November 7th, 2025 | 07:00 CET

Takeover battle between Novo Nordisk and Pfizer! Is BioNxt Solutions the next target?

Who will acquire Metsera? That is currently the subject of dispute between Novo Nordisk and Pfizer. Both pharma giants are seeking access to a new generation of metabolic therapies through the acquisition - treatments that have the potential to transform the billion-dollar market for obesity and diabetes care. Novo Nordisk views Metsera's drug pipeline as a complement to its GLP-1-based preparations, while Pfizer is trying to finally gain a foothold in the market after several setbacks. The takeover battle illustrates that big pharma companies are willing to dig deep into their pockets for innovations. This makes BioNxt Solutions a potential takeover candidate. The Company is not only working on innovations in the field of multiple sclerosis and obesity, but on an entire platform technology.

time to read: 3 minutes

|

Author:

Fabian Lorenz

ISIN:

Bionxt Solutions Inc. | CA0909741062 , NOVO NORDISK A/S | DK0062498333 , PFIZER INC. DL-_05 | US7170811035

Table of contents:

"[...] Defence will continue to develop its Antibody Drug Conjugates "ADC" and its radiopharmaceuticals programs, which are currently two of the hottest products in demand in the pharma industries where significant consolidations and take-overs occurred. [...]" Sébastien Plouffe, CEO, Founder and Director, Defence Therapeutics Inc.

Author

Fabian Lorenz

For more than twenty years, the Cologne native has been intensively involved with the stock market, both professionally and privately. He is particularly passionate about national and international small and micro caps.

Tag cloud

Shares cloud

Business model focused on partnerships and acquisitions

BioNxt is on its way to becoming a hot takeover candidate for Big Pharma. The Canadian-German biotech company specializes in developing innovative dosage forms for already approved blockbuster drugs. Thanks to its proprietary sublingual thin film technology, BioNxt can bring reformulated drugs to market within two to four years, at significantly lower costs and with substantially reduced research risk. Strategically, the Company focuses on research, patent protection, and early clinical development, while commercialization is pursued through licensing deals or acquisitions by major pharmaceutical companies. BioNxt is also open to its own strategic collaborations or acquisitions to accelerate growth and expand its technology platform. Most recently, management confirmed ongoing discussions in the field of artificial intelligence.

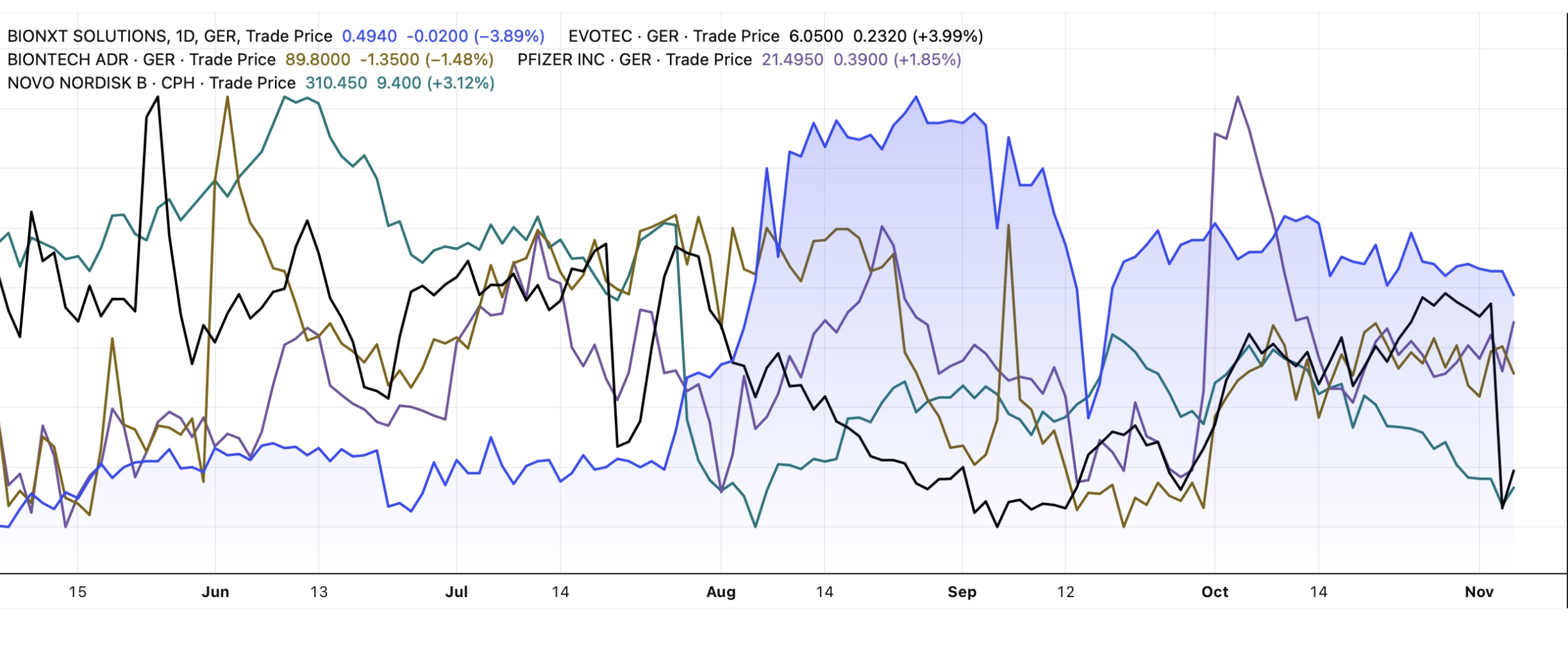

Due to the positive development of the Company, BioNxt's share price has roughly doubled this year, outperforming peers such as Evotec, BioNTech, Pfizer and Novo Nordisk, which are currently engaged in a bidding war. At the same time, the market capitalization of just around CAD 100 million would be easily manageable for large pharmaceutical companies. For a potential buyer, the strategic value lies in enhancing existing injectable drug portfolios with patient-friendly, dissolvable thin film variants. Such innovations not only improve patient comfort but also expand market potential and differentiation from competitors.

Dissolvable film for Ozempic

Amid the ongoing bidding war between Pfizer and Novo Nordisk, BioNxt has been developing a dissolvable film formulation of Ozempic since earlier this year. The popular weight loss drug currently requires regular injections, which is a factor that likely discourages some users. A dissolvable film formulation of semaglutide could substantially increase demand. The global obesity market is already enormous and, according to experts, is expected to reach around USD 150 billion annually by the end of the decade. An oral dosage form would be an attractive innovation for all players in this field.

Key technology with patent protection

BioNxt recently reported significant progress in securing patent protection for its core technologies. The Eurasian Patent Organization (EAPO) has signaled its "willingness to grant" the biotech company a comprehensive patent covering the sublingual administration of cancer and autoimmune drugs. At the same time, the European Patent Office (EPO) has now announced its "intention to grant a patent" for BioNxt's sublingual dissolvable film formulation of cladribine, designed for the treatment of multiple sclerosis (MS) and related neurodegenerative diseases.

The focus is on the drug candidate BNT23001, a sublingual dissolvable film formulation of cladribine for the treatment of multiple sclerosis (MS). These patents will secure BioNxt protection in up to 54 countries, including all EPO member states and the eight EAPO member countries, covering a target population of nearly one billion people.

The protected technology is based on an innovative cladribine-cyclodextrin complex that is absorbed through the oral mucosa, enabling fast, patient-friendly, and highly bioavailable therapy. It is designed to improve efficacy and tolerability compared to conventional tablets or injections. According to market researchers, the European market for MS treatments is expected to exceed USD 13 billion by 2032, with oral formulations gaining increasing market share.

BioNxt advances clinical development and partnership search

Parallel to the expansion of its patent protection, BioNxt is advancing clinical development. A large-scale bioequivalence study in animals is currently underway and will form the basis for subsequent human studies. CEO Hugh Rogers speaks of a "crucial phase" in which the Company is not only consolidating its innovation leadership in oral drug delivery systems, but also finalizing its global commercialization strategy. With its upcoming regulatory planning and active development of partner networks, BioNxt is positioning itself as one of the most promising players in the growing market for advanced, patient-oriented drug formulations.

BioNxt Solutions is increasingly becoming a takeover candidate. Partnerships, licensing agreements, or a takeover could send the stock soaring. Developments in recent months show that the Company is on a strong trajectory and is attracting attention from a growing number of investors. At the same time, the share's upside potential does not yet appear to be fully realized.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.