August 6th, 2025 | 07:20 CEST

Inevitable: High-tech and AI require strategic metals! Share price gains at Siemens Energy, Nordex, and Power Metallic

The availability of strategic metals is geopolitically risky because China controls the global market for most of these raw materials, from extraction to processing. The EU and the US are increasingly facing the problem that geopolitical conflicts and export restrictions can quickly lead to supply bottlenecks and price spikes. The COVID-19 pandemic and the war in Ukraine have painfully exposed the dependence of Western industrialized countries. In addition, demand for strategic metals is growing rapidly. Experts expect demand for lithium, for example, to increase twentyfold by 2050. Anyone who wants to secure long-term innovation and prosperity, therefore, needs independent sources of supply and new players in the raw materials market. We are looking around!

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

SIEMENS ENERGY AG NA O.N. | DE000ENER6Y0 , NORDEX SE O.N. | DE000A0D6554 , POWER METALLIC MINES INC. | CA73929R1055

Table of contents:

"[...] China's dominance is one of the reasons why we are so heavily involved in the tungsten market. Here, around 85% of production is in Chinese hands. [...]" Dr. Thomas Gutschlag, CEO, Deutsche Rohstoff AG

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Power Metallic Mines – The next steps are clearly defined

This is exactly where Power Metallic Mines from Canada offers a promising investment opportunity. The Company focuses on strategically important exploration projects and is in a particularly promising growth phase. In recent weeks, Power Metallic Mines has announced an important discovery of high-purity lithium at its main project area in northwestern Ontario, a milestone for the supply of the North American battery industry. At the same time, the Company published a new resource estimate that revises the potential of the deposit upward by over 40%.

Power Metallic recently reported promising results from the mineralogical analysis of the "Lion" zone. Canadian laboratory IOS Geosciences is examining over 100 rock samples to assess the metallurgical potential. Initial findings show that the copper mineralization is mainly present in chalcopyrite and cubanite, both of which are easily processed sulfide minerals comparable to those found in the Sudbury Basin. It is particularly encouraging that the high-value platinum group elements (PGEs), such as froodite, stannopalladonite, and merenskyite, occur predominantly in direct association with copper minerals. This suggests high PGE recovery rates using conventional flotation in copper concentrate. The deposit also has similarities to well-known polymetallic deposits such as Norilsk and Sudbury. Mineralogical investigations should be completed by the end of summer, with initial metallurgical tests starting before the winter drilling program begins. Initial results are expected in early 2026.

Power Metallic Mines embodies innovation, sustainability, and economic future, an investment in the independence of critical raw materials and a stable industry for decades to come. With prices around CAD 1.22 now after consolidation, it is once again highly attractive!

Siemens Energy – Dividends back on the table

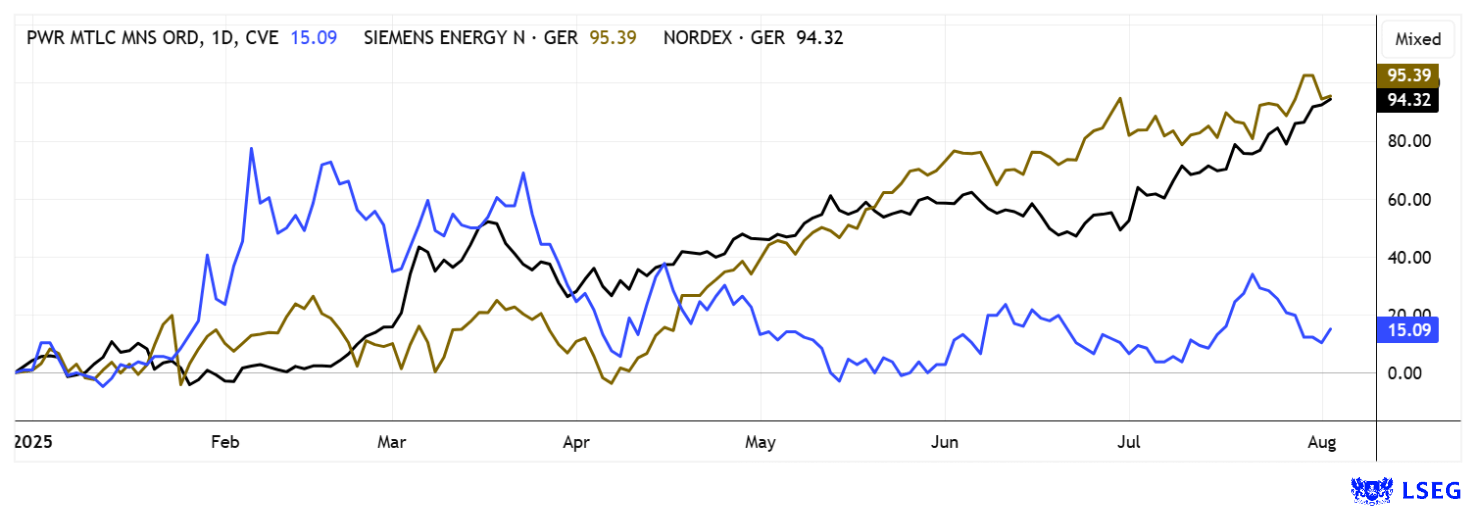

Siemens Energy is a buyer of many metals and is heavily dependent on functioning supply chains. In 2024 and this year, the stock is the strongest performer in the DAX, rising by over 1,200% overall. Plagued by refinancing difficulties at the end of 2023, the government stepped in as guarantor, with the stock trading below EUR 8 at the time. In July, the stock reached a new high of EUR 104.6. Siemens Energy can once again offer its shareholders a dividend for the current fiscal year. The Bundestag's budget committee has lifted the dividend ban that had been imposed in 2023 as part of a EUR 11 billion government guarantee. This was replaced in June by a bank guarantee, thereby removing the prerequisite for the distribution ban originally planned until 2026.

Siemens Energy will determine how much shareholders will receive in November. The target is a distribution of 40 to 60% of net profit, which is traditionally paid out after the Annual General Meeting in February. The return to the dividend policy is another milestone on the road to recovery. Just two years ago, banks refused to assume sole liability, despite full order books. CEO Christian Bruch and his team have also had to forego bonuses since then. In order to retain the management, the Supervisory Board has already promised special compensation for the period after the restrictions expire. After the strong share price gains, the P/E ratio for 2025/26 is now 33.7, while the planned revenue of EUR 42.2 billion is reflected in a P/S ratio of 1.8. Fifteen of the 24 analysts on the LSEG platform expect a 12-month average price of EUR 83.70. The Q3 figures will be released today before the market opens, with earnings per share of EUR 0.43 expected. It is going to be exciting!

Nordex – Back in the black after two years of turnaround

Hamburg-based wind turbine manufacturer Nordex is also a major consumer of critical metals. There have been no delivery shortages to date. The Company is currently performing brilliantly, with its share price up 74% after 12 months. Nordex already reported its figures on July 28. In the second quarter, earnings per share reached EUR 0.13. Driven by the wind turbine boom, order intake increased by 81.7% to 2.3 GW, with new orders reaching EUR 2.2 billion. Revenue remained stable at around EUR 1.9 billion. However, profitability improved significantly, with EBITDA climbing by over 64% to EUR 108.2 million and delivering a margin of 5.8%. Free cash flow improved to EUR 145 million, and the financial position was better than ever.

CEO José Luis Blanco expressed his satisfaction: "We are continuing on our positive course with rising profitability and strong cash flow. The stable order intake confirms the confidence of our customers."

Management confirmed its outlook and plans to further expand growth and profitability. The order backlog of EUR 14.3 billion provides a solid basis for this. Nordex intends to further strengthen its market position in the international wind energy sector. Experts on the LSEG platform are, on average, comfortable with a price target of EUR 23.20. Not far from the recent price of EUR 21.90. The big movement appears to be over, so consider raising your stop to EUR 19.90 and calmly watch to see if it goes any higher.

Politically stable producing countries remain a key issue for commodity investors. North America is becoming increasingly important with its extensive resources. Under the current US administration, mining permits are being issued much more quickly, and Canada is also pushing ahead with projects at a faster pace. Renewable energy companies such as Siemens Energy and Nordex rely on various critical metals, and a reliable supply of these metals is crucial. With its project, Power Metallic Mines offers a promising source of these metals and could soon play an important role in industry.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.