July 14th, 2025 | 07:05 CEST

Stock market correction? Gold target raised to USD 4,500 – Barrick, Sranan Gold, Rheinmetall, and Strategy

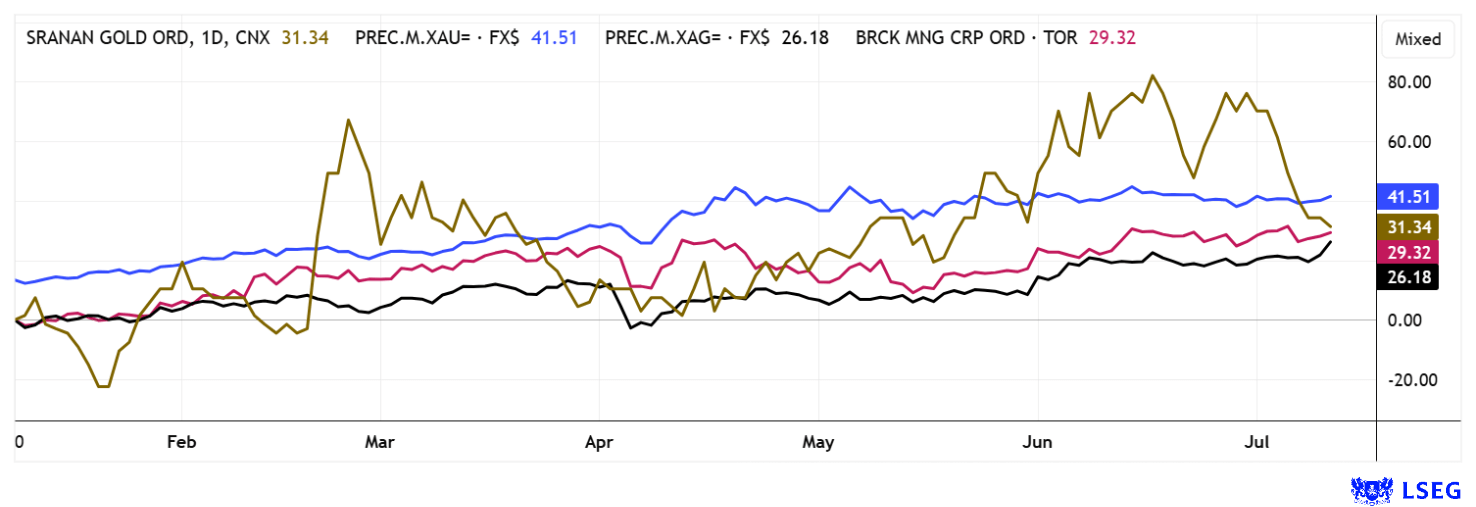

The time seems ripe for new positions. While the major indices DAX-40 and NASDAQ recently reached new highs, gold, silver, and Bitcoin are about to open entirely new chapters. At over USD 38.50, silver recently hit a 14-year high, and chart analysis now indicates a breakout. Bitcoin, often referred to as digital gold, also hit new highs with prices above USD 118,000. Arguments such as war, debt and inflation are causing investors to flee to safe havens. In the equity sector, defense and high-tech stocks with AI exposure are among this year's best performers. Investors should slowly start to slow down here, as the risk of a correction is increasing. Those investing in gold should consider adding stocks like Barrick Mining and First Majestic Silver to their portfolio, but Sranan Gold is an absolute buy. We are becoming increasingly skeptical about Rheinmetall, as the momentum has run out! We can help you restructure your portfolio.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

BARRICK MINING CORPORATION | CA06849F1080 , SRANAN GOLD CORP | CA85238C1086 , RHEINMETALL AG | DE0007030009 , MICROSTRATEG.A NEW DL-001 | US5949724083

Table of contents:

"[...] We quickly learned that the tailings are high-grade, often as high as 20 grams of gold per tonne; because they are produced by artisanal miners, local miners who use outdated technology for gold production. [...]" Ryan Jackson, CEO, Newlox Gold Ventures Corp.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Gold keeps rising – Barrick Mining breaks out

Goldman Sachs sees a gold price target of USD 4,500 by 2030. Over the past three years, central banks worldwide have purchased around 1,000 tons of gold annually. By the end of 2024, this had led to gold's share of global currency reserves rising to over 20%, surpassing the euro for the first time. Gold became the second most important reserve asset after the US dollar. The largest buyers were China, India, and Poland. One of the most significant producers is Barrick Gold, which recently renamed itself Barrick Mining. The name change highlights the strategic realignment toward copper, which now accounts for about 20% of total production and is expected to rise to 30% by 2029. The large-scale Reko Diq project in Pakistan, which is scheduled to start production in 2028, is expected to make an important contribution to this.

In the first quarter of 2025, Barrick achieved a net profit of USD 474 million, or USD 0.27 per share, significantly more than the previous year's USD 295 million. Gold production declined to 758,000 ounces, as did copper production to a lower 44,000 tons. Nevertheless, profit margins improved significantly thanks to higher metal prices. The Company therefore confirmed its production targets for 2025 and is focusing on growth, particularly in Pakistan and Zambia. With an annual performance of 14% to date, analysts on the LSEG platform see further upside potential from the current level of around CAD 29 to around CAD 37. The share price has recently broken out to the upside from a technical chart perspective. This is an investment for long-term gold and copper enthusiasts.

Sranan Gold – Gold exploration in Suriname

Suriname is a resource-rich country whose economy is heavily dependent on mining. The most important sector is gold mining, which accounts for around 75 to 80% of export earnings. Two large mines, Rosebel and Merian, contribute significantly to industrial production. Thousands of small-scale miners are also active in the country, often under informal or illegal conditions - the mining sector accounts for around one-third of gross domestic product. In recent years, Suriname has suffered from economic crises, high inflation, and growing government debt. A reform program in cooperation with the International Monetary Fund brought initial stabilization. The withdrawal of aluminum company Alcoa in 2015 ended what was once significant bauxite mining. Since then, the raw materials sector has focused primarily on gold and, looking ahead, on the huge offshore oil reserves.

Suriname's raw material potential has not gone unnoticed by investors. USD 10 million in exploration funds have already been invested in analyzing the mineral deposits, with big names such as IAMGOLD, Newmont Mining, and Golden Star already involved. Sranan Gold is a new player on the scene. With the 29,000-hectare Tapanahony project, Sranan has an excellent property to follow up on the 15 million ounces of gold discovered by its predecessors. CEO Oscar Louzada has 12 years of experience in the area and has taken the Sela Creek and Nassau projects public with Miata Metals. Now he aims to top the story of Founders Metals, an exploration company focused on advancing the Antino gold project in the heart of the Guiana Shield. Antino covers an area of 20,000 hectares and has produced over 500,000 ounces of gold to date from historical open pit and alluvial mining.

The cards are being reshuffled. Sranan has completed a capital increase of approximately CAD 8.5 million and is now moving into the first phase of drilling. Construction of the camp infrastructure and core logging and storage facilities is nearing completion. Two drill rigs and drill hole equipment acquired by Sranan have arrived on site to prepare for the upcoming drilling. At the target location, Randy's Pit, at the southern end of the 4.5-kilometer trend, initial drill sites have been selected for drilling to a depth of 6,000 meters, and the drill pads are currently being prepared with excavators. Sranan's share price (SRAN) is performing well at around CAD 0.44, and the Company's value of CAD 27.2 million is certainly not the end of the road.

MicroStrategy – New name, old business model

In addition to gold, investor interest in 2025 is also very focused on Bitcoin. The cryptocurrency gained a full 10% last week. Crypto fans are jubilant because the resistance level of USD 111,000 has finally been broken – the sky is the limit! Bitcoin collector Michael Saylor has created a legendary BTC story with MicroStrategy, with the stock gaining another 35% in 2025 after rising more than 1,700% since 2022. In recent days, the Company reaffirmed its strategy. In total, the Company holds a portfolio of more than 597,000 coins with a total value of around USD 70.4 billion. Strategy did not make any further purchases between June 30 and July 6, 2025. Strategy finances its Bitcoin purchases through so-called at-the-market (ATM) share sales. In Q2, the Bitcoin collector raised USD 6.8 billion through the sale of Class A common stock and preferred stock. But that is not all: as part of its expanded "42/42" strategy, Strategy plans to raise an additional USD 84 billion through equity and convertible instruments by 2027. However, this business is no longer unique, as 135 listed companies now hold Bitcoin holdings, including Tesla, Twenty One, and Japan's Metaplanet. Strategy remains very highly valued at a 50% premium to NAV, but enjoys first-mover advantages. Nevertheless, caution is advised!

Rheinmetall – NATO invests billions

We have looked at Rheinmetall shares many times before. After four weeks of sideways movement despite a flood of new NATO orders, it seems likely that Rheinmetall's share price, which has risen twentyfold since February 2022, is finally due for a break. No new highs have been recorded recently. The volatile swings are more indicative of a top formation that could soon turn into a hefty consolidation. 15 of 18 analysts on the LSEG platform have a "Buy" rating, and the average price target of EUR 1,935 has been reached three times intraday so far. As Giovanni Trapattoni once so aptly put it: "Bottle empty!" From a valuation perspective, the stock could soon plunge by up to 25% overnight without warning, as the 2027 P/E ratio is around 30. Such growth must first be achieved logistically.

**Targeted selection is currently the most critical factor on the capital markets, as selection has become crucial. While US President Trump is damaging the international reputation of the US with a series of controversial appearances, yields on US government bonds are rising significantly. Against this backdrop, China in particular has announced that it will gradually shift its holdings of long-term US bonds into gold. This is creating additional buying pressure on precious metal producers such as Barrick and explorers such as Sranan Gold. Bitcoin is also benefiting from the increased demand for alternative assets and is attracting more investor interest. Nevertheless, caution is advised: the market is showing clear signs of exaggeration and euphoria.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.