Lithium

Commented by Nico Popp on September 2nd, 2025 | 07:00 CEST

The auto industry is at a crossroads – Who will solve the lithium problem? BYD, Mercedes-Benz, European Lithium

When the Chinese step on the gas, German premium manufacturers are left in the dust! As a recent article in Handelsblatt shows, Chinese auto suppliers are increasingly overtaking their international competitors. This is fatal – after all, suppliers are the ones driving innovation. One indicator is the battery sector: in the first half of 2025, the two largest Chinese battery manufacturers, CATL and BYD, together controlled 55.7% of the global electric vehicle battery market. The next-largest non-Chinese supplier is LG from South Korea, with a market share of just 9%. As it stands, European car manufacturers remain heavily dependent on Chinese batteries. We examine why this dependence is risky, which companies are already working to reduce it, and which stocks offer opportunities for investors.

ReadCommented by Armin Schulz on August 27th, 2025 | 07:05 CEST

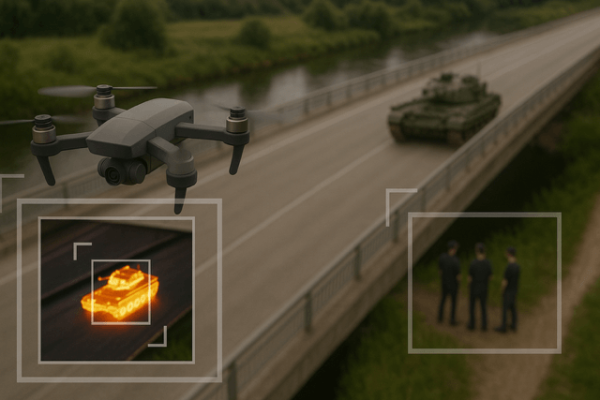

China's leverage: Why Rheinmetall is struggling, European Lithium is benefiting, and BYD remains confident

The next wave of global conflicts will not be fought with weapons, but with export licenses. At the heart of this geopolitical struggle are critical metals without which no high-tech weapon, electric vehicle, or wind turbine can function. China's recent tightening of export restrictions has exposed the West's brutal dependency, forcing governments and corporations alike to rapidly rethink and realign their supply chains. While some companies are fighting to secure their supply chains, others are consolidating their sources or celebrating their monopolistic position. Three companies exemplify this dichotomy: the recently pressured defense giant Rheinmetall, the rare earth and lithium beneficiary European Lithium, and the Chinese giant BYD.

ReadCommented by Nico Popp on August 22nd, 2025 | 07:00 CEST

Raw materials as the key to greater value creation: SQM, Lynas Rare Earths, Almonty Industries

Equality is a social construct. Reality, however, is diverse. This also means that some companies are in a much better starting position than others. In free markets, companies compete for market leadership and thus spur each other on to become better. However, some companies are in pole position for a variety of reasons and also have a few extra horsepower than their competitors. We use the examples of lithium specialist SQM, rare earths company Lynas Rare Earths, and innovative tungsten specialist Almonty Industries to explain which characteristics promise long-term advantages for companies and how investors can benefit.

ReadCommented by Fabian Lorenz on August 21st, 2025 | 07:00 CEST

Up to 300% with raw materials and defense! Standard Lithium, DroneShield, and zinc play Pasinex!

DroneShield's stock has plummeted by around 20% in recent days. However, with a performance of over 300% in 2025, the Australian company remains one of the top performers. The drone defense specialist recently reported on its performance in Q2. Revenue is at record levels, and the order book is full. Will that be enough? Pasinex Resources remains in rally mode. The chances of a continuation are high, as important milestones are coming up and the stock remains favorable. Standard Lithium has celebrated a comeback in recent months, recovering from its brutal crash at the turn of the year. What is next?

ReadCommented by Armin Schulz on August 12th, 2025 | 07:10 CEST

Lithium? Zinc! Steel! BYD's supply chains, Pasinex's deposits, thyssenkrupp's recycling: Your triple protection against trade wars

Trade conflicts are escalating! New US tariffs and stricter export controls on critical raw materials like lithium and rare earths are destabilizing global supply chains. Experts warn of rising prices and supply risks, especially for future-oriented technologies. Investors are therefore now seeking out resilient companies. Preference is given to those with vertically integrated supply chains, direct access to strategic mineral deposits, or revolutionary recycling technologies. Those who master the new reality of raw materials will win. Three players exemplify this transformation: BYD, Pasinex Resources, and thyssenkrupp.

ReadCommented by André Will-Laudien on August 11th, 2025 | 07:10 CEST

Buying frenzy – Indices are heading upward! Another 150% possible with Palantir, European Lithium, VW, and BYD

The NASDAQ and DAX 40 indices are basking in sunshine. A veritable buying wave is sweeping across tech stocks, especially Palantir Technologies. The share price continues to rise, driven by an almost irrational demand for AI and outstanding business performance. At the same time, short positions on this stock are rising sharply to over 50 million shares - a warning sign of potential short-covering scenarios. There is currently no sign of the typical summer slump. On the contrary, the stock markets are climbing from one high to the next as if the tariff decisions were a blessing for the global economy! In contrast, BYD is experiencing weaker-than-expected sales performance in July. Quarterly figures are down, and the stock is coming under considerable pressure. There is also plenty of movement in the commodities sector, as the US seeks stable supply chains. But where can these be found?

ReadCommented by Fabian Lorenz on August 7th, 2025 | 07:20 CEST

Momentum stocks: D-Wave! Standard Lithium! European Lithium following in the footsteps of MP Materials!

Rare earth projects outside China are in high demand, as MP Materials has demonstrated with the entry of the US government, its cooperation with Apple, and its rise to a multi-billion-dollar corporation. Is a similarly rapid share price development possible for European Lithium? In any case, the stock is currently inexpensive, and the rare earth project in Greenland is delivering strong results. Standard Lithium shares have also performed strongly again recently. And analysts believe the stock has even more upside potential. And what is D-Wave doing? After breaking through the USD 20 mark, the stock is currently consolidating. Operationally, the quantum high-flyer continues to go full throttle, and analysts remain bullish.

ReadCommented by André Will-Laudien on August 6th, 2025 | 07:20 CEST

Inevitable: High-tech and AI require strategic metals! Share price gains at Siemens Energy, Nordex, and Power Metallic

The availability of strategic metals is geopolitically risky because China controls the global market for most of these raw materials, from extraction to processing. The EU and the US are increasingly facing the problem that geopolitical conflicts and export restrictions can quickly lead to supply bottlenecks and price spikes. The COVID-19 pandemic and the war in Ukraine have painfully exposed the dependence of Western industrialized countries. In addition, demand for strategic metals is growing rapidly. Experts expect demand for lithium, for example, to increase twentyfold by 2050. Anyone who wants to secure long-term innovation and prosperity, therefore, needs independent sources of supply and new players in the raw materials market. We are looking around!

ReadCommented by Nico Popp on August 1st, 2025 | 07:15 CEST

Auto crisis in Germany – Here is the solution: European Lithium, BMW, and Porsche

Fear is spreading through the German automotive industry. The latest figures from Porsche and BMW have been poor. Sales figures in China are collapsing, and tariffs on exports to the US are eating into profit margins. At the same time, buyers remain cautious when it comes to electric vehicles – whether due to the uncertain economic situation or the lack of convincing models, which are also quite expensive. The fact is that the German auto industry's next steps must be in the right direction. Those who invest in time could benefit in the long term. We explain the role lithium from Europe will play in the future of the automotive industry.

ReadCommented by Armin Schulz on July 23rd, 2025 | 07:15 CEST

Critical raw materials such as rare earths in the spotlight – How European Lithium is saving RENK, BYD, and your returns

The global battle for lithium and rare earths will determine the future viability of industry. While countries are investing billions to gain control of critical value chains, companies without secure access to raw materials are becoming pawns in the midst of geopolitical tensions. A notable example is the Pentagon's investment in MP Materials. RENK, a defense specialist in high-performance transmissions, and BYD, the electric mobility giant, are existentially dependent on stable supply chains. This is exactly where European Lithium comes in: the Company could break Europe's strategic dependence through domestic production.

Read