August 11th, 2025 | 07:10 CEST

Buying frenzy – Indices are heading upward! Another 150% possible with Palantir, European Lithium, VW, and BYD

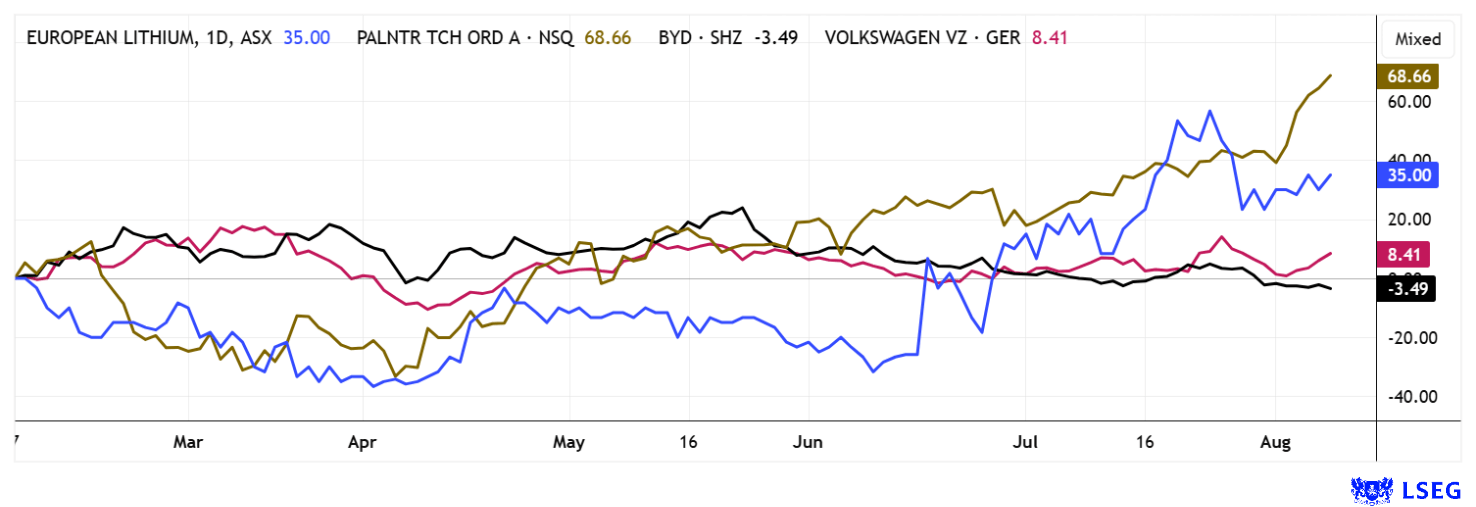

The NASDAQ and DAX 40 indices are basking in sunshine. A veritable buying wave is sweeping across tech stocks, especially Palantir Technologies. The share price continues to rise, driven by an almost irrational demand for AI and outstanding business performance. At the same time, short positions on this stock are rising sharply to over 50 million shares - a warning sign of potential short-covering scenarios. There is currently no sign of the typical summer slump. On the contrary, the stock markets are climbing from one high to the next as if the tariff decisions were a blessing for the global economy! In contrast, BYD is experiencing weaker-than-expected sales performance in July. Quarterly figures are down, and the stock is coming under considerable pressure. There is also plenty of movement in the commodities sector, as the US seeks stable supply chains. But where can these be found?

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

EUROPEAN LITHIUM LTD | AU000000EUR7 , PALANTIR TECHNOLOGIES INC | US69608A1088 , VOLKSWAGEN AG VZO O.N. | DE0007664039 , VOLKSWAGEN AG ST O.N. | DE0007664005 , BYD CO. LTD H YC 1 | CNE100000296

Table of contents:

"[...] In 2020, the die is finally cast in the automotive industry towards electromobility. [...]" Dirk Harbecke, Executive Chairman, Rock Tech Lithium Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

BYD versus VW – Margin losses for all

BYD shares have been the subject of much discussion over the past two weeks. The recent 3:1 stock split caused irritation among European investors in particular, as many have not yet received their converted shares. The Q2 figures published at the same time fell short of expectations, further dampening market sentiment. This was compounded by an aggressive price war. BYD cut prices for more than 20 models by up to 30% to boost sluggish sales. This move triggered concerns on the market about falling margins and the threat of overproduction, pushing the share price down by around 30% in the last three months. Although BYD now sells more vehicles in Europe than Tesla, sales growth is stagnating, and demand remains below expectations. Despite ongoing expansion plans, the market is currently nervous. The combination of technical uncertainty following the split, disappointing figures, and concerns about margin pressure means that BYD, a favorite with the public, is currently being viewed with particular skepticism. Twenty-eight analysts on the LSEG platform recommend buying the stock with a weighted price target of EUR 17.70, representing potential upside of 70%.

Volkswagen is currently facing similar challenges to BYD. The switch to e-mobility is causing transformation costs running into the billions. While BYD is expanding in Europe, VW is having to cope with declining sales of electric vehicles and has already announced that it will cut production at some plants. The price war triggered by China is putting considerable pressure on margins, especially in international competition. Unlike BYD, VW is also struggling with internal structural problems and costly software delays that are slowing down its planned model offensive. Technically, the share price has now tested and confirmed the EUR 88 level at least four times. Bold investors could consider buying at this point, with a P/E ratio of just 3.8 and a dividend yield of nearly 7%.

European Lithium – Investors eye Greenland

The debate about strategic metals has intensified significantly in recent times, not least due to the growing importance of copper, uranium, and rare earths. As a stable European jurisdiction, Greenland offers additional advantages in terms of approvability, security of supply, and infrastructure. Australian company European Lithium is ideally positioned through its NASDAQ-listed 68% stake in Critical Metals Corp. The focus is increasingly on Greenland, which Donald Trump has claimed, and the highly regarded Tanbreez rare earth project there. The robust economic figures of a scoping study recently showed a net present value of up to USD 3 billion and an internal rate of return of 162% before taxes. The project is therefore clearly attractive from an economic perspective. With the latest drilling results, European Lithium has reported exceptionally high gallium grades (up to 140 ppm) and a peak heavy rare earth oxide (HREO) grade of 28%. The values are derived from the initial analysis of ten historical diamond drill holes and mark a new supply potential that massively increases the project's importance for Western supply chains and strategic industries. Particularly relevant: Unlike other deposits, the uranium and thorium grades are extremely low, which clearly increases environmental compatibility and political approvability.

Furthermore, gallium is essential for the semiconductor industry and, since China's export restrictions on the US, has been crucial for security of supply in the defense and high-tech sectors. "These top results underscore Tanbreez's strategic value for rare earths and gallium with high scalability," said CEO Tony Sage. The concentration is well above the typical average of other rare earth deposits and has triggered price momentum among analysts. European Lithium shares have already gained over 60% in value this year. The goal is now to expand the resource potential. Critical Metals Corp. is therefore advancing a new drilling campaign at the Fjord deposit. More than 1,200 meters of drilling have already been completed this year, with earlier surveys showing high values for HREO and gallium, and further analysis results are expected in the coming months.

The opportunity for European Lithium to establish itself as a reliable source of critical metals outside China's sphere of influence is becoming increasingly evident. This scenario could act as a catalyst for the entire industry. The share price currently stands at around AUD 0.082, and in Germany, an active investor community regularly trades several million shares. Given the Company's current valuation of only EUR 66.5 million, this level seems hardly comprehensible to many market observers. As a result, the potential for a significant revaluation cannot be ruled out.

Palantir Technologies – There seems to be no stopping it now

Palantir Technologies is a phenomenon! The Company once again significantly exceeded analyst expectations in Q2 2025 with earnings per share of USD 0.16 (forecast: 0.14). Revenue rose by 48% to over USD 1 billion for the first time, exceeding estimates of only USD 940 million. The operating EBIT margin reached an impressive 46% and free cash flow was USD 569 million. The figures catapulted the stock to over USD 187 in recent days, representing an annual gain of over 500% in 12 months. Despite positive quarterly figures, the market environment remains tense, as experts consider the valuation to be far too high. Short sales of over 50 million shares confirm this view, with traders positioning themselves for possible corrections. Analysts have discussed the "doomerism" sentiment, which is being fueled primarily by short sellers and skeptics surrounding the topic of artificial intelligence. Despite these concerns, many market participants viewed the quarterly figures as proof of Palantir's sustainable growth story, with prominent voices such as Jim Cramer already talking about price targets above the USD 200 mark. The stock's status as a growth star with strong AI momentum continues to attract strong attention, while its inclusion in the S&P 500 and NASDAQ-100 is providing additional capital inflows. The weighted LSEG price target of USD 165 at the end of the year has long been exceeded by 15%. A blatant blow-off story with a unique 2025/26 price-to-sales ratio of over 100!

The capital markets are currently under severe pressure to adjust as geopolitical risks, volatile commodity prices, and technological upheavals coincide. While Palantir investors are benefiting from the sudden surge in share prices and short covering is fueling the hype, BYD and Volkswagen are struggling with declining sales figures and gloomy margin prospects. European Lithium is considered one of the most promising candidates in the critical metals sector for securing important resources outside China's sphere of influence. This opens up a scenario with significant upside potential for risk-aware investors.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.