June 17th, 2025 | 07:05 CEST

Takeovers! A new dawn for biotech companies – Evotec, BioNTech, PanGenomic Health, and CureVac in focus

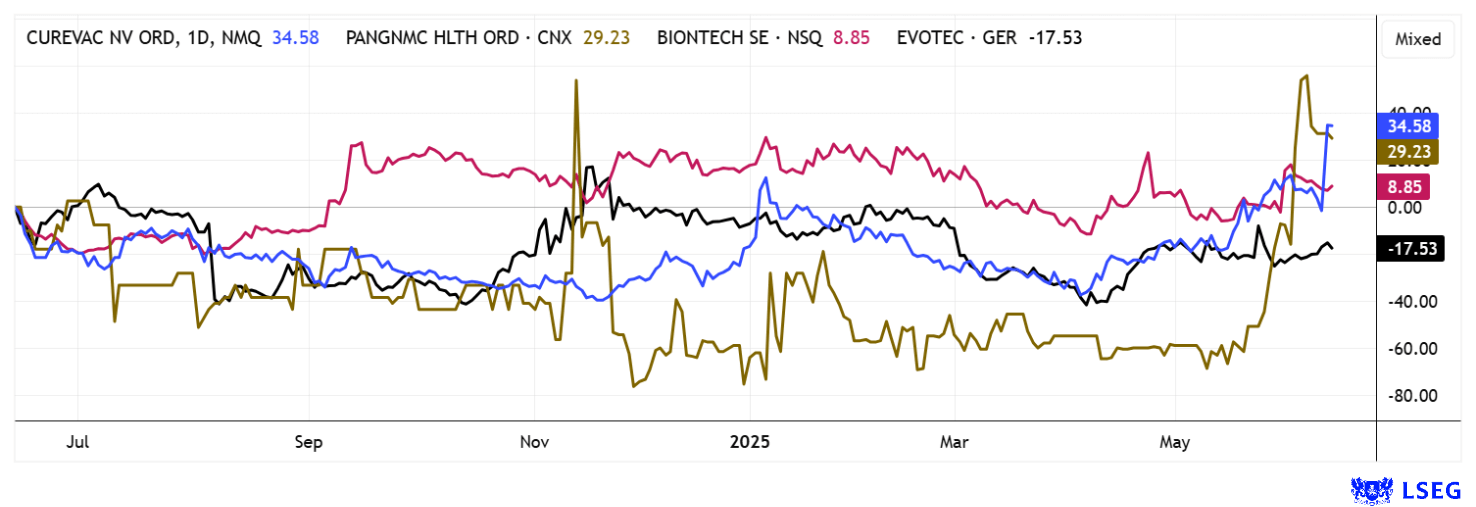

Many large pharmaceutical companies are facing the "patent cliff" as patents on blockbuster drugs expire, threatening massive revenue losses in the future. To fill these gaps, they are acquiring suitable and innovative biotech companies with promising drug pipelines. Sometimes, however, they simply acquire technologies already worth billions. The current wave of acquisitions in the biotech sector is being driven by a combination of economic pressure, technological change toward AI and digitalization, and a weak financing environment for smaller biotech companies. After years of restraint and high volatility, fundamental valuation factors are back in focus. Investors are returning, creating a prosperous environment for those who jump on the bandwagon in time. We highlight a few ideas.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

EVOTEC SE INH O.N. | DE0005664809 , BIONTECH SE SPON. ADRS 1 | US09075V1026 , PANGENOMIC HEALTH INC | CA69842E4031 , CUREVAC N.V. O.N. | NL0015436031

Table of contents:

"[...] Defence will continue to develop its Antibody Drug Conjugates "ADC" and its radiopharmaceuticals programs, which are currently two of the hottest products in demand in the pharma industries where significant consolidations and take-overs occurred. [...]" Sébastien Plouffe, CEO, Founder and Director, Defence Therapeutics Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Evotec – Many rumors are circulating

Things have calmed down again at Hamburg-based drug developer Evotec. After setbacks under long-time CEO Werner Lanthaler, the share price recovered significantly from EUR 5.06 to EUR 8.50 in May. However, profit-taking and subdued first-quarter figures led to another setback to around EUR 6.80. Since then, there have been many rumors surrounding the Company, and two takeover attempts since 2023 have so far been unsuccessful. The Canadian bank RBC recently raised its price target for Evotec from EUR 11.60 to EUR 11.90 and confirmed its "Outperform" rating. Although analysts continue to see a significant margin gap compared to the competition, they believe this can be closed within three years. This year's Annual General Meeting was held under the theme "Pioneering Drug Discovery." Evotec is developing into an accelerator in the field of life-changing drugs through the integration of AI-supported platforms and state-of-the-art technologies. With a revenue forecast of approximately EUR 850 million for 2025, the Company is not too expensive at EUR 1.3 billion. Taking the average price target on the LSEG platform as a benchmark, EUR 10.35 would be achievable for the next 12 months. This represents a premium of almost 50% on prices around EUR 7.15. However, it is also conceivable that Big Pharma will come knocking again.

PanGenomic Health – People-focused

As with BioNTech, Pfizer, Moderna, and CureVac, the story of PanGenomic Health (ticker: NARA) also dates back to the Corona pandemic. As it spread rapidly, it became clear that there was an urgent need for accessible healthcare and effective, self-directed health solutions. Anxiety and depression were on the rise, access to doctors and therapists collapsed, and an overwhelming percentage of those who struggled the most were left without meaningful or substantial support. In a time of isolation, technology was the obvious answer. PanGenomic recognized the market opportunity and began developing digital products and tools that would transform the world of wellness. The Company has grown rapidly over the past 5 years.

Today, PanGenomic Health offers self-directed programs, user-friendly platforms, and resources based on validated research. The Company positions itself at the intersection of technology and preventive medicine with three advanced AI-powered platforms. The NARA mobile app combines genetic profiles with behavioral data to provide personalized naturopathic recommendations. Mindleap.com offers digital support for stress management, with personalized self-help programs and remote access to suitable therapists. The MUJN clinical system analyzes neurological biomarkers, enabling precise fine-tuning of cognitive or neurological disorder therapies. PanGenomic deliberately avoids the traditional doctor referral structure and combines conventional medical methods with scientifically based alternative approaches. The technological foundation is provided by the Company's proprietary Nustasis AI platform. This is where various data streams converge, including genetic information from NARA, digital symptom logs from Mindleap, and laboratory parameters from MUJN. The system evaluates this data in real-time using specially developed deep learning models. To reduce the risks of generative AI, PanGenomic uses a multi-level security concept: In addition to validated sources such as PubMed, diagnostic markers serve as objective control variables; patented analysis methods are also used. This results in individually tailored therapy recommendations whose effectiveness is continuously monitored.

The Company pursues a hybrid business model: recurring revenues from subscription models are supplemented by online sales of herbal supplements and precision diagnostic services via MUJN. While its origins lie in women's health care, the portfolio has now expanded to include neurological diagnostics and mental performance enhancement. This is an area that is increasingly appealing to health-conscious men as well. The direct link between data collection, AI-based analysis, and product delivery sets PanGenomic apart from traditional telemedicine providers such as Hims & Hers. NARA's share price has almost quadrupled since May, although trading liquidity remains low. It can be assumed that the technology portfolio is worth significantly more than its market capitalization of CAD 6.8 million. Rapid increases in value should, therefore, come as no surprise.

BioNTech and CureVac – Old disputes, new pledge of loyalty

The big shake-up in the German biotech industry has begun. Last week, it was announced that Mainz-based pharmaceutical company BioNTech intends to acquire its rival CureVac from Tübingen in its entirety. With this acquisition, the Mainz-based company aims to gain further expertise in mRNA-based cancer therapies. The transaction will slightly exceed EUR 1 billion, which is no problem for cash-rich BioNTech, which still had funds of almost EUR 20 billion at the end of 2024. CureVac is already the second billion-dollar deal announced by BioNTech within a few weeks. At the height of the Corona pandemic in 2020, the two companies were still fierce competitors, with BioNTech earning billions with its partner Pfizer and CureVac failing with its vaccine. The planned transaction will involve a share swap, with the valuation basis for a CureVac share set at USD 5.46 or EUR 4.72. The transaction value is thus USD 1.25 billion, and upon completion of the acquisition, CureVac shareholders will hold approximately 4 to 6% of BioNTech. It is expected that existing shareholders such as Dietmar Hopp-Holding Dievini and KfW will approve the deal. The takeover bid is subject to a minimum acceptance threshold of 80%. BioNTech, once known for its mRNA-based COVID-19 vaccine "Comirnaty", is researching cancer immunotherapies and aims to submit its first application for approval in the US by the end of this year. CureVac's research and development site in Tübingen will remain unchanged. This also marks the end of years of patent disputes in court. A win-win deal for everyone involved!

The biotech sector has come back to life. BioNTech is showing how internal and external expansion can go hand in hand. These factors mean that 2025 could be a "year of change" for M&A activity in the biotech sector, with a resurgence of large transactions and a realignment of the competitive landscape. Companies are increasingly focusing on smaller, specialized deals and partnerships to minimize financial risk and invest in niche markets. PanGenomic Health, with its innovative platform, is valued at only CAD 6.8 million.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.