November 25th, 2024 | 07:00 CET

Takeovers – The 200% opportunities for 2025! Speculate now on the turnaround for Evotec, BioNxt, Bayer and Nel ASA!

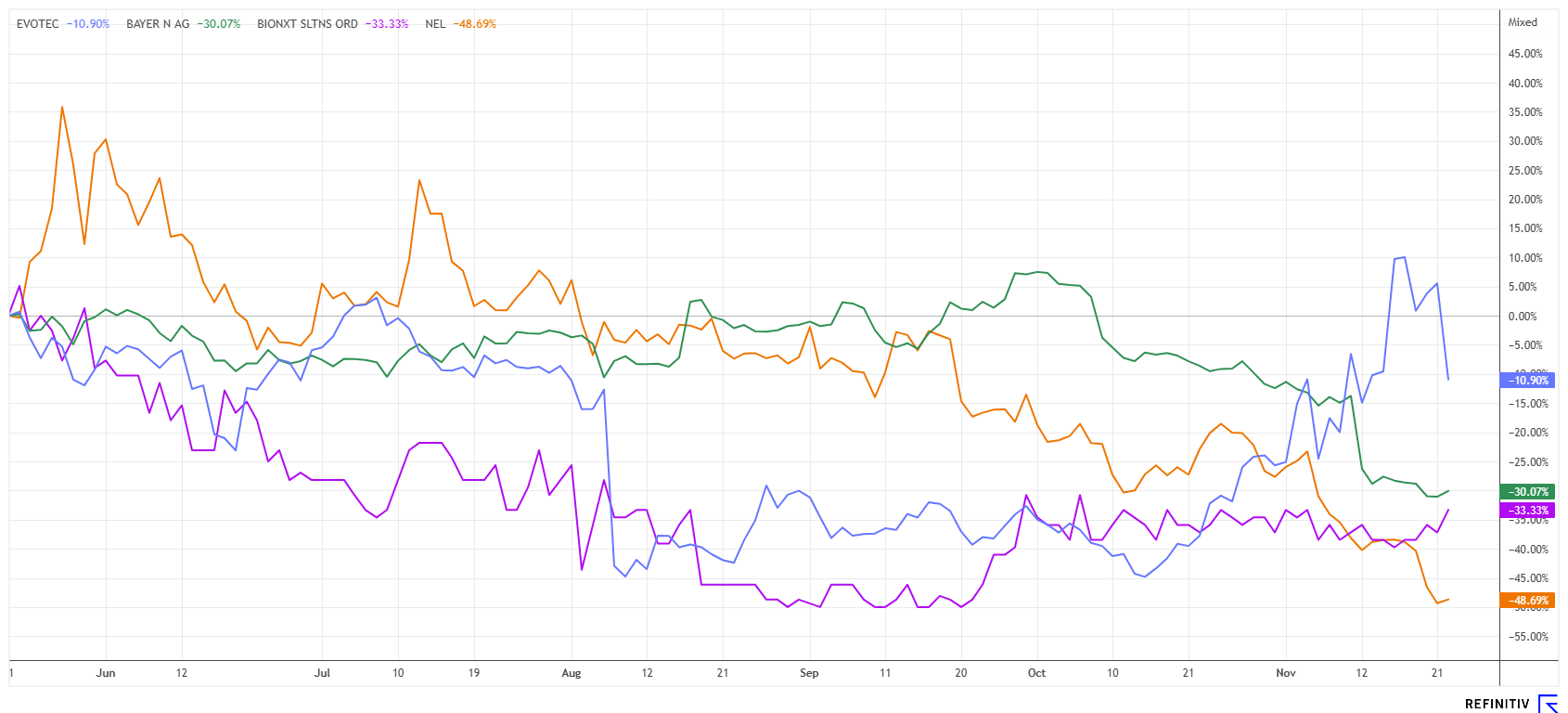

The DAX 40 index is going from strength to strength, following the huge wave of buying since the US election. High-tech and defense stocks are leading the charge. Contrary to this positive trend, biotech stocks have so far been ignored. However, since interest rates are likely to be lowered for the foreseeable future due to the weakening economy, the time of the research-intensive life sciences industry will soon return. There are takeover rumors about Evotec. BioNxt is currently undervalued, and Bayer should be among the winners next year after successful restructuring efforts. It is worth taking a closer look.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

EVOTEC SE INH O.N. | DE0005664809 , Bionxt Solutions Inc. | CA0909741062 , BAYER AG NA O.N. | DE000BAY0017 , NEL ASA NK-_20 | NO0010081235

Table of contents:

"[...] As a company dedicated to developing treatments for rare heart diseases, we see this as an opportune moment to contribute to the fight against heart disease and make meaningful strides in improving heart health worldwide. [...]" David Elsley, CEO, Cardiol Therapeutics Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Evotec and Bayer – Now it is getting exciting

Called off – but still a clear double! After a spectacular rally from Evotec's low of EUR 5.08 in August, it then rose to EUR 10.45 last week. We have repeatedly recommended the stock because the Hamburg-based company, in addition to stabilizing its operations, was attracting potential buyers due to its low market capitalization. However, the Evotec share has fallen by more than 20% since the US company Halozyme refrained from the takeover attempt. Halozyme CEO Helen Torley decided to withdraw after the Hamburg-based company refused to further consider the acquisition under the offered terms. The Americans had made Evotec a non-binding offer of EUR 11 per share. This would correspond to a valuation of EUR 2 billion. However, a company spokesperson emphasized after the offer that the top priority was to advance Evotec as an independent company in the best interests of its shareholders. We could not agree more – consider entering the stock at new lows in the EUR 7.70 to 8.50 zone and wait for a new offer. Yield-hungry financial investors are lining up.

Contrary interest is currently being shown for Bayer. The Leverkusen-based company is sinking from low to low, reaching a sell-off level of EUR 18.99 after the Q3 figures. Investors are still retreating from the stock after the agrochemical and life sciences expert once again lowered its annual targets and issued cautious remarks regarding its agricultural business for the coming year. Additional analysts lowered their estimates and revised their price targets, with UBS recently lowering its target from EUR 30 to EUR 22 with a "Neutral" rating. However, the FDA's acceptance of the approval application for the blockbuster drug Nubeqa is positive. With a market capitalization of less than EUR 20 billion, Bayer is opening a new crash chapter. Investors should, therefore, keep a close eye on the stock. In the long term, there is the prospect of 200% gains and more, but the entry point is key.

BioNxt Solutions – New patents and a convertible bond

If you look at the turnover of BioNxt shares in Germany, it seems like a quick comeback. After bottoming out between EUR 0.11 and 0.13, the share is now trading again at an appealing EUR 0.17 to 0.20. BioNxt focuses on next-generation drug formulations and delivery systems. In recent months, the focus has been primarily on transdermal and orally dissolvable preparations. In September 2024, the European Patent Office gave the green light for the recently applied-for property rights of BioNxt. Now, a series of patents will be submitted in over 40 destinations in order to have IP protection for international marketing. The current patent series covers the sublingual administration of cancer drugs to treat autoimmune and neurodegenerative diseases. BioNxt's lead development program in its portfolio is its sublingual cladribine product for treating multiple sclerosis (MS). This could take off in 2025 with a manufacturing partner because BioNxt's developers expect the Company's cladribine product to offer a significant advantage over the tablet form for patients with dysphagia (difficulty swallowing).

BioNxt successfully returned to the capital market in November. An 8% convertible bond raised CAD 425,000 in the first tranche. The management board has also been strengthened once again. Hugh Rogers is back as CEO, with Wolfgang Probst now taking on the role of CFO. The team has been working together successfully for years, and now powerful structures have been created for a product launch in 2025. With the appropriate milestone announcements, a quick jump towards EUR 1.00 could be achieved. Risk-conscious investors will remember the old highs of over EUR 2.00 in 2021.

Nel ASA – What happened here?

This was unexpected for the electrolysis pioneer in Norway, back to four years of Trump after the rather climate-friendly policies of the Biden administration. Now, investors no longer believe funding will continue under the Inflation Reduction Act (IRA). Nel ASA has been reporting a decline in public-sector orders for several quarters. Unfortunately, the hydrogen story is making little headway without funding programs. Now, there is also a hail of downgrades. Last week, there was a critical analyst comment from Kepler Cheuvreux. The research firm has recently added Nel to its coverage. The initial rating is "Reduce", with a 12-month price target of just NOK 2.50, or the equivalent of just EUR 0.22.

At the beginning of November, Morgan Stanley lowered its target price from NOK 9.00 to 3.50. The drastic revaluation signals considerable uncertainties in Nel's growth strategy, particularly about developments in the US market and potentially changeable political conditions. According to the experts, demand for hydrogen technology is developing more slowly than expected, and the analyst consensus for 2025 may prove to be exaggerated. There is also good news: the current market capitalization of around EUR 430 million is backed by 40% cash. However, the burn rate per month is likely to be high. Caution is advised, as little can be expected from the highly indebted EU governments, especially when facing international hydrogenation efforts alone.

The stock market is currently making a strong distinction between its favorites and the stocks that seem to be in an endless decline. While Nvidia, with a market capitalization of USD 3.5 trillion, continues to rise from high to high, stocks in the biotech sector are mostly being sold off. However, long-term investors are not being shaken because there should be interest rate cuts from 2025 onwards due to the economic situation. Then, cyclically, an industry rotation would be called for.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.