September 18th, 2025 | 07:20 CEST

Margins war and soaring commodity prices! Caution advised on BYD, Mercedes, RENK, and European Lithium

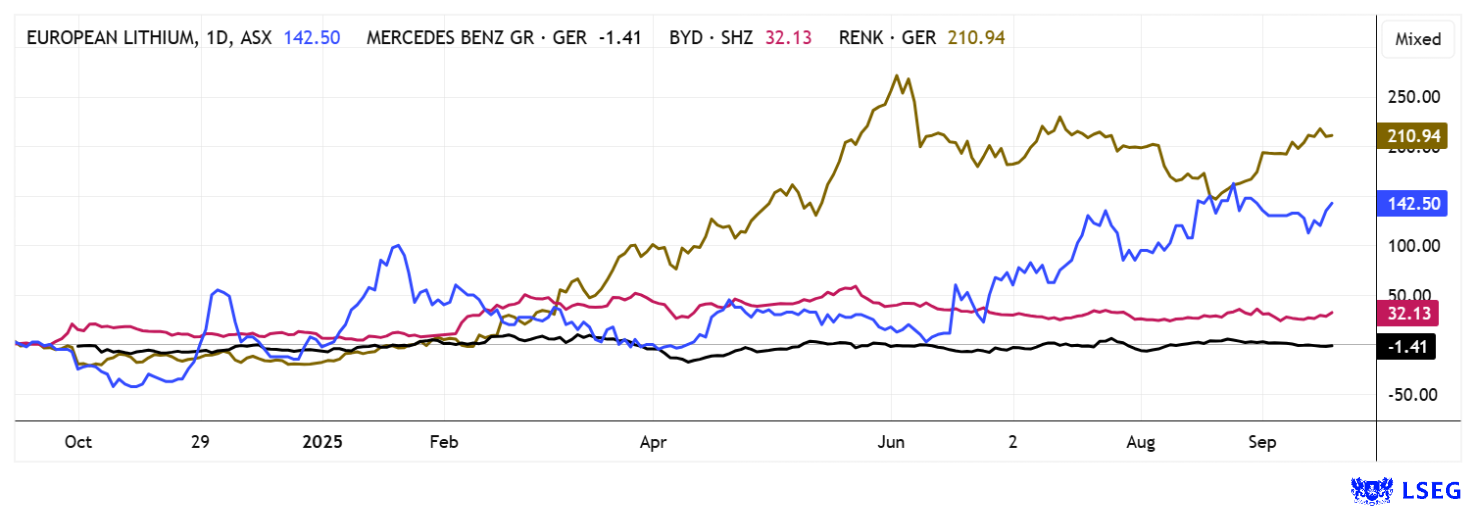

So far, September has turned out to be a month of bliss. It appears that the stock market already underwent its full correction back in April. Investors are still buying high-tech and AI stocks, seemingly unconcerned by valuations of historic proportions. In the wake of this super bull market, automakers BYD and Mercedes have recently suffered significant price corrections. At the same time, the wave of euphoria surrounding defense stock RENK now appears somewhat exaggerated. The rally around critical metals has also driven European Lithium and its US subsidiary Critical Metals significantly higher. With commodity prices recently exploding, however, the rally here is likely only just beginning. We take a closer look at the numbers.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

BYD CO. LTD H YC 1 | CNE100000296 , RENK AG O.N. | DE000RENK730 , MERCEDES-BENZ GROUP AG | DE0007100000 , EUROPEAN LITHIUM LTD | AU000000EUR7

Table of contents:

"[...] In 2020, the die is finally cast in the automotive industry towards electromobility. [...]" Dirk Harbecke, Executive Chairman, Rock Tech Lithium Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

European Lithium – Critical metals are becoming scarce

Greenland is increasingly becoming the center of the global battle for strategic metals and rare earths: The icy island is considered a gigantic treasure trove that, with its deposits, including some of the largest rare earth deposits in the world, has the potential to meet a significant portion of global demand for decades. Thanks to stable political structures, simplified procurement procedures, and favorable infrastructure, the chances are growing that Greenland will become a key supplier of raw materials for Europe and Western industries, thereby reducing dependence on China.

Against this backdrop, European Lithium is strategically positioned in several ways through its US subsidiary Critical Metals Corp. In addition to an Austrian lithium project, which has already secured BMW as a customer for the period from 2027 onwards, the Tanbreez project in Greenland is currently causing a stir in the market. The deposit is one of the world's largest rare earth projects outside Asia. Recent drilling results from the ongoing campaign not only confirm exceptionally high and consistent values for heavy rare earths (HREO) and gallium, but also zirconium and gallium contents well above industry average. The project is also environmentally friendly, as uranium and thorium content is particularly low, an important factor for approval. The ongoing upgrade program already includes 1,900 meters of drilling; further results are imminent.

The economic parameters also speak in favor of Tanbreez. A net present value of up to USD 3 billion and an internal rate of return of 162% make the project highly attractive. Analysts particularly highlight the proportion of heavy rare earths, which are indispensable for high-tech, magnet production, and defense. The main beneficiary is the Australian holding company European Lithium, as the majority shareholder of rights holder Critical Metals. The Company has a supply agreement for up to 10,000 tons of concentrate per year with Ucore Rare Metals, whose planned downstream processing in the US and Canada will further strengthen security of supply for the West. With ongoing drilling at the Tanbreez project and the established lithium offtake agreement with BMW, European Lithium is positioning itself as a leading supplier of critical raw materials outside China. The stock has been on an upward trend for the past 12 months and has recently attracted a lot of attention in the German market. With a current market capitalization of around EUR 72.5 million, many market observers continue to see considerable potential for a revaluation.

BYD versus Mercedes – China goes its own way

While the world discusses the difficult supply of critical metals, car manufacturers are under constant stress due to declining sales figures. Rising raw material prices and never-ending tariff discussions are further delaying the purchasing processes of uncertain consumers. BYD and Mercedes are now competing as substitutes in the market, as trade tensions in China are leading to more domestic purchases, while German automakers have been relying on their export successes for decades. In this complex situation, BYD shares have recently recovered after a 40% correction from their peak. The 3:1 stock split caused confusion for some time, but now the missing shares have been credited to German investors' portfolios as well. Nevertheless, weak Q2 figures and aggressive price reductions of up to 30% on over 20 models are weighing on sentiment. BYD now sells more vehicles in Europe than Tesla, but growth is noticeably slowing down. Nevertheless, 28 analysts on the LSEG platform recommend buying the stock with an average price target of EUR 17.70, representing a 45% premium over the current price of EUR 12.30.

Mercedes is struggling with high costs for the transition to e-mobility and weaker demand, especially in China. Price pressure is weighing on margins, while rising development costs are reducing earnings. Although the stock has been moving sideways between EUR 50 and EUR 54 for a long time, it scores with a favorable 2026 P/E ratio of 7.4 and a high dividend yield of 6%. All in all, investors are still up more than 30% after 12 months with BYD shares, while Mercedes is struggling to make headway with a loss of 10%. Overall, BYD remains a promising but risky growth stock. Mercedes impresses with solid dividends and stability, but also faces major structural challenges and a gloomy mood in Germany.

RENK benefits from bulging order books

RENK also requires a wealth of metal raw materials to maintain stable production. Business has been booming for the Augsburg-based company since its return to the stock market two years ago. The drive and transmission specialist has currently secured several new projects. These include orders from Latvia for 42 HSWL-256B transmissions for the AJAX armored personnel carrier and additional deliveries to an international customer. New orders for CODAD and CODAG drives for European ships were also added in the naval segment. Order intake in the first half of 2025 reached around EUR 921 million, an increase of almost 50% compared to the previous year. The total order backlog now amounts to EUR 5.9 billion. With a book-to-bill ratio of 1.5, new business is growing faster than it can be processed. Most recently, revenue and profits rose significantly, with an EBIT margin of over 14%. RENK expects a large wave of new framework agreements, particularly in its home market of Germany, as the German Armed Forces plans to procure over 1,600 new armored vehicles by 2035.

Overall, RENK is clearly benefiting from rising defense budgets. The bulging order books and the prospect of further large orders from the German Armed Forces ensure high visibility for revenue and profits. The strong margin development and planned investments in new capacities underpin the growth story. Risks lie primarily in possible delays in political decisions, high dependence on public budgets, and increasing international competition. The research firm Jefferies reaffirmed its "Buy" recommendation for RENK shares last week with a price target of EUR 80. Important for investors: The share price has more than doubled in the last 12 months, meaning that, in our view, a large part of future upside is likely already priced in.

The capital markets continue to rejoice, even though the global economic environment is clearly deteriorating. The reason for this is the enormous supply of credit being pumped into the markets by defense and infrastructure spending by governments in the EU, the US and Asia. This is driving up commodity prices worldwide, as they are considered a scarce commodity in an environment of unstable supply chains and high tariff barriers. While car manufacturers are increasingly losing their margins, current and future commodity suppliers are on the sunny side. Investors are now responding to challenging economic situations with price premiums, whereas in the past, stock markets typically reacted with caution or uncertainty. A new world indeed!

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.