January 27th, 2026 | 07:35 CET

Stress test: Nuclear power instead of hydrogen? Caution advised with Nel ASA, First Hydrogen, Oklo, and Plug Power

"Drill, baby, drill" – that is the loud cry coming from the White House. For the Trump administration, that means quick approvals and a capital-intensive push for fossil fuels. However, it currently seems unclear what will happen with alternative energies. Some of the funds from the Inflation Reduction Act (IRA) passed by the previous administration under Joe Biden have not been paid out, and hoped-for public contracts in line with the Paris Climate Agreement are now obsolete due to the absence of the US. However, the shift away from alternative energies has not been communicated very clearly. After all, there is a large following for ESG-compliant energy models, with nuclear energy in particular becoming socially acceptable again as a net-zero source. Where should investors prick up their ears?

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

NEL ASA NK-_20 | NO0010081235 , First Hydrogen Corp. | CA32057N1042 , OKLO INC | US02156V1098 , PLUG POWER INC. DL-_01 | US72919P2020

Table of contents:

"[...] We are committed to stay as the number one Canadian and global leader in the Hydrogen-On-Demand diesel technology [...]" Jim Payne, CEO, dynaCERT Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Oklo – It does not get any more volatile than this

A brilliant start to the year for innovative reactor designer Oklo from the US. While there was a veritable sell-off at the end of 2025 from over USD 190 to below USD 75, January at least saw prices rise back above USD 100. One positive development is certainly the mega-deal with Meta Platforms to develop a 1.2 GW nuclear power plant in Ohio by 2034, which is even secured by an advance payment from Meta. This pact supports Meta's AI data centers and marks Oklo's first major commercial contract. Construction of the plant is scheduled to begin in 2026, with the plant going online as early as 2030. In addition, Oklo is planning a radioisotope pilot plant with the US Department of Energy for the domestic production of medical isotopes through its subsidiary Atomic Alchemy. It all sounds good, but a bitter aftertaste remains due to the CEO's sale of shares worth USD 10.2 million immediately after the Meta deal was announced. The share price plummeted from around USD 113 to USD 84 yesterday. The LSEG platform estimates a 12-month price target of approximately USD 117 based on 20 analysts with the following ratings: 1 "Sell", 6 "Hold", and 13 "Buy". Despite mixed feelings, many investors see Oklo as a key player in AI-powered clean energy. However, the correction of the immense overvaluation of Oklo shares, which will not generate operating profits until after 2030, does not seem to be over yet.

First Hydrogen – SMR research as an option for the next growth spurt

First Hydrogen is also making a name for itself in the field of SMRs. The Canadian innovator is increasingly evolving from a pure hydrogen and mobility provider to an integrated clean energy company with a clear long-term technological perspective. A key strategic step is the research program launched with the University of Alberta, which focuses on fuel materials for molten salt reactors in the SMR sector. In this early phase, non-radioactive substitutes are deliberately being investigated in order to realistically map key physical properties and reduce development risks at an early stage. This approach allows First Hydrogen to build up expertise without regulatory hurdles or high safety costs. The findings will serve as a basis for decisions on the further expansion of the Company's own laboratory capacities and for partnerships along the supply chain.

The Company's strategic goal is to combine base-load-capable, clean energy from SMRs with electrolysis to provide scalable green hydrogen. This creates an attractive field of application with growing global attention, especially for industry, data centers, and AI infrastructure. The example of Oklo shows that, given sufficient project maturity, large US tech companies are increasingly willing to invest billions. This is because the energy crisis is growing exponentially. To finance the next steps in its development, First Hydrogen has announced a private placement of up to CAD 3 million. The funds are to be used flexibly for research, working capital, and strategic expansion. The current valuation on the stock market does not yet reflect the long-term potential of this platform, but the industry is already taking notice of First Hydrogen. For investors, this currently represents a speculative but clearly thematically positioned exposure at the intersection of hydrogen, zero-emission mobility, and base-load clean energy. Visionaries are quickly jumping in at CAD 0.38 to 0.45 ahead of a potential acceleration in the Company's development.

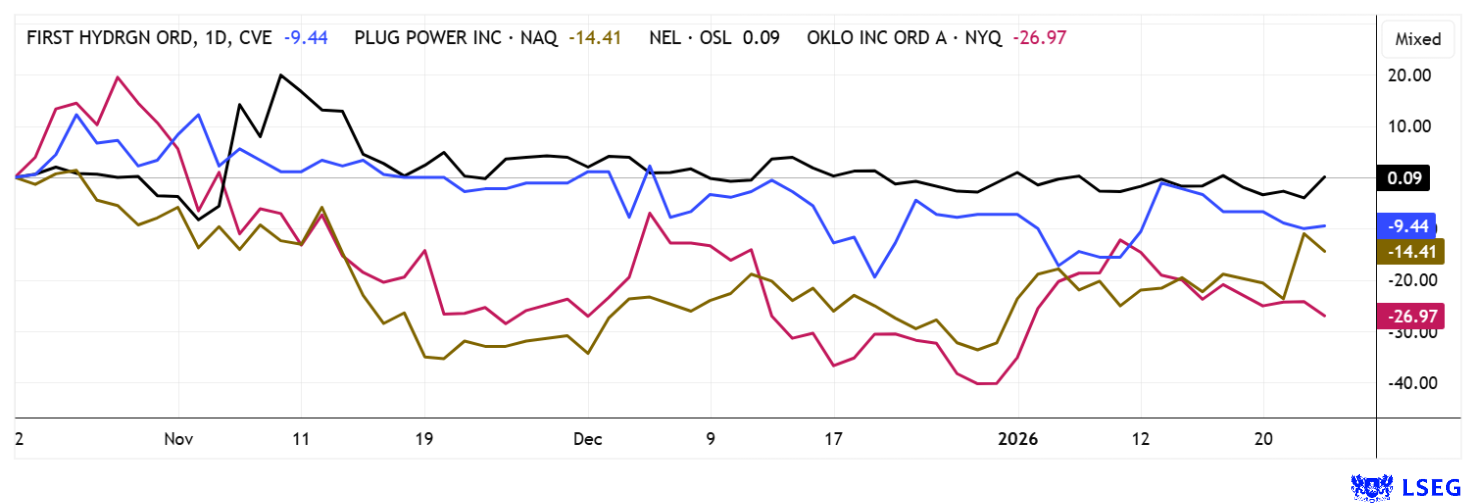

Plug Power and Nel ASA – A tragedy with subtle differences

It is not much fun looking at the charts for Nel ASA and Plug Power. That is because the global hydrogen sector is currently undergoing a phase of consolidation in which technological substance is becoming more clearly separated from political hype. Plug Power is emblematic of the extreme cycles in industry. A euphoric surge was followed by a massive revaluation, triggered by capital requirements, operational setbacks, and a harsher funding environment in the US. However, after several rounds of financing at low share prices, the situation appears to be stabilizing, while smaller government-led orders are securing the operational basis and confirming the Company's relevance in the market. Even though the road to sustainable profitability is still long, initial operational and technical signals indicate that the bottom has been reached, putting Plug Power back on the radar, especially for very risk-conscious investors. The USD 1.95 to 2.55 zone is technically important. If one of the edges breaks, there will be a rapid adjustment in the respective direction!

The Norwegians Nel ASA are pursuing a clearer operational path, as they can benefit more from the long-term European hydrogen strategy. With a comparatively solid cash position and a reduced pace of investment, Nel is better able to synchronize technological development and scaling. A key lever is the new generation of electrolysers, which rely on pressure-driven alkaline technology and are specifically designed for cost leadership. The planned expansion of production in Herøya with a capacity of up to one gigawatt is expected to realize economies of scale that will significantly improve the economic efficiency of green hydrogen. The modular design without classic industrial buildings further reduces investment costs at the project level. For investors, this results in a differentiated hydrogen story with more structural foresight and better jurisdiction than in Trump's fossil fuel world.

The year 2026 holds a few surprises. Gold is above USD 5,000, and silver is completely unleashed, with an increase of more than 250% since mid-2025. Just as things are looking up here, hydrogen stocks are no longer moving at all. Investors have other issues on their minds. However, it is important to note that First Hydrogen is currently changing its business model, and Plug Power can at least achieve technical stabilization. Stay tuned – sector rotation is coming!

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.