Lithium

Commented by Fabian Lorenz on October 13th, 2025 | 07:30 CEST

Drone boom and multiplication: Following DroneShield, RENK, and Standard Lithium, NEO Battery Materials shares are taking off!

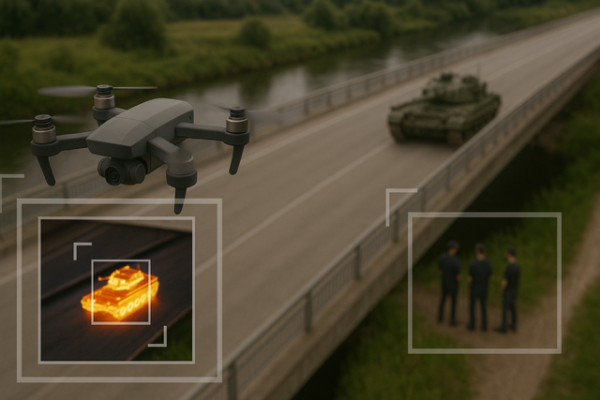

Missed out on the multiplication of shares such as DroneShield, RENK, and Standard Lithium? Investors can still get in early with NEO Battery Materials. The Company is benefiting from the drone boom and the raw materials conflict between the US and China. NEO Battery Materials has developed advanced battery technology. The first manufacturer of drone batteries has already placed an order. In the future, the Company also plans to offer complete batteries itself. To save time in commercialization, a factory has been leased. This will allow for rapidly increasing sales and profits. The tariff and raw materials conflict between the US and China is likely to give NEO an additional boost. When will the stock take off?

ReadCommented by Armin Schulz on October 13th, 2025 | 07:20 CEST

The beneficiaries of the raw materials crisis: How BYD is circumventing the problem, and how Power Metallic Mines and Albemarle are profiting

The global energy transition is fueling an unprecedented hunger for strategic metals. However, China's recent tightening of export controls on critical raw materials has triggered a global supply alert and sent markets into turmoil. This geopolitical turning point is forcing the West to radically rethink its approach and is fueling a fierce race for secure supply chains. In this volatile environment, smart players are repositioning themselves along the entire value chain. Who are the winners in this new reality? The strategies of BYD, Power Metallic Mines, and Albemarle provide decisive answers.

ReadCommented by Fabian Lorenz on October 13th, 2025 | 07:05 CEST

Winners in the tariff war: Almonty Industries, MP Materials, Bayer

Stock market turmoil on Friday: Donald Trump once again threatens to wield the tariff club. This came in response to China's announcement to tighten export controls on rare earths. Yet, there are also winners in the raw materials battle between the two superpowers. In recent months, the US government has invested in companies such as MP Materials, focusing so far on rare earths and lithium. Will tungsten be next? This critical metal has not been mined in the US for a long time, and Almonty would be the logical partner to change that. Notably, while US stocks lost ground, in some cases heavily, on Friday, Almonty shares recovered significantly from their intraday lows.

ReadCommented by Fabian Lorenz on October 10th, 2025 | 07:20 CEST

Bombshell at Plug Power! Things are getting "critical" at Standard Lithium and Graphano Energy! Donald Trump is shaking up commodity stocks!

Investors are currently rushing to buy stocks in the rare earths, tungsten, and lithium sectors. The driving force behind this is the US government, which is investing in companies involved in critical raw materials to secure independence from China. Could Graphano Energy be next in line for government participation? In any case, no battery can function without the critical mineral, graphite. Graphano Energy is attractively valued and holds projects in Canada. Standard Lithium is benefiting from the hype surrounding critical metals. After rising more than 60% in four weeks, has a correction now arrived? Plug Power is in the midst of one. This week, the stock fell by over 20%. A capital measure and the surprising departure of the CEO are causing uncertainty.

ReadCommented by André Will-Laudien on October 10th, 2025 | 07:10 CEST

The AI tech high-flyers! Up to 3,500% dream returns with D-Wave Quantum, Power Metallic, Nvidia and AMD

Hard to believe, but unfortunately true! Without a single setback, share prices in the AI, high-tech, and strategic metals sectors have been rising unabated for months now. This has led to dream returns, some of which are in the triple digits. The curtain call for this party seems a long way off, while underinvested investors are sitting on billions in idle cash. There is no conclusive advice for such a situation. Fundamental analysts have been sounding the alarm for months, noting that the well-known Shiller P/E ratio, at over 42, has long since broken through the band of irrational exaggeration. But who cares? Here is a selection of stocks that face daily demand, forcing constant appreciation. Of course, as with any party, it only ends when the last guest turns off the lights.

ReadCommented by André Will-Laudien on October 9th, 2025 | 07:25 CEST

E-mobility tax-free through 2035! Keep an eye on BYD, NEO Battery Materials, NIO and BASF

In the third quarter of 2025, the global market for electric mobility continued to develop dynamically: over 4.2 million new electric vehicles were registered, an increase of around 28% compared to the previous year. While China confidently maintained its leading position as the largest single market, Europe also grew strongly with double-digit growth rates. Driven by manufacturers such as BYD, Tesla, and Volkswagen, NIO is also slowly entering the scene. At the same time, more and more capital is flowing into innovative battery technologies to meet rising demand in the long term. NEO Battery Materials is emerging as a specialist in the innovative battery solutions business. This rapid development illustrates how closely technology, raw material markets, and the electric mobility boom are intertwined. We present some ideas for investors.

ReadCommented by Fabian Lorenz on October 7th, 2025 | 07:10 CEST

SHARE PRICE EXPLOSION at Standard Lithium, European Lithium, MP Materials! These commodity stocks are outshining Barrick Mining!

It does not always have to be gold! Barrick has gained around 80% so far this year. The following commodity stocks are outperforming it significantly. European Lithium's share price has exploded by over 100% since Friday. Initially, a share buyback sparked the euphoria, then came the bombshell: Reuters reported a possible US government investment in Critical Metals. European Lithium holds the majority of the Company, which is focused on the exploration of a massive rare earths project in Greenland. The impact of a US entry was already demonstrated by MP Materials this summer, where Apple is also involved. Standard Lithium has gained an impressive 200% in six months. How far will the boom in critical raw materials drive these stocks?

ReadCommented by Nico Popp on September 22nd, 2025 | 07:15 CEST

Serbians don't want mines – Are Europe's battery supply chains at risk? BYD, BMW and European Lithium

A recent article in the Frankfurter Allgemeine Zeitung (FAZ) reveals that the vast majority of Serbians oppose lithium mining in the country. The Journal for International Politics and Society cites a survey according to which 55% of Serbians are against a lithium mine in the Jardar Valley – only 25% are in favor of it. The latest media report paints an even bleaker picture. According to the report, the various population groups in Serbia have rarely been as united as they are in their opposition to the mine. But what does this mean for European battery supply chains? Which companies will be penalized, and which will benefit? We analyze the situation.

ReadCommented by André Will-Laudien on September 18th, 2025 | 07:20 CEST

Margins war and soaring commodity prices! Caution advised on BYD, Mercedes, RENK, and European Lithium

So far, September has turned out to be a month of bliss. It appears that the stock market already underwent its full correction back in April. Investors are still buying high-tech and AI stocks, seemingly unconcerned by valuations of historic proportions. In the wake of this super bull market, automakers BYD and Mercedes have recently suffered significant price corrections. At the same time, the wave of euphoria surrounding defense stock RENK now appears somewhat exaggerated. The rally around critical metals has also driven European Lithium and its US subsidiary Critical Metals significantly higher. With commodity prices recently exploding, however, the rally here is likely only just beginning. We take a closer look at the numbers.

ReadCommented by Fabian Lorenz on September 8th, 2025 | 07:05 CEST

Top news and price target raised! Plug Power, Standard Lithium, and BMW partner European Lithium

In the run-up to the IAA, BMW is stealing the spotlight from other automakers. The focus of attention is clearly on the Munich-based company's "Neue Klasse". If the new electric models are a success, European Lithium stands to benefit - they are set to supply the lithium for the batteries. But this raw materials gem has a second ace up its sleeve: rare earths. The stock is being driven by positive news flow, which is likely to continue. Standard Lithium is also seeing strong momentum. Analysts have recently raised their price targets significantly. In contrast, the alarm lights continue to flash at Plug Power. While revenue is rising and costs are falling, cash burn remains a concern. Nevertheless, analysts are recommending the hydrogen stock as a "Buy".

Read