April 10th, 2025 | 07:20 CEST

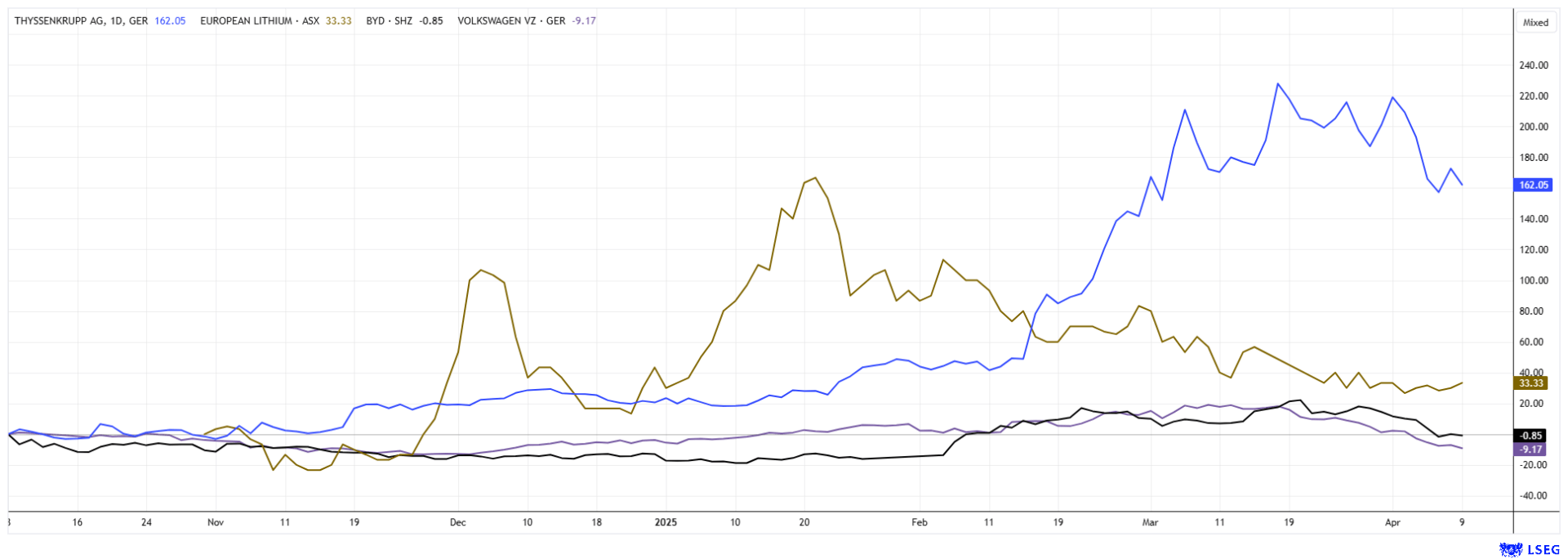

Tariffs, rare earths, Greenland, and Trump! BYD, European Lithium, VW, and thyssenkrupp in focus

The cat is out of the bag! Donald Trump is imposing tariffs of 20 to 34%, thus snubbing his transatlantic trade partners. What has worked well for years is now being put to the test. It did not take long for reactions to the extensive tariff plans to materialize. The state and party leadership in Beijing responded to Trump's ultimatum by announcing counter-tariffs of 34 to 84%. This means that the escalation spiral in the trade dispute between the USA and China continues. The EU had already imposed some additional tariffs in March and is now waiting to see whether the US administration will change its mind. Meanwhile, the focus is once again on rare earths, as China is now imposing export restrictions on this precious commodity. Trump's imperialism is also targeting Greenland again. This is an interesting situation for investors.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

BYD CO. LTD H YC 1 | CNE100000296 , EUROPEAN LITHIUM LTD | AU000000EUR7 , VOLKSWAGEN AG VZO O.N. | DE0007664039 , THYSSENKRUPP AG O.N. | DE0007500001

Table of contents:

"[...] In 2020, the die is finally cast in the automotive industry towards electromobility. [...]" Dirk Harbecke, Executive Chairman, Rock Tech Lithium Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

BYD and VW – In the eye of the hurricane

Now, things are really heating up in the automotive sector. That is because the neck-and-neck race between international manufacturers will likely also be decided by the various tariff plans of governments, which are taking on a whole new urgency under Donald Trump. Last year, the EU had already imposed import tariffs on vehicles from China - these range from 17 to 35%, depending on the manufacturer. In September, the US imposed a 100% import duty on Chinese e-vehicles. So far, the EU has had tariffs of 2.5% for passenger vehicles and 25% for light commercial vehicles. As of the beginning of April, there will be surcharges of a further 25%. Brussels has not yet reacted to these surcharges, although China published the shocking news of an 84% special duty on all US goods yesterday. We believe this would bring trade between China and the US to a standstill.

Meanwhile, there is a chance that the EU and China will converge again and return to normal. This could create advantages for both economic blocs, leaving the US out in the cold. BYD will start production in Hungary in 2026, when tariffs will no longer be an issue. The integrated technology company is currently the biggest competitor to Volkswagen, as a range of 8 models with the latest e-technology is now available in Germany. Some of the prices are 25% lower than the well-known ID models from Wolfsburg. The share prices reflect the current plight. While BYD recently gained 50% at its peak and is now consolidating at around 20%, VW continues to languish near its 5-year lows of between EUR 79 and 85. However, yesterday brought a first glimmer of hope, with VW reporting a 1.4% increase in overall sales, with the e-models even up 60%. VW shares are trading at a 2025 P/E ratio of 3.5. Incredible!

European Lithium – Rare earths becoming a super-asset

We have already discussed the topic of rare earths in Greenland several times. The annexation discussion keeps flaring up again and again; most recently, the visit of Vice President Vance to Greenland caused concern. With the comment "this vast land is not sufficiently protected," the US Vice President reiterated his president's hegemonic ambitions. The fact that this would interfere with Denmark's territorial sovereignty apparently does not seem to bother anyone.

Things are getting exciting once again for the Australian resource company European Lithium. The explorer owns a flagship lithium property in Austria, three additional lithium deposits in Ukraine and Ireland, and the Tanbreez rare earth project in Greenland. This gives the Company a key role in the global raw materials landscape, particularly in the area of critical metals. As political relations between the US and China continue to deteriorate, resource deposits in Western jurisdictions are receiving special attention under Donald Trump and within the EU. Also significant is European Lithium's significant stake in Critical Metals Corp. (CRML), which just raised a further USD 24.5 million in February - leaving it well-funded to acquire additional rare resource assets.

The current orientation of European Lithium thus adds up to a unique and promising future portfolio. There are rumors of a revival of the e-environmental bonus - which would put lithium back in the spotlight. Due to China's trade restrictions on rare earths, particular interest is also being paid to deposits in Greenland. The coalition agreement between the CDU and SPD was concluded yesterday. It remains to be seen what the approach to critical metals will be. The EU should provide support, as it had already called for an action plan to support international supply chains two years ago. In 2023, it was decided that by 2030, at least 10% of the demand for strategic raw materials should be met through domestic production, and 40% of the raw materials should be processed in the EU. What is currently lacking is the active implementation of appropriate measures. Hopefully, future discussions will include Greenland.

European Lithium holds several trump cards in its portfolio: If a swift ceasefire in Ukraine is possible, the lithium properties Dobra and Shevchenlivske there would move into the spotlight. Donald Trump's intentions in Greenland may sound outrageous, but they nonetheless shed new light on the Tanbreez rare earth project. It remains surprising that the entire "options portfolio" could be worth billions, yet investors can still pick up a European Lithium share for just AUD 0.04. The corresponding market capitalization of a low EUR 32 million can only be described as incredibly low! Time to accumulate!

thyssenkrupp – Fantasy for the marine division

The thyssenkrupp share has come under heavy pressure. In March, the stock was still trading at over EUR 10, but at the beginning of the week, it plummeted to EUR 7.85. The great uncertainty relates to steel imports into the USA. thyssenkrupp, one of Europe's largest steelmakers, will in future be subject to the increased tariff rate of 25%. However, the Company has immediately stated that the direct impact of these tariffs on its business is limited, as the share of steel and aluminum exports to the US is relatively low. Nevertheless, thyssenkrupp expressed concerns about indirect effects. There are concerns that the US tariffs could divert steel products previously destined for the US market to the European market. This could lead to increased competitive pressure and potentially lower prices in Europe.

The announcement that the marine division will be floated on the stock market via a spin-off this fall seems to have been forgotten. This could result in prices not yet reflected in the current share price. Analysts currently estimate the 2025 P/E ratio at 11.5 – however, debt could fall dramatically if shares in TKMS are sold. From this perspective, the current share price of just under EUR 8 represents a renewed buying opportunity for thyssenkrupp shares.

The stock market is currently having to deal with a great many negative influences. Sometimes, it is imperialist statements by the US administration, but in the last few days, new tariff laws have been making the rounds. All in all, there is great uncertainty and high volatility. For investors, one can only hope that things will calm down again. At current levels, European Lithium and thyssenkrupp are very exciting investments.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.