November 28th, 2022 | 10:41 CET

SynBiotic SE, Cardiol Therapeutics, Canopy Growth - Like hitting the jackpot

The final draft of the German government's key issues paper on the legalization of cannabis in Germany is ready, and final approval is likely to be a mere formality. For the companies concerned, this is equivalent to winning the lottery. The global cannabis market is expected to grow by 13.9% annually to USD 64.91 billion between 2022 and 2027. However, these profit increases have yet to reach the stock market. Some companies, for example, are trading below cash, while others lost more than 90% of their value in the correction that has been underway since 2019.

time to read: 5 minutes

|

Author:

Stefan Feulner

ISIN:

SynBiotic SE | DE000A3E5A59 , CARDIOL THERAPEUTICS | CA14161Y2006 , CANOPY GROWTH | CA1380351009

Table of contents:

"[...] We have built one of the largest land packages of any non-producer in the belt at over 440 sq.km and have made more than 25 gold discoveries on the property to date with 5 of these discoveries totaling about 1.1 million ounces of gold resources. [...]" Jared Scharf, CEO, Desert Gold Ventures Inc.

Author

Stefan Feulner

The native Franconian has more than 20 years of stock exchange experience and a broadly diversified network.

He is passionate about analyzing a wide variety of business models and investigating new trends.

Tag cloud

Shares cloud

Cardiol Therapeutics - Exaggerated correction

The central banks' change in strategy from an ultra-loose to a tighter monetary policy at the beginning of the year was the starting signal for a broad-based correction in capital-intensive growth stocks. This correction was particularly sharp in the biotechnology sector, with the NASDAQ Biotech Index losing more than 40% at its peak. Second-tier stocks were particularly hard hit. However, in the case of the Nasdaq stock Cardiol Therapeutics - the share has fallen by almost 88% since mid-October - one might speak of an exaggeration. For example, the current market capitalization is CAD 45.18 million, but the cash balance alone is well over CAD 50.00 million. In addition, the Company does not need any external funds through 2026 for the research and development of its blockbuster candidate CardiolRX for treating acute myocardial and pericardial inflammation. In a recent report, analyst firm Cantor Fitzgerald gave the Company a "buy" rating with a price target of CAD 5.00. Compared to the current share price of CAD 0.71, this means an upside potential of 600%.

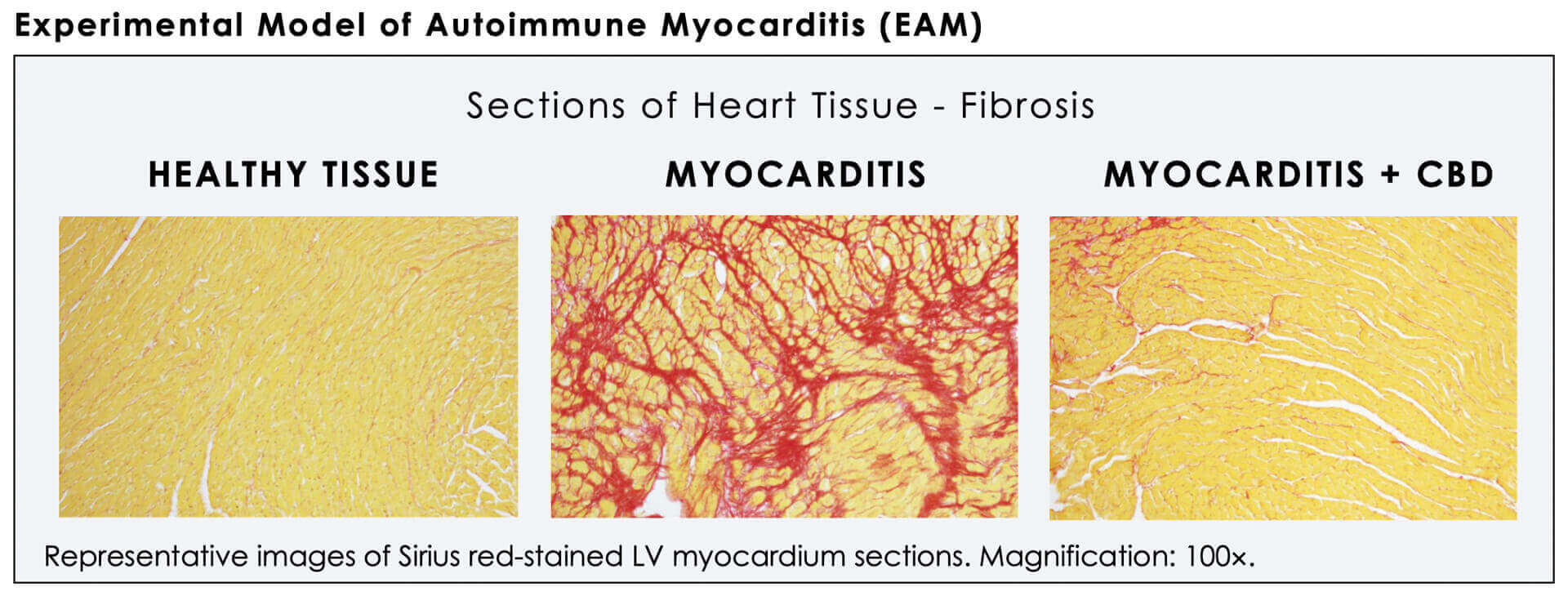

Cardiol Therapeutics is a platform drug company developing a synthetic cannabidiol (CBD)-based liquid drug. The formulation, CardiolRX, is being evaluated to treat various life-threatening cardiovascular conditions. As such, the Canadians have received approval from the US Food and Drug Administration to conduct clinical trials to evaluate the efficacy and safety of CardiolRx for two heart conditions. First, the focus is on advancing the Phase II ARCHER study, which was investigated to evaluate CardiolRx in acute myocarditis, an inflammation of the heart muscle. Acute myocarditis is considered a leading cause of sudden cardiac death in people under 35. The study, developed with renowned international experts in heart failure and myocarditis, has already received regulatory approval in several countries and will be conducted with 100 patients in major cardiac centers in North America, Europe, Latin America and Israel. In this regard, study results expected early in the first quarter could provide a significant turnaround.

In addition, a Phase II pilot study is underway in recurrent pericarditis, which is an inflammation of the pericardium. The study is expected to enroll 25 patients at major clinical centers specializing in pericarditis in the United States. Initial results are expected to be published here over the next year. In this area, study results were recently announced, demonstrating that pharmaceutically produced cannabidiol significantly reduced pericardial fluid increase and thickening in a preclinical model of acute pericarditis.

Canopy Growth - Fallen angel

Aurora Cannabis, Tilray and Canopy Growth were the companies that were among the stock market stars in the first wave of cannabis stocks in 2018. As recently as February 2021, Canopy Growth's share price peaked at USD 56.50, and the market value of the Canadian company, which specializes in the development of medical cannabis, was over USD 35 billion at the time. As a result, the shares of the market leader corrected by over 93%; the current quotation is at USD 3.66. In the second quarter, the Ontario-based company increased its net sales by 7% from the previous quarter to CAD 117.9 million. Net loss was CAD 231.9 million, and adjusted EBITDA was negative CAD 78.1 million.

A major milestone, which should push access to the lucrative US market wide open, was set with the announcement of the formation of a new US-based holding company, Canopy USA. The formation of Canopy USA gives Canopy Growth the ability to handle pending deals with multiple US-based companies. That is because, due to the federal prohibition of marijuana in the US, Canopy Growth currently cannot invest in a marijuana operator in multiple states or in a company that grows plants without violating NASDAQ and Toronto Stock Exchange rules.

"Our second quarter marks an important inflection point for Canopy, demonstrating momentum in our key businesses and accelerating our entry into the US cannabis market through the formation of Canopy USA. Canopy is ideally positioned to capitalize on this unique opportunity and accelerate our path to leadership in the North American cannabis market," said David Klein, Chief Executive Officer.

SynBiotic SE - Like winning the lottery

Speaking of Canopy Growth. As announced by Europe's leading cannabinoid company, SynBiotic SE, Bruce Linton, one of the world's most experienced and successful cannabis entrepreneurs and former CEO of Canopy Growth, has been recruited as chairman of the newly created advisory board. In addition, Linton participated in the Company's recent funding round. With his investment and the option to acquire additional shares from existing shareholders, he will hold a stake of approximately 5% in SynBiotic SE.

In addition to the finalization of the key issues paper by the German government, this is the second significant achievement of the past weeks. SynBiotic SE CEO Lars Müller says: "The presented key issues paper and the regulations planned therein are like winning the lottery for us. I am glad that our decades of pioneering work are slowly paying off and that we were fortunately able to anticipate the developments very well. Our corporate structure and the companies within it that specialize in the various applications of cannabis put us in a real pole position. We are optimally positioned on almost all points of the draft and will use this starting position to provide significant support for legalization in Germany as a leading provider."

Despite the rosy outlook for the future, SynBiotic's stock has yet to benefit much. Thus, the share failed at the resistance area of EU 16.50 and is currently at the broad support at EUR 13.90. In the long term, however, the stock, as one of the largest representatives of the German cannabis industry, should benefit from the eventual approval of cannabis. The analyst firm Alster Research reiterated its buy rating with a price target of EUR 40.00.

Despite the expected strong growth and the probable legalization of cannabis in Europe and the US, companies in the sector are still in a correction. Cardiol Therapeutics is trading well below cash in the process. Canopy Growth should benefit from the move to the US. For SynBiotic, legalization in Germany is like winning the lottery.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.