ 100 marches on to 30,000 and leaves all the procrastinators out in the cold.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.