April 30th, 2024 | 07:30 CEST

The 100% opportunity with Big Data and Artificial Intelligence: Nvidia, Softing, Microsoft and Super Micro Computer!

Big Data, Web 3.0, IOTA and Artificial Intelligence are terms of the modern age. When the internet and high-tech stocks saw the light of day on the stock exchange during the dot-com bubble at the end of the 1990s, there were hundreds of companies with an idea but only a few customers, rarely any turnover, and certainly no profit. Now, 25 years later, computing power has increased a hundredfold, and the possibilities seem endless. Data for industry is finally usable, and consumers' usage behavior shows where manufacturers need to focus their products. We are in the age of complete transparency about movements, purchasing behavior and opinions. Large Internet companies such as Microsoft, Google and Apple have trillions of pieces of data at their disposal and the fastest mainframe computers to analyze them accordingly. With the deployment of machine learning, artificial intelligence knows no bounds. The stock market thrives on these advancements, with high-tech and AI stocks continuing to promise significant potential. However, it is worth taking a look at undiscovered followers.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

NVIDIA CORP. DL-_001 | US67066G1040 , SOFTING AG O.N. | DE0005178008 , MICROSOFT DL-_00000625 | US5949181045 , SUPER MICRO COMPUT.DL-_01 | US86800U1043

Table of contents:

"[...] In Canada, there is $1.75 of debt for every dollar of disposable income - and that was true even before the pandemic. [...]" Karim Nanji, CEO, Marble Financial

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Web 3.0 - The world of big data and artificial intelligence

The year is 2024. The problems of Web 1.0 and 2.0 no longer exist because Web 3.0 is here, an independent "thinking" Internet. If you ask the search engine today for a good Italian restaurant in your immediate vicinity, it does exactly what a good friend would do: it gives you a name and an address. Because it knows from user reports what "good" means. It also recognizes what "nearby" means by combining location and address. And indeed, it also finds the cute little "pizzeria", because the search engine now knows that a "pizzeria" is an "Italian restaurant".

Now, as we know, Web 3.0 is already several light years ahead in its development. Today, consumer habits and stored actions from social media platforms are so interlinked that image analysis systems are also used to store style, people and the entire environment, including places of residence, in a personal profile. This is complemented by financial data from recent transactions stored on Amazon. Anyone who does not come across suitable marketing concepts here is likely still part of the old world. Companies such as Microsoft, Apple and Alphabet are today's "data octopuses" - they know everything and profit from their adaptive programs. Users only ever see what they love and ultimately consume. In the final step, artificial intelligence uses probabilities to decide how successful one action or another will be and adjusts the parameters accordingly.

Softing - The data professional for industrial solutions

With an annual turnover of almost EUR 100 million, Munich-based Softing AG is a specialist in the field of automotive, industrial and IT networks. The Company is a strategic partner to international vehicle manufacturers and a system and control unit supplier with over 30 years of industry experience in the key technologies of automotive electronics and related electronics areas, such as commercial vehicles and agricultural machinery. Electronic components and software already account for around 40% of value creation in automotive engineering. Topics like "autonomous driving" or "connected cars" will increase this share further. The diagnosis of complex electronic networks, including access to electronic control units and the analysis of data traffic between these control units in the vehicle, is becoming increasingly important.

Softing's solutions enable the functional evaluation of electronic vehicle components and thus help to ensure their quality and optimize costs. Measurement, testing and diagnostics, as well as the data communication associated with these core competencies, accompany the systems throughout their entire life cycle, from development through production to service. Softing Automotive's competencies are complemented by the Industrial division's expertise in networking industrial worlds and Softing IT Networks' expertise in measurement technology for IT cabling.

In the dawn of the Industry 4.0 era and the Industrial Internet of Things (IIoT), robust and reliable digital communication is a basic prerequisite for the integrated production of the future with networked systems across geographical boundaries and the constant need to optimize systems and production processes. With the rapidly increasing, comprehensive, and interconnected networking of people, things, and services (IoE), powerful and reliable IT networks are the backbone of the modern world. Last but not least, the ability to work and the success of modern companies depend to a large extent on the quality of their IT networks.

Softing AG was founded in 1979 and has been listed on the stock exchange since 2000. In 2023, an important sales hurdle was exceeded for the first time with revenues of EUR 115 million. Due to the high pressure to innovate and constant market changes, the surpluses from the operating business were largely invested in research and development, which always kept profitability at a manageable level. In the last financial year, there were surprising goodwill corrections totaling EUR 6.2 million at the investments Psiber Data and GlobalmatiX. Therefore, the announced dividend increase for 2023 will be smaller than investors had hoped. After 2019, however, net earnings per share should be achieved again in 2024. Analysts at Warburg vote on the Refinitiv Eikon platform with a "Buy" rating and a 12-month price target of at least EUR 8.00 - around 50% above the last share price. Highly interesting valuation, as only 50% of the expected turnover is reflected in the market capitalization.

Nvidia and Super Micro Computer - Analysts versus investors' fantasies

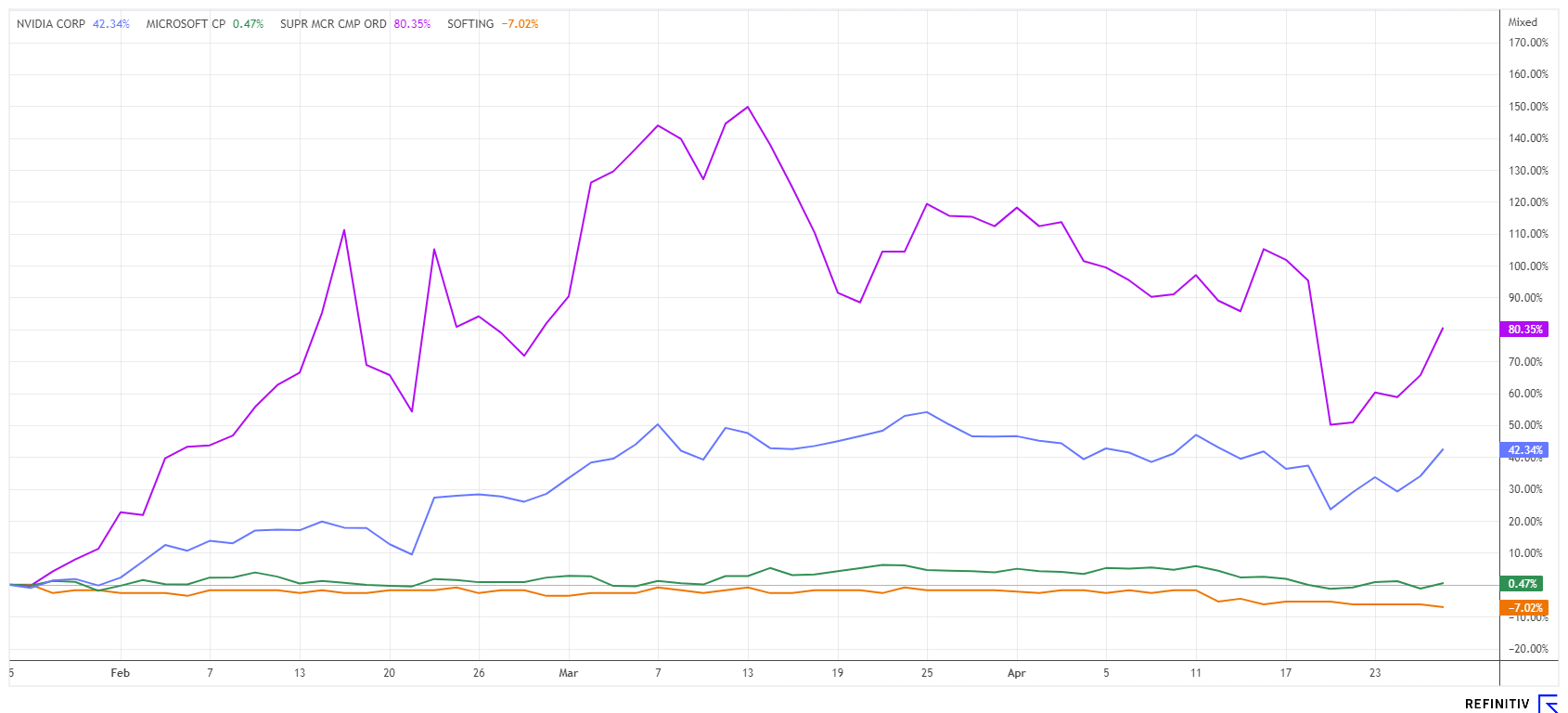

With the currently sought-after high-tech stocks Nvidia and Super Micro Computer, opinions are divided. While Internet investor letters hold out the prospect of several 100% potential, the two shares were brought back down to earth by a sharp correction at the end of April. The AI star Nvidia had already gained 85% in the first quarter of 2024, while Super Micro Computer had even achieved an exhilarating 340% increase. However, Nvidia could quadruple in size by 2024. With discounts of up to 20%, one could, therefore, speak of a consolidation at a high level. Overall, both shares were the winners in the S&P 500 Index, which also reached an all-time high of 5264 points in March. The world's heaviest index rose 30% in just 10 months, catapulting its market value to over USD 40 trillion.

On the Refinitiv Eikon platform, the average Nvidia price target of the 53 "Buy" recommendations is USD 1004, almost 15% above the current price. At its high in March, the share had already reached USD 974. For Super Micro Computer, 12 out of 16 analysts have a "Buy" recommendation with a price target of USD 968, a good 10% above the current level. Those who have been invested in these stocks for a long time have all the options. Late buyers, on the other hand, will have to wait and see whether the rally gains traction again.

The Nasdaq-100 Index has recently suffered some setbacks. With inflation figures still too high, the time for a possible interest rate adjustment by the central banks has moved further forward. As a result, the stock markets have run too far in the short term and can technically be described as overheated. The onset of spring in the northern hemisphere could also bring a few frosty days to the stock markets.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.